By Mark Paris, Chief Investment Officer, Head of Municipal Strategies, Invesco Fixed Income | Stephanie Larosiliere, Head of Municipal Business Strategies and Development

In our latest update on what’s going on in the muni market, we ask and answer key questions and highlight munis by the numbers for a quick look at some commonly used muni market data points.

Stephanie: The Federal Reserve (Fed) didn’t raise interest rates in September but did maintain a hawkish policy stance. What’s your view?

Mark: The Fed’s action was widely expected. Underlying inflation cooled faster than policymakers expected, suggesting that their efforts to restrain inflation have largely been successful. But the Fed has also said it’s concerned that stronger-than-expected economic growth could boost inflationary trends. On balance, this suggests to me that the Fed will remain on pause — or even end interest rate hikes — unless the data indicates otherwise. That said, there are wild cards. Rising crude oil prices, the potential US federal government shutdown, and US autoworkers’ strike may impact economic conditions and inflation expectations.

Stephanie: September and October are historically challenging for municipal bonds. What should investors keep in mind?

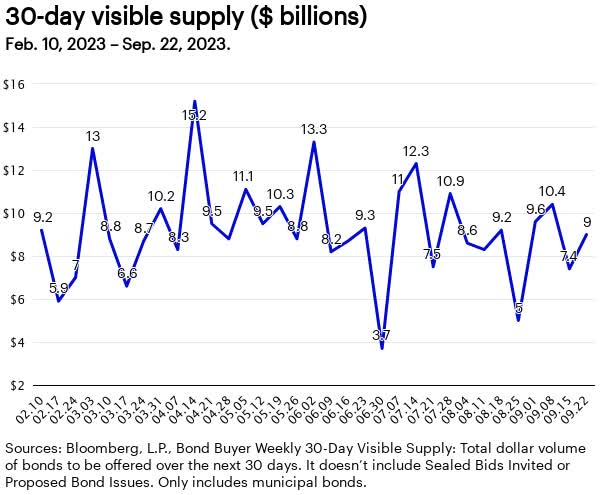

Mark: We often see disappointing performance during September and October, when returns have historically been weaker than at other times of the year.1 During these months, we typically have a weak coupon payment season, and generally high net issuance, resulting in an imbalance between supply and demand. Now through late October may be a good time to put new money to work at a potentially lower cost basis. Alternatively, November, December, and January have tended to be good months for munis, with the January reinvestment period one of the most potentially advantageous times to be invested.

Stephanie: Let’s talk government shutdown. We’re on the verge of the 22nd government shutdown in five decades if Congress cannot pass appropriations bills by September 30. Should muni investors be concerned?

Mark: I think we’d all like for the government to avert a shutdown, but the odds aren’t good. The last time federal government shutdown was December 21, 2018. It was a partial one, lasting 35 days.2 Consensus is that a brief shutdown, one lasting 30 days or less, could delay certain federal payments to municipal issuers, but would have minimal-to-no credit impact on municipal debt. That said, a more protracted shutdown would be more concerning. The silver lining for munis is that, unlike previous shutdowns, municipalities have received record amounts of federal stimulus since 2020. Billions were allocated to municipalities from the American Rescue Plan Act, the Coronavirus Aid, Relief, and Economic Security Act, the Infrastructure Investment and Jobs Act, and the Inflation Reduction Act. This is a real-life example of why strong rainy day fund balances are so important. They just might be the thing that gets munis through a potential government shutdown.

Muni by the numbers

A quick look at some commonly used muni market data points.

Fund flows: Weekly and monthly reporters ($ millions)

Week ending Sept. 27, 2023

|

Actual |

YTD total |

4-wk avg |

|

|---|---|---|---|

|

All term muni funds |

(1,240) |

(12,003) |

(1,108) |

|

Open-end muni mutual funds |

(1,266) |

(17,286) |

(1,548) |

| Municipal ETFs | 26 | 5,283 | 440 |

|

New York |

(30) |

(850) |

(24) |

|

California |

(37) |

(355) |

(12) |

|

National |

(1,109) |

(7,835) |

(930) |

|

High yield |

(365) |

(240) |

(426) |

|

Intermediate |

(262) |

839 |

(81) |

|

Long term |

(459) |

7,296 |

(377) |

|

Tax-exempt money market |

1,021 |

4,016 |

194 |

Sources: Lipper US Fund Flows, JPMorgan. YTD = year-to-date.

Footnotes

-

Sources: Citi Research, Bloomberg, L.P. based on the Bloomberg Municipal Bond Index, an unmanaged index considered representative of the tax-exempt bond market. The Bloomberg Municipal Bond Index had negative monthly returns in September in 2016, 2017, 2018, 2019, 2021, and 2022. In October, it had negative monthly returns in 2016, 2018, 2020, 2021, and 2022.

-

Source: The Brookings Institution, as of September 17, 2023.

Important information

NA3150907

Municipal securities are subject to the risk that legislative or economic conditions could affect an issuer’s ability to make payments of principal and/or interest.

Junk bonds involve greater risk of default or price changes due to changes in the issuer’s credit quality.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

The values of junk bonds fluctuate more than those of high-quality bonds and can decline significantly over short time periods.

All fixed income securities are subject to two types of risk: credit risk and interest rate risk. Credit risk refers to the possibility that the issuer of a security will be unable to make interest payments and/ or repay the principal on its debt. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa.

Municipal bonds are issued by state and local government agencies to finance public projects and services. They typically pay interest that is tax-free in their state of issuance. Because of their tax benefits, municipal bonds usually offer lower pre-tax yields than similar taxable bonds.

All data as of September 27, 2023, unless otherwise stated.

All data provided by Invesco unless otherwise noted.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. It is not intended or written to be used, and it cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on the taxpayer under US federal tax laws. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Past performance does not guarantee future results. An investment cannot be made into an index.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties, and assumptions; there can be no assurance that actual results will not differ materially from expectations.

There is no guarantee the outlooks mentioned will come to pass.

©2023 Invesco Ltd. All rights reserved.

Thoughts from the Municipal Bond Desk by Invesco US

Read the full article here

Leave a Reply