Covered Calls continue to become more popular for investors to generate income on their positions and for fund managers to create unique income-producing exchange-traded funds (ETFs). Many different strategies have been introduced over the past few years, and on August 18th, 2022, iShares by BlackRock (BLK) debuted the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (BATS:TLTW). What iShares has basically done is created a separate ETF that invests in its iShares 20+ Year Treasury Bond ETF (TLT) and runs an option overlay strategy to generate additional income. While TLTW has produced $5.06 of income over the trailing twelve months (TTM) which works out to a 15.27% yield on invested capital, the fund has lost -16.86% from the $33.15 level it traded at this time last year. After falling by more than -16% in the past year, TLTW may be finding a bottom as treasury yields started selling off, and more information is pointing toward a Fed pivot in the first half of 2024. TLTW looks like an interesting speculative opportunity to benefit from a Fed pivot while generating a double-digit yield.

Seeking Alpha

I think TLTW is a speculative way to generate yield, and there are several risks to consider

Normally, I save the risks for the end, but since I consider TLTW a speculative yield play, I want to make this the first aspect I discuss. When you write a covered call on an underlying asset, you’re getting paid immediate income by selling the right to purchase your asset at a specific price on a specific date in the future. You are effectively capping your upside potential for an immediate payment. With other covered-call funds, such as the Global X S&P 500 Covered Call ETF (XYLD), a decade of data establishes the ability to rebound after a decline. TLTW isn’t investing in equities like XYLD, and there isn’t enough data to indicate that TLTW would be able to rebound as some other covered call ETFs have in the past.

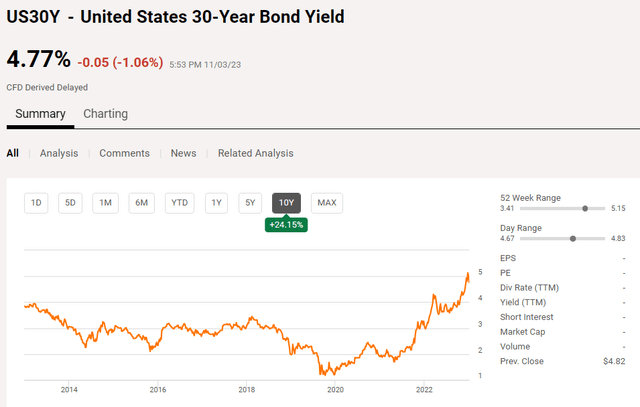

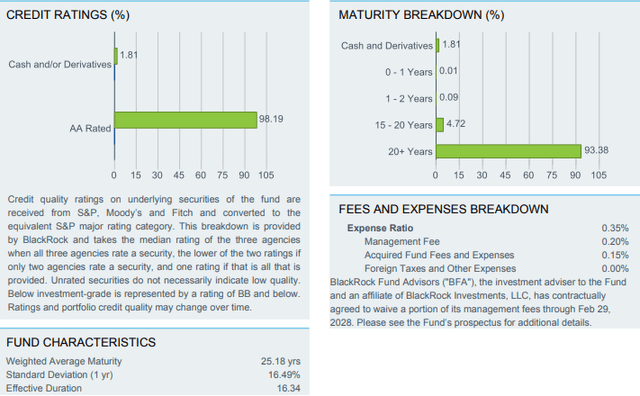

TLTW has 100% of its investments outside of cash and a money market account allocated toward TLT. In 2023, TLT has declined by -13.63% as the rising rate environment has been unkind to TLT’s underlying assets. TLT holds U.S. Treasury bonds with remaining maturities greater than twenty years. Their weighted average maturity is 25.46 years, and the average weighted coupon for TLT’s assets is 2.52. Due to TLT’s decline, the average yield to maturity has increased to 4.93%. The rising rate environment has created a situation where the risk-free yield of a 30-year treasury reached 5.15% recently and currently sits at 4.77%. Since October of 2022, the 30-year treasury notes have had a yield that exceeded 4%.

Higher treasury yields have crushed the underlying assets within TLT, which gets passed on to TLTW as TLT is its underlying asset. Back in the summer of 2020, when rates were basically non-existent, TLT traded at $171.57 and since then has lost -49.27% of its value. As the Fed raised rates, a larger portion of TLT’s bonds were impacted, as the weighted coupon was 2.52. As rates increase, previous debt issued with lower coupons loses value as investors are not willing to pay par value when they can go on the open market and purchase new treasuries at higher yields. This caused TLT’s underlying assets to depreciate, TLT to decline, and its yield to increase. There is over $40 billion parked in TLT now as it’s approaching its lowest levels in two decades.

TLTW is very speculative because it’s dependent on the Fed. If the Fed decides to take rates higher, then previous bonds should continue to see steeper discounts to par value, which should cause TLT to decline further. This would also cause TLTW to see further losses. A higher rate environment for longer is also a negative as more debt gets issued at higher yields and keeps previous debt discounted for longer. If a recession doesn’t occur and inflation decides to remain sticky or even increase from these levels, the Fed could decide to go higher on rates, which would negatively impact TLTW, which is why it’s a speculative income investment with elevated levels of risk.

Seeking Alpha

Why I am considering starting a small position in TLTW even though it’s speculative

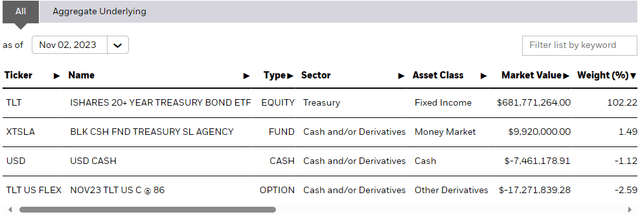

TLTW tracks the investment results of the Cboe TLT 2% OTM BuyWrite Index provided by Cboe Global Indices and measures its performance by holding the underlying asset while writing one-month call options to generate income. The Underlying Index utilizes a European-style call option where each call option has a strike price closest to 102% of the closing value of the Underlying Fund one day prior to the roll date. TLTW will write options that trade on national securities exchanges and look to sell call options up to the full amount of shares it holds of TLT, the underlying asset. The call options allow TLTW to generate an immediate premium by providing the purchaser of the option the right to purchase shares of the Underlying Fund at the strike price of the option at expiration. TLTW won’t physically settle outstanding option positions as it will generally purchase offsetting call options on the roll date as necessary to close out the open call positions. This leaves TLTW susceptible to market dynamics as TLTW is not structured to participate in market gains above the strike price of the call options, but it will be impacted if the underlying asset declines and participates in 100% of the losses. Investors are paying a 0.35% total expense ratio, which consists of a .20% management fee and .15% in acquired fund fees and expenses.

iShares

I was actually considering purchasing shares of TLT as I think bonds may have bottomed the writing-covered calls against my shares. When I was looking into this, I noticed that iShares created an ETF that will automatically do this for me. The upside on purchasing TLT would be that I can lock in a 3.71% yield on cost through its current dividend rate and pick what strike prices and contract dates I sell my covered calls at. This will give me greater control over the option strategy, and I can write options at a higher strike price to generate less income if I feel TLT is going to rally so I can participate in more of the upside rather than selling calls at or close to the money.

By investing in TLTW rather than TLT, I can take the work out of it and pay a small fee for the fund managers to run their option overlay strategy. I can also make a much smaller investment and see how it goes rather than buying TLT in lots of 100 shares to have the ability to write calls against my position. I am not worried about the underlying assets as they are U.S Treasuries, my concern would be the Fed.

We have seen what TLTW has done in a rising rate environment, but there is no data on what it will do if the Fed pivots. If I enter into this position, it would be under the premise that the bleeding will stop due to the Fed cutting rates. I wouldn’t be looking for upside appreciation but rather a bottoming and generating a double-digit yield on my invested capital. That’s why this is an interesting speculative investment for me because I do think the Fed is done, and since I haven’t participated in TLTW’s downside, I wouldn’t need to participate in its upside and could utilize it as a proxy to generate income.

iShares

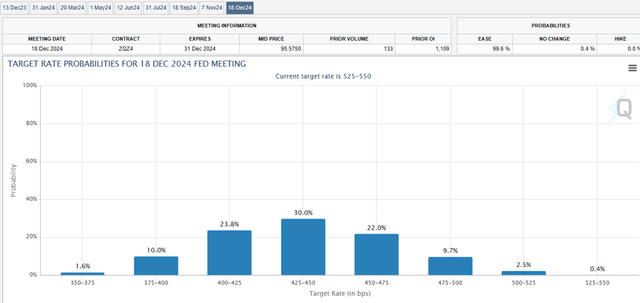

After the November Fed meeting, the bond markets sold off, indicating they think the Fed is done raising rates. Jerome Powell was hawkish but did provide aspects within his commentary that made me believe they will hold rates where they are, and even if we get a 25 bps increase this winter, a pivot is coming in the 1st half of 2024. The non-farm payroll report came in under the consensus estimates, and core CPI has declined for six consecutive months as it now sits at 4.1%. The CME Groups Fed Watch Tool now shows that there is a 10.3% chance of rates getting a 25 bps increase in January 2024, but they are now calling for a 25.9% chance that we will see our first 25 bps cut in March of 2024. Looking out to the end of the year, it looks like the Fed will cut several times, and if they do, it should be a bullish scenario for the bond markets.

CME Group

Conclusion

I think TLTW is a speculative income play that could provide a significant amount of income without having to run an option overlay strategy on my own. There are certainly risks, and the Fed could continue to raise rates, which would impact this investment thesis. Since I am not invested in TLTW currently, I am looking at this as trying to catch TLTW near the bottom and just use it as a vehicle to generate distributions. I think there is more of a chance that we’re at the end of the cycle and that we will see a Fed pivot before the 4th of July. I may test the waters by adding TLTW to my Dividend Harvesting Portfolio series on Seeking Alpha, and (can be read here) after a couple of months, I may make a bigger investment in my main dividend account. If you’re interested in TLTW, please look at the risks closely.

Read the full article here

Leave a Reply