Situation Overview

After months of a comprehensive portfolio review, Tidewater Midstream (TSX:TWM:CA) has decided to sell its Pipestone-related assets to AltaGas for $650 million. The proceeds will be used to strengthen its balance sheet. It sounds like while future divestitures are still on the table, this concludes TWM’s portfolio review and the next catalyst will be the commercialization of the renewable diesel production.

Playing devil’s advocate first, this transaction is giving me that “everything was on the table but nobody wanted anything else” feel and this is no doubt one of the crown jewels. Having said that, I applaud management for getting this transaction done, as it should more or less solve the (perceived) balance sheet issue for good. Tidewater Midstream (excluding the term loans at the renewable entity) has a ~$550 credit facility and $75 million convertible bonds outstanding. The $650 million proceeds (half in cash and half in AltaGas’s stocks) puts TWM in a zero net debt position.

AltaGas is valuing the current operating assets at $525 million, and the Pipestone Phase II expansion at $125 million ($650 million total consideration). TWM says the assets disposed represent $55-$60 million of its normalized 2023 adjusted EBITDA. Therefore, TWM was able to achieve a ~9.0x EV/EBITDA transaction multiple, plus $125 million in option value. This is a great outcome, especially considering that the construction cost for the phase II expansion is estimated to be ~$360 million and there is no way TWM is able to finance this even with a partner.

Valuation

With the fully contracted Pipestone plant sold, the EBITDA generated from the remaining midstream assets will be more volatile and more tied to the commodity price. TWM still has a decent presence in the Deep Basin (e.g. Brazeau River Complex, Ram River) and Central Alberta (e.g. Acheson), with a combined processing capacity of ~980 mmcf/d. The downstream side of the business remains the same, but of course, on a consolidated basis, TWM is more downstream-heavy going forward.

TWM guided ~$180 million EBITDA before the transaction, which means the remaining assets will generate ~$120 million EBITDA. With the less contractual nature of the remaining assets, I think the valuation multiple deserves to be a little lower. Below is my estimate of fair value for TWM:

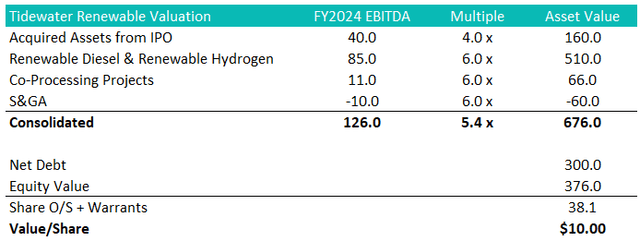

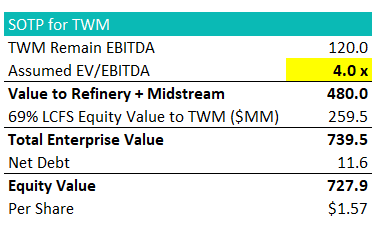

I applied 4.0-6.0x to Tidewater Renewable segmented EBITDA and get to an enterprise value of $676 million, deducting ~$300million of net debt, leaving an equity valuation of $376 million. TWM’s 69% equity stake is worth ~$260 million. I then applied a 4.0x multiple to TWM’s deconsolidated EBITDA (i.e. excluding Tidewater Renewable). I previously applied a 5.0x multiple, but the Pipestone divestiture degrades the cash flow quality.

Author

Netting the assets sales proceeds against the current net debt, I get to pro forma net debt of only ~$12 million. Adjusting for some outstanding warrants, I get to a price target of $1.57/share for TWM or ~55% upside.

Author

Where Do We Go From Here?

Admittedly TWM has been a value trap for years. There were multiple forces working against the company. The old debt-funded midstream grow-by-acquisition playbook is no longer viable, and the market has moved to focus on free cash flow generation, but TWM’s strategy was stuck in the past. The Prince George Refinery acquisition turned out to be a slam dunk, but also capped TWM’s valuation multiple in my opinion since downstream assets are perceived to be more volatile.

What investors can look forward to is the commercialization of the renewable diesel & renewable hydrogen facility (HDRD), which on a run-rate basis should generate ~$100 million EBITDA and substantial free cash flow. The commercialization should hit sometime in October 2023. I believe with HDRD achieving commercialization and the close of the Pipestone sales in late 2023, TWM’s 2024 guidance will be cleaner to analyze, lowering the hurdle for marginal investors.

One potential risk is the upcoming maturity of the $75 million in convertible bonds in September 2024. I sincerely hope that management won’t attempt an amend and extend by offering bondholders a lower strike price and (inevitably) a higher coupon. What they should do is refresh its RCF capacity with the Pipestone sales proceeds, and redraw on (in all likelihood) a smaller RCF to call the convertible bonds at par. I understand that the 5.5% coupon is attractive in today’s rate environment, but even if the rate differential is 4.5% (i.e. the interest on the RCF is 10% vs. the 5.5% coupon on the convertible), on a $75 million balance the additional interest expense is merely ~$3.4 million. I think that’s a fair price to pay to permanently retire a dilutive instrument and avoid a messy negotiation with bondholders. Fellow shareholders, please reach out to the company and convey this message.

A potential strategic maneuver that I see TWM could pursue is to collapse the TWM/LCFS structure by buying back the minority shareholder of LCFS. LCFS is clearly a failed IPO (so far) and the drop-down structure is becoming less and less popular in the market. While the negotiation with the minority shareholders might complicate things in the near term, I believe it’s value accretive in the long run.

Conclusion

Overall I like the Pipestone transaction. It was done at an accretive multiple and the sales proceeds will significantly deleveraging the balance sheet. TWM still remains deeply undervalued but admittedly this has been a value trap for years. One big upcoming catalyst is the commercialization of the HDRD facility in October. The risk on the horizon is the upcoming convertible bond maturity, but with the balance sheet in much better shape I believe TWM has options to take the convertible bond out with cash by drawing on a new and smaller RCF. A longer-term strategic move would be to collapse the TWM/LCFS structure. I remain a patient investor of TWM and LCFS.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply