Real estate investment trusts (“REITs”) were absolutely crushed this week as the Federal Reserve indicated after their recent meeting that high interest rates are here to stay for a while.

What is striking about this selloff is that very little from the Fed’s decision or statements was a surprise.

Still, the market went into panic mode and sold. Thus, the meltdown in REITs, including many blue-chip names with strong credit ratings and minimal refinancing risk over the next few years, has accelerated.

It is impossible to time the bottom in downturns like the current one, because the market does not exhibit the same logic that an individual person would. Unlike an individual acting in their own self-interest, the market is made up of countless individuals with widely varying goals and interests. Hence its unpredictability over short time periods.

However, regardless what the market does or how low certain REIT share prices go, my own financial goal and investment plan remains the same: Keep buying shares in high-quality, best-in-class dividend stocks for as long as they remain attractively valued.

Right now, the most attractively valued dividend stocks are in the REIT space, in my opinion. Therefore, that’s where I’m focusing most of my buying.

After some brief commentary on the recent acceleration in the REIT meltdown, I want to shift from pitching my favorite REITs to buy today to something else. Those who have read my other articles know what my favorite REIT buys are today. I’ve written about them ad nauseum.

So, instead, I’ll briefly discuss three of my REIT holdings that are actually up over the last year. They are the calm in the commercial real estate storm.

The Fed Ratchets Up The Pressure On REITs

Here are some key takeaways from Federal Reserve Chairman Jerome Powell’s recent post-meeting statement:

- The Fed remains committed to returning inflation to its 2% year-over-year target rate.

- Powell says that PCE rose 3.4% over the twelve months ending August 2023, or 3.9% for core PCE (excluding food and energy).

- Powell believes the current restrictive policy and level of interest rates are necessary to ensure a return to 2% inflation.

- The process of getting inflation down to 2% “has a long way to go.”

- The labor market is tight, although conditions are coming back into balance somewhat as the unemployment rate ticked up in August.

- The Fed’s updated “dot plot” of expectations among FOMC members for the future trajectory of rates shows the Fed’s key policy rate remaining high and possibly even going higher from here.

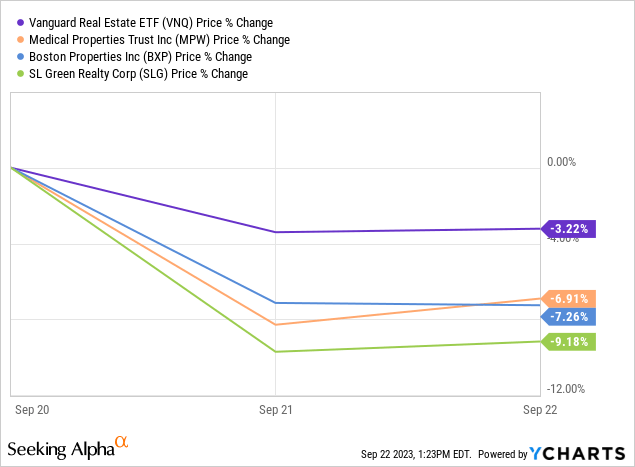

The market clearly interpreted this as a “hawkish pause,” which triggered a sharp selloff in stocks, particularly in rate-sensitive sectors like real estate (VNQ).

Among real estate, the REITs with weaker fundamentals and/or lower credit ratings suffered the severest selloff. This includes the debt-heavy hospital landlord Medical Properties Trust (MPW) as well as coastal office REITs Boston Properties (BXP) and SL Green (SLG).

MPW, BXP, and SLG all have debt-to-EBITDA ratios well in excess of 7x as well as significant debt maturities coming over the next few years. There are no good options to refinance this debt, which is why these REITs have largely turned to asset sales / property dispositions to repay the debt.

When the fundamentals and investor sentiment for a certain property sector are very low, as they are for office buildings and hospitals, selling assets to repay debt is tricky. If management sells lower quality properties, they will likely get bad pricing for them, locking in losses in shareholder value in the short run. But if they sell higher quality properties, they may get better pricing but will leave the remaining portfolio more heavily populated by lower quality properties, potentially making shareholder value losses more likely down the road.

In my recent article “Medical Properties Vs. CareTrust REIT: One On The Rise, The Other In Decline,” I mentioned MPW’s plan to sell properties to pay off all maturing debt through 2024. That is preferable to refinancing loans that are expiring with 3-5% interest rates with new debt at double-digit interest rates. But investors will need to pay attention to the pricing MPW gets on these sales as well as the quality of the remaining portfolio thereafter.

Another point to keep in mind is that the Fed’s “higher for longer” posture is likely to put downward pressure on property prices, as the diminished number of willing and available buyers demand higher investment yields in accordance with a higher-for-longer risk-free rate.

This reaction in the market has been the catalyst for multiple selloffs in REITs. The market seems to get its hopes up that the Fed will start hinting at rate cuts in the future, which leads to some inflows into REIT stocks. Then Powell or some other Fed official comes out and makes it very clear that they are more likely to raise rates further than cut them. That leads to a rapid deflation of hope in the REIT space and a sudden spate of selling.

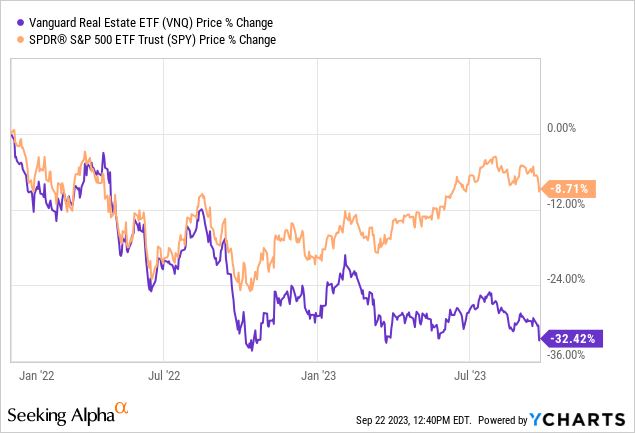

Somewhat discouraging is the fact that the S&P 500 (SPY) seems to have rolled over from its rally from October 2022 to the end of July 2023. It has now made a lower high and a lower low as the market and all its eclectic participants struggle to figure out what comes next.

Perhaps encouraging (if you could call it that) for REITs is that the overall average has not broken through its October 2022 low. Does this mean there’s support for REITs near the index’s current level?

Candidly, I have no idea. Technicals are voodoo to me.

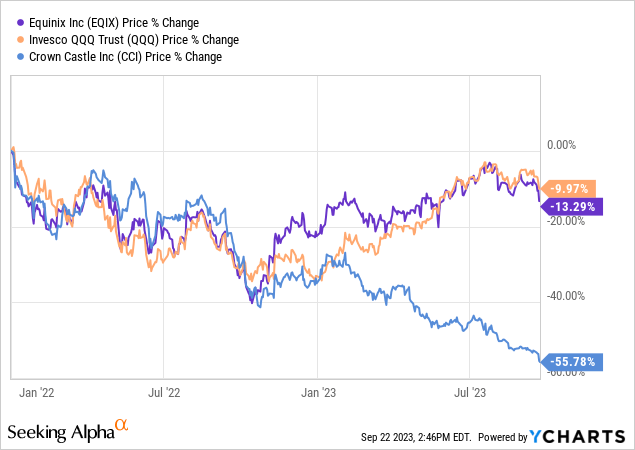

Just think about the incredible tyranny of averages at play in the REIT space. For example, you have both global data center landlord/operator Equinix (EQIX), which basically trades like one of the tech stocks in the Nasdaq index (QQQ), and telecommunications infrastructure REIT Crown Castle (CCI).

Yes, EQIX has lower leverage than CCI with its ~3.5x debt-to-EBITDA compared to CCI’s ~5.5x. But both REITs are investment grade-rated that have demonstrated a fundamental resilience and ability to refinance debt maturities recently.

Yes, there are differences in each’s fundamental backdrop and growth prospects, but the variance in price performance is far more wide than these fundamental differences would justify, in my opinion.

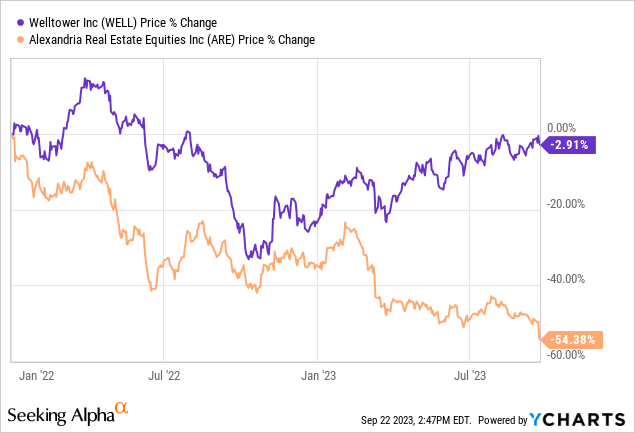

And then you can look at the healthcare REIT space, where the differing performances between top-tier senior housing landlord Welltower (WELL) and top-tier life science landlord Alexandria Real Estate Equities (ARE) is incredibly wide.

These two REITs have roughly similar leverage ratios (with ARE actually the lower of the two), but ARE has a far superior debt maturity schedule with no loans maturing until 2H 2025, compared to 14% of WELL’s total debt maturing before the end of 2024.

You wouldn’t think it based on stock price action over the last year and a half, but ARE is better positioned to withstand a “higher-for-longer” rate environment over the next few years than WELL.

With such dramatic variance in performance between different REITs, how can one say that “REITs” are likely to do anything — as if they are one monolithic block?

How can one say that “REITs” are finding support at their October 2022 lows when many REITs crashed right through that low long ago and others are trading far above it?

The Calm In The Storm: 3 REITs That Have Held Up

At this point, your Pavlovian reaction is probably an expectation for me to give what are, in my humblest opinion, the X most opportunistic buys right now among high-quality REITs.

That’s a worthy discussion, but I’ve done a lot of that lately, and rather than try to reword the same pitches for the same REITs, I’ll instead simply point you to the recent articles that make those pitches:

- REIT Meltdown: 3 Rarely Discounted Buying Opportunities

- REIT Crash: The More They Drop, The More I Buy

In the charts above, we saw glimpses of REITs that have actually held up quite well since the market peak in early 2022. WELL, for example, has outperformed the S&P 500 since then.

While I own neither WELL nor EQIX, I do own a handful of REITs that have held their ground over the last year or so. Even if they haven’t outperformed the market, they’ve held their own and acted as a small corner of calm amid the storm.

Those three REITs are:

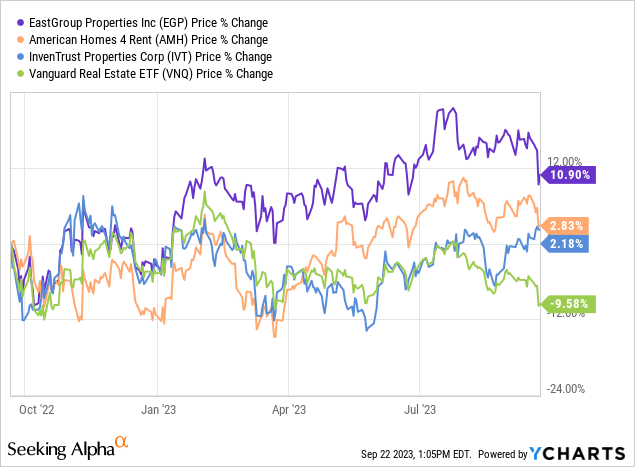

- EastGroup Properties (EGP)

- American Homes 4 Rent (AMH)

- InvenTrust Properties (IVT)

Compared to the REIT index’s roughly 10% price drop over the last year, these three REITs are all in the green, even if not by a lot.

They are a demonstration of why it is worthwhile for REIT investors to seek out the best-in-class names across various property sectors.

- EGP owns high-quality, extremely well-located multi-tenant industrial campuses in Sunbelt cities. When I say “extremely well-located,” I am referring to EGP’s infill locations within the cities themselves. These sites act as invaluable last-mile distribution hubs for e-commerce and business-to-business tenants alike. Infill industrial is much more insulated from new deliveries of industrial supply than the big-box properties outside of population centers. Tenants compete for EGP’s properties based on location, not price, which naturally means they’re more willing to accept rent hikes. Hence the ~50% rent growth rates EGP has enjoyed recently.

- AMH’s ~60,000-property portfolio of single-family rentals makes the REIT one of the largest institutional single-family landlords in the nation. It has several major competitive advantages, including scale efficiencies, concentration in fast-growing Sunbelt states, and an in-house homebuilding platform churning out thousands of build-to-rent houses every year. High mortgage rates and Millennials entering their prime single-family home years is a magnificent combo for continued strong rent growth.

- IVT has, in my opinion, a mediocre name that poorly communicates the REIT’s focus, but don’t let that dissuade you. It owns a high-quality portfolio of well-located, grocery-anchored retail centers in the Sunbelt. When your locations are as desirable as IVT’s, even a seeming setback like a tenant bankruptcy is actually a good thing. The REIT quickly released its newly vacant Bed, Bath, & Beyond locations at rent rates significantly higher than what BB&B had been paying. Plus, development of retail space is extremely low right now and expected to stay that way for the foreseeable future.

While EGP is a moderately large position in my portfolio, I only wish I owned more of these three REITs at a time like now.

Bottom Line

Despite the sharpness of the recent selloff in REITs, there really hasn’t been anything new to catalyze it. The Fed had already been communicating a “higher-for-longer” view for a while.

But the Fed’s history of predicting their own future rate decisions goes completely out the window when the economic data takes a turn for the worst. Recessions have a tendency to ruin even the best laid plans. Though the market obsesses over what the Fed oracles say they are going to do next, the oracles’ foresight is as limited and fallible as anybody else’s.

In any case, this distress in REITdom is a great reminder of some important investing lessons:

- Balance sheet strength is always an important consideration, even when interest rates are low, precisely because interest rates are not always low (like right now).

- Quality assets and best-in-class management teams are a “moat” in themselves.

- If you want to sleep well at night, focus primarily on the quality of the company and only secondarily on the dividend yield and dividend growth.

If you’re a long-term investor abiding by these points and you have money available to buy stocks, I’d argue that you should be rejoicing at this downturn.

The opportunity to buy quality assets on discount is a blessing, even if, right now, it is a blessing in disguise.

Read the full article here

Leave a Reply