Prima Facie, A Prime Mean-Reversion Candidate..

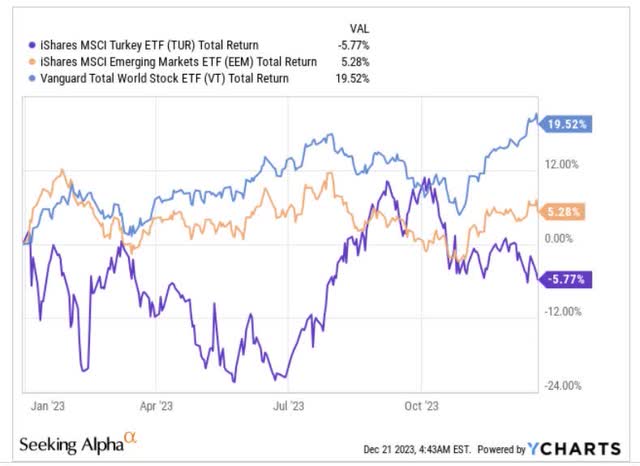

The iShares MSCI Turkey ETF (NASDAQ:TUR), a product that offers coverage to 90 Turkish equities, hasn’t fared particularly well in 2023. In a year when the global markets have delivered returns of close to 20%, and its emerging market peers have eked out positive returns of mid-single-digits, TUR has slumped by -6% on a YTD basis.

YCharts

The underperformance this year also means that TUR’s allure as a potential mean-reversion trade still burns bright. Note that TUR’s strength relative to a portfolio of global stocks is still rather beaten-down, and is currently trading a good -63% off the mid-point of its long-term range.

StockCharts

The temptation to latch on to TUR is also further emboldened by the fact that its valuations are astoundingly cheap. According to Morningstar, TUR only trades at a P/E of less than 5x; contrast that with the flagship emerging markets ETF (EEM) which is priced at a P/E premium of 135%, and the Vanguard Total World Stock ETF (VT) which is priced at an even greater premium of 212%. Meanwhile, Turkey’s high inflation threshold (it has been at +60% levels for the last three months) also invariably filters through to much superior earnings growth runway, with long-term earnings growth of 27% (Source: Morningstar). In contrast, emerging markets and global stocks offer a much lower earnings runway of 10-11%.

But A Trust Deficit With Erdogan Still Likely Lingers

Given what we’ve presented in the last couple of paragraphs, TUR doesn’t appear to be in a bad spot at all, but yet still, given the previous actions of the Erdogan administration, there are still question marks over his ability to stay the course and not renege on the policy pivot that came into force a few months after his re-election in May.

One of the reasons why TUR still remains a massive risk is because of what’s happening with the Turkish Lira. TUR’s NAV has taken a massive hit because of the relentless depreciation of the Turkish Lira, which is currently at record low levels. That’s why, even though Turkish equities in local terms have been rather robust (the benchmark BIST 100 is actually up by +47% this year) that strength hasn’t quite played out in the dollar-denominated TUR, making this product a risk.

Now given how strongly policy rates have been lifted in Turkey, some may wonder why the currency has been taken to the cleaners. For context, since June the central bank, under a new regime, has lifted its policy rates by 3400 points, including 250 points as recently as today. Under normal circumstances, this should’ve boosted the allure of Turkish-denominated assets and stopped the depreciation of the Lira, but weakness has persisted, and much of this could be on account of fears linked to Erdogan’s previously mercurial stance which has seen him fire central bank governors with abandon.

The other uncertainty is probably linked to the onset of local elections towards the end of Q1 next year, which could once again prompt the administration to be profligate with stimulus and policy in order to garner votes.

Fear from foreign investors could potentially be mitigated when the current Turkish central bank governor- Hafize Gaye Erkan (a former Wall Street executive) holds an investor day meeting of the bank in New York in the second week of January.

Admittedly, even though the Lira continues to depreciate, the authorities there deserve some commendation for arresting the decline in FX reserves and bringing it back up. Reports coming out of Turkey suggest that central bank FX reserves have surged by $43bn since June.

The Competitive Positioning of Turkish Equities Could Diminish

The other variable to consider is how competitive Turkish equities look relative to bank deposits, particularly after witnessing close to a +50% gain this year. Meanwhile, given the elevated interest rate regime that has been in play across recent months, lira-denominated deposits are proving to be a tasty safe haven for local investors to park their funds. A study by Bloomberg suggests that the weighted average interest rate for 3-month lira-denominated deposits has hit a 21-month high of 50%. Yes, given where inflation currently still is, in real terms, those rates are still not competitive, but the central bank has suggested that the monetary policy effects which take place with a lag, will make its presence felt next year, and their medium-term target is to bring inflation down to 5%.

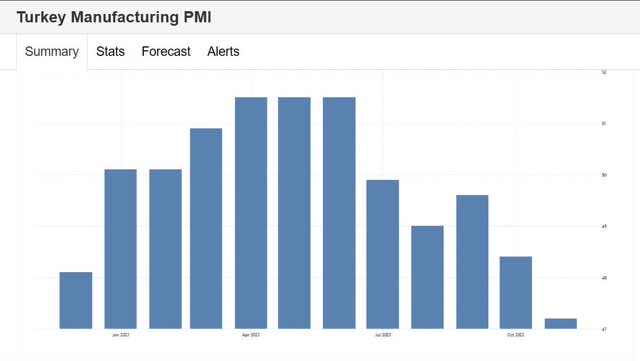

Then TUR’s own prospects are not particularly abetted by the fact that it is heavily exposed to the industrial stocks (this segment accounts for the largest weight in the portfolio at 28%) whose growth ambitions could be curtailed by sky-high interest rates. The latest manufacturing PMI reading (47.2) was particularly weak, dropping to its lowest level in a year, whilst the pace of new orders continues to ease through Q4.

Trading Economics

Meanwhile, GDP next year as well will not be particularly robust, with the growth rate expected to fall from 4% this year to 3% next year.

Conclusion

In summary, even though TUR appears to have some tenuous potential as a cheap, mean-reversion bet, we’re not convinced the economic conditions and the currency dynamics are supportive enough to generate sustainable alpha, more so when Turkish economies in local terms have already appreciated by 48% on a YTD basis.

Read the full article here

Leave a Reply