TransAlta (NYSE:TAC) is a Calgary, Alberta, Canada-based electricity power generator and wholesale marketing company with operations spread across Canada, the United States, and Australia and generation facilities across wind, hydro, natural gas, and coal mediums.

TradingView

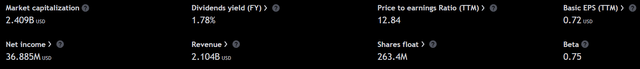

Through these activities, TransAlta has secured Q2 revenues of $471.50mn- a 32.58% YoY increase, alongside a net income of $55.83mn and free cash flow of -$136.55mn- a 31.84% increase.

Introduction

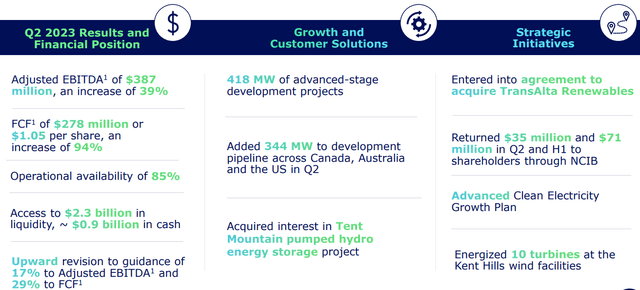

TransAlta, through its diverse revenue structure, is effectively able to capitalize on commodity price swings while leveraging public and private investment megatrends across its renewables businesses and opportunistic investments in undervalued and niche interests, such as its involvement in the Tent Mountain pumped hydro energy storage project.

With its focus on multisided growth, TransAlta’s acquisition of TransAlta Renewables has supported synergetic growth opportunities, allowing TransAlta Renewables to effectively access TransAlta’s expertise and durable cash flows and enabling TransAlta itself to access ESG inclusionary policies and be supported by secular growth tailwinds relating to the emerging green economy.

TransAlta Q2’23 Presentation

The synergetic growth enabled by the acquisition of TransAlta Renewables, which supports a superior capex pipeline, ultimately facilitating superior free cash flow and growth prospects, which, alongside a moderate undervaluation, leads me to rate the stock a ‘buy’.

Valuation & Financials

Trailing Year Performance

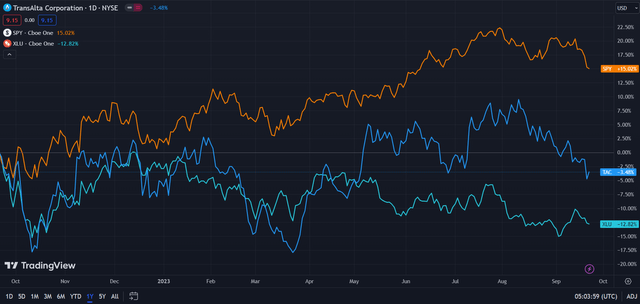

In the TTM period, TransAlta’s stock- down ~3.48%- has experienced middling performance between the Utilities Select Sector SPDR Fund (XLU)- down 12.82%- and the broader market, as represented by the S&P 500 (SPY)- up 15.02%.

TransAlta (Dark Blue) vs Industry & Market (TradingView)

While the declining value of utilities can largely be attributed to the higher cost of capital and deteriorating risk-adjusted return value of dividend stocks, TransAlta has effectively sidestepped many of these risks with its judicious capital deployment strategy and its relatively lower cost of capital than peers.

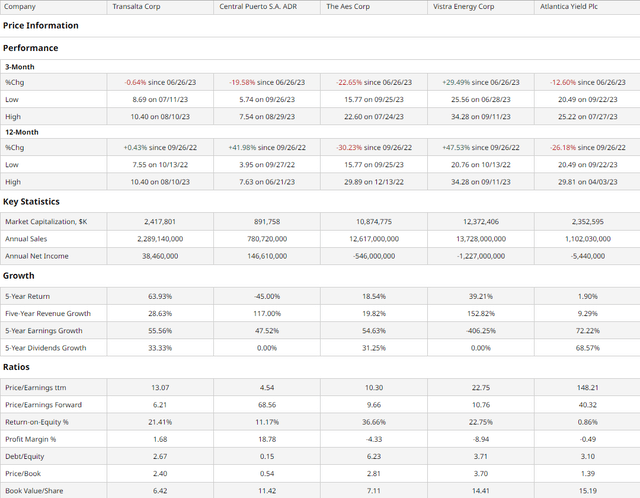

Assessing Comparable Companies

As a power generation firm with an international presence, TransAlta retains few direct competitors in a generally regionally constrained market. As such, I sought to compare TransAlta to similarly sized utilities. To do so, I looked at TransAlta’s peer companies through the ‘Peers’ tab on TransAlta’s Seeking Alpha page; Central Puerto S.A. (CEPU) is a leading producer of electric energy in Argentina; AES (AES) is an Arlington, Virginia-based electric generation and distribution company; Vistra Corp. (VST) is an Irving, Texas-based integrated retail electricity and power generation company; Atlantica Sustainable Infrastructure (AY) is a London, UK-based multi-utility with a focus on renewable energy.

barchart.com

Over the past year, TransAlta has seen the second-best performance, well-supported by their low-beta price action, seeing essentially break-even QoQ performance.

In spite of this dynamic, considering TransAlta’s growth capabilities and multiples-based value, I see the company as having superior investor return capabilities.

For instance, the company maintains the best-in-class 5-year stock price growth, supported by second-best earnings growth, and with evidence for future growth with a 21.41% ROE.

Moreover, TransAlta sustains the lowest forward P/E ratio, demonstrating its undervaluation considering its forward guidance.

