Titan Machinery (NASDAQ:TITN) sells heavy machinery and accessories into the agricultural and construction industries. The company has achieved phenomenal financials in the past couple of years as a result of a hot agricultural industry and several quite small acquisitions. The stock market seems to price in a very significant earnings fall with the current forward P/E of 5.0. With some earnings fall in my DCF model estimates, the stock still seems undervalued; I believe the stock is worthy of a buy-rating.

The Company & Stock

Founded in 1980, Titan Machinery is a company that operates agricultural and construction equipment stores in the United States and Europe. The equipment is used in food production and in maintaining properties – the company’s two main segments are agriculture and construction. The company’s provided equipment includes heavy machinery as well as smaller accessories and parts.

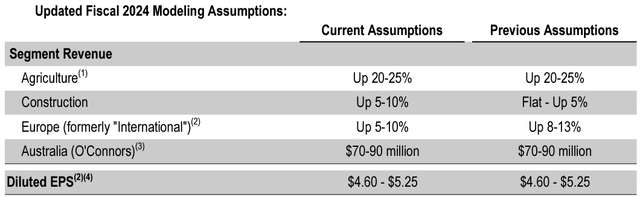

Titan Machinery’s financial performance has been exceptional as the agricultural segment has performed exceptionally well. In the current year, the company expects the agricultural segment’s revenues to be up by 20% to 25%:

FY2024 Guidance (TITN Q2/FY2024 Investor Presentation)

The agricultural segment seems to currently operate in a very favorable environment. Although commodity prices have come down significantly, corn futures are still significantly above the 2020 level, and wheat futures are still above the early- to mid-2020 level. Higher commodity prices lead to more profitable farming, that seems to have led to tailwinds in the industry. The tailwinds could prove to be temporary as commodity prices continue to come down.

As Titan Machinery doesn’t pay a dividend, the stock’s total return in the past ten years has been quite poor – the price appreciation of 40% only represents a CAGR of 3.4% in the period.

Ten-Year Stock Chart (Seeking Alpha)

Financials

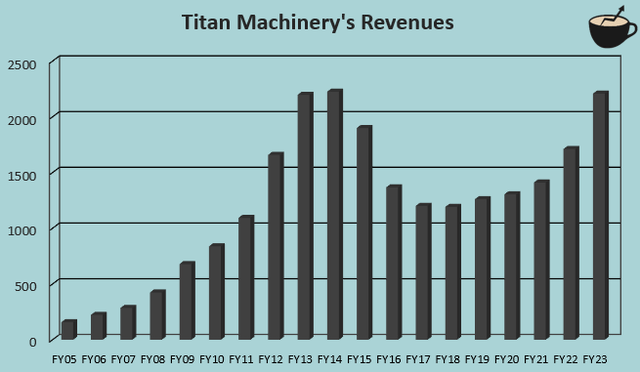

Titan Machinery’s revenues have had clear trends in the company’s history – the company achieved a significant amount of growth from FY2005 to FY2014, that turned into severe revenue declines from FY2014 to FY2018. Since the latter year, Titan Machinery’s revenues have turned into a good amount of growth again. For example, in FY2023, the company’s revenues increased by 29.1%:

Author’s Calculation Using TIKR Data

In addition to quite small acquisitions, such as the $63 million acquisition of dealership group J.J. O’Connor & Sons in August, Titan Machinery’s growth seems to be partly due to the previously mentioned industry tailwinds. The company seems to continue to grow in FY2024 as well, as Titan Machinery guides the agricultural segment to grow 20% to 25% in the current fiscal year.

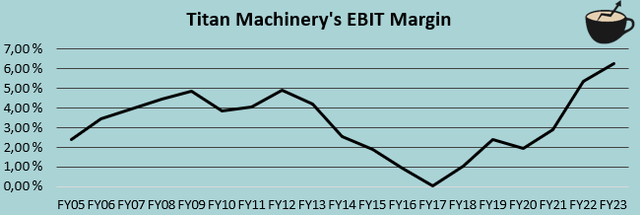

Titan Machinery’s EBIT margin has mostly followed the company’s sales patterns in the long term. The EBIT margin has fluctuated between a level of 0.0% and 6.3% from 2002 to 2022, with an average EBIT margin of 3.2%. The company’s current trailing EBIT margin of 6.6% is a new record for the company, above double of the company’s historical average. As the margin quite closely follows sales trends, I believe that the margin will come down if the revenue growth stops into a halt.

Author’s Calculation Using TIKR Data

Although Titan Machinery has a large amount of short-term borrowings at a current figure of $596 million, I don’t see the company’s balance sheet as too leveraged. The company has a very large inventory of machinery – currently the company’s inventory stands at $979 million, significantly above previous years’ inventory levels The short-term borrowings seem to correlate highly with inventories, as the debts are floor plan borrowings with low interest rates. Titan Machinery does also hold $88 of long-term debt, but the amount is quite insignificant to Titan Machinery as a whole.

Valuation

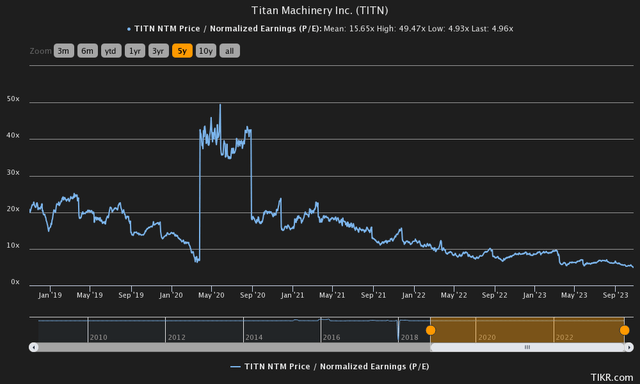

The stock market seems to price in a large earnings fall in the medium term – Titan Machinery currently trades at a forward P/E of 5.0, widely below the company’s five-year average of 15.7:

Historical Forward P/E (TIKR)

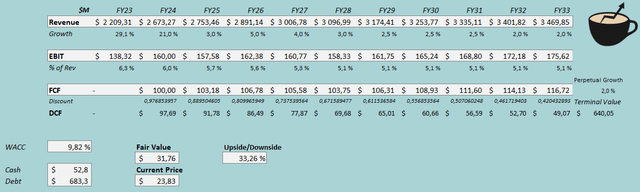

I believe that pricing in an earnings fall is justified as the industry is quite turbulent and is facing current tailwinds. To estimate a rough fair value for the stock, I constructed a discounted cash flow model. In the model, I estimate a growth of 21% for the current year, signaling growth that’s along with Titan Machinery’s segment guidance. For the next year, I estimate the organic growth to stop completely with a figure of 3%, mostly growing due to inflation and the recent acquisition of O’Connor & Sons. After the year, I estimate slight revenue growth with a figure of 5% in FY2026. After the year, I estimate the growth to come down in steps into a perpetual growth rate of 2%.

As I estimate the sales growth to come down, I believe that Titan Machinery’s EBIT margin will come down. For the current year, I estimate a margin of 6.0%, signifying a margin fall in H2. After FY2024, I estimate the EBIT margin to come down further with an estimate of 5.7% in FY2025 that falls into a perpetual margin of 5.1% in FY2028. The estimated margin is still significantly above Titan Machinery’s twenty-year average of 3.2%, but I see the higher margin as very possible due to a larger scale of operations than in the twenty-year period.

The mentioned estimates along with a cost of capital of 9.82% craft the following DCF model with a fair value estimate of $31.76 signifying a fair forward P/E of 6.6, or around 33% above the price at the time of writing:

DCF Model (Author’s Calculation)

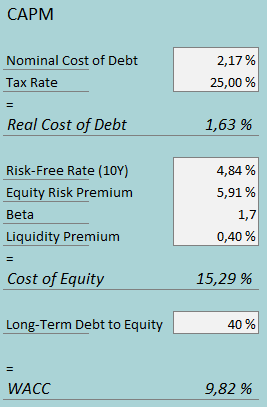

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Titan Machinery had $3.7 million in interest expenses. With the company’s current amount of interest-bearing debt, Titan Machinery’s interest rate comes up to an annualized figure of 2.17%. The figure seems very low compared to current interest rates, but as the short-term borrowings seem to be somewhat operational in nature, the figure could make sense. As Titan Machinery has leveraged short-term borrowings quite largely in the company’s history, I estimate the company’s long-term debt-to-equity ratio to be 40%.

On the cost of equity side, I use the Unites States’ 10-year bond yield of 4.84% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the Unites States, made in July. Titan Machinery’s beta is estimated at a figure of 1.70 by Yahoo Finance. Finally, I add a small liquidity premium of 0.4% into the cost of equity, crafting the figure into 15.29% and the WACC into 9.82%, used in the DCF model.

Takeaway

I believe that Titan Machinery is currently a worthy investment. The thesis does rely on Titan Machinery’s improved financial performance to mostly carry on into the medium- and long-term future – the currently well-performing operations are partly due to tailwinds in the agricultural industry. If the earnings level drops below my DCF model estimates, the stock could still be a poor investment. At the moment, I believe that the risk-to-reward is good, though; I have a buy-rating for the stock.

Read the full article here

Leave a Reply