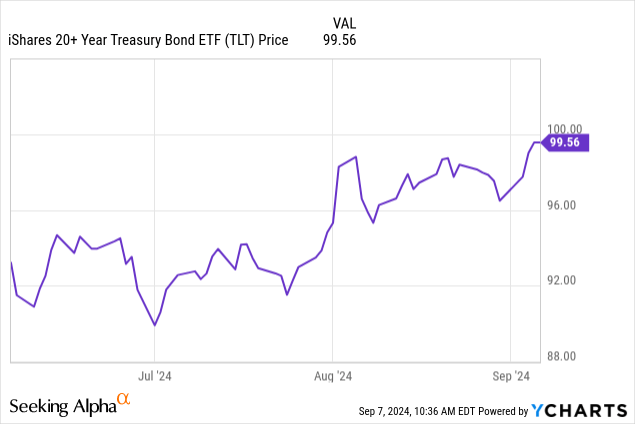

The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) is finally breaking out and making a higher high for 2024. TLT shares are appreciating along with their underlying treasuries in advance of the forthcoming rate cut cycle and lower levels of inflation. Share of TLT are now breaching the triple digits and appear likely to trend higher for most of the remainder of 2024, and for them to continue higher in 2025.

Long-term Treasury bonds provide a steady stream of income through their interest payments, and Treasuries cannot be called back through early redemption like most competing bonds and CDs. Treasuries are also some of the highest rated of securities available due to their express U.S. government guarantee that is backed by the ability to tax and print dollars. Alternatively, most investments are not allowed by law to include such a guarantee.

In 2022 and 2023, the Federal Reserve aggressively raised interest rates to combat inflation, pushing up yields on fixed income instruments like Treasury bonds. When yields go up, the valuation of existing fixed income assets goes down. The aggressive nature of the Fed’s rate hikes cause a serious drop in Treasury valuations. Those declines compromised some bank balance sheets and contributed to their failure. Certain commercial real estate markets were also seriously affected.

Now, we are on the cusp of the Federal Reserve lowering interest rates through a series of rate cuts, with most expecting the first such rate cut to come this month. Lowering rates should have the opposite effect upon Treasury valuations, though primarily at short and mid-term maturities. Nonetheless, when shorter term rates go down, competing fixed income will follow. It is also likely that government agency debt will undergo aggressive early redemption, as they are callable. The result of this is that longer-term Treasuries become considerably more attractive.

Bonds also balance the risk of equity investments in a portfolio, and are often held for their hedging capacity. This is because it is often the case that higher rated bonds perform well when the equity markets undergo declines. This inverse relationship did not appear to be in effect over much of the last decade, that was likely due to the already exceedingly low-interest rates that fixed income was offering. Now, though, it appears more likely that high-quality credit will work as a hedge to equity downturns.

Global economic uncertainty is another reason to anticipate that Treasuries will remain strong in the near term. In particular, markets should be concerned with heightened geopolitical tension and the potential for a continuing slow-down in Asian economies, and particularly China. Investors are likely to desire the safety and stability of Treasury bonds if such conditions were to continue or worsen.

Treasury bonds have now reached their highest valuation of 2024 and appear likely to trend higher with rate cuts and potential weakness in equity markets. Last month, TLT spiked along with a broad market decline and spike in volatility. TLT subsequently sold off a bit while volatility calmed and the market rallied, but TLT has made back all of that so far in just the first week of September.

TLT 2024 chart also shows a well-rounded bottoming pattern over the last eight months, and is now breaching the level that it reached last month and also at the end of 2023. Once TLT makes it through this level, which acted as strong resistance in the past, it could quickly turn to a level of support. I believe that such an outcome is highly probable upon the initiation of the rate cut cycle.

TLT daily candlestick chart (Finviz.com with red line by Zvi Bar)

Further, there is some strong potential that TLT’s rise will accelerate along with rate cuts and possible market weakness. This would especially be the case if the market were to undergo such weakness that the Federal Reserve were forced to cut rates at an even more aggressive pace than is anticipated. While I do not believe that the Federal Reserve is likely to move in an aggressive manner in advance of the presidential election, it may become more aggressive after the fact.

While TLT did not finish the week above $100, it stayed exceedingly close, and this weekly closing price is a higher high for the year. Also, both this week and last week, bonds sold off near the close. Pricing may end up staying close to $100 through the next two weeks while waiting out the Federal Reserve’s ultimate decision on whether to initiate the rate cut cycle, and also whether to do so with a cut of 25 or 50 basis points. Any further weakness is likely both a short and long term buying opportunity.

Risks

Long-term Treasuries come with various risks, and the main risk is interest rate risk. When interest rates rise, as was the case in 2022 and 2023, the price of existing bonds will decline. Further, such interest rate risk is enhanced by the duration of a bond, where the interest rate change is multiplied by their duration, so it is greater in longer-term maturities.

Another risk to long-term bonds is opportunity cost. Treasuries are not expected to perform in line with equities over the longer term, so locking capital into long-term bonds can come at the expense of lost opportunities to allocate into better performing alternatives.

Treasury investing also faces the risk of a declining dollar and higher levels of inflation in the future. Lower interest rates are generally associated with a weaker dollar. Increased rates of inflation would obligate the Federal Reserve to increase interest rates in order to firm up the dollar, which is bad for Treasury valuations.

Conclusion

TLT finally made it through the $100 level. While it did not hold that level into the weekly close, it still broke out and maintained a higher weekly closing price for 2024. Though TLT may not advance higher without issue, this move is a show of strength that is likely setting up for further appreciation. It is also impressive that TLT was able to make it to this level in advance of the first-rate cut by the Federal Reserve.

TLT appears likely to continue to appreciate in the final months of 2024 and into 2025 when the Federal Reserve is actually cutting rates. TLT’s current level is probably going to convert from resistance to support for a further move upward during the start of the rate cut cycle that should occur later on this month.

Read the full article here

Leave a Reply