This article is part of a series that provides an ongoing analysis of the changes made to Fundsmith’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 08/14/2024. Please visit our Tracking Terry Smith’s Fundsmith 13F Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q1 2024.

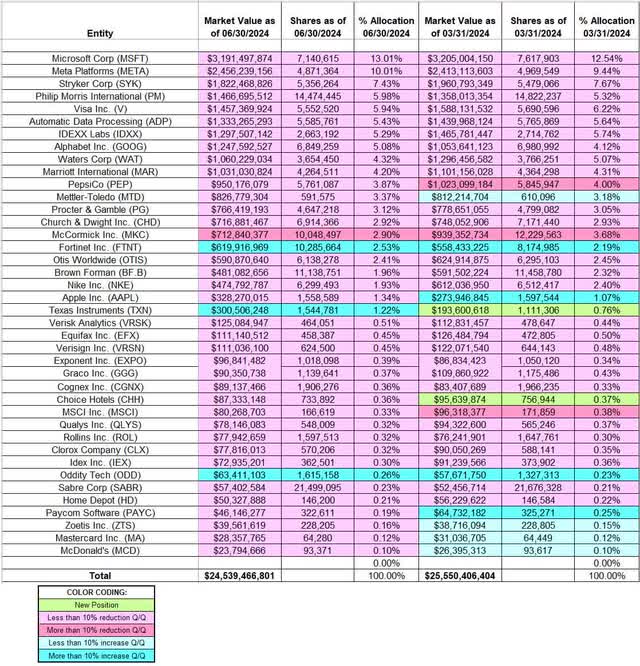

This quarter, Fundsmith’s 13F portfolio value decreased $25.55B to $24.54B. The number of holdings remained steady at 40. The top three holdings are at ~30% while the top five are close to ~42% of the 13F assets: Microsoft, Meta Platforms, Stryker, Philip Morris, and Visa.

Note: Their flagship Fundsmith Equity Fund (2010 inception) has returned 15.1% annualized compared to 11.9% for the MSCI World Index. 2022 was their first down year since inception – negative 13.8%. The following top holdings are not in the 13F report: Novo Nordisk (NVO), L’Oréal (OTCPK:LRLCF), and LVMH Moët Hennessy Louis Vuitton (OTCPK:LVMUY).

Stake Increases:

Fortinet, Inc. (FTNT): The 2.53% stake in FTNT was more than doubled during Q3 2023 at prices between ~$57 and ~$80. That was followed by a ~50% stake increase in the next quarter at prices between ~$49.50 and ~$60. The position was increased by 11% during the last quarter at prices between $57.78 and $73.07. This quarter saw a ~25% further increase at prices between $57.94 and $71.32. The stock is now at ~$76.

Texas Instruments (TXN): TXN is a 1.22% of the portfolio position established in the last quarter at prices between ~$156 and ~$174. There was a ~40% stake increase this quarter at prices between ~$158 and ~$201. The stock currently trades at ~$211.

Oddity Tech (ODD): The very small 0.26% of the portfolio position in ODD saw a ~22% stake increase this quarter.

Stake Decreases:

Microsoft Corp. (MSFT): MSFT is currently the largest position at ~13% of the portfolio. The stake was built during the five-year period from 2013 to 2018 at prices between ~$27 and ~$115. There was a ~23% selling in Q1 2022 at prices between ~$276 and ~$335. The stock currently trades at ~$414. The last several quarters have seen trimming. They are harvesting gains.

Meta Platforms (META): The ~10% META stake was built in 2018 at prices between ~$125 and ~$210. The stake remained steady since, although adjustments were made in most quarters. There was a ~20% reduction in Q1 2022 at prices between ~$187 and ~$339. That was followed by a ~11% selling during Q3 2023 at prices between ~$283 and ~$326. The stock currently trades at ~$519. The last three quarters also saw minor trimming.

Stryker Corp. (SYK): SYK is a large (top three) 7.43% of the portfolio position purchased during the decade that ended in 2021 through consistent buying every quarter at prices between ~$50 and ~$275. There was a ~20% reduction in Q1 2022 at prices between ~$245 and ~$278. The stock currently trades at ~$359. The last several quarters only saw minor adjustments.

Philip Morris International (PM): The top five ~6% PM stake was established during the decade that ended in 2021 through consistent buying every quarter. Pricing ranged between ~$60 and ~$120. Q1 2022 saw a ~20% selling at prices between ~$89 and ~$112. The stock is now at ~$122. The last several quarters have seen minor trimming.

Visa Inc. (V): Visa is a ~6% of the portfolio position established over the decade that ended in 2021 through consistent buying in most years. The build-up happened at prices between ~$30 and ~$245. Q1 2022 saw a ~18% selling at prices between ~$191 and ~$235. The stock currently trades at ~$271. The last several quarters have seen only minor adjustments.

Automatic Data Processing (ADP): The 2013-19 timeframe saw consistent buying in ADP at prices between ~$52 and ~$173. Q1 2020 saw a ~40% selling at prices between ~$112 and ~$181 while in the next quarter there was a ~70% increase at prices between ~$128 and ~$160. Since then, the activity had been minor. Q1 2022 saw a ~22% reduction at prices between ~$196 and ~$245. The stock is now at ~$275 and the stake is at 5.43% of the portfolio. The last two years saw only minor adjustments.

IDEXX Laboratories (IDXX): IDXX is a 5.29% of the portfolio position established during the 2015-16 timeframe at prices between ~$63 and ~$120. Since then, the position remained relatively steady, although adjustments were made in most quarters. There was a ~15% trimming in Q1 2022 at prices between ~$466 and ~$631. That was followed by a similar reduction during Q1 2023 at prices between ~$406 and ~$515. The stock currently trades at ~$483. The last five quarters saw only minor adjustments.

Alphabet Inc. (GOOG): GOOG is a ~5% of the portfolio position purchased in Q4 2021 at prices between ~$133 and ~$151. There was a ~9% trimming in the next quarter. The stock currently trades at ~$166. Q4 2023 saw a ~8% selling, and that was followed by minor trimming in the last two quarters.

Waters Corp. (WAT): WAT is a 4.32% of the portfolio stake built during the 2015-2017 timeframe at prices between ~$115 and ~$200. The next two years also saw incremental buying. There was a ~23% selling in H1 2020 at prices between ~$175 and ~$240. Since then, the activity had been minor. There was a ~18% reduction in Q1 2022 at prices between ~$307 and ~$365. The stock currently trades at ~$337. The last several quarters have seen only minor adjustments.

Note: they have a ~7.4% ownership stake in Waters Corp.

Marriott International (MAR): The 4.20% stake in MAR was primarily built during Q3 2023 at prices between ~$182 and ~$208. The stock currently trades at ~$228. There was marginal trimming in the last three quarters.

PepsiCo (PEP): The 3.87% PEP stake was built over the decade that ended in 2021 through consistent buying during most quarters. The buying happened at prices between ~$65 and ~$170. There was a ~25% reduction in Q1 2022 at prices between ~$154 and ~$176. The stock is now at ~$175. There was a ~12% trimming in the last quarter. This quarter saw marginal trimming.

Mettler-Toledo (MTD): The 3.37% MTD stake was purchased during H1 2022 at prices between ~$1098 and ~$1675. The last quarter saw a ~7% stake increase at prices between ~$1132 and ~$1350. The stock currently trades at ~$1423. There was a ~3% trimming this quarter.

Procter & Gamble (PG): The 3.12% PG stake was built during Q1 2023 at prices between ~$137 and ~$154. There was a ~180% stake increase during Q2 2023 at prices between ~$143 and ~$157. The stock is now at ~$169. There was minor trimming in the last four quarters.

Church & Dwight (CHD): The 2.92% CHD position was built during the three quarters through Q2 2021 at prices between ~$72 and ~$93. There was a ~28% selling in Q1 2022 at prices between ~$95 and ~$104. That was followed by a ~20% reduction during Q2 2023 at prices between ~$88 and ~$100. The stock currently trades at ~$101. Q3 2023 saw a ~9% increase while the last three quarters saw minor trimming.

McCormick (MKC): MKC is a 2.90% of the portfolio position built during the 2018-19 timeframe at prices between ~$50 and ~$86. There was a ~18% reduction in Q1 2022 at prices between ~$92 and ~$104. The stake was decreased by 19% in the last quarter at prices between $64.25 and $76.88. That was followed by a similar reduction this quarter at prices between $67.27 and $77.38. The stock currently trades at $79.26.

Note: they have a ~5% ownership stake in the business.

Otis Worldwide (OTIS): OTIS is a 2.41% of the portfolio stake established during Q3 2022 at prices between ~$64 and ~$82 and the stock currently trades at ~$93. The last several quarters have seen minor trimming.

Brown-Forman (BF.B): BF.B is a ~2% of the portfolio stake built in 2019 at prices between ~$45 and ~$68. 2021 saw a ~50% stake increase at prices between ~$67 and ~$81 while in Q1 2022 there was a ~28% selling at prices between ~$62 and ~$72. The stock is now well below their purchase price ranges at $45.10. The last several quarters saw minor trimming.

Nike, Inc. (NKE): The 1.93% NKE stake was built in H1 2020 at prices between ~$67 and ~$105. There was minor buying in most quarters since. Q1 2022 saw a ~23% reduction at prices between ~$118 and ~$166. The stock is now at $85.29. The last several quarters saw only minor adjustments.

Apple Inc. (AAPL): AAPL is a 1.34% of the portfolio position built during Q1 2023 at prices between ~$125 and ~$166 and the stock currently trades well above that range at ~$228. The position was increased by 20% during the last quarter at prices between ~$169 and ~$195. This quarter saw a minor ~2% trimming.

Choice Hotels (CHH): The very small 0.36% of the portfolio stake in CHH was established during the last quarter at prices between ~$109 and ~$130, and it is now at ~$127. There was a minor ~3% trimming this quarter.

Clorox Company (CLX): CLX is a very small 0.32% of the portfolio position purchased during Q4 2023 at prices between ~$115 and ~$146 and the stock currently trades at ~$157. There was a ~6% trimming over the last two quarters.

Cognex (CGNX), Exponent, Inc. (EXPO), Equifax Inc. (EFX), Graco Inc. (GGG), Home Depot (HD), IDEX Corporation (IEX), MSCI Inc. (MSCI), Mastercard Inc. (MA), McDonald’s (MCD), Paycom Software (PAYC), Qualys, Inc. (QLYS), Rollins, Inc. (ROL), Sabre Corp. (SABR), VeriSign, Inc. (VRSN), Verisk Analytics (VRSK), and Zoetis Inc. (ZTS): These very small (less than ~0.5% of the portfolio each) positions were reduced during the quarter.

The spreadsheet below highlights changes to Fundsmith’s 13F holdings in Q2 2024:

Terry Smith – FundSmith Portfolio – Q2 2024 13F Report Q/Q Comparison (John Vincent (author))

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply