U-Haul Holding Company (NYSE:UHAL), formerly known as AMERCO, operates storage units and rental moving services. The company has had a successful strategy of reinvesting cash flows into a further growth to fuel U-Haul’s path into the nationwide brand it is today. Although the stock is currently quite far from its YTD high of $77, I don’t think the current price represents too good of an opportunity as the company is currently facing a tougher market. With my DCF model estimates pointing towards a fairly valued stock, I have a hold-rating for U-Haul.

The Company & Stock

U-Haul is a self-moving equipment rental company – the company rents out cars for do-it-yourself moving. In addition, U-Haul has almost a million rentable storage units, representing a smaller but notable part of the company’s revenues. The company has grown its operations both organically and through acquisitions into a nationwide leader in the United States.

U-Haul’s stock has had a very good run – the stock has appreciated 3805% in price over the last 29 years, making the stock’s CAGR a great 13.5%:

Stock Chart (Seeking Alpha)

Financials

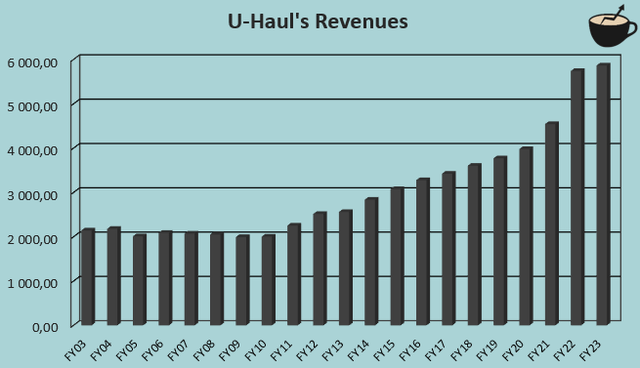

In the company’s history, U-Haul has achieved a good amount of growth – U-Haul’s compounded annual growth rate has been 5.2% from FY2003 to FY2023:

Author’s Calculation Using TIKR Data

The growth has been achieved as a result of extensive reinvestments – U-Haul hasn’t been paying dividends, because the company seems to allocate its capital towards expanding the operations. For example, the company just recently bought out a storage business in September in South Dakota as reported by Seeking Alpha, as well as expanding through multiple other transactions:

Recent Acquisitions and Expansions (Seeking Alpha)

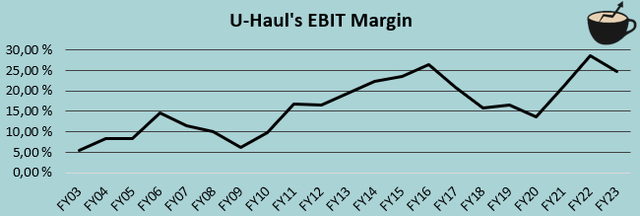

U-Haul’s EBIT margin has had some large swings in the company’s long-term history, as the margin has ranged from 5.4% to 28.6% with an average of 16.2% in the period from FY2003 to FY2023:

Author’s Calculation Using TIKR Data

The company has achieved a very good margin level in recent years, as the EBIT margin rose by 7.7 percentage points in FY2021 into a margin of 21.2%. Since FY2021, the margin has risen a bit further with a current trailing figure of 23.3%.

Despite a largely good past couple of years in U-Haul’s financials, the company has started to face a tougher period in the current economy. In the company’s most recent reported earnings, Q1/FY2024, U-Haul’s revenues decreased by 3.6%, and the company’s EBIT margin fell by 5.1 percentage points – a tougher market in terms of demand is currently weakening the financials. In U-Haul’s Q1 earnings call, CFO Jason Berg commented the following about U-Haul’s current market:

“The trends that we’ve seen in the past several quarters continued; declining transactions and reduced miles per transaction. Revenue per mile growth has remained positive. And July results trended down compared to last year.”

The company has had three sequential quarters with declining revenues – the worse economy has caught up with the firm. As comparison figures become softer in Q3 and forward, though, I believe the company should be able to eventually get back on track in terms of growth.

U-Haul has around $4.7 billion in long-term debt on its balance sheet, of which $561 million is in the current portion. As interest expenses are currently only around 17% of U-Haul’s EBIT, I believe the debt is on a healthy level. Even with the partly weakened earnings, the company’s underlying cash flows should be quite good – the debt doesn’t seem to pose a risk and provides cheaper financing for the company. U-Haul also has a very large cash balance of almost $2.4 billion – the cash seems to be used to finance further expansion.

Valuation

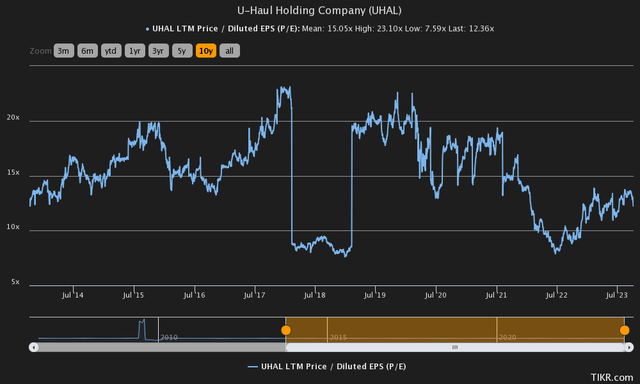

U-Haul trades at a trailing price-to-earnings ratio of 12.4 at the time of writing, below the company’s ten-year average of 15.1:

Historical Forward P/E (TIKR)

The lower figure seems well explained by the rising interest rates, as investors seek for a higher return on the stock market.

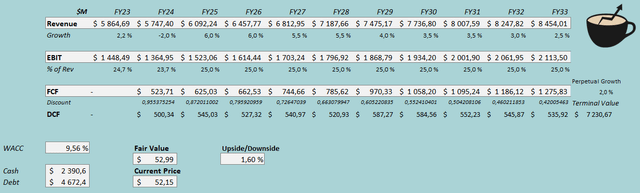

To further analyse the valuation and to get a rough estimate for the stock’s fair value, I constructed a discounted cash flow model as usual. In the model, I estimate a revenue decrease of 2% for FY2024 – the company has had decreasing revenues for the past three quarters due to slower rental transaction rates. In the company’s Q1/FY2024 earnings call, U-Haul communicated the trend to have continued down in July, constituting a more pessimistic view for the current year. Going beyond FY2024, I believe U-Haul will execute its growth strategy quite well with a growth estimate of 6%, very slightly above the company’s long-term average. I estimate the growth to continue into FY2026, after which the growth slows down in steps into a perpetual growth rate of 2%.

U-Haul’s EBIT margin has risen into a whole new level in FY2021. After the year, the company has maintained a very good operating margin, although the margin currently sits 5.3 percentage points below the FY2022 level. Because of the softer demand, I estimate U-Haul’s EBIT margin to fall by one percentage point in FY2024 into a margin of 23.7%. After the year, I estimate the margin to jump back into a level of 25.0%, at which the EBIT margin stays into perpetuity in my model. I believe the estimate of 25% is fair for the company; the margin represents some expansion after the softer demand subsides, but doesn’t expect too much further margin leverage. As U-Haul constantly reinvests its cash flows to fuel growth, I estimate the company to convert its earnings into free cash flow quite poorly in the first years, but as the growth slows down, I estimate a moderately better conversion rate.

The mentioned estimates along with a weighed average cost of capital of 9.56% craft the following DCF model with a fair value estimate of $52.99, around 2% above the current price:

DCF Model (Author’s Calculation)

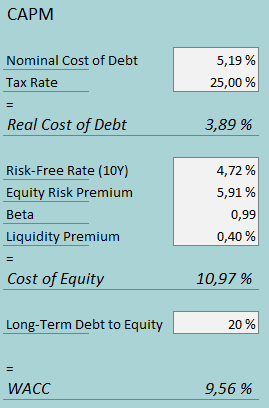

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2 U-Haul had around $61 million in interest expenses. With the company’s outstanding interest-bearing debt, the company’s interest rate comes up to 5.19%. The company operates with a moderate but useful amount of debt – I estimate the company’s long-term debt-to-equity ratio to be at 20%.

I use the United States’ 10-year bond yield of 4.72% as the risk-free rate on the cost of equity side. The equity risk premium of 5.91% is Professor Aswath Damodaran’s estimate made in July. Yahoo Finance estimates U-Haul’s beta at 0.99. Finally, I add a small liquidity premium of 0.4% crafting a cost of equity of 10.97% and a WACC of 9.56%.

Takeaway

At the current price, U-Haul seems to be quite correctly priced. The company is continuing its long-term strategy of investing cash flows to expand further. Despite the tougher economy and financials, U-Haul has kept its operations quite stable, and continues to acquire new business territories. I don’t see a significant driving force into either direction for the stock; for the time being, I have a hold-rating.

Read the full article here

Leave a Reply