Investment Thesis

In February this year, we started to cover one of Singapore’s largest banks United Overseas Bank (OTCPK:UOVEY), and concluded that there were potential dark clouds in the economy, and we had concerns about whether their Non-Performing Assets could remain low. As such we gave it, and other Singapore banks a Hold stance.

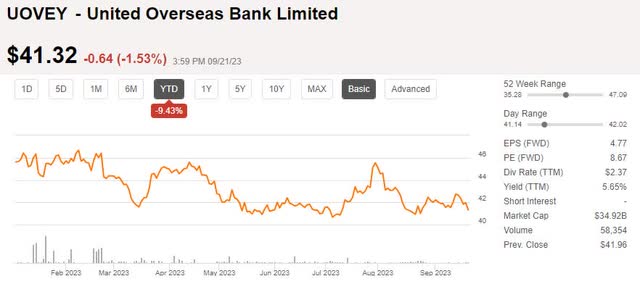

So far this year, the share price is down 9%.

UOB – YTD share price (SA)

The ADR UOVEY constitutes 2 ordinary shares. Presently the ordinary shares, which are trading on the Singapore Stock Exchange are priced at SGD 28.30

As UOB has come out with its FH 2023 financial results, we take this opportunity to revisit our thesis.

From there, we will shed some light on the bank’s NPA and Singapore’s economy in order to reassess the validity of our concern.

FH 2023 Financial Results

All banks have benefited from the higher interest rate environment. That is also the case for UOB.

Net profit in FH 2023 was up 45% Y-o-Y from SGD 2.018 billion to SGD 2.925 billion. The main driver of this improvement came from interest income which went from SD 3.549 billion in FH 2022 to SGD 4.846 billion in FH 2023. NIM, or Net Interest Margin, improved from 1.63% a year ago to 2.13% in FH 2023.

Net fees and commission income were slightly lower by just 6%.

We always like to assess a company’s return on equity.

Many of the banks we follow and own shares in, have been delivering ROEs of around 14-15% lately. UOVEY’s ROE in the FH of this year was in line with this delivering 14.1%.

The integration of Citibank’s (C) consumer banking business in Malaysia has gone well so far this year, with Indonesia to be completed by the end of this year. Next year, they expect to complete the integration of the business in Thailand and Vietnam. The bank now has roughly 77 million retail customers.

The bank is on track to gain an uplift of approximately one billion SGD in revenues from the purchase of consumer bank businesses from Citibank.

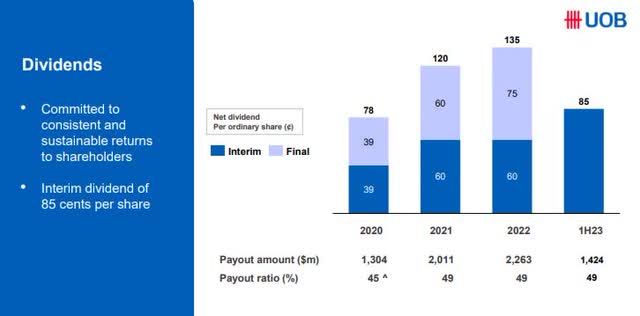

UOB does have a shareholder-friendly dividend policy where they will pay out 40-50% of their earnings.

UOB dividend history since 2020 (UOB FH 2023 Results – CFO Presentation )

Based on the present share price of SGD 28.30 for UOB’s main listing in Singapore, shareholders get a decent yield of 5.7% on a TTM basis.

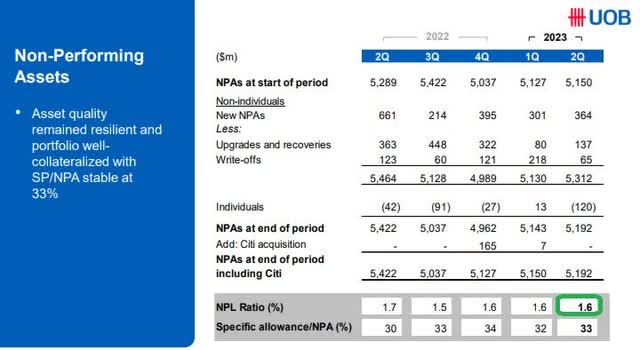

Since our concern earlier this year was an increase in the bank’s Non-Performing Assets, as a result of a potentially worsening economy, we shall look at the current status of this as of the end of June 2023.

Fortunately, things are looking good. As a matter of fact, NPA as a percentage of loans and liabilities is lower now than it was earlier.

UOB – NPA as of FH 2023 (UOB FH 2023 Results – CFO Presentation)

UOB do have a strong market share in the Small and Medium-sized Enterprise sector here in Singapore and we did have some concern about their business environment. However, SMEs only constitute 12% of the bank’s loan book. 54% is with large corporations and institutions. The balance 33% is to individuals.

In Singapore, there was an increase in foreclosures and sales of properties through auctions in 2022. Bear in mind that the prices of these auctions are not done as “fire sales”. The real estate market in Singapore is still resilient and UOB has an average loan-to-value similar for private residences as what they have in the commercial property sector which is 50-60%.

UOB’s exposure to the office sector is 8% of its loan book. Largely backed by strong sponsors.

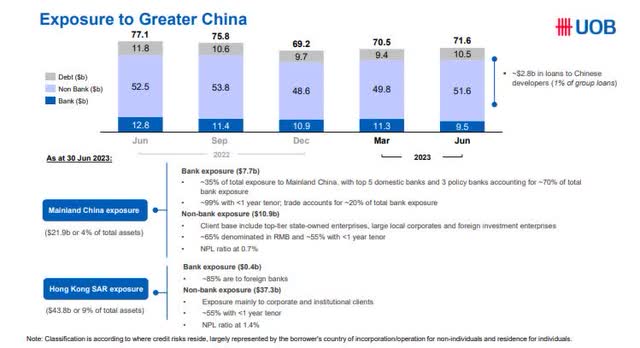

The exposure to mainland China as of the end of Q2 was SGD 71.6 billion.

UOB’s exposure to China (UOB FH 2023 Results – CFO Presentation)

Finally, let us examine how safe the bank is in terms of the capital it holds.

UOB’s Common Equity Tier 1 capital ratio is 13.6%

NAV per share is SGD 25.11 which is slightly higher than the SGD 24.24 it was six months earlier. This gives us a price/NAV of 1.12 which is a fair price. Their competitors OCBC (OTCPK:OVCHY) have a price/NAV of 1.11 and DBS Group (OTCPK:DBSDY) a more expensive ratio of 1.55

A more attractive ratio can be found at HSBC (HSBC) which currently trades at a price/NAV of just 0.92. As such, we think UOB is fairly priced, but not cheap.

Singapore Economy

It is commendable that UOB is focused on growing its business outside of Singapore. Their efforts are starting to bear fruit.

However, it is important to bear in mind that 71% of their profit comes from Singapore. Hence, what happens to its economy matters the most.

Singapore’s GDP grew by 3.6% in 2022. On a Q-o-Q basis this year, we have seen a drop. Q1 GDP was -0.4% and Q2 recorded a slightly improved positive 0.3%.

It was especially the manufacturing sector that did poorly in the last quarter, as it contracted by 7.5%. It was especially weak bearing in mind that Q1 was also a negative growth of 5.3%.

The Ministry of Trade forecasts that the GDP for FY 2023 will be in the range of 0.5 to 1.5%.

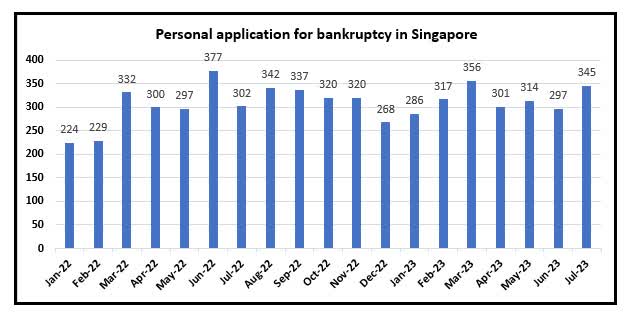

We do not see a significant increase in bankruptcies.

Monthly trend of personal application for bankruptcy in Singapore (Data from Singapore Ministry of Law. Graph by author)

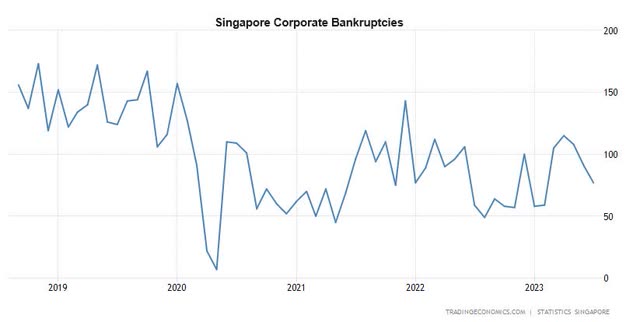

On a corporate level, we have seen some increase in bankruptcies, but not on an alarming level.

Singapore Corporate Bankruptcies (Trading Economics)

Risk to Thesis and Conclusion

One of the risks we can think of is that NIM has peaked by now.

The 3-month Singapore Overnight Rate Average, or SORA, which is the key benchmark used by the banks for their home mortgages, has gone from 0.2% in January to 3.70% in September 2023.

UOB is offering mortgages at 3M SORA plus 0.7% interest.

There is a risk that interest rates and NIM will start to fall next year. We do not think it will be as early as 2024 because we do believe, as recently indicated by the Chairman of the U.S. Fed that we might need to get used to a “higher for longer” period in terms of interest rate levels.

One could argue that it is a normal level. It was abnormal over the last 20 years. It is not healthy that the cost of money is close to zero.

Another risk is what will happen to the economy in China.

On the macro level, Singapore’s economy is now much more dependent upon China than it was in the past. UOB is also clearly exposed to China as we just showed.

On a more positive note, we do think that the integration of Citi’s customer base in Asia could be a catalyst for earning growth going forward if it is well executed.

To conclude, we do think that UOB, and its Singapore peers for that matter, hold relatively low risks of facing large write-offs from NPAs

However, there is more uncertainty as to whether interest income will remain elevated as it is now.

As such, we maintain our Hold stance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply