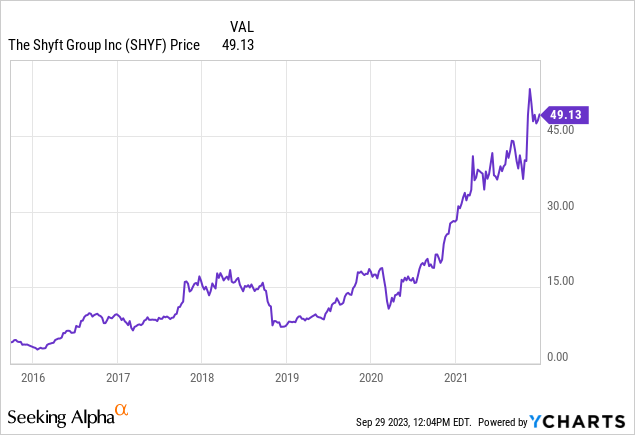

The Shyft Group, Inc. (NASDAQ:SHYF) underwent a successful transformation in 2016 that led to fantastic financial results through 2021. The transformation revolved around focusing on higher growth segments and creating efficiencies in those segments in order to drive profitable growth. Management executed well on this plan and the company was able to grow its top line, increase margins, and generate consistent and high returns on invested capital, all without diluting equity holders. The stock followed this improved performance and was up 1,000% from its trough in 2015 to its peak in 2021.

The stock has fallen recently due to the reversal of tailwinds as both RV and parcel delivery vehicle demand has dropped. These declines have occurred because demand for these products were pulled forward during the pandemic when consumers avoided air travel and when e-commerce businesses invested heavily in last-mile delivery to keep up with consumers that couldn’t go to stores to make purchases. Shyft saw a huge benefit from these trends in 2021 with revenue up almost 50% year-over-year and operating income up over 70% year-over-year.

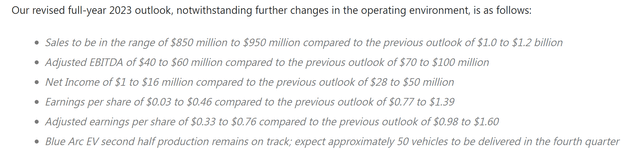

In Q2 2023, however, Shyft updated its full-year guidance to reflect a softer demand environment than what was previously expected. Full year 2023 sales are now expected to be 15% lower than what was indicated in previous guidance and EPS guidance was lowered 66%. The stock rightfully dropped about 30% on that news. This decline in demand is the most pressing question for investors in the short term, as it will dictate Shyft’s earnings over the next 12-24 months.

Shyft’s Revised Full Year 2023 Guidance (Shyft Q2 2023 Press Release)

The longer-term question for Shyft investors revolves around production and sales of the company’s Blue Arc EV, which is a fully electric last-mile parcel delivery vehicle. I am thinking of this as the company’s next business transformation after its successful efficiency transformation from 2016-2021 which was led by Daryl Adams, the recently appointed CEO at that time.

Despite leading the successful transformation in 2016, it was announced recently that Adams is transitioning from his role as president and CEO and will not lead this next transformation. I don’t blame him because this transformation is in a much earlier stage, will require building from the ground up, is a bit more speculative than the previous transformation, and is taking place in a much more competitive space.

With so many short-term and longer-term uncertainties and an unsavory valuation relative to my full year 2024 EPS estimate, I am assigning a sell rating to Shyft Group with a $16 price target. Additionally, the speculative nature of the Blue Arc EV growth plan creates too many questions for the company’s long-term outlook beyond 2024.

Business Overview

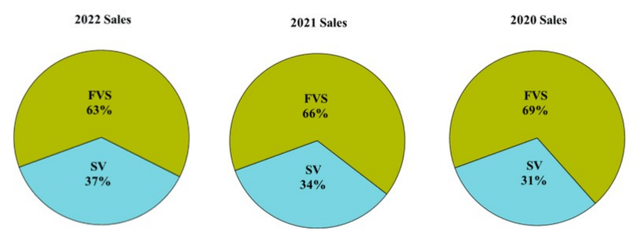

Shyft separates itself into two business segments: fleet vehicles and services (“FVS”) and specialty vehicles (“SV”). The FVS segment primarily encompasses the manufacture and sale of commercial vehicles for e-commerce, last mile, parcel delivery, and a variety of other purposes. These vehicles are sold through leasing companies, fleet accounts, and independent dealers in the U.S. and Canada. In 2022 this segment accounted for 63% of total sales.

The SV segment primarily consists of the Spartan RV Chassis and Builtmore Contract Manufacturing brands. This segment accounted for the remaining 37% of sales in 2022.

Percentage of Total Revenue by Segment (2022 Annual Report)

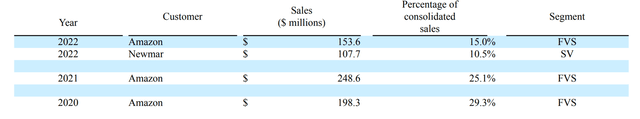

Both of these segments have some customer concentration risk. In the FVS segment, Amazon.com, Inc. (AMZN) accounted for 15% of sales in 2022 while Newmar, an RV manufacturer, accounted for 10.5% of the SV sales in 2022.

Shyft Customer Concentration (2022 Annual Report)

Shyft’s recent decline in sales makes sense given Amazon’s commitment to cutting costs after overinvesting in its e-commerce infrastructure following the pandemic, and given weakness in the RV industry. For reference, Winnebago Industries, Inc. (WGO), another RV manufacturer, saw sales in its most recent quarter decline almost 40% year-over-year. Newmar, a privately owned company, is likely facing a similar decline in sales.

Past Financial Results

Shyft’s transformation from 2016 to 2021 led to markedly better financial results. The new management team prioritized narrowing the company’s focus on its more profitable products in order to drive growth in its core markets, while expanding margins and improving returns on invested capital. The following slides from a 2017 investor presentation show what the company’s primary focus was during this transformation. Please note, the company changed its name from Spartan Motors to Shyft in 2020.

2017 Business Plan (2017 Investor Presentation)

They largely accomplished these goals. In 2021, sales reached $1 billion, adjusted EBITDA margin was 10.9%, ROIC was an impressive 25%, and earnings flowed well through the cash flow statement. 2021 ended up being an outlier year due to the pandemic related demand shocks that inflated Shyft’s results but the results were impressive nonetheless.

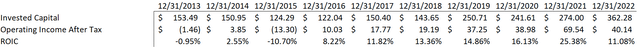

ROIC even prior to 2021 was very impressive for a manufacturing company, indicating that Shyft wasn’t just successful because of the demand environment in 2021.

Shyft ROIC (Created by Author)

Much of the company’s transformation was focused on improving efficiencies to drive margins higher. Daryl Adams provided a specific example of an improvement in a 2017 investor day presentation:

We feel Spartan was at least 20 years behind the auto industry, so when you see some of the new team that’s joined Spartan, the gentlemen that will be up here, you’re going to see a pedigree, a common DNA, when we were hiring these people what we were looking for. Once the new team started, our first move was to build a new facility to build that F-series. Spartan’s plants in the past have been square. The reason we wanted to build a new facility is assembly plants aren’t square. They’re usually long, narrow. That’s what we built, 85,000-foot facility on our campus, long, straight line with a materials area. We can kit it and bring it to the line. A very lean, flexible operation that we can use if we want to build more fire truck chassis, more motorhome chassis, additional F-series. Very flexible and can handle some high volume.

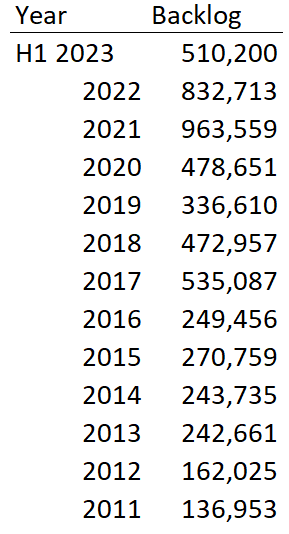

Smart investments in facilities generated high returns partly because they were intelligently designed, but also because there were demand tailwinds for their products. The following chart shows the company’s backlog since 2011, in thousand’s of dollars.

Shyft’s Backlog Since 2011 (Created by Author)

Now that demand has slowed down significantly, the backlog has declined and returns on invested capital have dropped as operating leverage has reversed.

Blue Arc, the company’s EV project that was announced in March 2022, is still in early stages so it hasn’t contributed much to the company’s top line. Despite this, it is a primary focus going forward and, while not necessarily a business transformation like the one in 2016, I am thinking of it as a new chapter for the business.

Valuation and Price Target

Shyft’s stock looks cheap on trailing numbers but those numbers don’t paint an accurate picture of earnings over the next 12-18 months. The stock is currently trading at about 12x trailing EPS while it’s about 60x the midpoint of the recently lowered full year 2023 EPS guidance of $0.23. Expectations of 2024 earnings will be the main determinate of the stock price over the next few quarters.

For my estimate of 2024 earnings I am assuming that 2023 sales will decline by about 12.4% to $900 million and that sales will grow by 10% from there to $990 million. The following are the rest of the assumptions that lead to my 2024 EPS estimate:

- 2024 gross margin is 20%

- 2024 operating expenses will be equal to 15% of revenue

- 2024 interest expense will be equal to 4% of my estimate of Shyft’s 2024 net debt ($25 million)

- Shyft’s 2024 tax rate will be 23%

- 2024 fully diluted shares outstanding will be 34.5 million.

These assumptions lead to an EPS estimate of $1.08 per share. With a 15x multiple, my price target for the stock is $16. While this provides some upside relative to the stock’s current price, it also assumes earnings more than double relative to 2023, the demand environment for RVs and e-commerce vehicles stabilizes and returns to growth, and that most Blue Arc EV milestones are met. These uncertainties along with the leadership change don’t give me much confidence that everything will go according to plan.

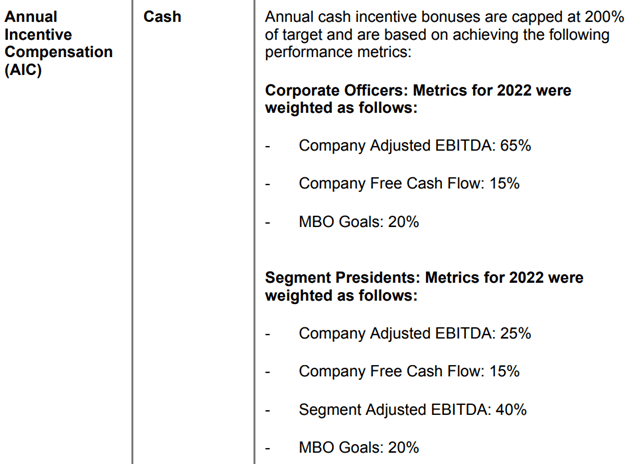

I can also foresee a scenario where management attempts to grow the business without thought to returns on invested capital going forward as the annual incentive compensation does not take ROIC into account. The company has mentioned ROIC in past investor presentation but management’s incentive compensation is based primarily on adjusted EBITDA, free cash flow, and certain unspecified management by objective goals.

Free cash flow accounts for capital expenditures but not acquisitions. Management can grow adjusted EBITDA and free cash flow by making acquisitions without being intelligent on the price they pay for those acquisitions. The company’s history doesn’t indicate that this will happen but with Daryl Adams leaving and with incentives that don’t mention the company’s asset base, it is a risk.

Shyft’s Annual Incentive Compensation (2022 Proxy Statement)

Final Thoughts

Shyft is facing with both short-term and long-term uncertainties as demand for its e-commerce related vehicles and RVs have declined drastically, and as its Blue Arc EV program is still in its early stages. To add to the uncertainty, Daryl Adams, who led the company’s successful business transformation from 2016 to 2021, is transitioning from his role as CEO and resigning from the company’s board.

I estimate FY2024 EPS of $1.08 per share, and with a 15x multiple, I am assigning The Shyft Group, Inc. stock a $16 price target and a sell rating given the lack of upside and the uncertainties that will likely lead to earnings volatility over the next 12-24 months.

Read the full article here

Leave a Reply