UiPath (NYSE:PATH) is the kind of stock that could be soaring on generative AI hype, but is not. The company helps automate processes for its customers, making generative AI a natural fit for the product portfolio. I expect generative AI to only increase the value proposition for PATH and to help catalyze revenue growth in spite of the tough macro environment. PATH maintains a strong balance sheet highlighted by $1.8 billion of net cash and is generating positive free cash flow. The stock trades very reasonably at just under 7x sales, with Wall Street skeptical of the company’s ability to sustain current top-line growth rates. I reiterate my buy rating as the stock looks highly compelling after the valuation reset.

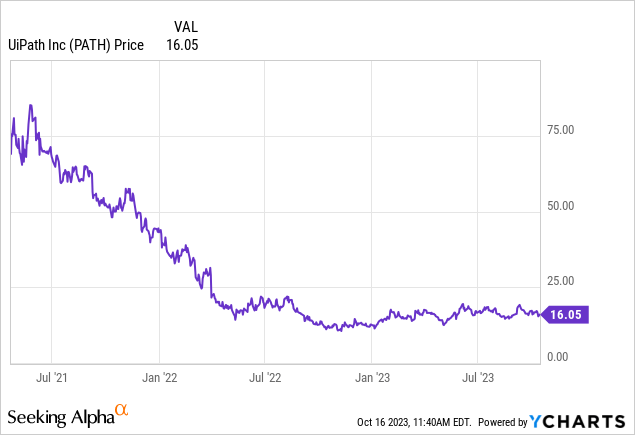

PATH Stock Price

When PATH became public in early 2021, it was welcomed with great enthusiasm. The stock is still 80% below all time highs, in large part due to the fact that valuations were unrealistic back then, though the case for PATH’s products is arguably more significant than ever.

I last covered July where I rated the stock a buy as a “generative AI stock without the hype.” The tough macro environment has continued to pressure growth rates, but PATH continues to make progress on improving profitability and is arguably growing at a solid pace relative to its valuation.

