Total Energy Services Inc. (OTCPK:TOTZF) delivered interesting new ESG initiatives that may interest the growing community of ESG investors. Recent lower debt levels, further stock repurchases, and more capital expenditures expected for 2023 are also quite beneficial announcements that may have a beneficial effect on future stock demand. There are obvious risks from crude oil volatility and covenant agreements signed, however I think that TOTZF continues to be undervalued.

Business Model

Headquartered in Calgary, Alberta, Total Energy offers contract drilling services, equipment rentals, and transportation services as well servicing to the energy industries operating in North America and Australia. With a diversified list of activities, Total Energy Services is making a significant amount of efforts to follow ESG guidelines. According to a recent presentation to investors, Total Energy Services is engaged in well abandonment and restoration work. Additionally, the company highlighted indigenous partnerships to enhance indigenous recruitment. With this new information, I think that new funds focused on ESG investments will most likely be interested in Total Energy Services. As a result, we may see increases in stock demand.

Source: Presentation To Investors

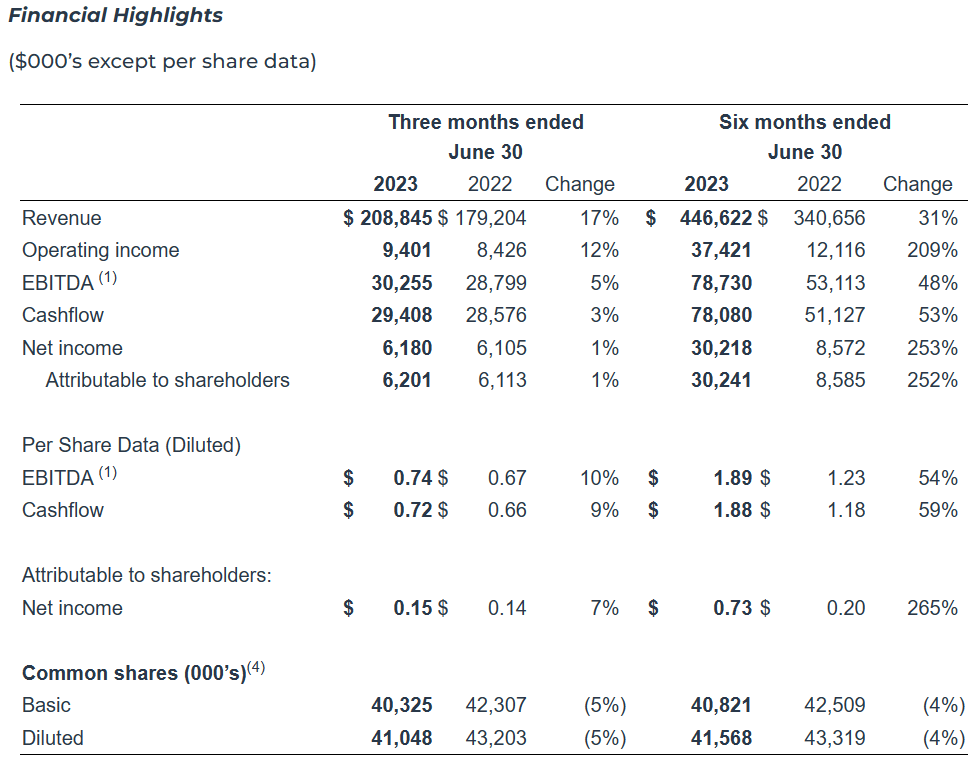

I believe that the figures reported in the last quarter were quite impressive, and some numbers are worth mentioning. In the quarter ended June 30, 2023, the company reported 17% growth y/y, operating income growth of 12% y/y, and EBITDA as well as net income growth. It is also worth noting that the total amount of diluted shares decreased, so shareholders are seeing the EBITDA per share increase.

Source: Q2 2023

I would also remind investors of some of the words that I said about Total Energy Services in my previous article. In particular, the agreements with Savanna and Pason may continue to enhance net sales in the coming years. With that, I did identify new FCF catalysts that I have included in the current article.

I am quite optimistic about new agreements with other partners, like those signed with Savanna and Pason. Together with other players in the energy industry, management may receive and share know-how, which may enhance FCF generation in the coming years. Source: Total Energy Services: Beneficial Guidance, Undervalued

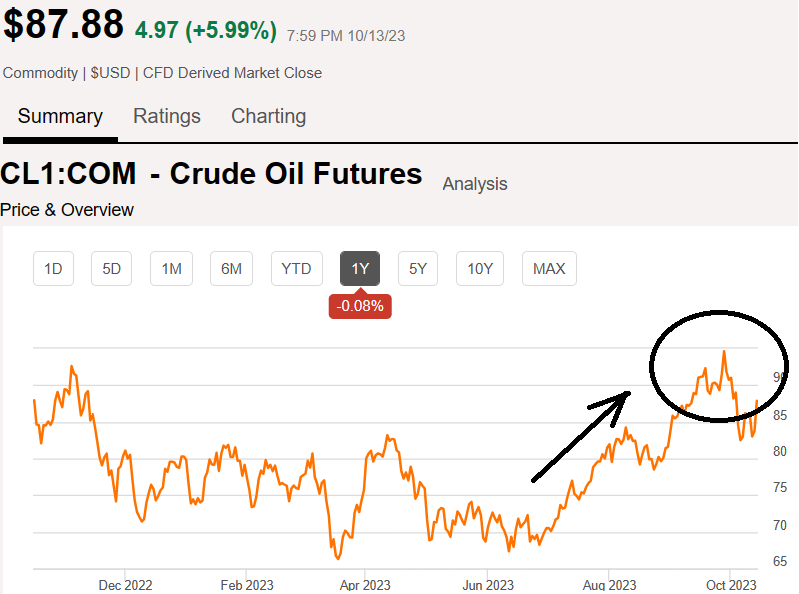

Recent Increase In The Oil Price, And Beneficial Expectations

The recent words of management were, in my view, quite conservative. Management noted disciplined deployment of capital. In my view, given the recent increases in the crude oil price that occurred after the quarterly press release, the words of management may be better in the future.

While oil prices have increased thus far during the third quarter of 2023, producers continue to be disciplined in their capital investment programs. In this environment, Total Energy remains focused on the safe and efficient operation of its business, the disciplined deployment of capital and opportunities to enhance shareholder value. Source: Total Energy Services Inc. Announces 2023 Third Quarter

Source: SA

The recent words about the ongoing operation in Australia are also beneficial. Considering the drilling that was recommended in early July following recertification and retrofitting, I believe that we could see an improvement in production in Australia by the end of the year 2023.

The Australian service rig removed from service in the second quarter is currently undergoing recertification and upgrades and is expected to return to service later this year. In Canada, the triple drilling rig moved from the United States to Canada during the second quarter commenced drilling in early July following recertification and retrofitting. Source: Total Energy Services Inc. Announces 2023 Third Quarter

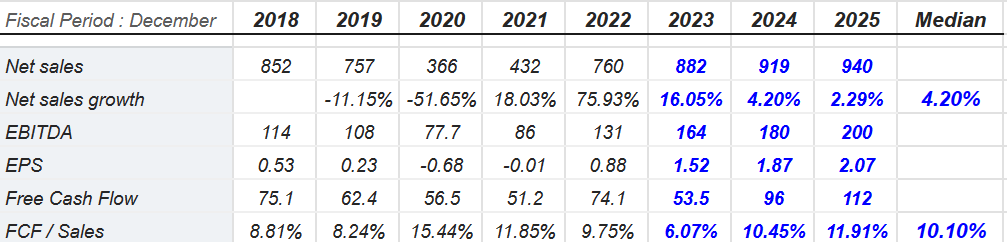

In my opinion, expectations for the years 2023, 2024, and 2025 are beneficial, and are worth a quick look. Keep in mind that my figures were designed after having a look at the expectations of other market analysts. Market expectations include double digit sales growth in 2023, double digit FCF/Sales in 2024 and 2025, and growing free cash flow.

In particular, the numbers of other market analysts include 2025 net sales of close to CAD940 million, net sales growth of about 2.29%, 2025 EBITDA of CAD200 million, 2025 free cash flow of CAD112 million, and FCF/Sales of 11%.

Source: Market Screener

Balance Sheet

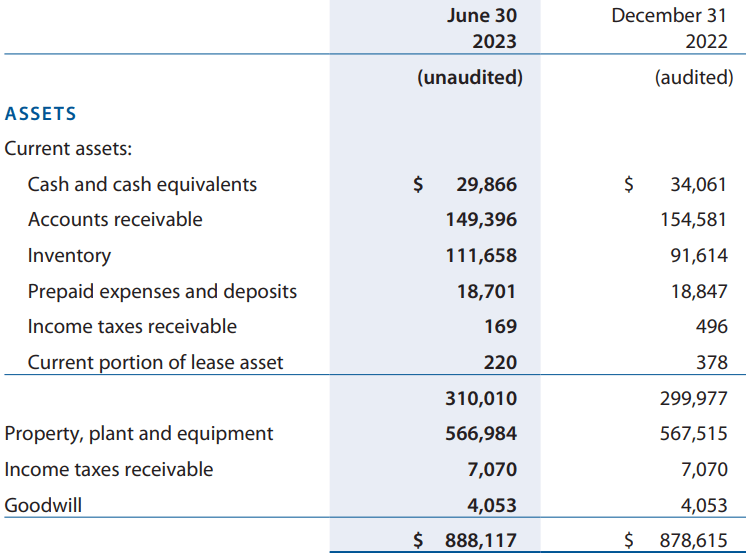

As of June 30, 2023, I believe that the financial figures reported in the balance sheet improved. The total amount of long term debt decreased, and the total amount of assets increased.

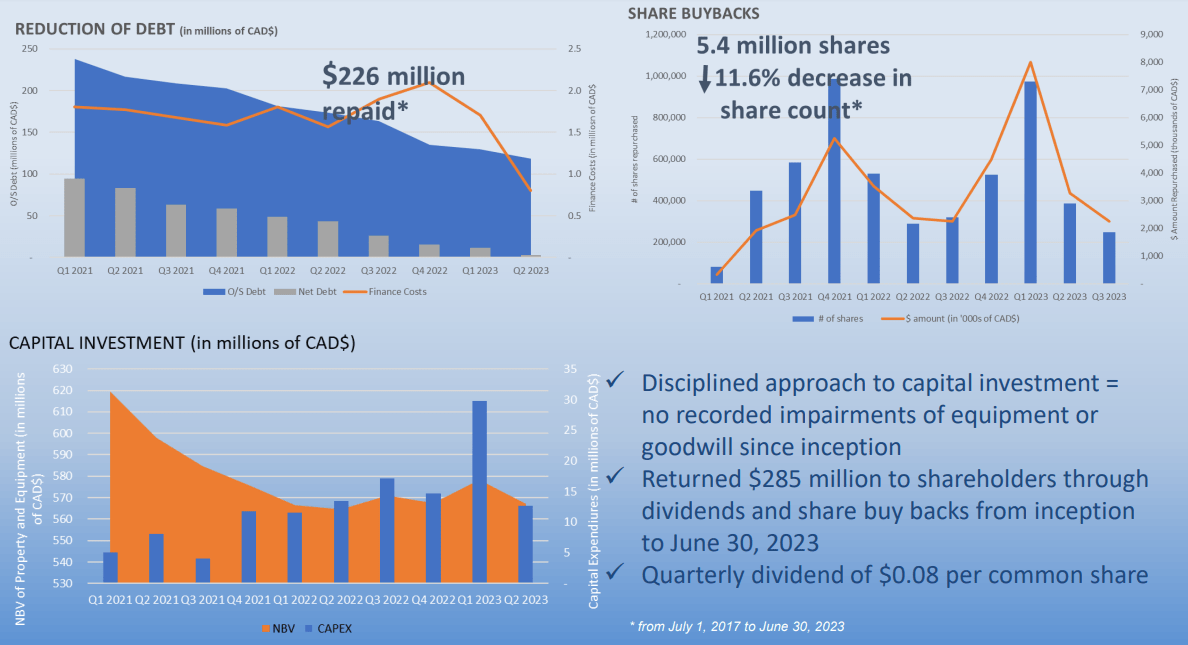

In the last quarter, the company mentioned decreased debt, but also a significant reduction in the share count. In my view, further reduction in the debt and stock repurchase agreements will most likely lead to stock price increases.

Source: Presentation To Investors

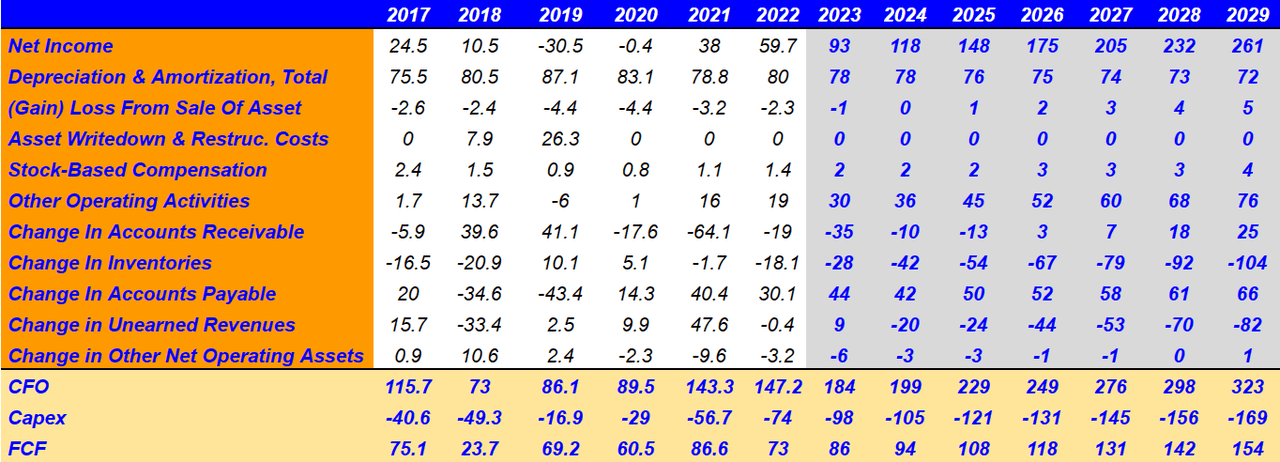

Cash in hand stood at about CAD29 million, with accounts receivable of CAD149 million, and inventory of CAD111 million. The current ratio is larger than 1x, so I do not see liquidity risks here.

Source: Q2 2023

With regards to the list of liabilities, Total Energy Services reported accounts payable worth CAD135 million, with deferred revenue of CAD55 million, and current portion of long-term debt of CAD2 million. The long-term debt was equal to CAD101 million, which is way lower than what the company reported in December 2022. Considering the asset/liability ratio, I think that the balance sheet stands in a good position.

Source: Q2 2023

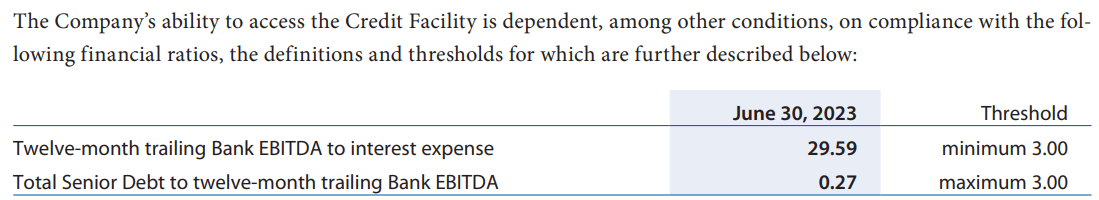

For the assessment of the cost of capital, I studied a bit the debt agreements signed by the company. In some of the credit agreements, Total Energy Services agreed to pay LIBOR or BBSY advances plus a 1.5% to 2.5% stamping fee, which implied, as of June 30, 2023, an applicable interest rate close to 6.55%.

The Credit Facility bears interest at the banks’ Canadian prime rate plus 0.25% to 1.25%, bankers’ acceptance, letter of credit, LIBOR or BBSY advances plus a 1.5% to 2.5% stamping fee. The applicable interest rate within such ranges is dependent on certain financial ratios of the Company. A standby fee ranging from 0.25% to 0.5% per annum is paid quarterly on the unused portion of the facility depending on certain financial ratios of the Company. At June 30, 2023, the applicable interest rate on amounts drawn on the Credit Facility was 6.55% and the standby rate was 0.25%. Letters of credit (“LOC”) of CAD0.3 million were outstanding at June 30, 2023 which reduces the amount of credit available under the Credit Facility by an equivalent amount. Source: Q2 2023

Recent Increases In Capital Expenditure And Reported Customer Demand May Accelerate Interest from Investors Waiting To See FCF Growth In The Coming Years

In the last quarter, the company noted customer demand and recent increases in 2023 capital expenditure budget, which will, in my view, most likely have an impact on future production capacity. As a result, I believe that most investors will most likely be interested in the new capex figures reported by Total Energy Services.

In direct response to customer demand, Total Energy has increased its 2023 capital expenditure budget to CAD72.1 million. This CAD6.0 million increase will be directed primarily towards continued equipment recertifications and upgrades. With CAD42.5 million of the Company’s 2023 capital expenditure budget funded to June 30, 2023, the remaining CAD29.6 million will be funded with cash on hand and cash flow. Source: Q2 2023

With that about capex increases, it is also worth mentioning that even with capex increases, management noted that FCF can be expected for the year 2023. In this regard, investors may want to read the following lines.

While Total Energy expects to generate significant free cash flow for the remainder of 2023, management remains committed to exercising discipline in the deployment of our owners’ capital. Source: Q2 2023

Stock Repurchases May Also Accelerate The Demand For The Stock

I believe that the millions recently invested in share repurchases will most likely have a beneficial effect on the stock price. Besides, the demand for the stock may increase as other investors may accelerate their investments in Total Energy Services.

Shareholders’ equity increased by CAD7.9 million from December 31, 2022 due to the realization of CAD30.2 million of net income, which was partially offset by CAD11.3 million of share repurchases. Source: Q2 2023

Considering The Previous Assumptions And Conservative Figures Based On Previous Results, My DCF Model Implied Significant Undervaluation.

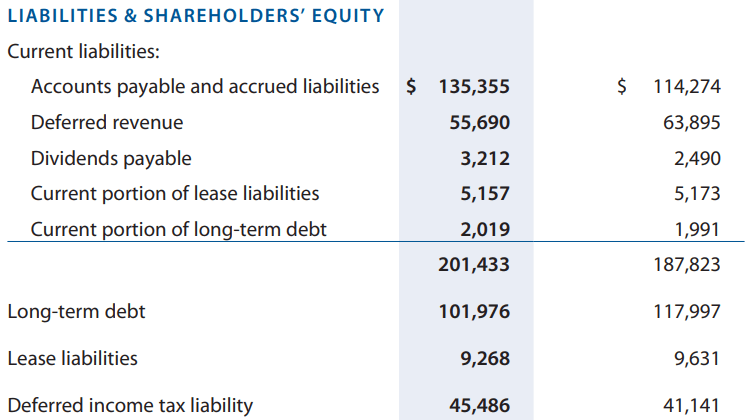

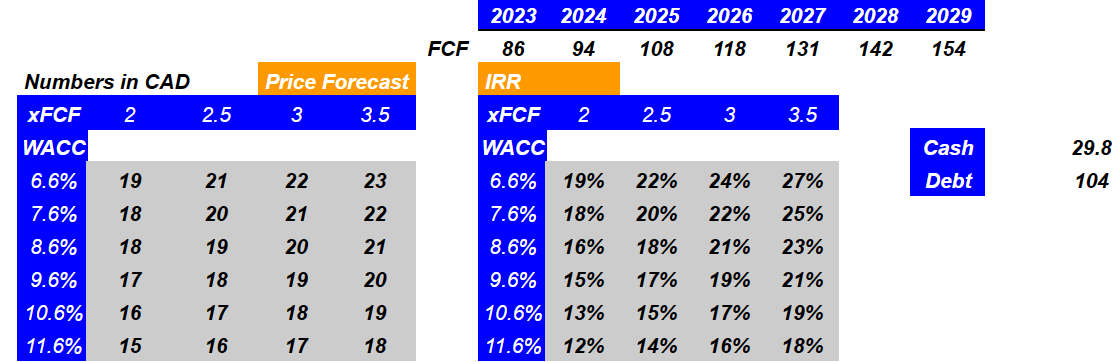

My DCF model includes 2029 net income of about CAD261 million, depreciation and amortization close to CAD72 million, and stock-based compensation of about CAD3 million. Besides, by including other operating activities worth CAD75 million, change in accounts receivable close to CAD24 million, and changes in inventories of -CAD105 million, I obtained 2029 CFO of CAD322 million. Finally, taking into consideration the capital expenditures of -CAD170 million, 2029 FCF would be close to CAD153 million.

Source: Financial Model

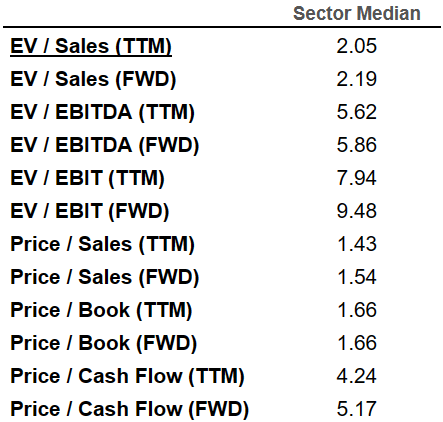

Financial advisors online chose to use a WACC close to 6% and 10%, which is not far from the interest rate signed in several debt agreements with debt holders. With these numbers in mind, I used WACC in the range of 6.6% and 11.56%. Also, with an EV/FCF multiple close to 2x and 3.5x, which is close to the current sector multiple, the implied forecast price would be about CAD15-CAD23 per share. Finally, the internal rate of return would be around 12% and 27%. In any case, I believe that the current valuation reported by the market is cheap.

Source: Competitors by SA

Source: My DCF Model

Risks

With several macroeconomic risks and industry risks that include changes in the oil price, increases in the price of equipment, or changes in salaries, Total Energy Services also reports some credit risks. In this regard, I believe that the most relevant are covenant agreements signed with debt holders. If the company cannot receive more debt to invest in capital expenditures or hire more personnel, we may see a decrease in production and revenue growth expectations.

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises primarily from the Company’s trade accounts receivable. The carrying amount of cash and cash equivalents and accounts receivable included on the statement of financial position represent the maximum credit exposure. Source: Annual Report

Source: Q2 2023

I also believe that delivering lower expectations than expected by market participants could lead to loss of confidence and even lower stock price valuations. Besides, increases in stock volatility may imply higher cost of equity, which may imply higher WACC. As a result, the implied financial valuation obtained by DCF models would lower.

Conclusion

Total Energy Services reported recent efforts to follow ESG guidelines, which may interest new funds interested in ESG focused companies. In the last quarter, the company noted lower net debt, significant stock repurchases, and recent increases in expected 2023 capital expenditures. In sum, I believe that many beneficial announcements were made recently, which may explain the beneficial expectations from other market analysts. I do see risks from lower production than expected, covenant agreements signed, or lower crude oil price, however I think that the stock remains significantly undervalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply