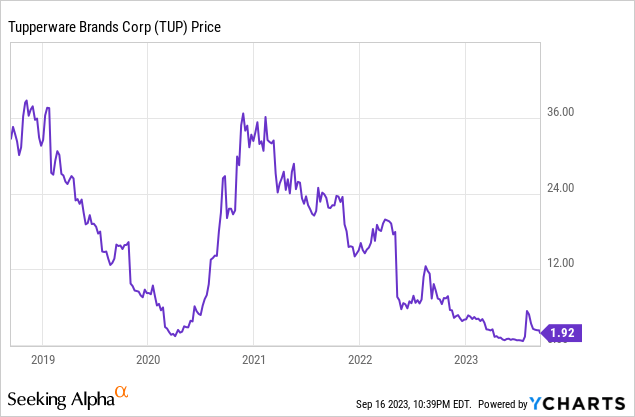

Tupperware Brands (NYSE:TUP) received a new lease on life in early August when they were able to negotiate a debt restructuring that kept them out of a potential Ch.11 filing – at least for now. Investors have no idea what their current operations actually look like because they have not filed any financial reports since the end of the 3Q 2022 – no 10-K for 2022, no 1Q 10-Q, and no 2Q 10-Q. The reality for shareholders is that TUP stock might be delisted from the NYSE and could actually be moved over to trade only on the “expert market” under the SEC 15c2-11 rule, which would effectively mean that many TUP holders could only close their current positions and not open new ones. Because of so many uncertainties, I continue to rate TUP stock a sell.

Still Waiting for 2022 10-K to Be Filed

An August 25 8-K filing stated that it “currently expects to file with the SEC its Form 10-K in September 2023, and its Q1 Form 10-Q and Q2 Form 10-Q in the fourth quarter of 2023”. I have serious doubts about that because they also stated in the same filing that they hired two restructuring and turnaround professionals. This is just my opinion, but I am assuming that these two professionals want to make sure that the 10-K is “perfect” and will not require some amendment filing to correct errors. Since Tupperware already stated in prior SEC filings that 2020, 2021, and 2022 financial statements require corrections for “material misstatements” that could be significant, these two restructuring professions may need more than just a few weeks to review everything in detail.

They also have a credibility issue. In an April 3 filing, they stated that the company “currently expects to file its Form 10-K within the next 30 days; however, there can be no assurance that the 2022 Form 10-K will be filed at such time”. It has been over five months. In a July 7 filing stated the company “currently expects to file with the (SEC)… its Annual Report on Form 10-K for the fiscal year 2022… by August 2023 and its…10-Q for the quarter ended April 1, 2023…by late September 2023; however, there can be no assurance that either the Form 10-K or Form 10-Q will be filed by such dates”. Its credibility about when they will actually file its 10-K is highly “questionable”, in my opinion.

There is, however, a strong incentive to file its 10-K by September 30 and that is to remain listed on the NYSE. The company received a delisting notification by NYSE last April 3 for failure to file a 10-K by the due date (within 90 days after the end of the fiscal year). Tupperware has six months from the 10-K due date to regain NYSE compliance, which would mean by September 30. Tupperware still might be able to avoid delisting if they do not file by September 30 because the NYSE may grant an extension of up to six additional months to regain compliance, depending on the specific circumstances. However, according to the NYSE Manual:

If the Exchange determines that an additional trading period of up to six months is not appropriate, suspension and delisting procedures will commence in accordance with the procedures set out in Section 804.00 of the Listed Company Manual”.

At this point, it is very unclear which way the NYSE decides. The NYSE does not have specific metrics or specific detailed factors – they are given wide discretion. As the NYSE Manual also states:

In determining whether an additional up to six-month trading period is appropriate, the Exchange will consider the likelihood that the filing can be made during the additional period, as well as the company’s general financial status, based on information provided by a variety of sources, including the company, its audit committee, its outside auditors, the staff of the SEC and any other regulatory body. The Exchange strongly encourages companies to provide ongoing disclosure on the status of the annual report filing to the market through press releases, and will also take the frequency and detail of such information into account in determining whether an additional six-month trading period is appropriate.

Tupperware, as I noted above, has stated expected 10-K filing times that they did not meet – disappointing investors. They also are planning on filing amended 2020, 2021, and 2022 SEC filings. So currently it seems that the latest accurate financial filings are from 2019. Tupperware has not even given some general basic financial statement releases for this year. At least it appears that it resolved a different delisting notice received in June regarding its stock price trading below $1.00 per share because TUP has traded over $1.00 on more than 30 consecutive days after the August debt restructuring announcement. I think, however, there is a serious risk that the NYSE will not grant them a six-month extension.

If the NYSE does not grant the extension and begins the delisting process under 804.00. Tupperware can request a review within ten days after receiving the notice. A request for review usually stays the trading suspension, but the NYSE still can suspend trading if they determine “that such immediate suspension is necessary or appropriate in the public interest, for the protection of investors, or to promote just and equitable principles of trade.”

When the NYSE committee actually considers the requested review and makes a decision is unclear. Based on my reading, it could be weeks.

Risk of Moving TUP Stock Trading to Expert Market

If a stock is delisted from the NYSE, it usually then starts trading on the OTC market or on the “pink Sheets”. Because of the relatively new SEC 15c2-11 rule, TUP might then only be traded on the “expert market”. Under this SEC rule, brokers/dealers must know and have certain information on file about a company that is current in order to publish or submit quotations for publication (make a market in a stock). Based on my reading of this SEC rule and multiple articles I have read, it seems that the financial information must be less than 180 days “old” unless a company’s stock trades on the “pink limited information” tier, which requires an annual report within the preceding 16 months. Currently, TUP fails on all these. It has not filed a quarterly 10-Q since the quarter ending September 24, 2022, and no annual report yet for 2022.

Even trading on pink limited information market often results in a significant drop in stock price and limited trading volume. Trading only on the expert market is often even worse for investors. One of the problems is that most retail investors can’t trade on the expert market because it requires finding a broker willing to post that specific investor’s bid or ask price/volume for that stock. Some brokerage firms allow their customers to close a current position, but not open a new one. The result is usually no irrational meme trading (or even “rational” trading).

While I am not asserting that TUP will be moved over to the expert market later this year, I do feel that investors need to understand the multiple factors that impact this serious potential risk. If Tupperware does get moved to the expert market and eventually becomes compliant with various filings, it could apply to be listed/trade again on the NYSE or even the OTC market.

If Tupperware does file its 10-K in the near future or the NYSE grants an extension, there could be a “pop” in TUP stock. If, however, that 10-K contains some very negative financials, the stock could plunge.

Debt Restructuring

Before looking at the recent debt restructuring, I want to point out that Tupperware repurchased $75 million worth of TUP stock during the first nine months of 2022. This is another example of completely irrational financial management by the board of directors of a struggling company, in my opinion. It should have used that $75 million cash to pay down some of its $700 million debt as of September 24, 2022.

I wonder if the very low prices received by bankrupt Bed Bath & Beyond (OTCPK:BBBYQ) for its assets under a bidding process influenced Tupperware’s lenders to help keep the company out of Ch.11 because the actual value of these lender’s collateral might not actually be as valuable as they originally estimated in a bankruptcy proceeding. What happened with BBBYQ reinforces the belief held by many, including myself, that any Ch.11 proceedings greatly reduce the value of assets, especially intellectual property.

Remember its financial situation was so bad that in early May it needed to amend its credit agreement that allowed it to borrow an additional $5.3 million under that agreement in order to pay past-due interest payments. It looked like they either were going to file Ch.11 within a few months, or they needed to do a complete debt restructuring. This August debt restructuring is very expensive. Besides extremely high fees and interest rates, the lenders were given 5-year warrants that are exercisable for 2,548,874 TUP shares, which is about 4.99% of the outstanding stock, at $0.01 per share. So, if Tupperware does eventually turn around the lenders could get a “nice payday” via the warrants besides receiving high interest payments.

There is a $16.25 million restructuring fee and an additional multi-million-dollar complex facility fee. There are a number of loans in various currencies that are due July 31, 2025. The variable interest rate payments on these loans are to be paid in cash. The 2027 loans are due July 31, 2027, and have a 14% PIK interest rate. This means the interest payments are not paid in cash but are paid in kind, which means the amount outstanding on the loans keeps increasing. Because the company has not filed any recent financials, it is difficult to forecast its ability to be compliant with the various loan covenants.

Conclusion

Because I could not just assert in an article that there is a serious risk that TUP shares could be moved over to the dreaded “expert market” without extensive documentation to support the assertion, most of this article is about this important potential risk. Since Tupperware has a serious credibility problem regarding when they will file required SEC financials, since they already stated there were material misrepresentations for 2020, 2021, and 2022, and since they are in serious financial trouble, it is unclear, in my opinion, if the NYSE will just “rubber stamp” an extension to file a 10-K if it is not filed by September 30 or if they will deny the extension. There is a real risk that TUP could eventually be moved over to the expert market.

Usually Seeking Alpha encourages writers to include the latest financials in articles – but there are none for Tupperware Brands. Besides all these filing and stock trading issues, I wonder if its individual salespeople are staying with Tupperware because of all the very negative financial news in the press. I assume it is also much more challenging now to recruit new salespeople. Given all these negatives and the reality that Tupperware Brands may eventually still file for Ch.11 bankruptcy, I continue to rate TUP stock a sell.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply