Investment thesis

I lower my rating on The Trade Desk, Inc. (NASDAQ:TTD) and update my revenue and EPS estimates following some recent developments, including two quarterly reports and a 33% share price appreciation since I last covered the company in February. While Trade Desk remains one of my top growth stock picks out there today, the current valuation is too demanding.

The Trade Desk continues to stand out in the digital advertising industry due to its unique and differentiated business model. TTD’s programmatic advertising model empowers advertisers to target specific audiences and demographics with transparency and advanced targeting capabilities. This has resulted in a rapidly growing customer base, including prominent brands such as Walmart (WMT), Coca-Cola (KO), and Target (TGT). The company’s flexibility, coupled with its focus on transparency, enables advertisers to achieve a higher return on investment (ROI).

Furthermore, TTD’s emphasis on connected TV (CTV) and retail media aligns with the evolving digital advertising landscape. As the digital advertising industry continues to shift from physical to digital formats, TTD is well-positioned to benefit. The global digital advertising industry is projected to grow, with programmatic display advertising leading the way, both of which bode well for TTD.

TTD’s commitment to CTV advertising, early focus on streaming, and partnerships with major media companies make it a key player in this rapidly growing segment. With streaming services overtaking cable TV viewership, CTV advertising spend is rising. TTD is expected to capitalize on this trend, with analysts predicting impressive growth rates in CTV advertising spend on its platform, most likely pushing TTD’s medium-term growth CAGR to over 20%.

In its most recent financial results, TTD reported excellent growth, outperforming industry giants like Google (GOOGL) and Meta (META). The company’s ability to achieve solid profitability, generate free cash flow, and maintain a strong balance sheet positions it for continued success.

While TTD is undoubtedly a high-quality company with an impressive growth history, investors should weigh the current valuation multiples, general market sentiment, and share price trends. While the future appears bright for TTD, prospective investors may want to wait for more attractive entry points.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

The Trade Desk’s differentiated business model and platform set it apart from the competition

I last covered TTD in February (I recommend reading this article for a full deep dive into TTD) when shares already did not look cheap. However, I still rated shares a buy as the company’s resilient performance compared to peers in a challenging macroeconomic environment, outstanding management team, differentiated business model, and great outlook gave me enough reason to remain bullish. Fast forward eight months and shares are up another 34%, even after shares are down from a 52-week high of over $91 per share.

This strong share price performance can be attributed to several factors, including an improving operating environment as the advertising industry returns to growth or the renewed enthusiasm for tech stocks, but the most important one is that the company shows that it remains excellently positioned for continued long-term growth as it continues to take market share as highlighted by its performance in recent quarters. Through its differentiated advertising platform, the company is able to fight the established giants – Meta and Alphabet.

For those unfamiliar with the company, this is what I wrote in my previous coverage:

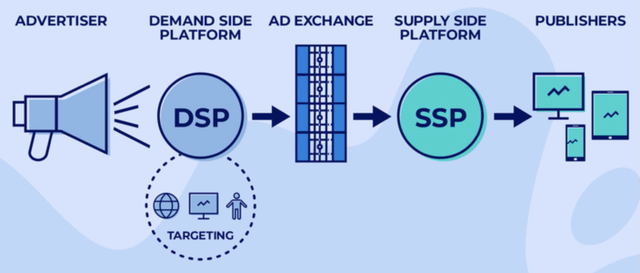

A DSP, like the Trade Desk, is a software platform used by advertisers and agencies to purchase digital advertising inventory across multiple ad exchanges and supply-side platforms (SSPs). The platform allows advertisers to manage and optimize their advertising campaigns and offers advanced targeting capabilities, real-time bidding, and a wide range of data and analytics tools to help advertisers reach their targeted audiences and optimize their campaigns for maximum performance. Advertisers can target their ads to specific audiences based on, for example, location, demographics, and browsing behavior. The Trade Desk charges a fee for using its platform, and they also earn a commission from the media companies where the ads are placed.

Digital advertisement placement process (AlikeAudience)

What sets TTD apart from its larger peers Meta and Alphabet is mainly the fact that the company offers a platform that gives advertisers much more control over where their ads are placed and provides them with much more data-driven insights about the effectiveness of the ads, practically giving advertisers much more control.

Meta and Alphabet are often referred to as the walled gardens as they operate closed ecosystems in which users, advertisers, and third-party developers are limited in their ability to access and share data. Meanwhile, TTD works with an “open internet” approach, indicating that the company operates an independent platform, not tied to any particular ad platform like the Google search engine, YouTube, Facebook, or Instagram, giving advertisers access to a wider range of media inventory and to have greater control over where their ads are placed, giving them much more freedom, opportunities, and personalization capabilities. The following quote from CEO Jeff Green highlights this:

Advertisers and media companies are increasingly aware that they need to work with technology partners who represent their interests, not conflicts of interest. As a result, advertising dollars are shifting to our platform.

This programmatic advertising business model from TTD allows advertisers to target specific audiences and demographics by utilizing key indicators based on audience preferences. Closely tied to this is one of TTD’s key selling points – its transparency, The Trade Desk platform provides advertisers with detailed information on where their ads are being placed, how much they are paying, and how they are performing.

Combining both factors (the open internet approach and transparency) allows for incredible flexibility and advanced targeting capabilities, allowing advertisers to achieve a much higher ROI. This is what I wrote previously:

The Trade Desk’s platform is designed to be flexible and customizable, allowing advertisers to tailor their campaigns to their specific needs and goals. This includes the ability to use their own data and technology, as well as to integrate with other third-party tools and services. This same system also allows them to target specific audiences.

This differentiated business model setting it apart from the competition and driving a higher ROI for advertisers has allowed it to rapidly grow its customer base, now including over 1,000 customers and 50,000 advertisers, including leading brands like Walmart, Coca-Cola, and Target. Furthermore, this has also allowed it to offset the headwinds the advertising industry faced over recent years. In fact, the industry weakness and challenging operating environment for advertisers with shrinking advertising budgets even strengthen TTD’s position in the industry.

Trade Desk investor presentations

Over the last several years, we have been hit with a number of significant worldwide economic headwinds like inflation, a pandemic, and banking uncertainty. During these times, according to Trade Desk CEO Jeff Green, advertisers have realized that data-driven precision is creating more value for their money and creates a sort of certainty and stability. The Trade Desk platform is the perfect option for advertisers who want more control over the performance of their placed ads, driven by the data insight provided by the Trade Desk, resulting in a far higher ROI for each ad placed. As advertising budgets were getting cut, advertisers obviously wanted the remaining budget to be deployed where it generated the highest ROI.

By using the data-driven and transparent platform from the Trade Desk, these advertising agencies and brands can generate maximum ROI and control everything to maximize this. As a result, TTD was able to keep growth above 20%, whereas Meta and Alphabet started reporting negative growth rates and its retention rate above an industry-leading 95%. Furthermore, it has allowed it to take market share and win over customers.

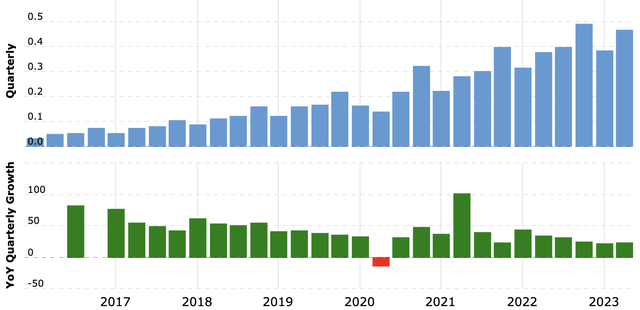

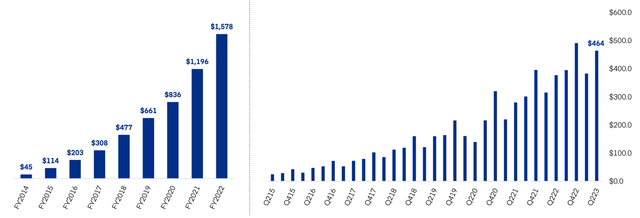

Revenue and quarterly growth rates (Macrotrends)

A focus on CTV and international expansion boosts the growth outlook

Furthermore, as TTD’s focus areas like CTV and retail media increase in importance in the digital advertising industry, I believe TTD is well positioned to keep gaining share at a consistent rate and report above industry growth rates, also helped by it increasing its presence in international markets (outside of the US).

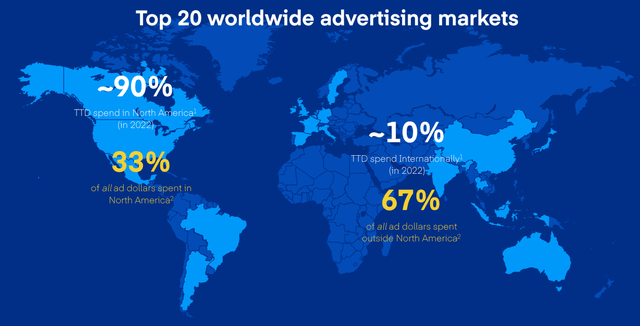

Trade Desk’s projected TAM (Trade Desk investor presentation)

For starters, the global digital advertising industry is projected to grow at a CAGR of 12.2% through 2030 as the shift from physical to digital continues to drive growth. Furthermore, programmatic display advertising is expected to grow at a CAGR of 35.8% through 2031, driving additional growth for TTD, which is a leader in this market. Based on these two industry growth projections alone and TTD’s earlier discussed operating model, there is plenty to fuel a strong bull case.

BTIG analysts indicated that their checks suggest that the programmatic market for TTD should be able to continue growing at 20% to 25% per year as the shift to digital advertising formats remains strong and a higher portion of this is spent outside of search and social media platforms, benefitting TTD with exposure to different verticals.

Most importantly, Trade Desk has, from the start, been committed to the CTV industry as CEO Jeff Green has always seen streaming as the future of TV consumption and advertising. According to the CEO, video remains the most effective way for brands to influence the hearts and minds of consumers.

Through CTV, brands can apply data to their TV campaigns and measure the effectiveness of every ad dollar with much more precision, also driving incredible ROI. As a result of The Trade Desk’s early focus, it is now perfectly positioned to benefit from the growing streaming industry and growth in CTV advertising. CTV has for years already been the fastest-growing segment for TTD.

Furthermore, as streaming giants like Disney (DIS), Netflix (NFLX), Warner Bros. Discovery (WBD), and many more now offer ad-based versions of their streaming subscriptions and are starting to increasingly substitute traditional TV, the CTV advertising market is rapidly growing.

In July 2022, streaming for the first time ever overtook cable TV in terms of viewership, according to data from Nielsen. It is, therefore, also no surprise that CTV advertising spend is growing rapidly as well. In the end, advertisers are eager to follow consumers’ eyeballs and purchasing power.

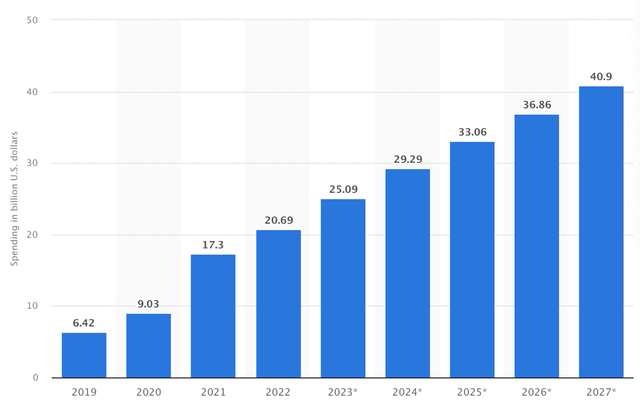

As a result of this shift from linear to streaming, the (US) CTV advertising industry is becoming one of the fastest-growing digital advertising verticals, outgrowing the overall industry by approximately 240 basis points and expected to grow at a CAGR of 14.6% through 2027, according to data from Statista.

Moreover, UBS analysts expect CTV gross spend on the TTD platform to grow at a much more impressive CAGR of around 41% through 2025, driving a consolidated CAGR of 28% in platform spend as a result, which is not far from the 20-25% estimate from BTIG analysts. It seems like TTD should be able to at least report growth of 20-30% in the medium term, with further upside definitely possible.

Anyways, TTD is here to benefit from growth in CTV demand, as highlighted by the following quote from Jeff Green during the most recent earnings call:

These dual forces of retail and CTV are truly bringing the power of data-driven decisioning home for advertisers, and it is accelerating their shift to programmatic on our platform.

US CTV advertisement spending (Statista)

Further contributing to its growth outlook is the company’s potential in markets outside of North America. While 67% of digital advertising spend is outside of the US, 90% of all spending on the TTD platform comes from North America, clearly highlighting the potential for TTD outside of North America. As it expands its operations and partnerships outside of the US, this should drive further growth.

Trade Desk

Positively, international markets have been outgrowing North America in terms of platform spending, moving the needle to 88/12 in the latest quarter in terms of percentages from North American and international. I expect the company’s continued efforts to grow its presence internationally to contribute a couple of percentage points in growth in the medium term. Just last quarter, TTD announced its most significant step into the European CTV market through a new partnership with RTL, one of the largest pan-European media companies, highlighting its commitment to this region.

Long story short, the company has a winning business model that allows it to gain market share in the highly interesting digital advertising industry. Considering its focus areas, the growth of the overall industry, and TTD gaining market share, the bull case for TTD is relatively straightforward. Growth of 22% to 28% should be achievable in the medium to long term, with plenty of room for potential upside.

TTD’s recent Q2 was solid as growth reaccelerates

Trade Desk reported its Q2 results on August 9 and delivered another quarter of excellent growth. It reported revenue of $464 million, up 23% YoY and beating the consensus by $9 million.

This growth was primarily driven by another strong performance in CTV advertising, driving video to account for a mid-40s percentage of spend. This is followed by mobile with a mid-30s percentage, display with low teens, and audio represented around 5% of spend in Q2. Also, as indicated before, international outgrew US platform spending for the second quarter in a row, highlighting the company’s success in expanding operations and partnerships outside of the US.

Furthermore, crucially, growth actually accelerated from a Q1 growth rate of 21.5%. That growth accelerated last quarter did not come as a huge surprise as the macro indicators in the digital advertising industry are improving, creating more robust demand. Still, there is some degree of uncertainty among advertisers, so the performance of the Trade Desk in Q2 should not be understated.

How strong the performance once again was is highlighted by the fact that it continues to outperform the digital advertising industry as its growth continues to be far better than the single digits reported by Google Search and YouTube and the 11% reported by Meta in Q2. Trade Desk continues to report impressive growth and it seems like this is now accelerating again.

TTD revenue (The Trade Desk)

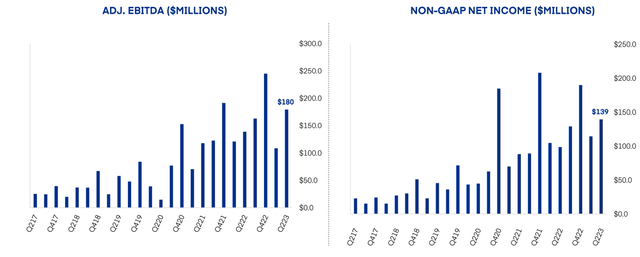

TTD has not just been driving impressive top-line growth for years but has done so while generating a solid profit. In Q2, the company generated approximately $180 million in adjusted EBITDA, representing an impressive 39% of revenue. Meanwhile, Trade Desk was able to slow growth in operating expenses to 22% YoY, from 41% in Q1, driving a stronger bottom-line result with EPS increasing 40% YoY to $0.28, beating the consensus by $0.02. However, GAAP net income, including stock-based compensation, was $33 million as SBC amounted to $117 million, down 6.4% YoY. This strong performance also led to a free cash flow of $119 million in Q2.

Q2 profitability metrics (The Trade Desk)

Overall, the company is able to drive solid profitability while investing in the business and growing the top line at an incredible rate. Yes, a large part of this profitability is offset by SBC, but this is largely due to a compensation package for CEO Jeff Green, which he received for achieving certain milestones. However, this package has now been largely paid out and this should result in SBC growth slowing down, as we already saw last quarter. Furthermore, as the top-line growth remains, this should result in SBC becoming a far smaller part of revenue in the future.

Finally, the company ended the quarter with a strong balance sheet with $1.4 billion in cash and no debt, providing it with ample liquidity.

Outlook & TTD stock valuation

For Q3, management guides for revenue of at least $485 million, representing growth of 23% YoY, roughly in line with Q2. This should also lead to an adjusted EBITDA of approximately $185 million, representing a slightly lower EBITDA margin of 38%.

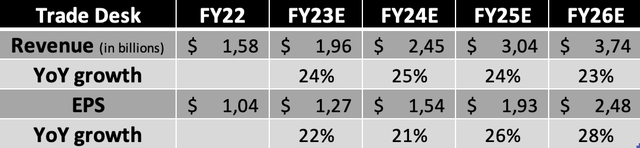

Following this guidance for Q3 and my research of the company and the underlying industry, I now expect the following financial results through 2026.

Financial projections (Author)

While it is easy to get enthusiastic about the company’s growth outlook and long-term potential, this gets quite a bit harder when we turn to the valuation side of things. Trade Desk has never been a cheap company to own, but investors got a lot in return as the company grew revenues at a CAGR approaching 40% in the last five years while driving a solid profit and operating in a highly promising industry. And while many of these aspects remain unchanged and the long-term outlook impressive, growth at a 40% CAGR is now behind it.

Yet, the company’s valuation remains very demanding, whether you look at earnings or sales. Of course, high quality comes at a price and TTD is definitely high quality, making it hard to put a multiple on it. It is really a question of what you are willing to pay for this company.

For me, when looking at current valuation multiples, general sentiment, macro indicators, and the fact that the share price is already up close to 80% YTD, I am not tempted to buy right now, despite my sheer enthusiasm for the company. At current prices, shares are not as attractive, and I would, for now, look for prices to drop below the $65/70 mark before considering adding to my position.

At the same time, I also see absolutely no reason to sell existing positions and recommend investors hold onto these shares to benefit from the impressive growth outlook. Therefore, I rate shares a Hold, downgrading from my February “Buy” rating following a 30% share price appreciation and few underlying changes to the investment thesis.

While the future is bright for this one, current prices offer very little upside.

Read the full article here

Leave a Reply