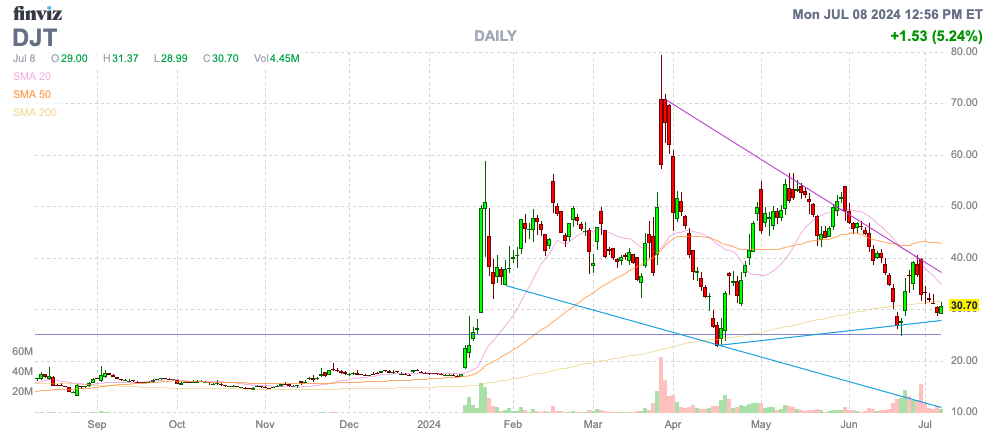

Trump Media & Technology Group Corp., or TMTG (NASDAQ:DJT), has lived up to expectations after closing the SPAC deal a few months past. The social media company still hasn’t delivered any meaningful business updates, but the business has announced a lot of share dilution and future share sales. My investment thesis remains ultra-Bearish on the stock, with no business to match the large stock valuation.

Source: Finviz

Share Dilution

Trump Media entered public life with a couple of major issues: limited cash and no real business. With the stock trading above $50 in May, the logical outcome was for warrants and other shares to be cashed in to provide extra cash for the business, while other SPACs haven’t necessarily faced diluted returns from warrants being exercised.

The media company recently announced the exercise of warrants worth $105 million in cumulative proceeds. The company now has a cash balance of $350 million, but the amount is a drop in the bucket of strong balance sheets for other social media platforms.

The one actual business plan announced by the operator of Truth Social is the plan to operate a CDN network for streaming of linear TV. The company announced a deal to acquire the assets of WorldConnect Technologies to obtain the worldwide non-exclusive licensing rights for the CDN technology from Perception Group.

The agreement is financed by 5.1 million shares of DJT stock worth ~$150 million, at current stock prices. The stock will have trading restrictions limiting immediate sales, while Trump Media will also pay $17.5 million in cash over a 3-year period.

On top of these share dilutions, TMTG announced a plan with Yorkville Advisors to sell up to $2.5 billion in shares of common stock over 3 years. The stock would be sold to Yorkville at a 2.75% discount to the market price.

The good news is that Trump Media is actually raising capital at closer to $30 now than the $10 of the SPAC price. The bad news is that the high share price allowed the Founder Shares to be granted, giving Donald Trump and others 40.0 million additional shares despite the company having no real business plan.

The company reported a Q1 share count of 137 million following the business combination. As part of the Yorkville S-1, TMTG lists 190 million shares outstanding, plus an additional 19 million shares related to warrants and shareholder disputes.

In essence, the fully diluted share count will be around 210 million shares depending on the additional warrants being exercised, the disputed shares and the recent 5 million share deal. Any shares sold to Yorkville will add to the total outstanding share count, but these shares are more desirable due to Trump Media obtaining $30 per share in cash.

The stock has a fully diluted market cap of ~$6.3 billion, without the results to match this valuation.

Another Weak Quarter Ahead

The prime bearish thesis was that once Trump Media started reporting weak quarterly results, the stock would start to slip. The company reported horrible Q1 ’24 results on May 20th, and the stock has been all downhill from the $48 level before the earnings report.

Trump Media didn’t even reach $1 million in quarterly revenues despite launching Truth Social back in 2022. The new TV streaming platform doesn’t really appear to drive the needle, and the company hasn’t actually explained the product plans.

The company still reports shareholder totals and not Truth Social active user totals. While the 621K shareholder counts sounds impressive and indicates some level of loyal users in the future, the amount isn’t useful for evaluating the business.

Truth Social will need 100+ million daily active users to scale. A shareholder base under 1 million is a drop in the bucket of the DAUs needed for the business to thrive.

Rumble (RUM) has seen its stock plunge after initial excitement surrounding the SPAC transaction. The online video platform has signed up numerous content creators to the platform and reached a peak of 80 million monthly active users, yet the market value is listed at only $1.6 billion, a fraction of the Trump Media valuation now.

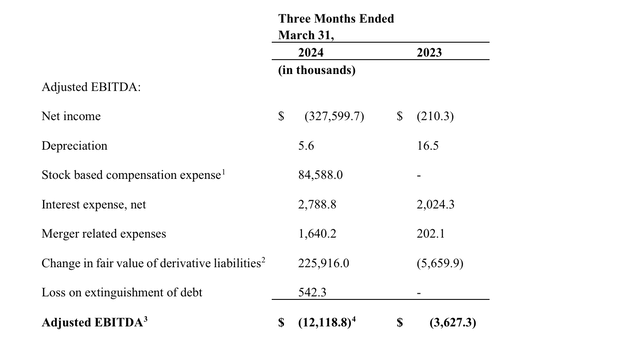

Investors should expect Trump Media to report another quarter of sub-$1 million revenues for Q2. The company had an adjusted EBITDA loss of $12.1 million in the prior quarter.

Source: Trump Media Q1’24 earnings release

A big key to the Q2 report expected in mid-August is that the losses will be cleaner. Trump Media had excessive costs for stock-based compensation, or SBC, and changes in fair values of derivatives impacted by the SPAC close that won’t repeat to this level during the June quarter.

The market will have a far more clear picture of the company not having a real business yet, and management will have to address how the live-streaming TV concept will advance. Trump Media will have to ramp up costs to support a product launch and the rubber usually hits the road when investors no longer focus on pie-in-the-sky business concepts and have to deal with a dose of reality that Truth Social launched over 2 years ago and revenues are still minimal while the company isn’t providing any metrics on users and usage.

Takeaway

The key investor takeaway is that Trump Media & Technology Group Corp. stock is starting to roll over as the market is hit with a dose of reality of the lack of a real business plan. The company is doing a good job of raising cash to provide a long runway to explore growth opportunities, but TMTG needs an annual revenue run rate of $1 billion to justify the current valuation, and the company hasn’t provided any business plan supportive of such a plan.

The stock isn’t necessarily worthless, but the valuation should be assigned below the cash balance.

Read the full article here

Leave a Reply