PATH Stock Key Metrics

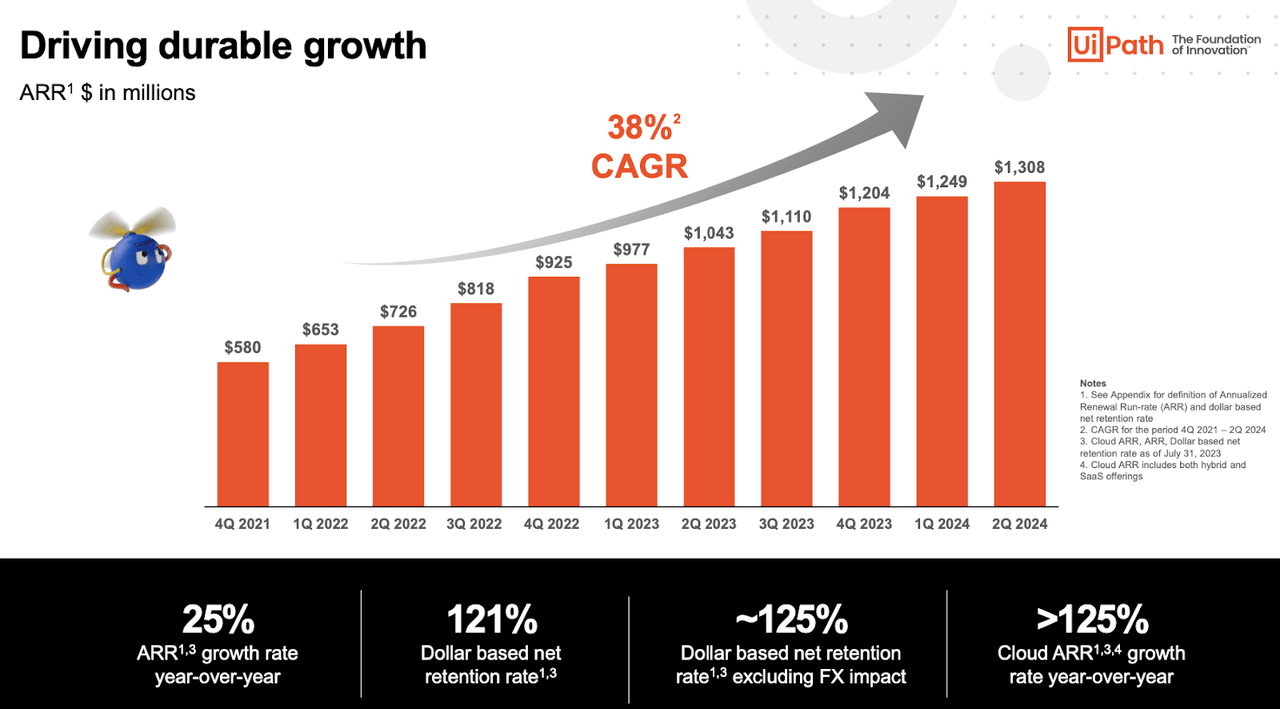

In its most recent quarter, PATH delivered 19% YoY revenue growth to $287.3 million, coming ahead of guidance for $284 million. Annualized renewal run-rate (‘ARR’), the company’s preferred metric, grew by 25% YoY to $1.308 billion (constant currency).

FY24 Q2 Presentation

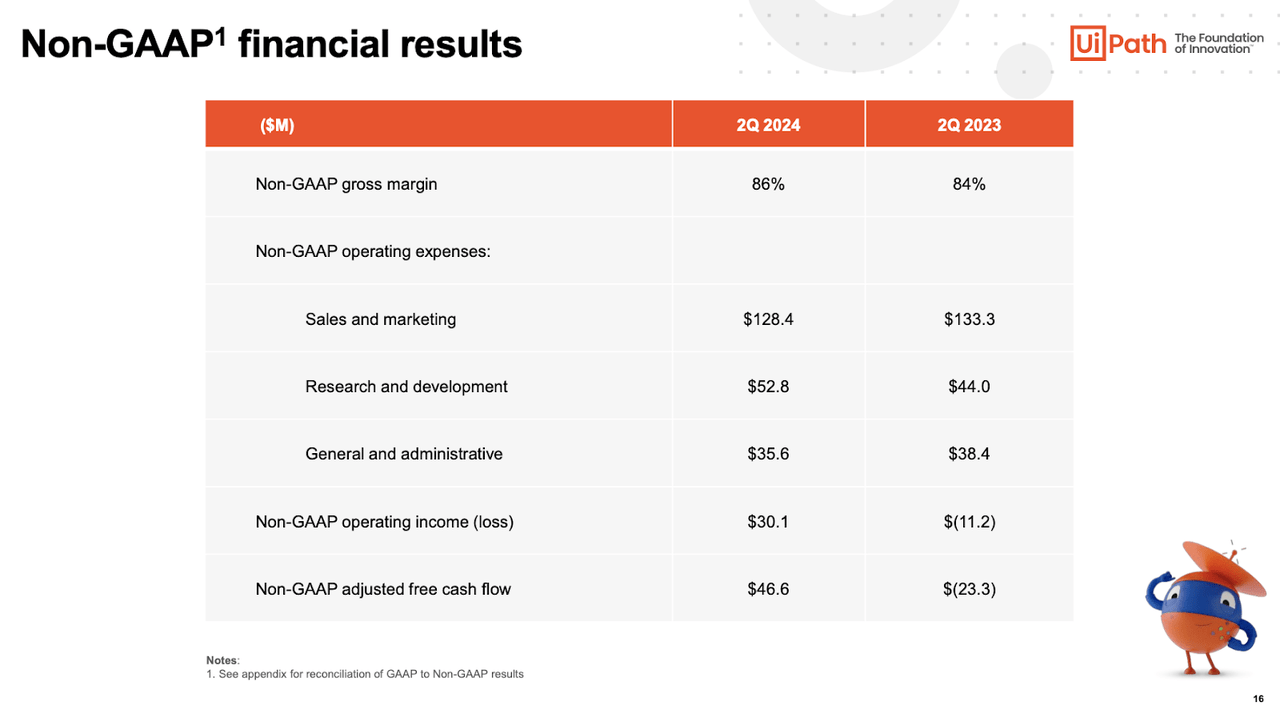

The company paired that strong top-line growth with further margin expansion. After losing $11.2 million in non-GAAP operating income in the second quarter of last year, PATH delivered $30.1 million in positive non-GAAP operating profits. We can see below that the margin expansion was due to operational efficiencies and operating leverage.

FY24 Q2 Presentation

PATH ended the quarter with $1.8 billion of cash versus no debt. The rising interest rate environment may have negatively impacted the company’s growth rates, but it has allowed it to generate higher interest income from its cash position, totaling $13.6 million in the quarter.

The company authorized a $500 million share repurchase program which makes sense given the company’s large net cash position and positive cash flow generation. At the very least, I expect the company to repurchase enough shares to offset ongoing dilution from stock-based compensation.

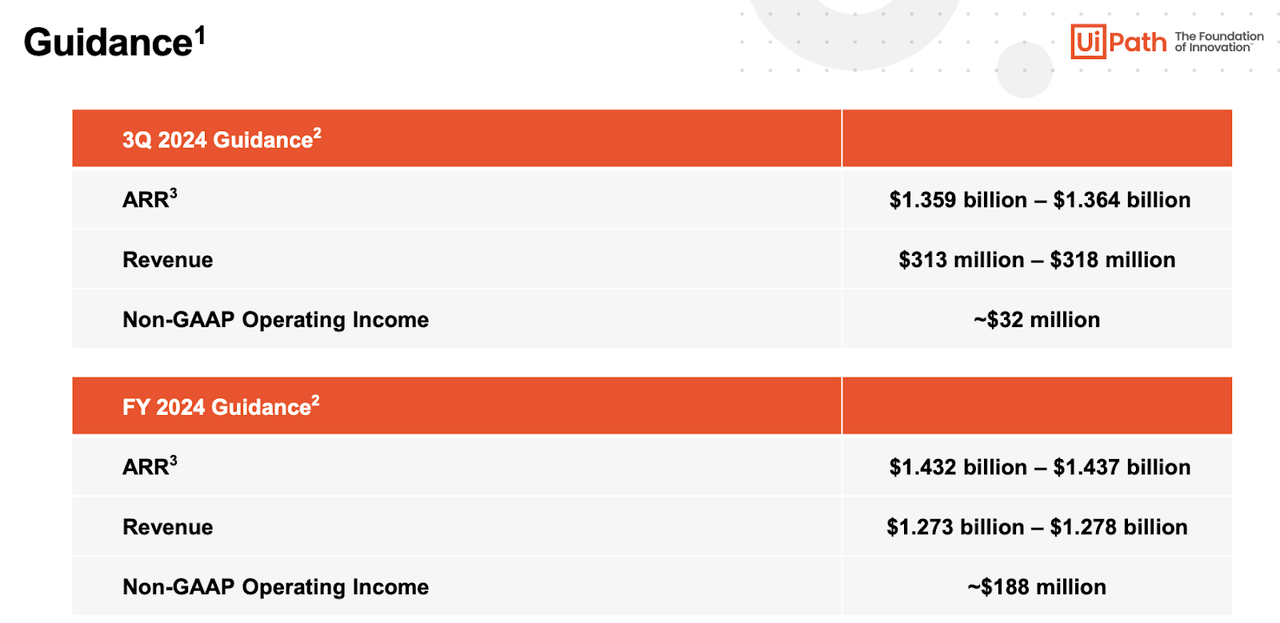

Looking ahead, management has guided for up to $1.364 billion in third quarter ARR, implying 22.9% YoY growth and healthy sequential growth. Management increased full-year guidance, now expecting $1.437 billion in ARR or 20% YoY growth exiting the year. Management also increased non-GAAP operating income guidance from $168 million to $188 million.

FY24 Q2 Presentation

Free cash flow is expected to come in at $250 million, or 20% of revenue. It is incredible how rapidly the company has been able to drive margin expansion – all while dealing with a tough macro environment.

On the conference call, management noted that remaining performance obligations increased 28% YoY to $905 million and current RPOs increased 26.5% YoY to $560 million. Investors sometimes view RPOs as helping to foreshadow forward growth rates. The fact that RPOs have remained strong is quite bullish for the company, though contract terms are likely shorter in duration than in years past and may make relying on this metric more difficult.

Is PATH Stock A Buy, Sell, or Hold?

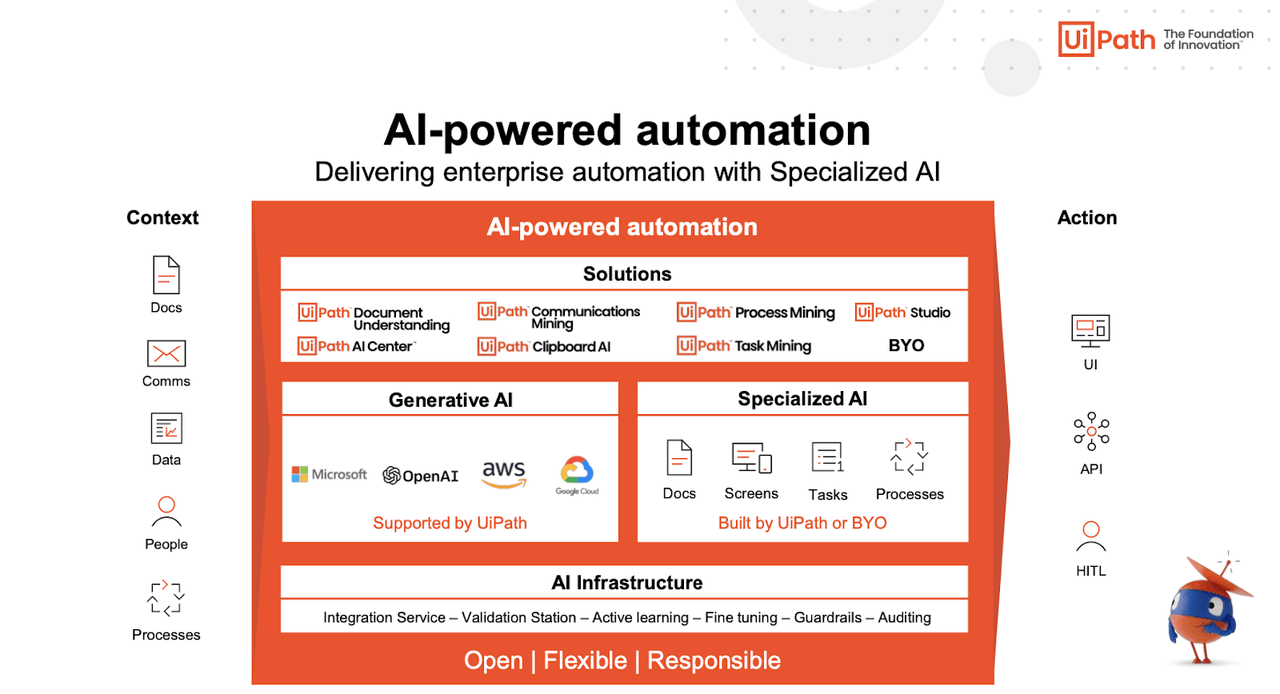

PATH is an enterprise tech company which helps its customers automate its processes – including those done electronically.

FY24 Q2 Presentation

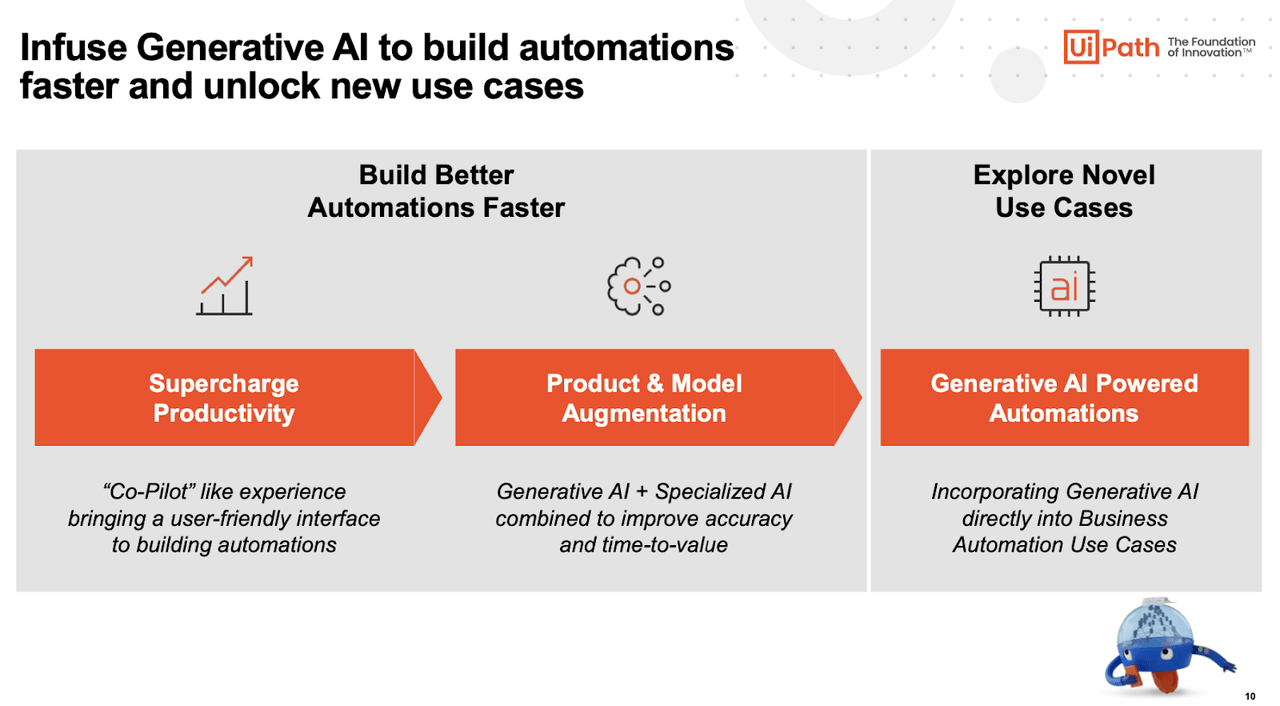

PATH expects generative AI to help the development of new automated use cases, as well as make existing automations faster and better. Whereas many companies may be still in the “discovery phases” of figuring out how to use generative AI for their own use cases, PATH’s entire product portfolio can arguably benefit from generative AI immediately.

FY24 Q2 Presentation

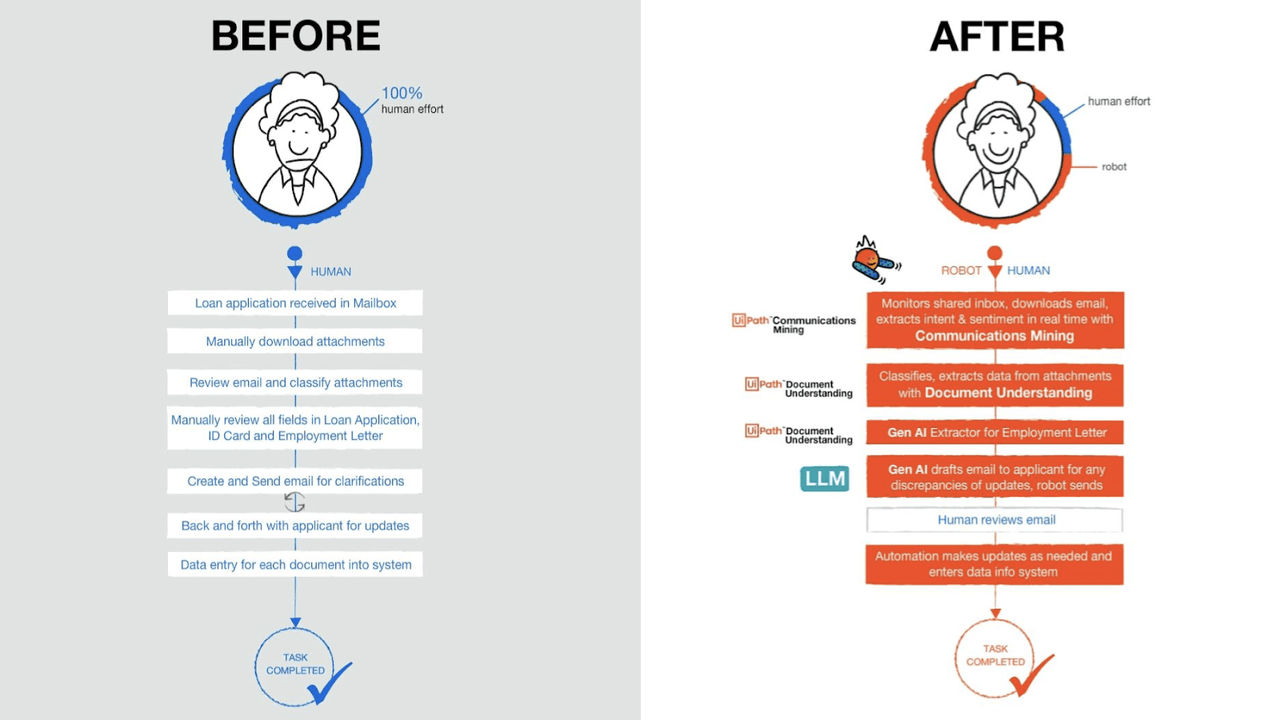

We can see an example of how PATH’s products can help most fully automate a loan application process.

FY24 Q2 Presentation

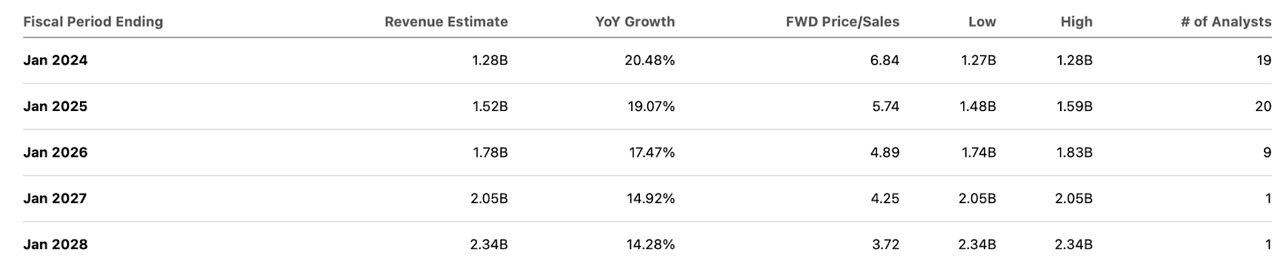

That kind of growth thesis might have earned PATH a 20x-30x revenue multiple in 2021, but these are different times. Higher interest rates have led to a brutal valuation reset in the tech sector. PATH stock recently traded hands at under 7x sales, with Wall Street consensus estimates calling for decelerating revenue growth in coming years. Clearly Wall Street either does not believe that an improved macro environment may lead to accelerating revenue growth, or does not believe in a quick macro recovery.

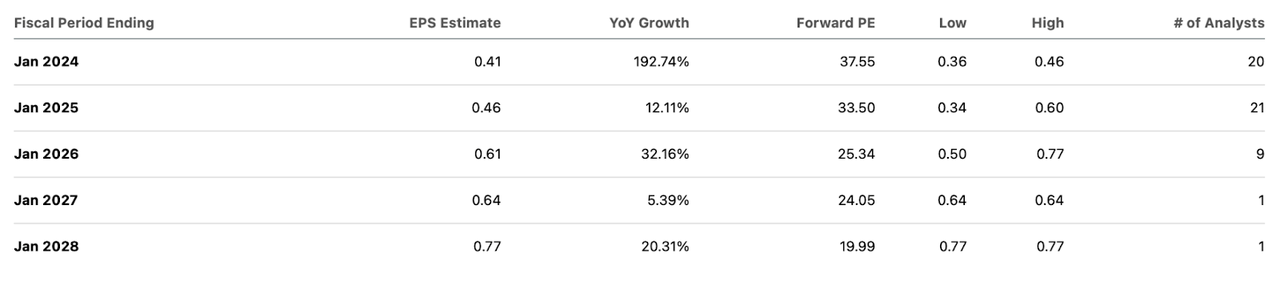

Seeking Alpha

Operating leverage is expected to drive rapid earnings growth.

Seeking Alpha

Management reiterated their 20% long term operating margin target, but with free cash flow margins expected to hover around 20% for the full-year, I find such guidance achievable if not conservative. Assuming 20% revenue growth, 25% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I see the stock trading at around 7.5x sales. An argument can be made that a 1.5x PEG ratio is too low given the recurring revenue model, strong balance sheet, and positive cash flow generation.

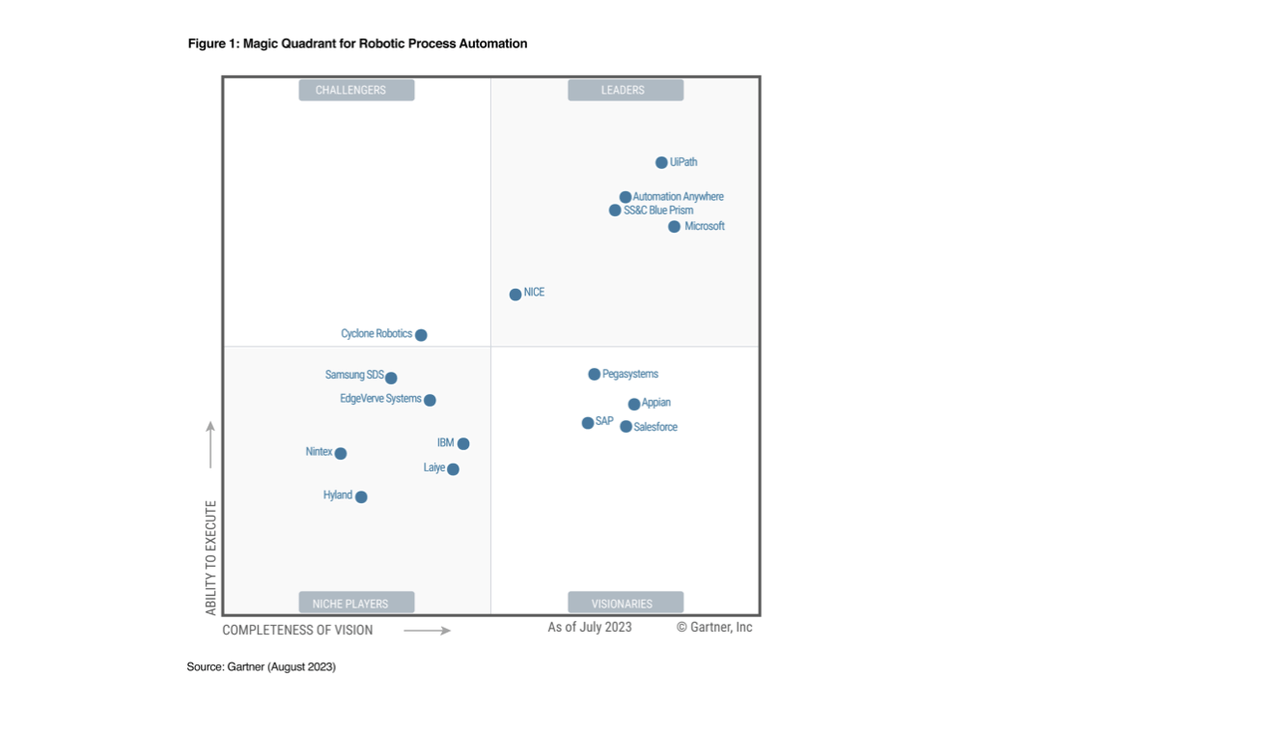

What are the key risks? Competition looms large. While PATH is considered a leader in its industry, it competes against a great number of competitors including the elephant in the room Microsoft (MSFT).

UiPath

While Wall Street has been fearing competition from MSFT for years, we have not yet seen clear market saturation take place just yet, and it is possible that it takes place some time in the future. Unlike in last year, PATH is not trading at dirt-cheap valuations – if the broader market were to experience a bout of volatility, I wouldn’t be surprised to see PATH trade down hard to as low as 4x sales. The current valuation looks solid for long term minded investors, but the company will need to prove that it can sustain stronger growth rates for longer before I have more confidence in the margin of safety.

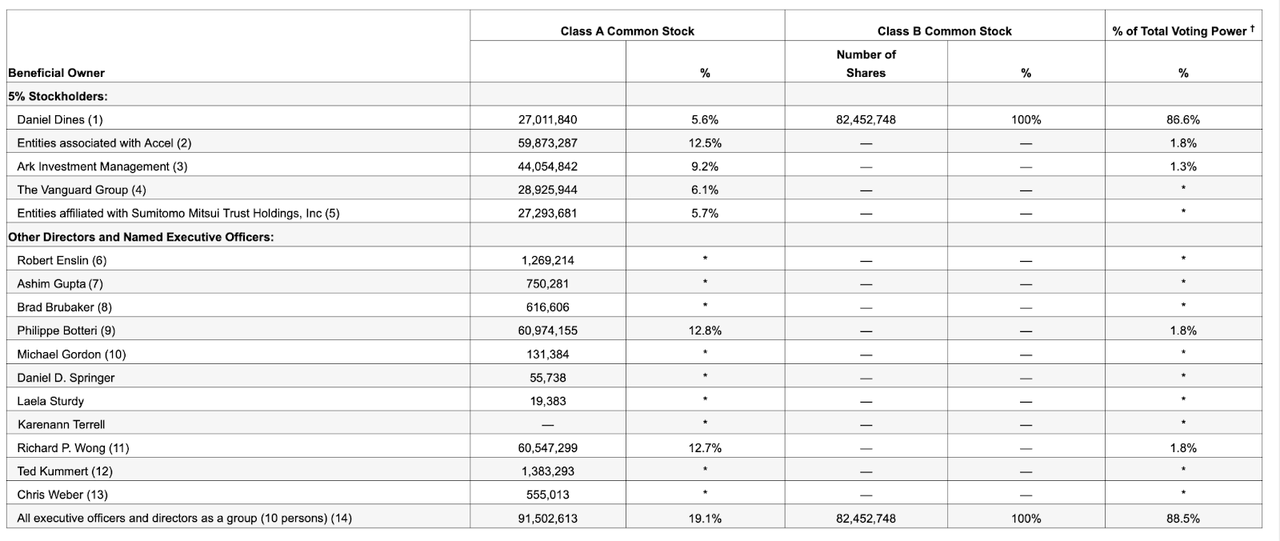

I note that management has large insider ownership, with Co-founder and CEO Daniel Dines owning over $1 billion worth of company stock.

2023 DEF14a

I reiterate my buy rating for PATH stock due to the solid revenue growth rate, attractive long term growth story, and net cash balance sheet.

Read the full article here

Leave a Reply