Investment Thesis

The overall demand for semiconductor products is strong, and thus, in the long term, the demand for Axcelis Technologies (NASDAQ:ACLS) ion implant products is strong. ACLS stock price decreased from $200 on 31 July 2023 to about $160. Mentioning the strong semiconductor market outlook, one might argue that after this recent drop, Axcelis is a buy. However, from my perspective, it might not be a good time to buy the stock due to two main reasons: 1) the trade war between the U.S. and China has escalated in the past few months, and 2) ACLS stock price has already increased enough to cover the company’s revenue outlook in the following year.

In 2018, Axcelis had a revenue of $553 million, and its revenue increased to $920 million in 2022. The company may achieve annual revenues of $1.3 billion in the next 1 to 2 years. I’m not going to say that annual revenues of about $1.3 billion (if achieved) can be ignored. However, as the company’s revenue increased by 40% YoY in 2021, and by 39% YoY in 2022, an increase of about 20% YoY (if achieved) in 2023, and an increase of about 18% YoY (if achieved) in 2024, may imply that the company is not in the position to continue growing at a pace it grew in the past few years (partly due to industry weaknesses, and partly due to escalated trade war between U.S. and China).

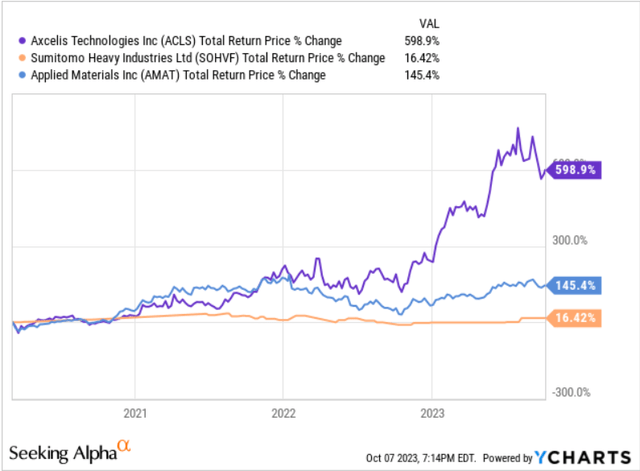

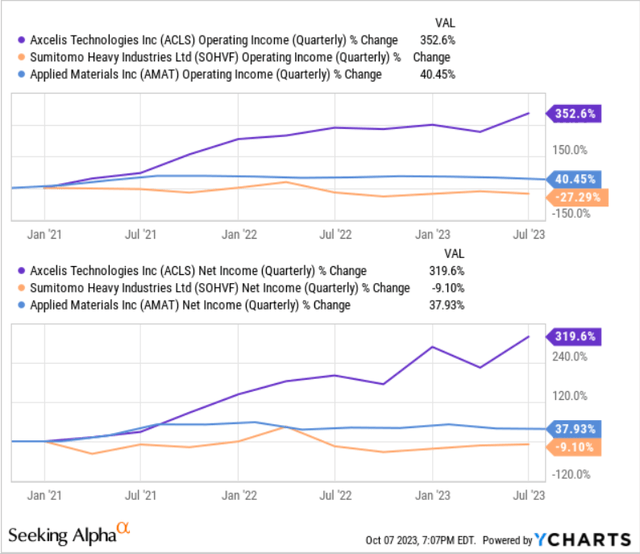

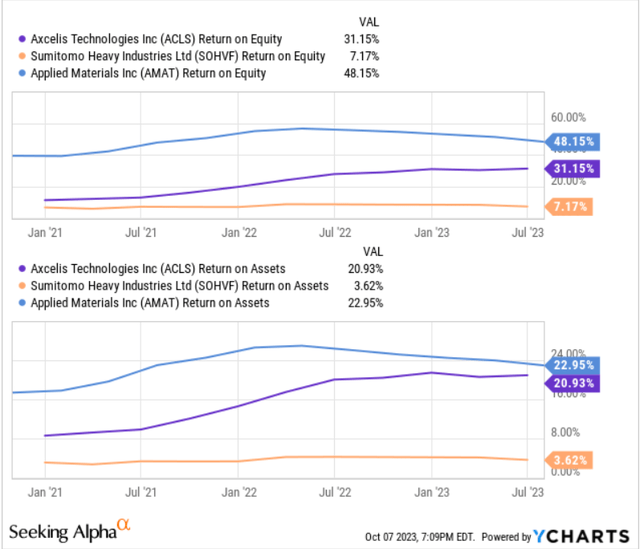

According to Figure 1, Applied Materials (AMAT) and Sumitomo Heavy Industries (OTCPK:SOHVF) price returns in the past three years have been much lower than the price return of Axcelis. This is not a surprise as we can see that in the past three years, Axcelis’ operating income and net income grew significantly more than AMAT and SOHVF’s (see Figure 2). Moreover, according to Figure 3, Axcelis’ return on equity (ROE) and return on assets (ROA) are higher than the ROE and ROA of Applied Material and Sumitomo Heavy Industries. Thus, Axcelis does not seem to be overvalued, and the company’s operational results are strong. However, as I mentioned before, the company is not expected to grow as it did in the past few years. The escalated trade war between the U.S. and China can have a significant effect on Axcelis’ operating results. As China accounts for a great part of the company’s revenue, Axcelis operations are exposed to significant risks that cannot be ignored.

