Introduction

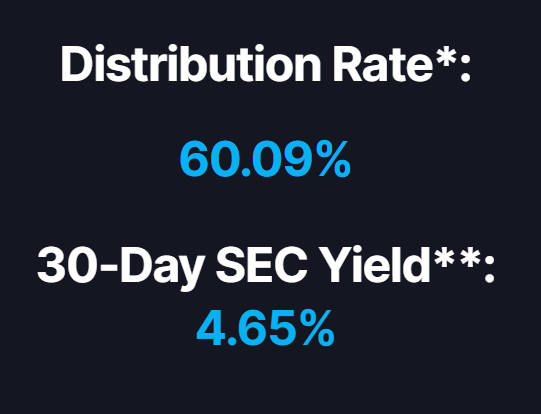

A new wave of covered call ETFs have swept unsuspecting income investors away with eye-popping distribution rates. The YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY) is one such ETF currently promising a 60% distribution rate. You read that right. Sixty percent.

TSLY Distributions (YieldMax ETFs)

TSLY (I’ve been pronouncing it “tes-lee”, please comment if you call it something different) has a singular strategy: sell options against Tesla (TSLA) for income and maintain an 80% price exposure cap.

Brief Overview

At a glance:

-

Price: $11.94

-

Dividend Yield: 4.65%

- Distribution Rate: 60.09%

-

Beta: 3.62

-

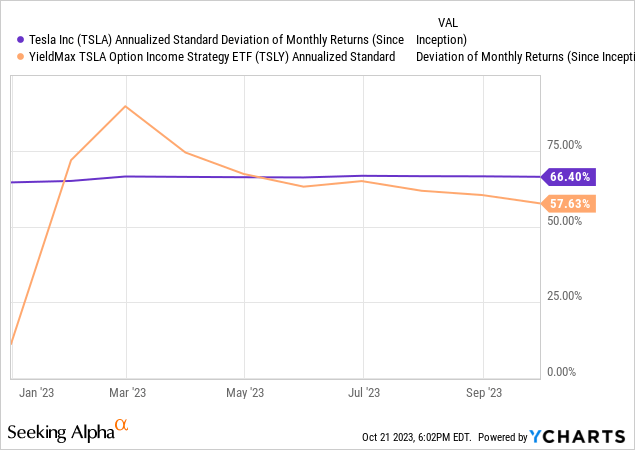

Volatility (1Y): 57.63

-

30-Day Trading Volume: 42,593,562

-

AUM: $680,320,000

As per YieldMax:

The YieldMax™ TSLA Option Income Strategy ETF (TSLY) is an actively managed fund that seeks to generate monthly income by selling/writing call options on TSLA. TSLY pursues a strategy that aims to harvest compelling yields, while retaining capped participation in the price gains of TSLA.

The Fund’s primary investment objective is to seek current income. The Fund’s secondary investment objective is to seek exposure to the share price of the common stock of Tesla, Inc. (“TSLA”), subject to a limit on potential investment gains.

This strategy may sound very compelling to many income investors, but as with all things: there’s more than first meets the eye (or meets the spreadsheet, I suppose). Covered call ETFs are nothing new, and their performance has overall been uncompelling to say the least. There are some shiny diamonds in the rough, for example, I recently gave a buy rating to a very similar covered call strategy employed on long-term bonds, TLTW.

TSLY is just one of many, by the way. Here’s a list of the others launched alongside and around TSLY (which is one of the oldest of their funds).

YieldMax Covered Call Suite (YieldMax ETFs)

The Strategy

First off, this is not an analysis of TSLA itself. That should be its own article. Instead, I am just going to be evaluating the strategy itself and see if it has lent or could lend value to TSLA shareholders moving forward. This analysis will assume you are already somewhat bullish on TSLA itself, at least up to an 80% price exposure cap.

YieldMax has done quite a bit of clever trading in this ETF. The ETF only has nine holdings, including cash, shown below.

TSLY Holdings (YieldMax ETFs)

We should take note of several things in the construction of this ETF:

- Underlying the strategy is a portfolio of US treasury notes currently weighted at 119% of the fund’s NAV

- The yield on these notes are terribly low compared to today’s rates because they were purchased in 2021. We should expect to see a higher yield from the notes once they are rolled into newer issues. The current 2YR treasury yield 5%

- The fund managers sell puts and buy call spreads to access TSLA price exposure via options delta, then sell tranches of calls against that position

- The fund is actively managed intraday in order to keep price exposure capped, meaning these holdings are dynamic and are constantly influenced by the change in price of both TSLA and the underlying options

- Options pricing can be very fickle since there is more at play than just price. Changes in volatility, interest rates, and time all have an effect

- There is significant volatility risk in the portfolio due to the options overlay and using derivatives for both the long and short exposure

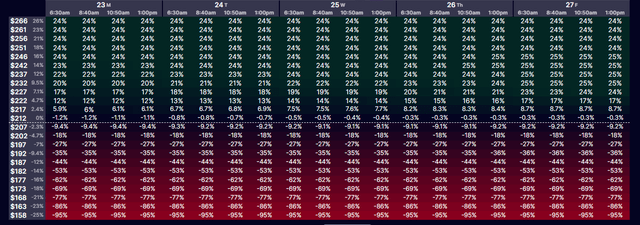

When you map out the current options holdings as of today, here’s what our profit/loss chart looks like at various dates assuming the price of TSLA.

P/L Table for TSLY Options (Portfolio Visualizer)

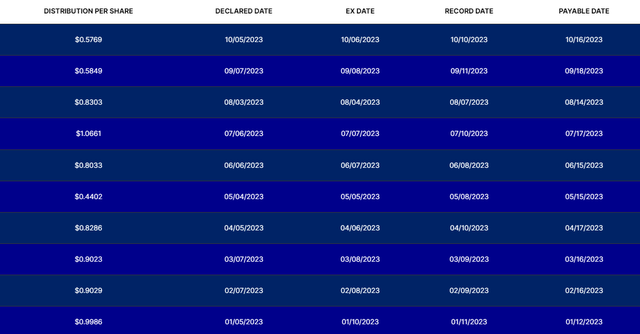

The dividends are income come and are paid once a month, following a very predictable pattern. The payments vary wildly as volatility and price action change how much the fund makes in a given month.

Distribution Dates (YieldMax ETFs)

Performance

Now that you’re up to speed on what’s going on under the hood, let’s see performance.

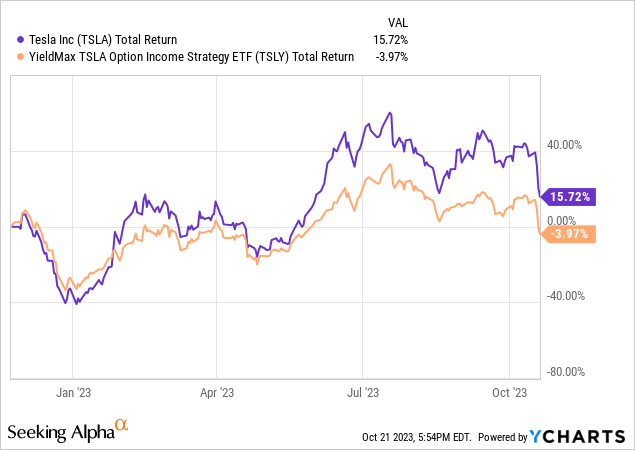

A swing and a miss! Since inception, except for the first few months, TSLY’s total return has trailed TSLA’s. Since inception, TSLY has lost investors almost 4% while TSLA, in that same timeframe, appreciated nearly 16%. Ouch.

The cause of this is complex, because options pricing and active trading is complex. The meat of it is this: high volatility increases the income from the options, but also the returns from TSLA. Over time, the extra 20% price increase that TSLY missed out on wasn’t covered by its own distributions. So while income looks very high, it can still be less than the price return from 80% of the underlying.

This is the trap that TSLY has set, trying to lure in investors with the promise of current income at the cost of equity exposure.

I mentioned risk in the beginning of the article, and there is certainly a lot of risk, but I do have to mention the fund’s out performance in its own volatility against TSLA. The managers are getting better at hedging risk in the portfolio as time has gone on, and you can see this as the fund begins to become more steady while TSLA’s volatility has remained the same.

While TSLY does have some buffer to the downside to protect drawdowns, it isn’t enough to justify itself and restricts the upside too much. Since inception, assuming we DRIP, we’ve seen the following:

| Return | Max Drawdown | |

| TSLA | 8.88% | (36.73)% |

| TSLY | (10.42)% | (31.58)% |

Counterpoints

Here are some of the bullish arguments that are worth considering. I don’t find them compelling enough to sway my rating away from a sell, but it is important that we hear them out anyway.

- The newly issued bonds will provide a good yield to TSLY, providing more cushion to the downside than in previous years

- As the managers perfect their strategy, we should see continued reduced volatility to the downside and more consistent income

- In a tax-advantaged account like a Roth IRA, TSLY can provide incredible amounts of tax-free income

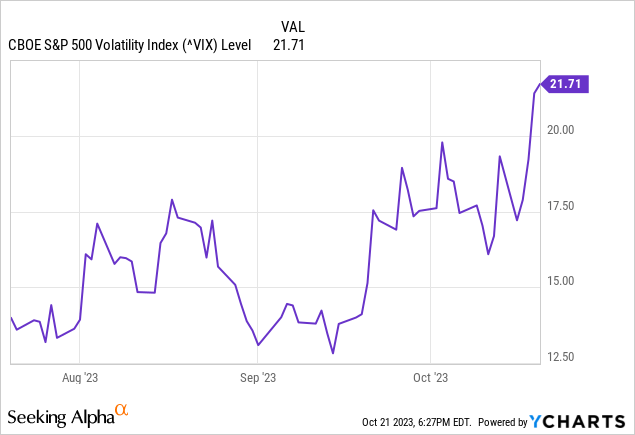

- Volatility is climbing, meaning that we may see a return to higher distributions moving forward, since volatility directly affects options pricing

Conclusion

The allure of covered call ETFs, especially those like TSLY with staggering distribution rates, can be tempting for income investors. However, a deep dive into the strategy and performance of TSLY reveals that the promise of high income might come at the expense of equity exposure and potential capital appreciation.

While TSLY offers a unique approach to generating income by selling options against Tesla, its total return since inception has been less than satisfactory when compared to TSLA’s own performance. The intricacies of options pricing, combined with the dynamic nature of the fund’s holdings, introduce complexities and risks that investors must be wary of. Although there are some bullish arguments in favor of TSLY, such as the potential for reduced price volatility and the prospect of higher distributions due to rising volatility, the evidence suggests caution.

Read the full article here

Leave a Reply