I came across the Innovator Buffer ETFs earlier this year when I reviewed the Innovator Nasdaq-100 Power Buffer ETF – April (NAPR) and recommended investors choose the July series instead. I believe the Buffer ETF concept is an interesting innovation that may be useful for conservative investors worried about market declines.

The Innovator Equity Defined Protection ETF (BATS:TJUL) is the first ETF in Innovator’s Equity Defined Protection suite that offers a 2-year outcome period and 100% downside protection while retaining modest upside capture.

Overall, I can see the benefits of TJUL’s strategy, as some investors simply cannot tolerate any losses. However, the strategy does introduce some risks that investors need to understand. Most importantly, investors need to realize that investors buying these defined protection ETFs during the outcome period may not obtain the desired outcome.

I would personally wait for the upcoming November series if investors are seriously considering the defined protection ETFs.

Fund Overview

The Innovator Equity Defined Protection ETF an exchange traded fund (“ETF”) that aims to provide moderate upside exposure to the S&P 500 Index with 100% downside protection over a 2-year outcome period (Figure 1).

Figure 1 – TJUL overview (innovatoretfs.com)

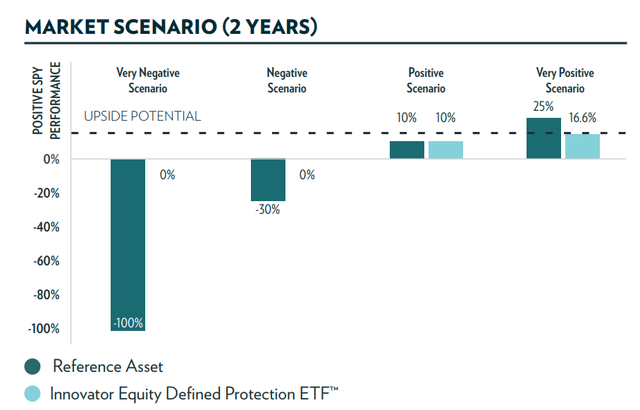

Over the next two years, if the reference asset (S&P 500 Index) experiences negative returns, investors in the TJUL ETF are protected 100% on the downside. If the S&P 500 Index delivers positive returns, TJUL investors receive 1:1 upside capture up to a 16.6% cap (Figure 2).

Figure 2 – TJUL market scenarios (TJUL factsheet)

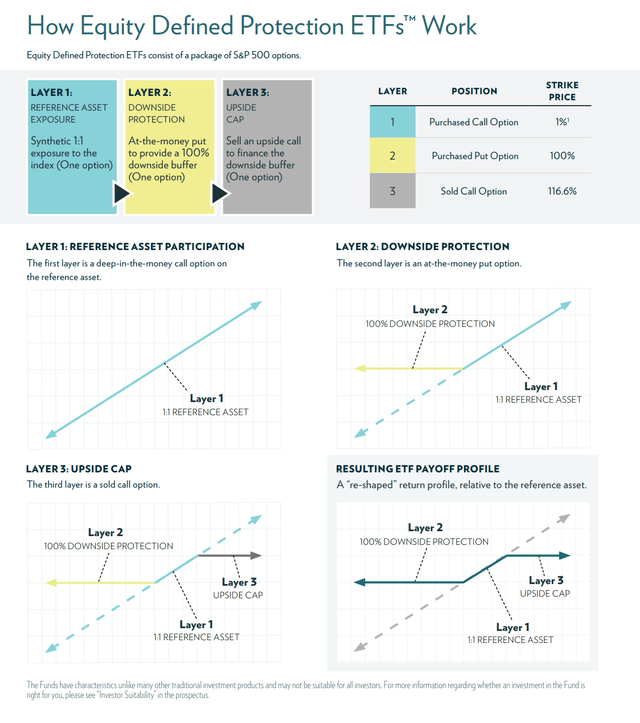

TJUL achieves the payoff profile in Figure 2 with the use of options. First, the ETF purchases deep in the money (“ITM”) options on the SPDR S&P 500 ETF Trust (SPY), giving investors synthetic 1:1 exposure. Next, the ETF will purchase an at-the-money (“ATM”) put option to project 100% of the reference asset’s downside. Finally, the ETF will sell an out of the money (“OTM”) call to finance the downside buffer (Figure 3).

Figure 3 – TJUL strategy implementation (TJUL factsheet)

To enjoy the full benefit of the TJUL ETF’s protective options, the TJUL ETF must be held for the entire ‘outcome period’. In other words, the ETF will only provide 100% downside protection if investors buy and hold the TJUL ETF from July 1st 2023 to July 31, 2025.

If investors buy the TJUL ETF at other times, they may experience investment performance that is materially different from the modeled behaviour. For example, if investors buy the TJUL ETF after a 10% gain within the ‘outcome period’, the ETF will not provide protection on this 10% gain.

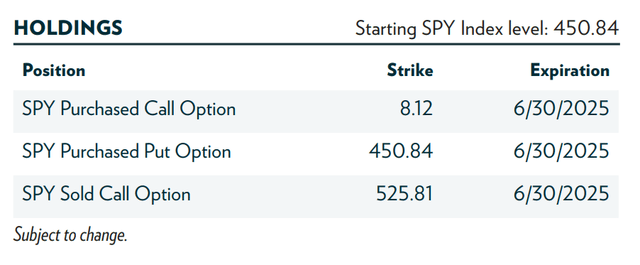

Portfolio Holdings

As designed, the TJUL ETF holds deep ITM SPY call options, with an ATM put (struck when SPY was 450.84), plus sold OTM calls with a 525.81 strike. All the options have a June 30, 2025 expiry (Figure 4).

Figure 4 – TJUL portfolio holdings (TJUL factsheet)

Returns

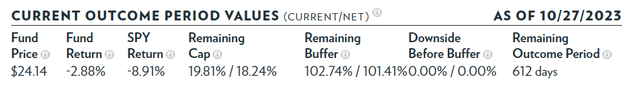

Since inception, June 30, the SPY ETF has declined by 8.9% while the TJUL ETF has declined by 2.9%, so on the surface, the TJUL ETF has not lived up to its mandate (Figure 5).

Figure 5 – TJUL performance (innovatoretfs.com)

However, investors need to understand that these are mark-to-market losses on the TJUL ETF. If investors continue to hold the TJUL ETF until maturity on June 30, 2025 and the SPY ETF stays at the current level of $410, then at maturity, the gains from the put options will offset the losses on the deep ITM calls, so net-net, they should experience no losses except for the management fees for the ETF over the next 2 years.

Impetus To Get Cash Off The Sidelines?

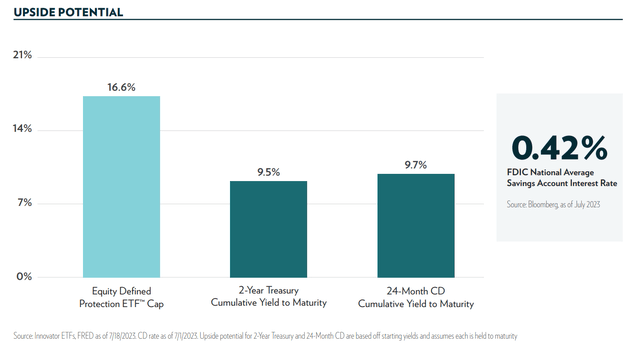

The manager, Innovator Exchange-Traded Funds, believe Equity Defined Protection ETFs like the TJUL can be a viable alternative for cash currently sitting in money-market funds and CDs. This is because if the ETF is held to maturity, 100% of the downside is protected while the TJUL ETF offers potential returns of up to 16.6%, better than cumulative treasury yields and CDs (Figure 6).

Figure 6 – TJUL is marketed towards cash on the sidelines (TJUL investor guide)

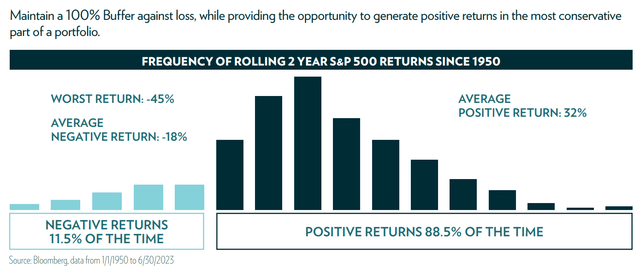

Over a rolling 2-year window, the S&P 500 has historically delivered positive returns 88% of the time with average positive returns of 32% (Figure 7).

Figure 7 – S&P 500 has delivered positive 2-year rolling returns 88% of the time (TJUL investor guide)

So the manager believes investors can buy the TJUL ETF and earn superior total returns compared to treasuries or CDs.

What’s The Catch?

Thinking about TJUL’s payoff structure, there are several potential risks and scenarios that investors need to watch out for. First, if investors purchase the TJUL ETF when SPY has rallied above the starting SPY level ($450.84), say $480, then investors will not be protected from $450.84 to $480, since the put option has a $450.84 strike price. Furthermore, upside potential will be reduced, as the sold calls will cap returns beginning at $525.81, or 9.5% above $480 instead of the 16.6% advertised.

In addition, the management fees will reduce the ETF’s total returns potential to ~15.0% instead of 16.6%.

Finally, if investors purchase TJUL during the outcome period when SPY is trading below the initial level, say currently at $410, forward returns may not be the same as the underlying ETF. For example, if SPY rallies back to $450 by June 30, 2025, investors who bought the SPY ETF today would experience total returns of 9.8%. However, an investment in TJUL today when SPY is $410 at TJUL is at $24.14 may only see TJUL return to its initial NAV at ~$25 or a 3% gain.

In fact, even if investors had bought TJUL on day 1 and the SPY ETF ended the outcome period at $450.84, investors may still lose money as the ETF must pay the 0.79% annual management expense. Furthermore, the initial deep ITM call option will have a certain amount of time value embedded in the premium that will decay over the 2 years.

Conclusion

The Innovator Equity Defined Protection ETF is a newly launched ETF that aims to protect investors 100% from drawdowns with modest upside participation using options.

With the SPY ETF currently trading 8.9% below the initial level, investors may be able to achieve a 19.8% return in the remaining outcome period to June 30, 2025 if the SPY ETF rallies by 28% to reach the upside cap of $525.81.

However, there is also the risk that total returns may be far less, if, for example, the SPY ETF does not exceed the initial level of $450.84 by the end of the outcome period.

Overall, the TJUL ETF may appeal to conservative investors looking to obtain equity exposure with limited downside. However, I believe the best time to buy Equity Defined Protection ETFs like TJUL may be at issuance, as investors buying the ETF at any other time may not experience the modeled benefits of the strategy. Investors looking at this strategy should consider waiting for the upcoming “TNOV” series that will be issued in November with an October 31st initial level.

Read the full article here

Leave a Reply