Figure 1 – ACLS stock price return vs. peers

YCharts

Figure 2 – Axcelis operating income and net income vs. peers

YCharts

Figure 3 – Axcelis ROE and ROA vs. peers

YCharts

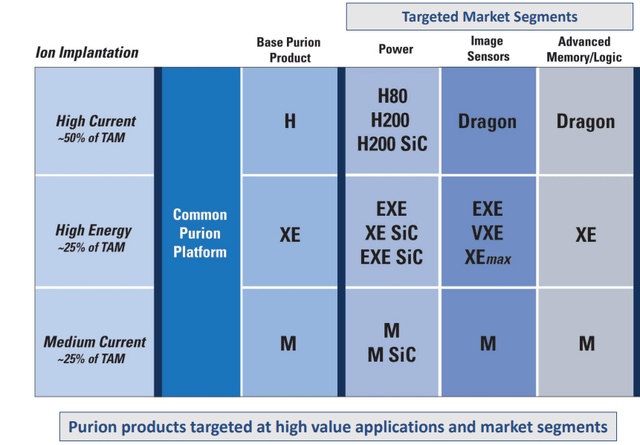

Axcelis’ strategic goal is to achieve $1.3 billion annual revenue in future years by ensuring high levels of customer satisfaction and quality. To do so, Axcelis has to grow its Purion footprint with its existing customer base, and also, sign contracts with new customers. Ion implantation is a principal step in the transistor formation cycle of the semiconductor chip manufacturing process. Axcelis offers a complete line of high energy, high current, and medium current implanters, covering all requirements across all targeted market segments (see Figure 4). It is worth noting that Axcelis ion implantation business accounts for almost 98% of its revenue. Thus, if the company wants to continue growing, its ion implant products need to continue to meet its customers’ demand, remaining competitive against ion implant products produced by its competitors. About 3100 of Axcelis products are estimated to be in use in 28 countries, and international revenues account for more than 80% of its total revenue. Samsung Electronics, and Semiconductor Manufacturing International Corporation (SMIC) represent 10% of Axcelis revenues.

The demand outlook for semiconductors is strong; however, the competition is severe too. In the United States, in the area of ion implantation, Axcelis competes with Applied Materials. From the international perspective, Axcelis competes with two Japanese companies (Sumitomo Heavy Industries Ion Technology and Nissin Ion Equipment), one in Taiwan (Advanced Ion Beam Technology, and one in China (CETC Electronics Equipment Group). Due to U.S. export control regulations for shipments of semiconductors and related products to China, Axcelis’ non-U.S. competitors have become more competitive in the past year. “While these regulations have further excluded exports to certain Chinese customers, we currently are able to continue to ship to the majority of our Chinese customers,” Axcelis declared in its 2022 annual results 8 months ago. However, the tensions between the U.S. government and the Chinese government have escalated further since then.

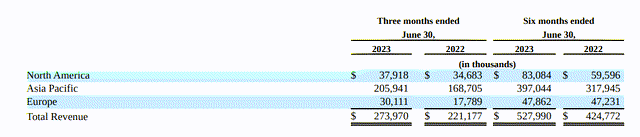

On May 2023, China’s semiconductor industry faced renewed pressure From the U.S. as Japan (a U.S. ally) announced it would impose export restrictions on 23 types of chipmaking technology. As an answer to U.S. restrictions, China started controlling exports of some metals widely used in the semiconductor industry to the U.S. a few months ago. Well, two plus two! I believe that now, Axcelis’ management knows that compared to 8 months ago, its revenue from Chinese customers is exposed to more serious risks. In a nutshell, Axcelis may not be able to sell its ion implant products to its Chinese customers as it expected before, and its non-U.S. competitors can now increase their market share more easily than before. According to Figure 5, in the six months ending 30 June 2023, Axcelis’ Asia Pacific revenue accounted for 75% of its total revenue. The company hasn’t published any information on the share of China; however, as China is one the main players in the industry, it is safe to say that a significant part of Axcelis ion implantation revenues are connected to China, and its future revenue growth and competitiveness are exposed to the tensions between U.S. and China.

Figure 4 – Purion products are the core of Axcelis growth strategy

Axcelis’ 2Q 2023 presentation

Figure 5 – Axcelis revenue by geography

Axcelis’ 2Q 2023 results

End note

The market outlook for ion implant products is promising, and Axcelis is still well-positioned to benefit from the increasing demand for semiconductors; however, not at a pace as it did in the past few years. In the long run (periods more than 1 year), ACLS is a buy. However, for the medium term (6 to 12 months), I don’t expect Axcelis stock to jump as the stock price has already increased significantly, and the tensions between the U.S. and China can materially affect Axcelis’ operational results. For now, the stock is a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply