On a Strike sign in red and white poster

Less than one week into the United Auto Workers union strike against General Motors Co. (GM), Ford Motor Co. (F) and Stellantis N.V. (STLA), nothing has been said or hinted publicly to suggest that the conflict will reach early resolution. In fact, the UAW announced that the strike could “expand” to more plants without “serious progress” in negotiations.

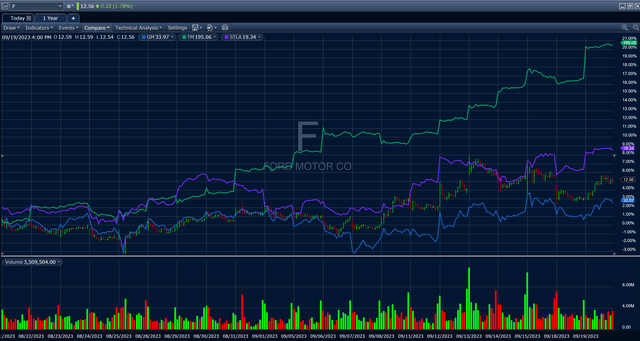

GM, F and STLA shares have experienced minor price fluctuations of less than 2% each since Thursday, when the strike deadline was reached. Most likely, the current pricing reflects the belief that a strike was inevitable, based on belligerent rhetoric from the UAW that began earlier in the summer.

Flying higher

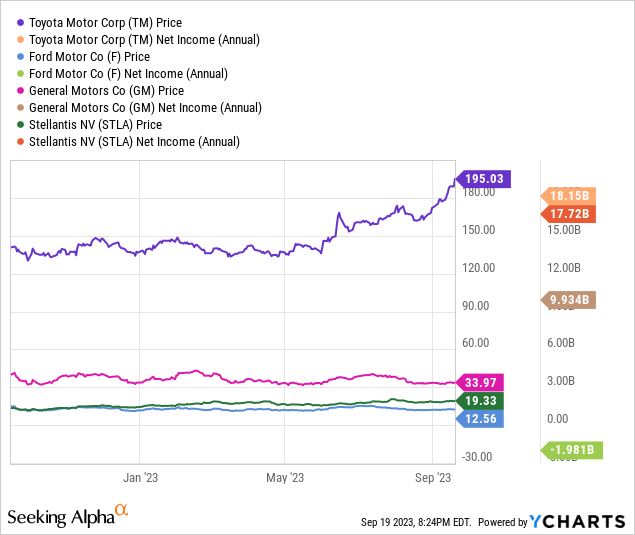

Toyota Motor Corp. (NYSE:TM) shares, by contrast, surged about 6% higher in the past few weeks. The most likely reason for the contrast is that TM stands to benefit from a long and difficult strike against the Detroit 3. Not only will a long strike cost rival Detroit automakers hundreds of millions and perhaps billions in lost sales and profit, it may hurt their standing among consumers.

Ford shares vs TM GM STLA (Fidelity)

How do consumers fit into the equation? Along with the consumers who support unions and a strike against the automakers for more pay and benefits are another group that opposes strikes and adversarial bargaining on ideological and political grounds. The latter group cites the government-sponsored (read: taxpayer-sponsored) bailout of the industry in 2009, effectuated in part to save the jobs of UAW workers; they likely resent the macroeconomic damage a long strike could inflict on the nation.

Detroit today accounts for less than half of the U.S. auto industry. In recent decades, dozens of non-union plants have opened and continue to flourish across the southern U.S. with little or no labor strife – to the benefit of the plant’s workers, government tax coffers and the national economy. Opponents of the UAW strike routinely express their anti-strike opinions on message boards, along with promises to boycott models built by GM, Ford and Stellantis.

Hazy forecast

The impact of threatened boycotts on sales are difficult to assess, much less quantify. Detroit automakers, hedging against the strike, have stepped up production and increased vehicle inventories in recent months so that dealers should be able to meet demand, at least initially, until idled assembly lines can be restarted. In a short strike, the number of lost sales might be minimal.

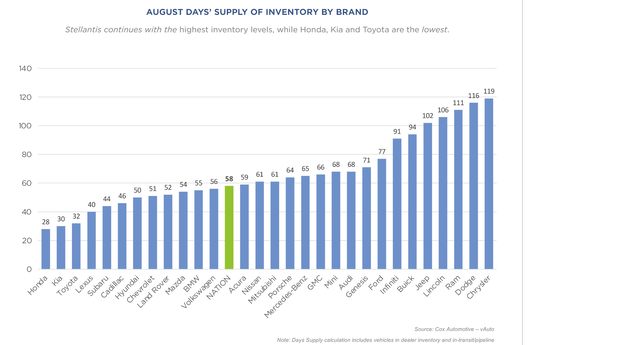

New-vehicle inventory in days supply terms (Cox Automotive)

As a matter of fact, some Detroit brands such as Ford and Jeep were in relatively good shape from a days-of-supply perspective as of early in the month. Toyota’s inventory, by contrast, remains fairly tight. According to Cox Automotive, Toyota had 32 days of supply and Lexus, its luxury division, 40 days of supply. Ford had 77 days of supply and Jeep 102 days of supply. Chevrolet, GM’s top-selling brand, had 51 days of supply.

As of Monday, about 13,000 workers at one of each of GM’s, Ford’s and Stellantis’ plants, were on strike. GM and Ford said they will have to lay off additional workers as a consequence of disruptions caused by the impacted plants. The UAW has adopted a strategy of striking plants at all three automakers – a departure from historic practice; the union also has struck a small number of plants, threatening to increase the number unless progress is made in negotiations.

Unifor, the Canadian labor union, had been threatening to strike Ford in Canada by midnight Monday, but this has since been resolved. The union represents 5,600 Ford workers.

Share gains

Toyota’s market share in the U.S., the world’s most profitable vehicle market, has hovered around 15%, just behind that of the market leader, GM. At the same time, a tighter vehicle market has allowed Toyota to shrink its discounts on new-vehicle retail prices by thousands of dollars per unit, adding to profit. I believe it’s quite possible for Toyota to lead the U.S. market if GM gets hurt badly in what would be its second major strike in four years. (The 2019 UAW strike against GM lasted forty days and cost the company $3.5 billion in lost profit).

In its latest financial report for its first fiscal quarter, Toyota posted profit of $9.6 billion, up from $5.7 billion a year earlier, on consolidated revenue of $77 billion, an increase of 24% from a year earlier. For the fiscal year 2024, ended next March 31, the automaker forecast net income of $20.6 billion on revenue of $304 billion.

Like its rivals, Toyota said it intends to invest heavily to continue electrification of its vehicles, including battery electrics along with gas-electric hybrids and conventional gasoline engines. The automaker intends to introduce over the next few years a solid-state battery and a battery using lithium iron phosphate chemistry – in addition to the lithium-ion battery now in use.

Toyota shares have surged over the past few days as investors absorb the latest information from the UAW strike and how the negative effects on the Detroit automakers may benefit their chief Japanese rival. For now, pickup truck shoppers should be able to find the color and trim packages of the ultra-profitable Chevy Silverado, Ford F150 and Ram models that they’re seeking. If the strike continues for a month or more, shoppers may begin visiting Toyota dealers to browse Tundra full-size pickups or the smaller Tacoma midsize pickups.

Seeking Alpha’s Quant rating, as well as Wall Street analysts, view TM highly. The only mediocre rating is for valuation, which likely reflects the recent runup in the stock’s share price. I attribute TM’s share price increase to three factors: 1) extremely strong financial results reflected in the latest quarterly report; 2) growing public acceptance of Toyota’s electrification strategy, which earlier had been criticized in the mass media; and 3) belief that the fortunes of the Detroit automakers are in decline, due in part to dysfunctional relations with the UAW – which, in turn, help Toyota.

My earlier endorsement of Toyota was based on long-term factors. With the strike constantly in the news, TM shares could experience a runup that might be short-lived once a contract settlement is reached.

Thus, my rating for TM remains a long-term BUY, albeit with caution in the short-term for traders who are seeking to profit from the latest labor turmoil.

Read the full article here

Leave a Reply