Introduction

Union Pacific (NYSE:UNP) owns and operates the largest network among the 5 publicly traded class 1 railroads. As Union Pacific’s Q3 earnings approach, it is time to see if going into earnings we should increase or trim our position or simply leave things as they are.

In this earnings preview, I will share why, though I own a tiny position in this railroad, I haven’t been adding more nor will I do so now.

Summary of previous coverage

In case you haven’t come across my articles on any railroad, I recommend reading this article: “Learning From Buffett and Berkshire About Investing In Railroads: The BNSF Case Study”.

I wrote it to share the foundation of my thought process when assessing railroads after I reversed-engineered Buffett’s investment in BNSF. Thanks to this research, I found out what criteria he used. After this article, I took advantage of the same principles to assess each one of the 5 publicly traded railroads and this is the article where we went over Union Pacific: “Looking At Railroads As Mr. Buffett Does: Union Pacific.”

The results were somewhat mixed. The company didn’t have an earning power as high as its peers, scoring 7.2. With earning power we mean how many times a company’s pre-tax earnings cover interest expense. In terms of efficiency, Union Pacific lagged behind its peers.

On the other hand, Union Pacific had a ROIC of 16.4% which positioned it above its other peers.

This year, Union Pacific’s share performance has disappointed many of its shareholders up to the point the company recently appointed a new CEO, choosing Jim Vena. Overall, this year has not been fun for shareholders of any Class 1 railroad. The general market has gone up while all publicly traded companies have underperformed. This has opened up the opportunity for investors who are willing to benefit from some weakness and initiate and increase their position in any of those companies. This is what I have been doing for the last two months. However, I haven’t increased my stake in Union Pacific, yet. As a matter of fact, Union Pacific sets me before a real dilemma.

Q3 Earnings

Union Pacific’s top-line is down YoY, especially due to a 20% drop in intermodal for the first six months of the year

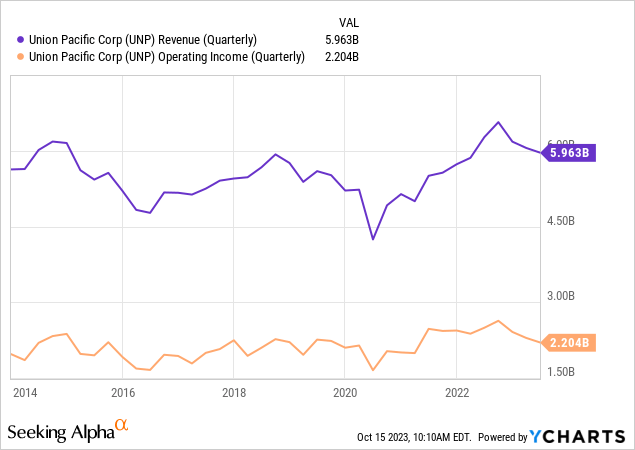

Slow or non-existent top-line growth may be an issue for a railroad’s margins. In fact, if a railroad is not able to grow its revenues, it needs to rely only on operating efficiency to drive its bottom-line up. Union Pacific has struggled with this because its revenues over the past decade have been pretty flat and so has its operating income.

For sure, the slow-down in rail traffic we are seeing this year is not going to help a company whose past history shows top-line growth as a weak point.

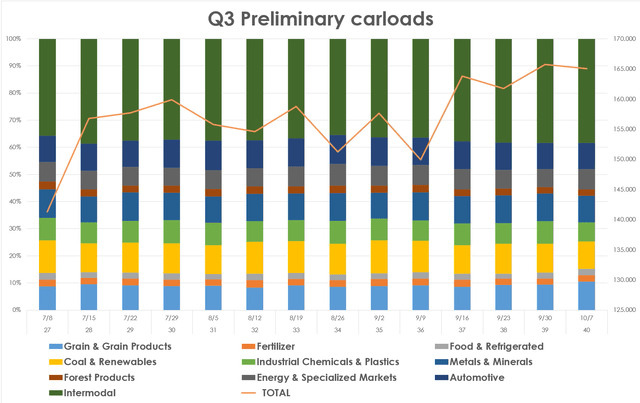

Now, since railroads have to report their weekly traffic to the Association of American Railroads, it is rather easy to know in advance of an earnings release some preliminary data.

In particular, here are the carloads reported for each revenue segment.

As we can see, during the past quarter, total weekly carloads were rather flat until September, when an increase in traffic took place.

Author, with data from Union Pacific weekly reports

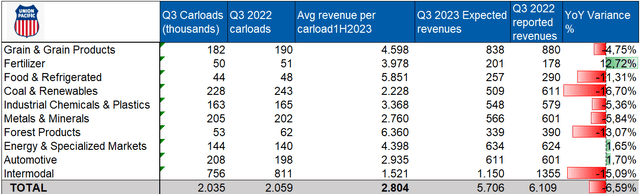

Once we know the number of carloads, we can make some estimates about expected revenues. In fact, I can take the number of carloads for each business segment and multiply it by the average revenue per carload for that segment reported by Union Pacific for the first six months of this year.

Now, consider this average revenue per carload was benefiting from additional revenues coming from the fuel surcharge program, which usually kicks in with a 60 day lag to fuel price movements. Therefore, since fuel prices have increased once again only of late, we can expect fuel surcharges to be low YoY, thus reducing the average revenue per carload. As a result, the estimates I made in this table can be considered as the higher boundary of a range.

As we can see, I am expecting lower revenues YoY all across the board, apart from fertilizers and, to a smaller extent, energy and automotive.

Author

Overall, while total carloads are down only 2% YoY, we might see a 6.6% decrease in revenues. This is a bit below the current estimate we find on Seeking Alpha, according to which Union Pacific should reach $6 billion in revenues.

Now, using Seeking Alpha profitability metrics, we find out that Union Pacific has a net income margin of 27.18%. This means net income should come in around $1.55 billion, assuming Union Pacific’s efficiency has not deteriorated during the last quarter.

Union Pacific is also doing buybacks, though at a very slow pace compared to what it did in its past ($130 million in Q2 2023) Therefore, let’s keep the number of total common shares outstanding flat QoQ and let’s use 609 million to calculate an EPS estimate.

While my revenue estimate is below consensus, my EPS estimate is $2.54, higher than consensus, based on the simple calculation of dividing the expected revenue by the number of outstanding shares.

Analysts actually see Union Pacific posting EPS of $2.43. This implies a net income of $1.48 billion. This means net income margin is expected to be around 26%.

As a result, Union Pacific may actually finish its fiscal year with EPS a little below $10, making the stock a bit more expensive than it actually is.

Overall, I think we should expect weak quarterly results, unless Jim Vena, who has just recently taken the lead of the company, has already managed in just a few weeks, to have an impact on its efficiency. As skilled as Mr. Vena might be, I doubt that this will be the real quarter to show a developing turnaround. I have much higher expectations from Q4 onwards.

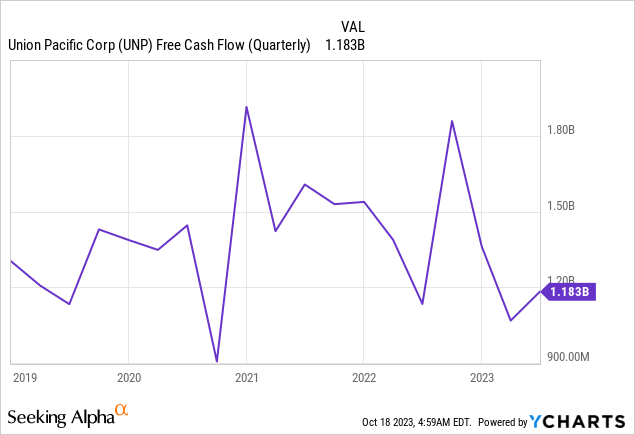

In fact, looking at the chart below, looking at the quarterly free cash flow Union Pacific generated in the past 5 years, we see the company “bar-coding”, that is, being substantially flat.

What I expect to see from Mr. Vena is a new upward trajectory not only on a per-share basis, which is a direct result of huge buybacks, but in terms of absolute value.

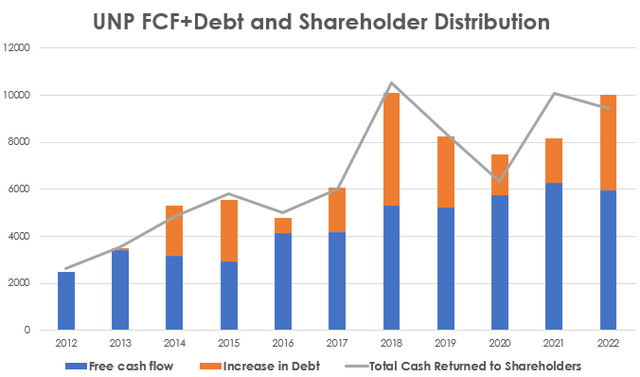

In fact, as I have shared in an article arguing why I don’t think the stock can double soon, Union Pacific has supported its shareholder distributions through a steady increase in debt. If free cash flow doesn’t increase substantially, the company won’t be able to keep on rewarding its shareholders as it has done in my view. This will potentially lead to downward pressure on the stock and we would all, as investors, have to deal with this issue and be patient.

Author, with data from UNP Sec filings

If Mr. Vena is able to turn around the operating efficiency of the company, then we can expect this policy to go on, perhaps not at the same pace seen in the previous decade.

As of now, from what we know given the available data, Q3 won’t probably be the quarter we are waiting for to see a major turnaround taking place.

Therefore, I stick to my valuation. At the moment, Union Pacific is a hold until it trades down to $185. This is already an 18.5 fwd PE, which is more or less aligned with the general index. For a company whose past history has been disappointing, I believe it is already a rather generous multiple which bakes in solid expectations for an upcoming turnaround.

Read the full article here

Leave a Reply