On Thursday, October 26, 2023, European energy supermajor TotalEnergies SE (NYSE:TTE) announced its third quarter 2023 earnings results. At first glance, these results were mixed, as TotalEnergies managed to beat the expectations of its analysts in terms of revenue but still missed earnings expectations. However, the company’s revenues were still down compared to the prior-year quarter, which is rather disappointing. For the most part, though, the market seems to appreciate the company’s results, as the company’s stock price did jump in the aftermarket session following the company’s earnings results:

Seeking Alpha

The fact that TotalEnergies’ revenues went down year-over-year is not necessarily anything that we need to worry about. After all, it was certainly not the only energy company to have experienced such a phenomenon with respect to its results. Exxon Mobil (XOM), which also reported last week, also saw its revenue go down compared to the prior year quarter. This is mostly due to the fact that crude oil prices were on average lower than they were during the equivalent period of last year. Fortunately, as we have discussed in various previous articles, the long-term fundamentals for crude oil point to higher energy prices going forward than we are used to, which should exert a positive influence on TotalEnergies’ results.

Earnings Results Analysis

As long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings results before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from TotalEnergies’ third-quarter 2023 earnings results:

- TotalEnergies brought in total revenue of $54.4130 billion during the third quarter of 2023. This represents a 16.24% decrease over the $64.9620 billion that the company reported during the prior year quarter.

- The company reported an operating income of $9.6450 billion in the most recent quarter. This represents a 33.85% decline over the $14.580 billion that the company reported during the year-ago quarter.

- TotalEnergies produced an average of 2.476 million barrels of oil equivalents during the reporting period. This compares rather unfavorably to the 2.669 million barrels of oil equivalents per day that the company produced during the equivalent period of last year.

- The company entered into a liquefied natural gas agreement with QatarEnergy LNG for the purchase of 3.5 million tonnes of liquefied natural gas annually for a 27-year period.

- TotalEnergies reported a net income of $6.6760 billion during the third quarter of 2023. This represents a 0.75% increase over the $6.6260 billion that the company reported during the third quarter of 2022.

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that many measures of TotalEnergies’ financial performance came in weaker during the third quarter of 2023 than they did during the equivalent quarter of last year. One of the biggest reasons for this is that energy prices were lower on average during the most recent quarter than they were during the third quarter of last year. We can see this quite clearly here:

Barchart.com

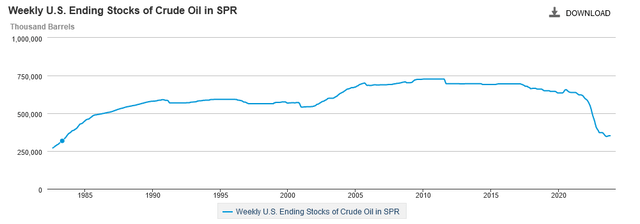

We can see that the price of oil did finally start to rise during this quarter following several months of suppression partly caused by the United States Federal Government flooding the market from oil using the Strategic Petroleum Reserve. Basically, as I pointed out earlier this year, the Organization of Petroleum Exporting Countries along with Russia made the decision to cut crude oil production in order to keep the balance between supply and demand very tight. In effect, what these cuts were intended to do was offset the impact of the sales from the Strategic Petroleum Reserve. The cuts remain in this place to this day, yet the Federal Government stopped selling oil from its stockpile back in mid-July. As of right now, there are 351.274 million barrels of crude oil in the nation’s storage, which is the lowest level that has been seen since the early 1980s:

Energy Information Administration

As such, the United States probably cannot use its national storage stocks to artificially manipulate the price of crude oil anymore. After all, there is a minimum amount of crude oil that needs to be stored in the salt caverns simply to maintain their structural integrity. Thus, with the cuts by the Organization of Petroleum Exporting Countries remaining in effect, the balance between the supply and demand for crude oil became tighter and pushed up energy prices.

However, we still see in the chart above that the average price of crude oil was lower in the third quarter of this year than during the equivalent quarter of last year. This is reflected in TotalEnergies’ results, as the company reported that it received an average of $78.90 per barrel of liquid hydrocarbons sold during the quarter compared to $93.60 per barrel of liquid hydrocarbons sold during the equivalent quarter of last year. It should be fairly obvious why this would have a negative impact on TotalEnergies’ financial performance. After all, if the company received less money per unit of product sold, then its overall revenue will be lower all else being equal.

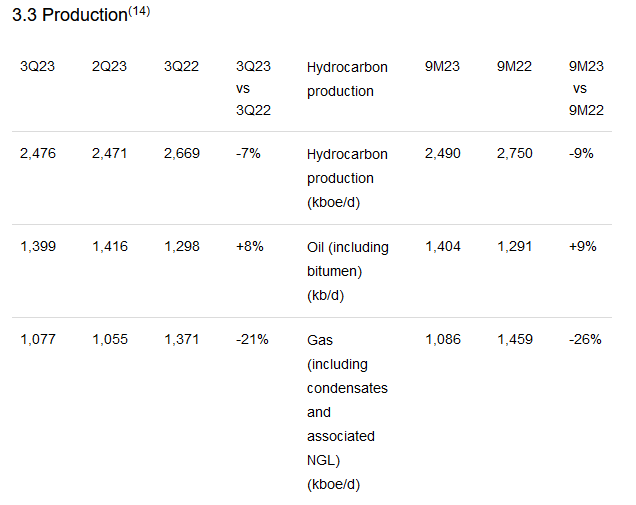

However, all else is rarely equal with a company like TotalEnergies. As noted in the highlights, the company saw its production decline in the most recent quarter compared to the equivalent one last year. During the third quarter of 2023, TotalEnergies produced an average of 2.476 million barrels of oil equivalents per day. That was a 7.23% decline from the 2.669 million barrels of oil equivalents per day that the company averaged during the year-ago quarter. That also had a negative impact on the company’s financial performance. After all, a lower production means that it has fewer products that it can sell in exchange for money.

When we combine the company’s lower production with the fact that it received less money per unit of product sold, it should be fairly easy to see why the company’s revenue would go down from period to period. The decline in revenue generally means that the company has less money available to cover its fixed expenses and similar things, which results in a decline in operating income. That is exactly what we see here.

With that said, the company’s crude oil production was actually up, even though its total production was down year-over-year:

TotalEnergies

As we can see, crude oil production went up by 101,000 barrels per day on average, which represents a 7.78% increase. This was more than offset by a massive decline in the company’s production of natural gas, which decreased its oil-equivalent production overall. Perhaps the biggest reason for this appears to relate to the sanctions that the United States and the European Union have levied on Russia. According to a press release that the company issued in March of 2022:

TotalEnergies holds a 19.4% stake in the company Novatek, a stake that it cannot sell given the prevailing shareholders’ agreements, as it is forbidden for TotalEnergies to sell any asset to one of Novatek’s main shareholders who is under sanction.

…

As a result, the criteria for significant influence is no longer being met within the meaning of the accounting regulations that apply to the Company, TotalEnergies will no longer equity account for its 19.4% stake in Novatek in the company’s accounts.

This will lead to record an impairment of approximately $3.7 billion in the accounts for the 4th quarter of 2022. In addition, TotalEnergies will no longer book reserves for its interest in Novatek, with an impact on the Company’s reported proved reserves at end of 2021 of 1.7 billion of barrels. However, the life duration of the Company’s proved reserves will remain above eleven years of production.

The company does not explicitly state in its earnings press release that it was the removal of Novatek (OTC:NSTKF) from its results reporting around the end of last year that is responsible for the production decline that we see reflected in these results. However, it seems likely as the company states that its hydrocarbon production went up once Novatek’s production is excluded from the year-ago figures. During the third quarter of 2022, TotalEnergies produced an average of 2.356 million barrels of oil equivalents per day excluding Novatek’s contribution to its upstream production figures. The company’s production excluding Novatek was 2.476 million barrels per day on average during the most recent quarter. That was a 5.09% year-over-year increase. Thus, it seems likely that one major contributor to TotalEnergies’ weaker financial performance year-over-year is because of the Russian sanctions that were levied due to the situation in Ukraine.

TotalEnergies did benefit from a few new sources of production in the quarter. These include the following projects:

- Absheron in Azerbaijan

- Johan Sverdrup Phase 2 in Norway

- Mero 1 in Brazil

- Ikike in Nigeria

- Bloc 10 in Oman

The company states that these projects alone increased its year-over-year hydrocarbon production by 5%. While this was partially offset by things such as natural field production declines and the aforementioned problems with TotalEnergies’ stake in Novatek, it is still good to see that some projects are coming on that are having a positive impact on the company. Clearly, it is not all bad news here.

Financial Considerations

As I have explained in numerous previous articles:

It is important that we analyze the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is normally accomplished by issuing new debt and using the proceeds to repay the existing debt. After all, very few companies have sufficient cash on hand to completely repay all of their debt as it matures. This can cause a company’s interest expenses to increase following the rollover depending on the conditions in the broader market.”

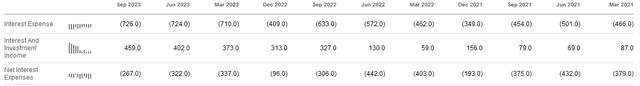

As of the time of writing, interest rates in most developed nations are at the highest rates that have been seen in many years. After all, most developed countries printed enormous amounts of money to help support their economies through the COVID-19 lockdowns and this sparked a worldwide inflation crisis. Most central banks in the Group of Twenty nations have been raising interest rates over the past two years in an effort to combat this inflation crisis. However, TotalEnergies has not really been impacted by rising rates so far. As we can see here, while the company’s interest expenses have indeed been rising over the past few quarters, its investment income has also been rising:

Seeking Alpha

This is partly due to the fact that energy companies in general have been using some of their good fortunes from supportive energy prices over the past few years to strengthen their balance sheets. That has been quite necessary considering that the market has not been especially friendly to traditional energy companies in general. As might be expected given these two factors, TotalEnergies has been reducing its net debt over the past several quarters:

| Q3 2023 | Q2 2023 | Q1 2023 | Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | Q4 2021 | Q3 2021 | |

| Net Debt | $26,690 | $24,115 | $25,559 | $19,883 | $15,054 | $22,561 | $26,435 | $31,514 | $34,904 |

(all figures in millions of U.S. dollars)

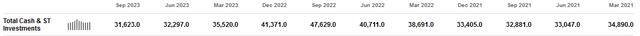

This has allowed the company to offset some of the impact of higher rates as it has a lesser amount of debt upon which it needs to pay financing costs. Meanwhile, the company has kept its cash and cash equivalents at a relatively stable level:

Seeking Alpha

This has allowed the company to increase the amount of interest that it collects from things such as money market funds and short-duration bonds. This has helped to offset the added amount of interest that the company needs to pay on the debt that it continues to carry. Thus, the company’s net interest expenses have not really been too badly impacted by the rising rate environment. This is certainly a better situation than what we have seen with companies in sectors such as utilities (see here).

As is always the case, we should take a moment to have a look at TotalEnergies’ financial structure. The usual way that we accomplish this is by looking at the net debt-to-equity ratio. As shown above, TotalEnergies had a net debt outstanding of $26.690 billion on September 30, 2023. On the same date, the company had a total equity of $118.424 billion. This gives the company a net debt-to-equity ratio of 0.23 today. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity Ratio |

| TotalEnergies | 0.23 |

| Exxon Mobil | 0.04 |

| Chevron Corporation (CVX) | 0.07 |

| Equinor ASA (EQNR) | 0.30 |

| Eni S.p.A. (E) | 0.25 |

As we can see here, TotalEnergies has considerably more debt than comparable American companies but it does compare reasonably well to its European peers. This is a sign that the company is probably not overly reliant on debt to finance its operations. We should not have to worry too much about the company’s debt load, even in today’s relatively high-rate environment.

Dividend Analysis

TotalEnergies has long been known for offering a relatively high dividend yield compared to many other assets that are available in the market. It is not necessarily alone in this though, as the entire energy sector is one of the highest-yielding sectors in the market. Indeed, the iShares Global Energy ETF (IXC), which tracks a portfolio of major traditional energy companies from around the world currently yields 4.58%, which is substantially higher than many other sector index funds.

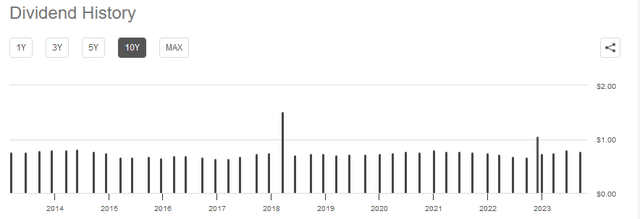

For its part, TotalEnergies currently has a 4.64% yield so its stock certainly does not disappoint in this respect. After all, there are not very many common stocks that boast such a high yield and have relatively strong forward growth prospects. Unfortunately, TotalEnergies’ dividend has not been especially stable over the years:

Seeking Alpha

One of the biggest reasons for this is that TotalEnergies declares and pays its dividends in euros, despite the fact that the company actually reports its results in U.S. dollars. The fact that it actually pays the dividend in euros means though that those investors who hold the American Depositary Receipts (which is anyone who buys the shares that trade on an American exchange) receive the U.S. dollar equivalent of the dividend. It is pretty common for foreign companies owned by American investors to have a dividend that fluctuates with exchange rates for this reason.

As is always the case though, we want to ensure that the company can actually afford the dividends that it pays out. After all, we do not want to be the victims of an unexpected dividend cut since that would reduce our incomes and almost certainly cause the company’s share price to decline.

The usual way that we judge a company’s ability to cover its dividend is by looking at its free cash flow. During the twelve-month period that ended on September 30, 2023, TotalEnergies reported a levered free cash flow of $27.2054 billion but only paid out dividends of $7.5940 billion. Thus, the company easily generated more than enough cash through its ordinary operations to cover its dividends.

We see the same general thing when we measure the company’s free cash flow and dividends in euros. During the twelve-month period, TotalEnergies reported a levered free cash flow of €25.7336 billion but only paid out €7.1832 billion in dividends to the shareholders. Thus, the company is clearly not having any particular difficulty maintaining its dividends. We should not need to worry too much about a potential cut.

Valuation

According to Zacks Investment Research, TotalEnergies will grow its earnings per share at a 9.30% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 0.73 at the current price. That suggests that the stock is undervalued at the current price. However, as I have pointed out in a variety of articles and blog posts over the past several months, nearly everything in the traditional energy industry appears to be significantly undervalued right now.

Thus, the best way for us to value the company is by comparing TotalEnergies’ valuation to its peers in order to determine which stock offers the most attractive relative valuation.

| Company | PEG Ratio |

| TotalEnergies | 0.73 |

| Exxon Mobil | 3.76 |

| Chevron Corporation | 0.75 |

| Equinor ASA | 1.11 |

| Eni S.p.A. | N/A |

As we can see here, TotalEnergies appears to boast a very reasonable valuation relative to many of its peers. This could suggest that the company’s stock is worth purchasing today. That is especially true considering the rather strong fundamentals for crude oil, which we have discussed in numerous previous articles here at Energy Profits in Dividends.

Conclusion

In conclusion, TotalEnergies’ third quarter 2023 earnings results were overall quite decent even if they were worse than the company’s numbers during the prior-year quarter. The fact that energy prices were lower in the reporting period compared to 2022 was a major drag on the firm’s performance and the sanctions that have been levied by the Western powers on Russia also do not help. Despite this though, TotalEnergies still looks like a reasonable purchase right now as the company’s valuation remains attractive and its balance sheet is strong. The fact that it sports a 4.64% yield at the current price only adds to its appeal. Overall, the company may be worth considering today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply