United States Cellular Corporation (NYSE:USM) recently reported its Q3 earnings as Seeking Alpha has covered here. Revenue of $963 million came in about 4% below the expected $1 billion mark while EPS of 26 cents beat by 500%. I wouldn’t read too much into that EPS margin as the company has a history of reporting some widely fluctuating numbers on that front. Overall though, the market seems to have liked the report as the stock ended up nearly 5% on Friday, November 3rd.

What Does USM Do?

USM is a mobile network operator, headquartered in Chicago, Illinois. Founded in 1983, USM is a subsidiary of Telephone and Data Systems, Inc. (TDS), which I reviewed earlier this year. In the company’s own words, USM “connects 5 million people, businesses, and government operations with our award-winning network“. The company reported $4.16 billion in revenue in 2022 and has recently been discussed as a potential acquisition target.

Let’s now review The Good, The Bad, and The Ugly from USM’s Q3 report.

The Good

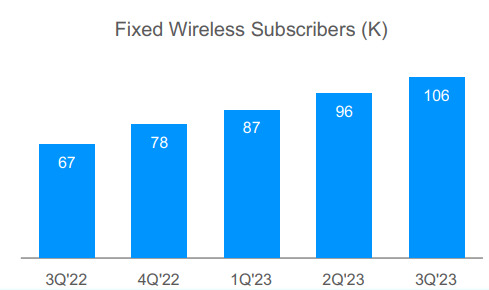

- Fixed wireless customer count grew 57% YoY to reach 106,000. Equally impressive is that this number has gone up QoQ at least for the last 4 quarters, validating the company’s growth initiatives that included fixed wireless services and tower portfolio.

Fixed Wireless Subs (investors.uscellular.com)

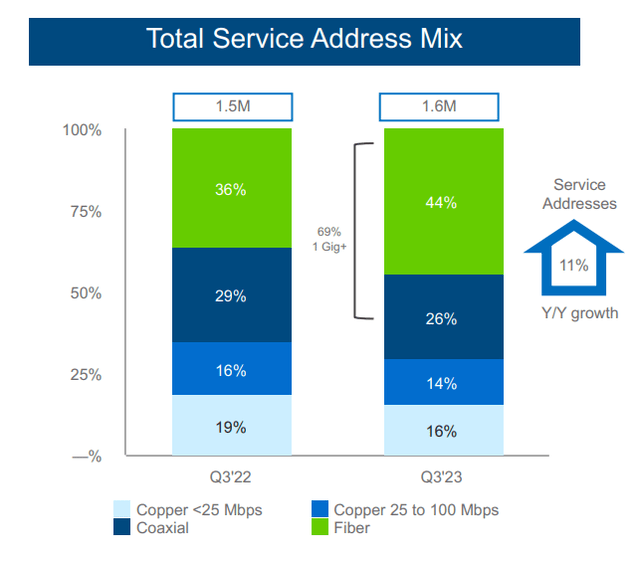

- USM is progressing towards its goal of having access to 1.2 million marketable addresses for its Fiber services by 2026. At the end of Q3 2023, the number stands at about 700 million, representing nearly 30% YoY growth. Fiber now represents 44% of the total service addresses that USM has access to. Reaching the 2026 goal is important for USM as well as its customers. Customers would undoubtedly appreciate having access to Fiber’s reliability and speed while USM would appreciate the fact that it can charge a little more for Fiber compared to Copper and Coaxial networks.

Fiber Growth (investors.uscellular.com)

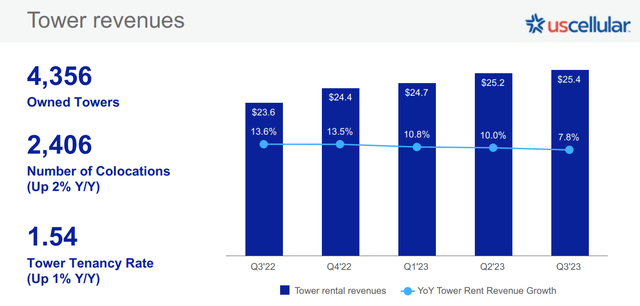

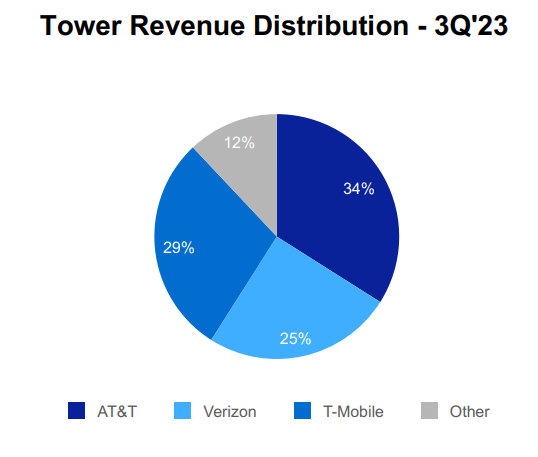

- Tower revenue grew 8% YoY and also showed at least a 4th QoQ increase to reach $25.4 million. It is important for USM to continue showing strength here as it is the biggest attractive point as far as potential suitors are concerned. US telecom’s “Big 3” made up 88% of USM’s tower revenue in Q3. At some point, one of them may simply decide to make an offer for USM at the right price instead of shelling out huge rent for the towers. As a related note, the number of towers has gone up sequentially in each of the last 4 quarters as well, going from 4,329 in Q3 2022 to 4,356 in Q3 2023.

Tower Revenue (investors.uscellular.com) Tower Revenue Distribution (investors.uscellular.com)

The Bad And The Ugly

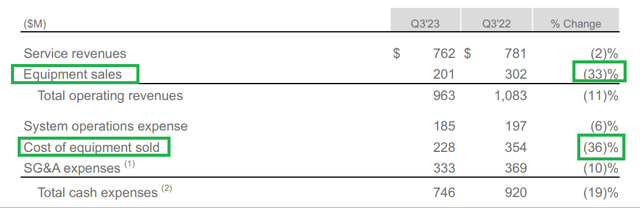

- Revenue showed a 11% YoY decline with equipment sales recording a 33% decline. The only solace is the fact that cost of equipment sold also went down 36% YoY due to slowing sales.

Revenue (investors.uscellular.com)

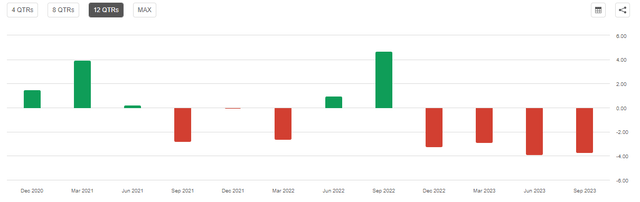

- As a result of the revenue weakness above, Q3 also was the fourth consecutive quarter where USM missed revenue estimates. Luckily for USM investors, the market’s general mood was upbeat when the report came out and the stock still ended up finishing higher despite the revenue miss.

USM Revenue (Seekingalpha.com)

- While USM’s net long-term debt has gone down about 9% YTD, it is still humongous at 75% of the company’s market capitalization, at nearly $3 billion. While this Seeking Alpha article makes an attractive case for USM to be a buyout candidate, the high-debt situation is likely to deter potential suitors as they need to buy out the debt as well. Meanwhile, the company has paid nearly $150 million in interest expense as a result of this high debt level (page 2).

Net long-term debt (investors.uscellular.com)

- Speculation about the buyout has sent USM’s stock up more than 100% YTD and the stock is trading at a ridiculous forward multiple of 154 as a result. At some point, I do believe the “Big 3” may make an offer to buy out USM but they’d have a lot to answer if they choose to make that offer now given the stock’s run as well as the high debt situation.

USM Chart (Seekingalpha.com)

Conclusion

While USM is progressing well towards its 2026 goals, it is operating in an industry that requires enormous capital expenditures, like its investments towards Fiber. The company’s high debt level and resulting interest expense are likely to continue adding pressure to the bottom line. I rate the stock a “Sell” here given the factors above and its 100% run YTD.

Read the full article here

Leave a Reply