Fair Value Derived from NPV & Relative Valuation

According to my discounted cash flow valuation, at its base case, the net present value of TransAlta is $9.62, meaning, that at its current price of $9.08, the stock is undervalued by 6%.

My model, calculated over 5 years without perpetual growth built-in, assumes a discount rate of 9%, balancing the cost pressures of sticky interest rates with the company’s lower implied volatility. Additionally, remaining conservative, I estimated a forward average 5Y revenue growth rate of 5%, lower than the trailing 5Y average of 5.74%.

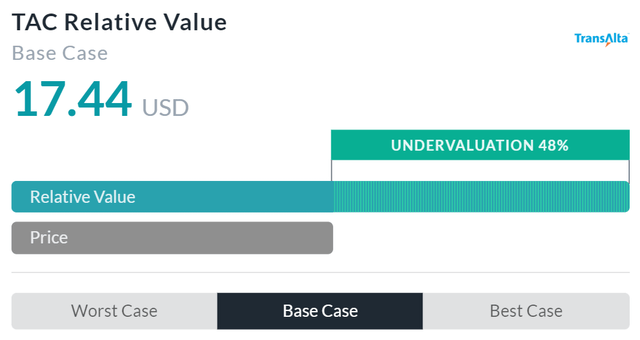

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool more than corroborates my thesis on undervaluation, projecting a base case relative value of $17.44, meaning the stock is undervalued by 48%.

However, Alpha Spread’s ability to adequately discount dividends or inability to forecast risk into forward projections means the model actually overvalues the stock.

Therefore, using a weighted average skewed towards my DCF, the fair value of TransAlta is $11.11, with the stock undervalued by 18%.

TransAlta Has Experienced Dual Scale & Margin Growth Tailwinds

Since Trapping Value has adequately covered the positive effects of the merger between TransAlta and its renewables counterpart, I will seek to discuss the company’s positive outlook pertaining to its forward capex schedule and diversified revenue base.

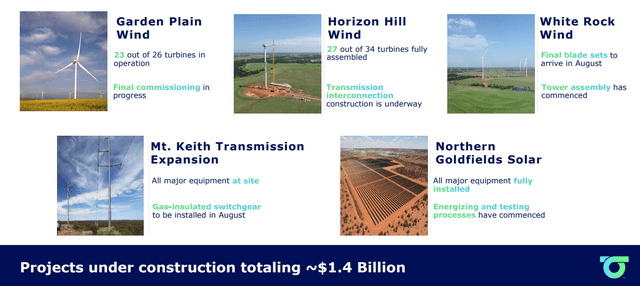

In terms of renewables, post-merger, TransAlta is able to efficaciously reallocate capital from lower-growth projects to accelerate the development of renewable projects; as such, the Garden Plain, Horizon Hill, and White Rock wind undertakings are nearing completion, and the firm is expediting its capabilities across cleaner natural gas energy generation and solar farms, with the Northern Goldfields project being a milestone in this respect.

TransAlta Q2’23 Presentation

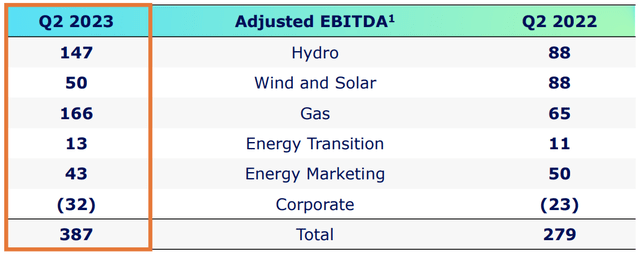

With these competencies, TransAlta is able to position itself for multi-sided success- the company is placed to benefit from rising gas, hydro, or electricity prices and otherwise maintains success in inelastic demand sectors. Exemplifying this, the higher interest macro environment of 2023 sees TransAlta expanding Hydro and Gas adjusted EBITDA significantly, covering marginal declines in Wind and Solar, Energy Marketing, and Corporate adjusted EBITDA, ultimately demonstrating resilience in the face of macro headwinds.

TransAlta Q2’23 Presentation

Wall Street Consensus

Analysts largely echo my positive view on the stock, projecting an average 1Y price target of $12.05- a 31.65% increase.

TradingView

Even at the minimum estimated price target of $10.35, analysts see a price incline of 13.07%.

I believe this reflects analyst sentiment that TransAlta, the accretive effects of its merger and its overall capital deployment to growth capabilities are undervalued by the market, which projects utility-sector fears onto TransAlta, which focuses more on generation and thus follows different earnings dynamics.

Risks & Challenges

Stickiness in Interest Rates May Compress Stock Attractiveness

Although TransAlta’s stock has performed well relative to the rest of the utility industry when concerned with rising interest rates, the value of the company’s dividends- its principal method of distributing cash flows to investors- is distorted by higher bond yields and thus makes TransAlta a less attractive company to hold. Moreover, as peer utility or renewables firms deteriorate in value given a contractionary monetary environment, TransAlta may additionally see value reduction due to its presence in utility and especially renewables indices such as SPDR S&P Kensho Clean Power ETF (CNRG) and SPDR S&P Kensho New Economies Composite ETF (KOMP).

International Presence Exposes Company to Regulatory and FX Stressors

TransAlta, contrary to many other utilities which build their presence in a single region, maintains operations and power plants in Canada, the US, and Australia. And while this increases access to capital and diversifies cash flows according to regional energy dynamics, this also means that TransAlta is exposed to increased compliance costs and potential foreign exchange fluctuations, which may damage profitability. This risk is all the more poignant with increased regulatory scrutiny owing to climate change concerns.

Conclusion

In the long term, TransAlta remains a stock with superior return capabilities to traditional utility companies and diversified cash flows ensuring stability and income for years to come.

Read the full article here

Leave a Reply