Tradeweb Markets (NASDAQ:TW) reported strong Q3 2023 results which basically matched lofty analyst expectations.

As of this writing, TW shares are up by more than 5% on the day and have touched a new 52-week high on the news.

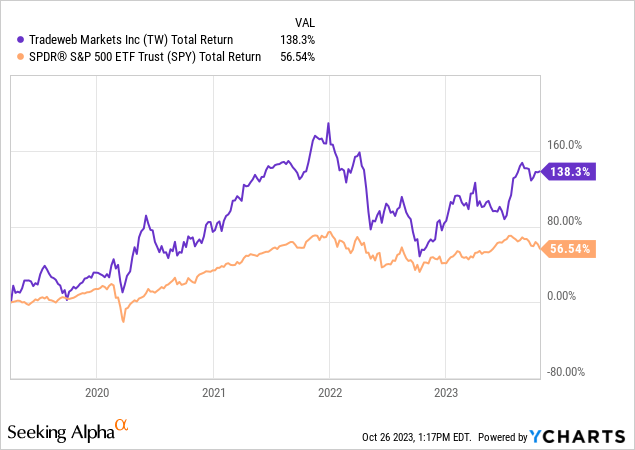

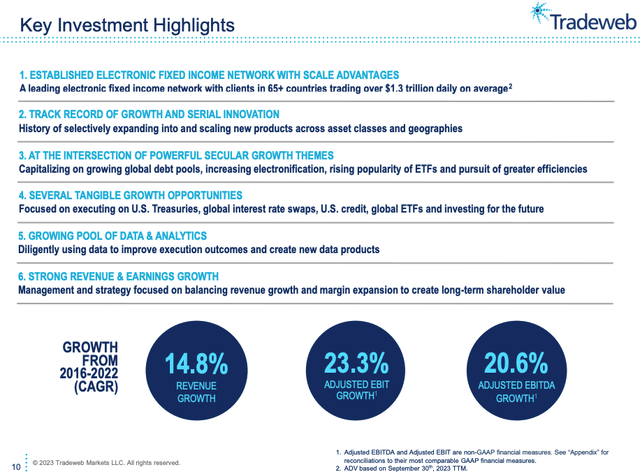

Since going public in 2019, TW shares have significantly outperformed the S&P 500. I believe TW is in the early innings of using technology to disrupt the traditional fixed income trading business and remains a strong buy.

Q3 2023 Results

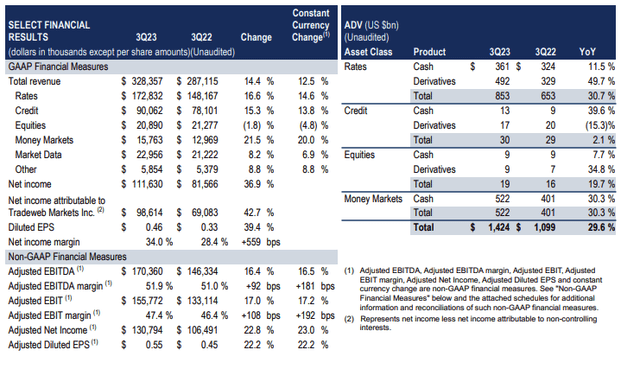

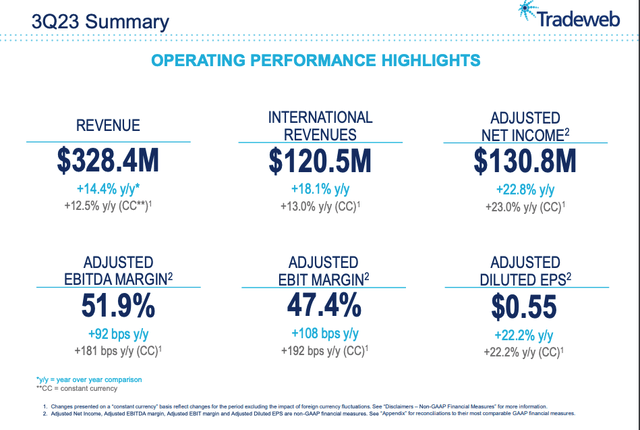

TW reported Non-GAAP EPS of $0.55, a 22.2% increase on a year-over-year basis, which was in line was analyst expectations. The company reported revenue of $328.4 million, a 14.4% increase on a year-over-year basis, which missed analyst estimates by $ 1 million.

Earnings growth exceeded revenue growth as TW was able to post a 92 bps increase in Adj. EBITDA margins on a year-over-year basis to 51.9%.

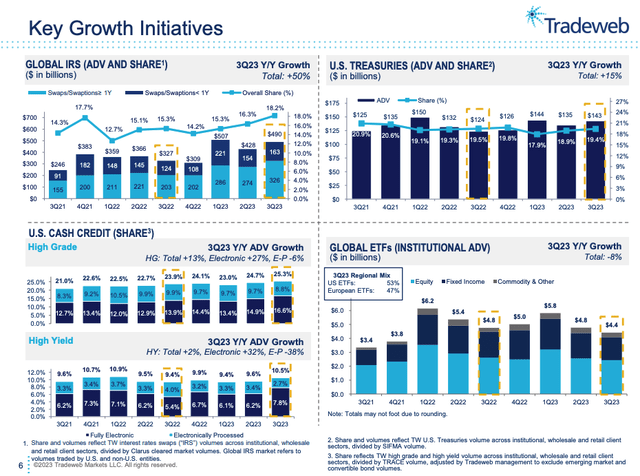

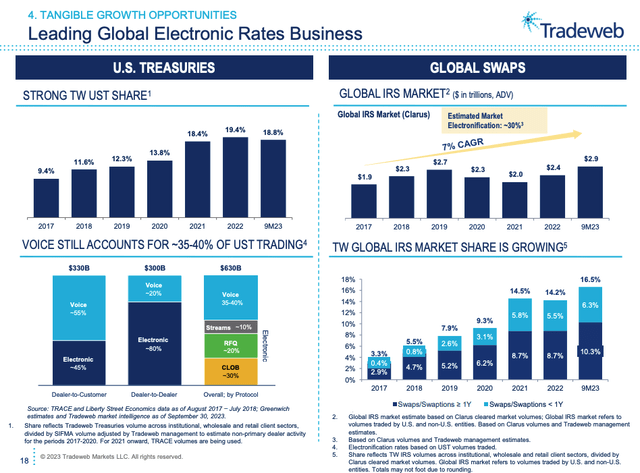

TW reported $1.4 trillion in average daily volume (“ADV”) for the quarter which represents an increase of 29.6% on a year-over-year basis. TW results have been driven by strong trading volume and growing share. TW continued to grow share in the U.S. High Grade TRACE market with market share increasing by 263 bps to a record 16.6% market share. Market share in the swaps/swaptions business increased to 18.2% from 15.3% during the same period a year ago.

TW also declared a quarterly dividend of $0.09 per share representing a 12.5% increase on a year-over-year basis.

TW Q3 2023 Earnings Release

TW Investor Presentation

TW Investor Presentation

Strong Business with Wide Competitive Moat

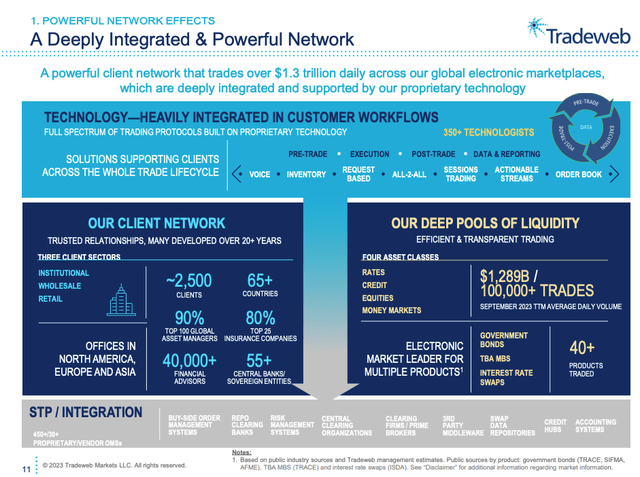

TW is a market leader in the electric trading business across government bonds, TBA MBS, and interest rate swaps. TW also has a strong business in credit and money markets electronic trading.

TW provides an integrated end-to-end technology solution which includes pre-trade, execution, post-trade, and data services. 90% of the top 100 global asset managers are clients.

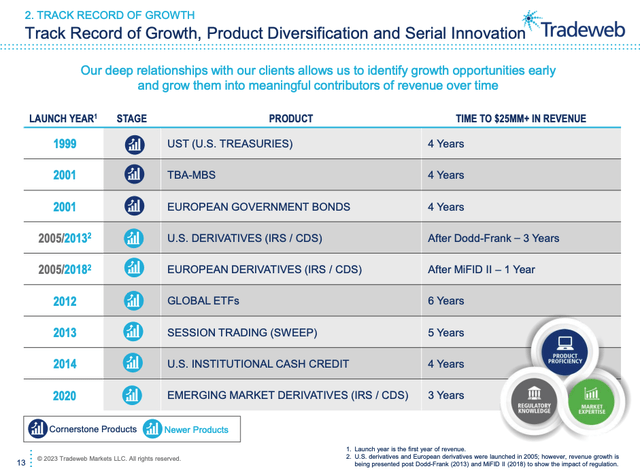

TW’s competitive advantage is driven by its scale and powerful network effects. TW has used its strong position in government bond and interest rate swaps trading to push into new areas such as credit and ETFs. The result is that TW has four important drivers of growth: annual increases in market trading volume, the secular shift towards electronic trading, market share growth, and new products.

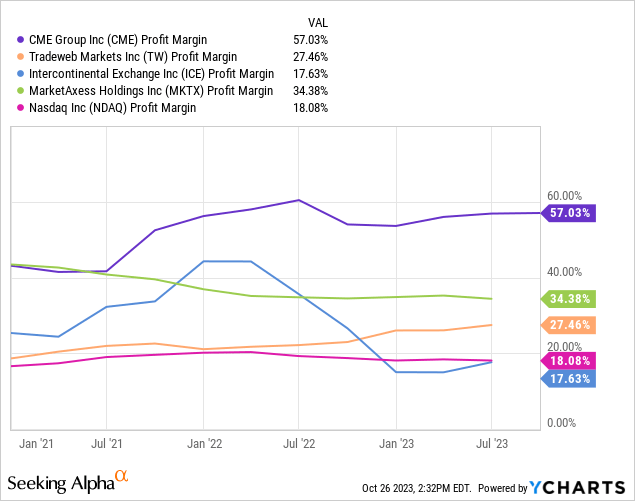

TW’s strong market position also allows the company to generate very strong net profit margins despite significant competition. Moreover, margins have expanded as TW continues to gain market share and benefit due to economies of scale. TW faces competition from a variety of players including Bloomberg, MarketAxess (MKTX), Intercontinental Exchange (ICE), CME Group (CME), Nasdaq (NDAQ), and others but has been able to maintain its competitive advantage due to its leading market position.

TW Investor Presentation

TW Investor Presentation

TW Investor Presentation

Growth Story

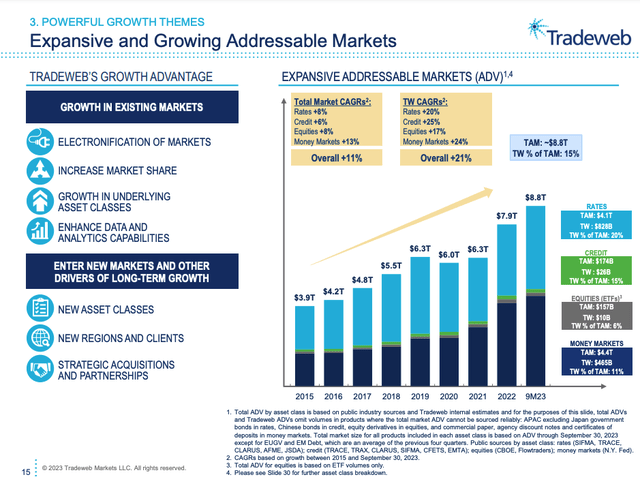

TM is a growth story that shows no signs of slowing down. The total CAGR of TW’s addressable market has been growing at 11% while TW’s business has grown at a CAGR of 21%.

To get a sense for how strong the growth outlook remains, it is key to note that 35%-40% of all U.S. Treasury trading is currently done over voice. TW is the leader in electronic U.S. Treasury trading with ~19% and is very well positioned to benefit. Additionally, just 14.8% of U.S. Investment Grade corporate bond trading is fully electronic and just 6.6% of U.S. High Yield trading is fully electronic. Thus, these markets also represent a massive growth opportunity for TW.

TW Investor Presentation

TW Investor Presentation

Relative Valuation Analysis

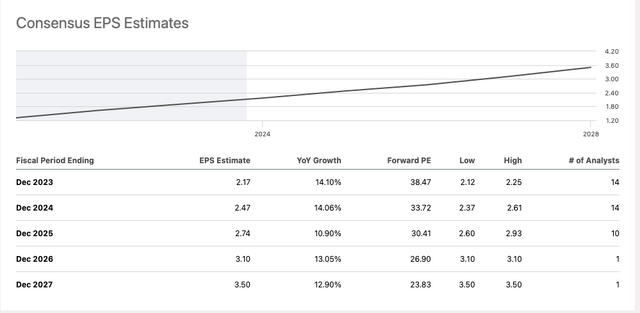

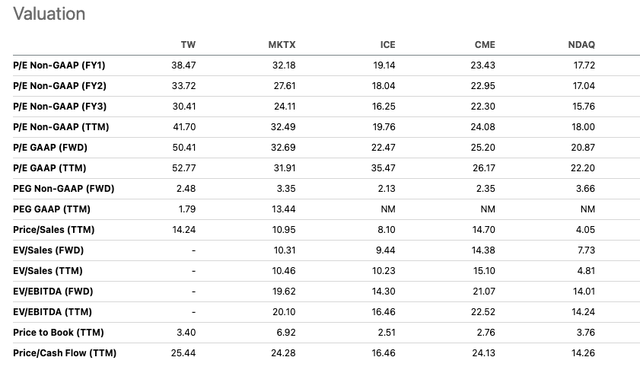

TW is trading at 38.5x estimated FY 2023 earnings, 33.7x estimated FY 2024 earnings, and 30.4x estimated FY 2025 earnings. This compares to ~17.4x estimates 2024 earnings for the S&P 500. While TW seems expensive on an outright basis, I believe the market is underestimating the long-term growth potential of TW.

The company has grown EPS over the past 3 years at a ~23% CAGR and I believe that a level of growth close to this is achievable over the next few years. In addition to growing faster than expected in the near term, I also believe that TW will be able to grow at an accelerated rate for a very long period of time given the relatively high percentage of trading that is still ripe for conversion to electronic marketplaces.

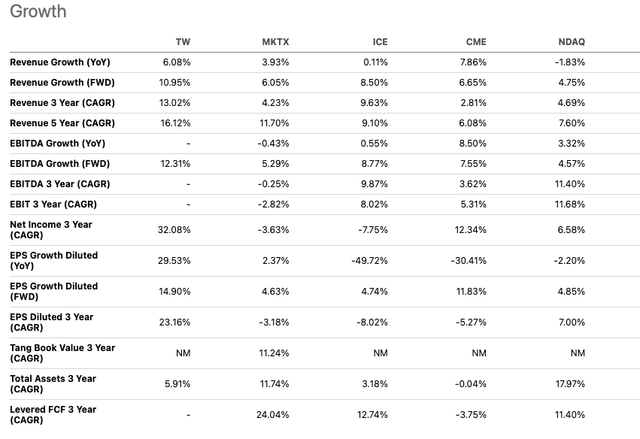

TW currently trades at a premium to its peers based on most metrics but TW is experiencing faster growth rates. MKTX is TW’s closest peer and trades at a forward P/E ratio of 27.6x compared to a forward P/E ratio of 33.7 for TW. However, MKTX has not grown EPS over the past 3 years and has actually experienced negative earnings growth during that time. While I believe MKTX will return to growth given the secular tailwinds, I think TW is the best-in-class operator in the space.

Seeking Alpha

Seeking Alpha

Seeking Alpha

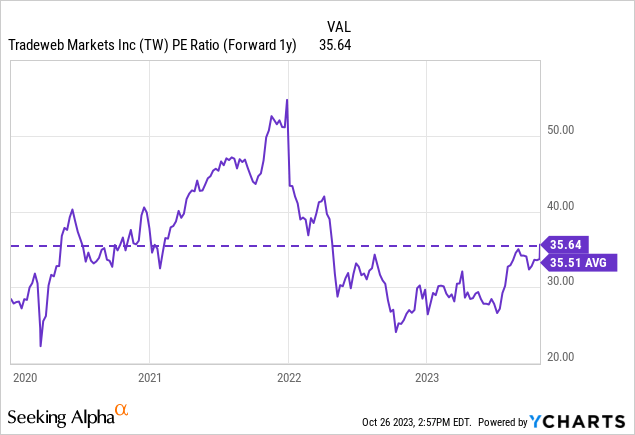

Historical Valuation Analysis

TW is trading close to its historical average forward P/E. I think it is important to highlight that TW has significantly outperformed the S&P 500 historically and thus the stock was previously undervalued. For this reason, I feel comfortable owning TW at the current valuations which are in line with historical norms.

Potential Takeover Target

TW currently has an enterprise value of ~$17 billion which means the company is not too big to acquire in my opinion. While regulatory hurdles could be an issue due to recent consolidation in the exchange business, I believe TW represents an attractive valuation target for a number of suitors. Given its market-leading position, TW may be an attractive takeover target for NDAQ, ICE, CME, or other players in the exchange business.

Risks to Consider

One potential risk to consider is that TW suffers operational challenges that restrict the company from achieving lofty growth expectations. I view this risk as low given the company’s strong historical operational performance but TW has recently entered a lot of new markets which increases the chances of a potential operational hiccup.

Another potential risk to my view comes in the form of increased competition. While TW has strong competitive advantages in its key markets due to scale, other competitors could attempt to enter the market and undercut TW’s pricing structure. Historically, competition has not posed a challenge to TW but as the industry matures and there are fewer organic growth opportunities competition could intensify. However, given TW’s strong position in its core markets, I believe most competitors will avoid attempting to undercut TW in terms of pricing.

Conclusion

TW reported strong Q3 2023 results and the stock is now trading close to a 52-week high. TW reported strong revenue growth and margin improvement resulting in EPS growth of ~22% on a year-over-year basis.

The company operates in a high growth industry and enjoys significant competitive advantages due to its large scale. For this reason, TW trades at a premium valuation to both the S&P 500 and peers. Current analyst estimates call for earnings in the mid-double digits over the next few years. I believe TW can exceed these expectations given the strong secular tailwinds and historical EPS CAGR of over 20%.

35%-40% of the U.S. Treasury market is still traded via voice. TW is the leading electronic player in U.S. Treasury trading and has recently been growing market share. Thus I believe this represents a major growth opportunity for TW in the years ahead.

I am initiating TW with a strong buy and would consider lowering my rating in the event the company fails to deliver strong earnings growth in the quarters ahead.

Read the full article here

Leave a Reply