Thesis

After conducting a comprehensive analysis, we strongly recommend a ‘Buy’ position on PayPal (NASDAQ:PYPL). Our conviction is based on several key factors. Firstly, PayPal holds a dominant market position and has consistently demonstrated revenue growth, indicating its strength in the digital payments sector. Despite facing intense competition and evolving market dynamics, PayPal has successfully maintained its leadership. This can be attributed to its user-friendly interface, extensive network of merchants and consumers, and an innovative business model. Furthermore, the company’s strategic decisions, such as share buybacks and management changes, suggest a promising future. Although the rapidly changing digital payment landscape poses inherent risks, we believe that PayPal’s strengths outweigh potential challenges, making it an attractive investment opportunity.

The Company

PayPal’s current market capitalization stands at $70.43 billion, with its stock trading at $64.13. Over the past year, the stock has fluctuated between a low of $57.29 and a high of $98.98. The company’s 5-year beta, a measure of its volatility in comparison to the market, is 1.33. Looking ahead to the fourth quarter of 2023, PayPal anticipates revenues of approximately $7.384 billion and an Earnings Per Share (EPS) of $0.87. For the full fiscal year 2023, the company projects revenues of nearly $29.765 billion and an EPS of $3.48.

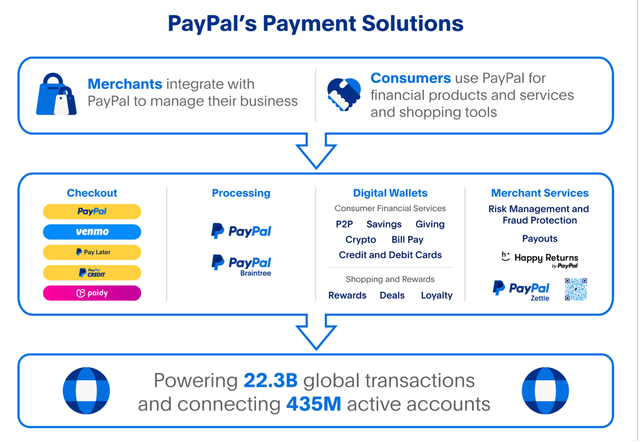

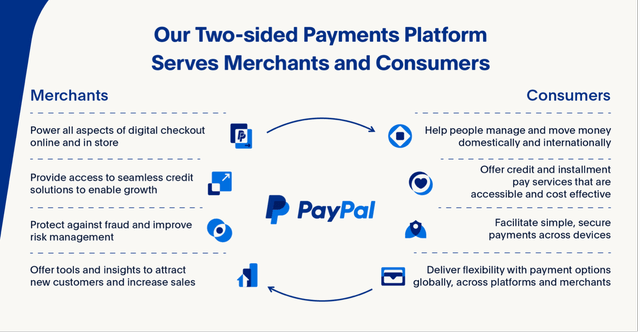

PayPal employs a unique business model that creates a closed loop between merchants and consumers.

PayPal Payment Solution Framework (PayPal 10-K 2022)

Two sided Platform (PayPal 10-K 2022)

PayPal holds approximately 42% of the market share, followed by Stripe at 20% and Adyen (OTCPK:ADYEY) at 11%. PayPal primarily generates revenue (90.4%) from transaction fees for facilitating payment services. These fees are usually proportional to the transaction volume. Additional revenue streams include foreign currency conversion fees, instant transfers, and cryptocurrency services. Notably, PayPal generally does not charge for account funding or withdrawals. The company also earns from various value-added services (9.4%), including partnerships, interest and fees from credit products, and gateway services.

Dan Schulman was announced as PayPal’s CEO on September 30, 2014, coinciding with the company’s separation from eBay in 2015. Schulman recently informed the Board of his intention to step down as of December 31, 2023. Alex Chriss will assume the roles of President and CEO starting September 27, 2023. Chriss brings nearly two decades of experience from Intuit, where he most recently served as the Executive Vice President and oversaw the $12 billion acquisition of Mailchimp.

Institutional investors own 74.4% of the outstanding shares. Vanguard is the largest shareholder at 8.36%, followed by BlackRock at 4.38% and State Street at 4.18%. Individual insiders own less than 0.1%.

PayPal’s primary competitive advantage stems from its position as the market leader, enabling it to easily capitalize on industry growth. Customers are generally reluctant to switch to alternative platforms like Stripe or Adyen. However, this advantage is eroding due to the rise of Google Pay and Apple Pay. Given that both Google (GOOG) (GOOGL) and Apple (AAPL) already possess extensive user data and offer highly user-friendly wallet services, the allure of using a third-party service like PayPal is diminishing but diminishes for Stripe and Adyen as well.

An important aspect to consider is the user growth and average user value, as revealed in PayPal’s latest 10-K. While the company has experienced a slowdown in the rate of user growth, it has seen an increase in the average value per user. This indicates that PayPal is effectively monetizing its existing customer base, which could serve to offset concerns related to its plateauing Year-over-Year growth rate.

PayPal leads in the expanding Digital Payments market, showing steady revenue and Free Cash Flow. Although facing regulatory challenges and stagnant YoY growth, it’s undervalued according to key metrics. The stock’s current downward trend presents an attractive investment opportunity.

Industry Analysis

According to forecasts from Statista, the total transaction volume in the Digital Payments sector is expected to reach approximately $9.46 trillion by 2023. Digital Commerce is the most prominent sub-sector, with its transaction volume projected to hit $6.03 trillion in the same period. The Digital Payments sector is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 11.80% from 2023 to 2027. This growth will likely result in a total transaction volume of $14.78 trillion by 2027. On a global scale, China leads with a projected transaction volume of $3.639 trillion in 2023, as per Statista’s data.

The global payments ecosystem is characterized by intense competition, continuous innovation, and a growing focus on regulatory compliance. The competitive landscape is dynamic, influenced by emerging technologies, evolving consumer behavior, merchant pricing sensitivities, and frequent product launches. Competition is expected to intensify as new entrants join the market, existing firms form alliances, and traditional companies diversify. Currently, PayPal dominates the online digital payments landscape due to its user-friendly interface and extensive network of merchants and consumers.

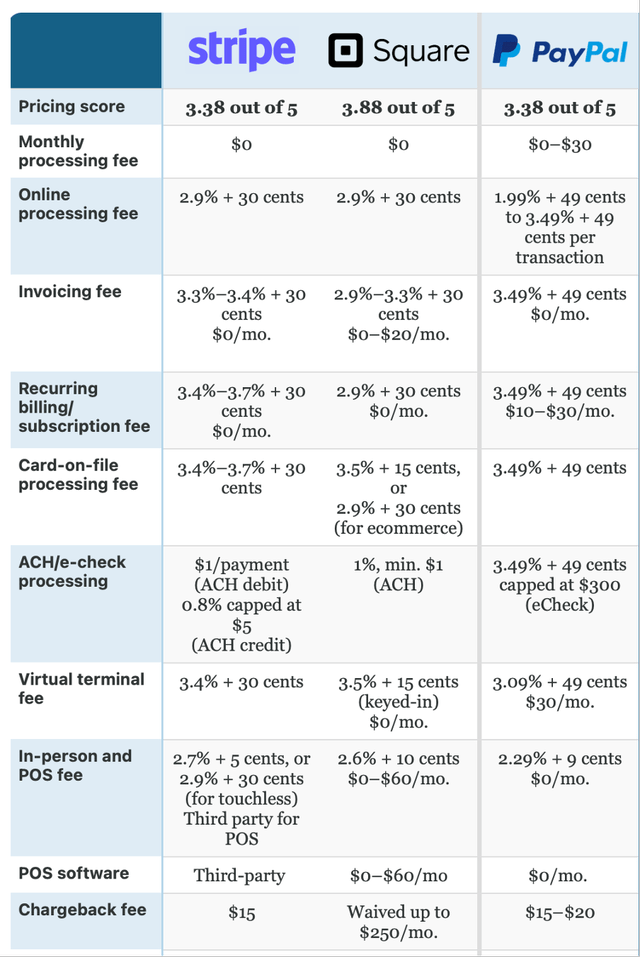

In the e-commerce marketplace, four brands stand out. Stripe is the go-to for online-exclusive ventures, tech-forward startups, B2B entities, and global firms. Square caters to individuals and small businesses with its hassle-free payment system. PayPal, with its intuitive checkout process, is a favorite among well-established companies. Meanwhile, Adyen is recognized for its adaptability, seamlessly integrating with numerous suppliers.

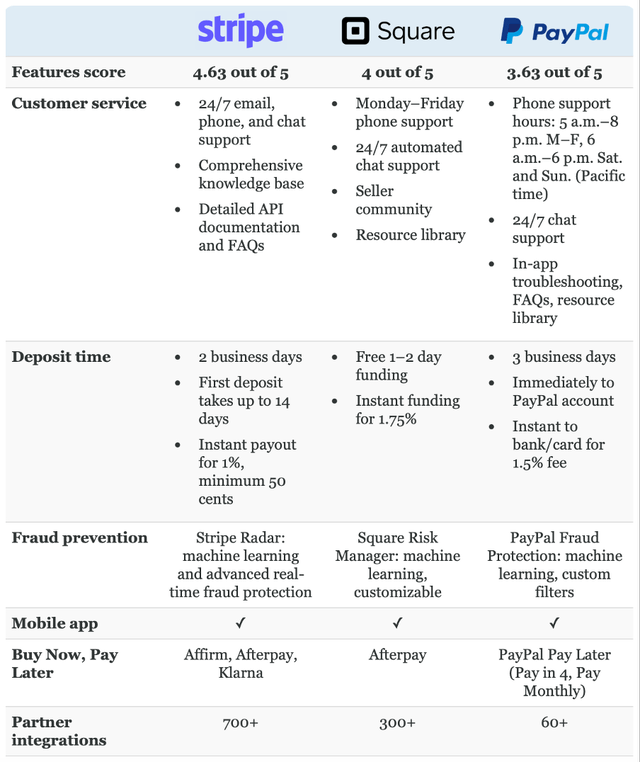

Comparison of Stripe, Square, PayPal (Source: Fit Small Business)

Features comparison Stripe, Square and PayPal (Source: Fit Small Business)

Based on the comparison above, PayPal’s pricing is on par with its competitors. Given its significant market share, one might expect more competitive pricing. However, the similarity in pricing acts as a deterrent for companies considering a switch in payment providers. PayPal appears to lag in partner integrations. If this issue remains unaddressed, it could lead to a rapid loss of market share.

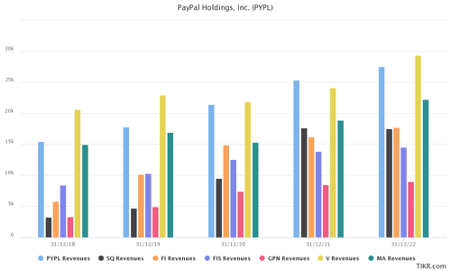

Revenue of Industry Comparison (TIKR)

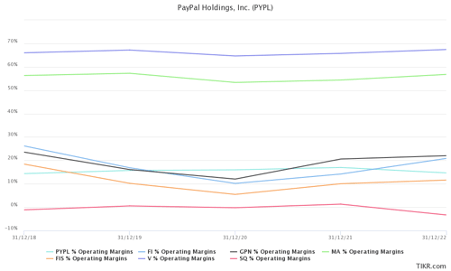

Operating expenses and margins of industry (TIKR)

It’s noteworthy that PayPal ranks second in revenue, just behind Visa (V), and has outperformed Mastercard (MA), especially over the last two years. PayPal’s operating margins have remained relatively stable over the past five years, while most competitors, except Square, experienced a decline in 2020 due to the COVID-19 pandemic. This stability suggests that PayPal has a competitive advantage as the go-to platform for online shoppers, at least for now.

Financial Analysis

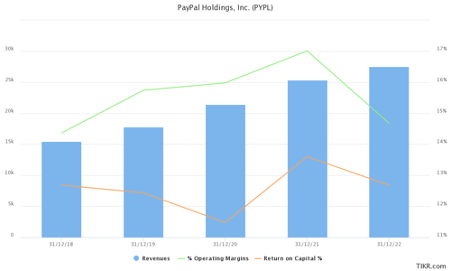

Revenues vs Operating Margins vs ROC of PayPal (TIKR)

PayPal has consistently grown its revenue over the past five years. The Return on Capital has averaged around 12.5% annually, and operating margins have been increasing. A comparison between the profit margins of 2023 and 2019 shows a slight but not materially significant decline. (Note: The impact of the COVID-19 pandemic in 2020-2022 has been excluded from this analysis.)

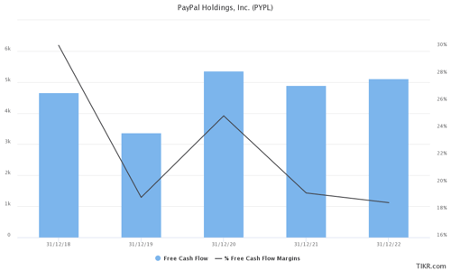

PayPal Free Cash Flow and % FCF Margin (TIKR)

PayPal’s Free Cash Flow has remained stable, likely due to increased expenses aimed at enhancing profit margins. This stability suggests that Free Cash Flow could improve in the future.

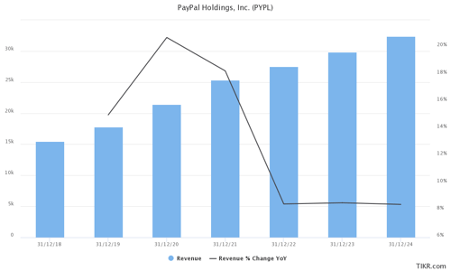

Revenue vs Revenues % Change YoY (TIKR)

PayPal’s revenue growth appears to have plateaued at 8% YoY, raising concerns. However, if the company can improve its profit margins, this slower growth rate may not be as concerning.

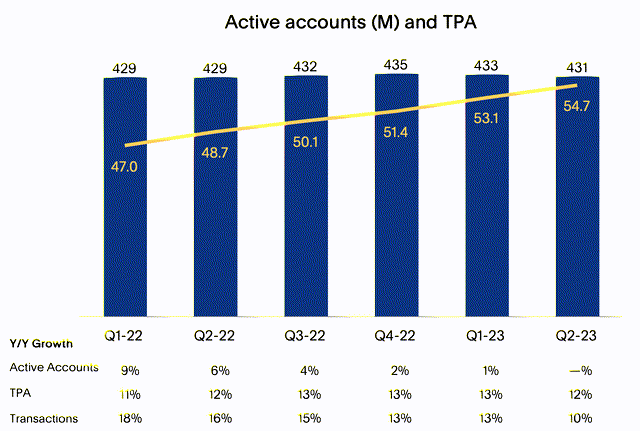

Active accounts and TPA (PayPal 10-K 2022)

While PayPal has seen a decline in user growth, it’s important to note that the average value from active accounts has increased, signaling a positive trend. According to the latest report from the management team, the decrease in user numbers is primarily due to the company’s strategy of removing inactive accounts from their records, rather than a decline in new user acquisition.

In addition to its strong financial performance and market position, PayPal has announced a $4.9 billion share buyback program. This move is indicative of the company’s confidence in its long-term strategy and offers an excellent way to provide shareholders with high returns.

Valuation

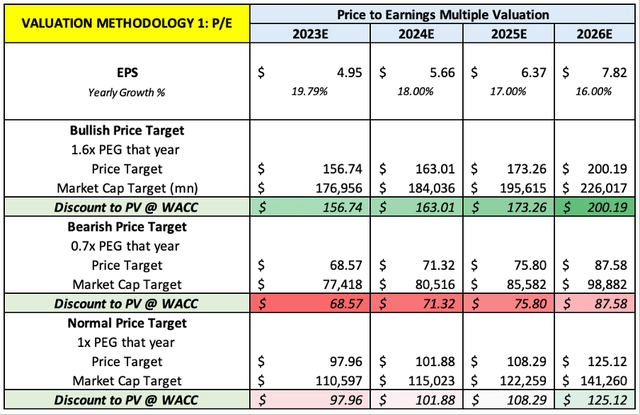

During this valuation, I’m using Normalized EPS as the basis for analysis. I believe that the lower EPS figures recently reported by PayPal are anomalies due to one-time expenses related to personnel restructuring.

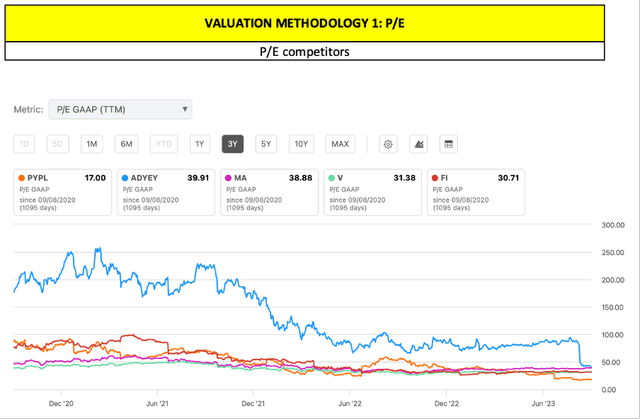

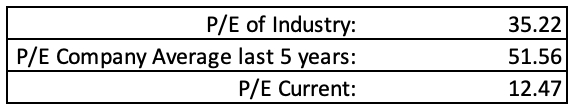

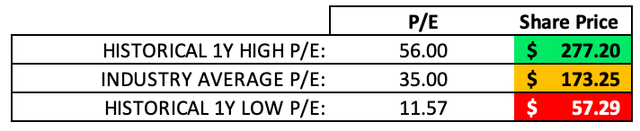

Based on the P/E ratios, PayPal appears to be undervalued by more than 50% compared to the industry average P/E, without any compelling reason. Even Fiserv (FI), which has lower ROE and narrower margins, is priced at 30 times its earnings. At a similar valuation multiple of 30x, PayPal’s share price should be around $150.

P/E ratio of Competitors (Seeking Alpha)

P/E of Industry, Average and Current (Author Calculation)

P/E Valuation based on Competitors and Industry averages (Author Calculations)

Based on the P/E valuations, the share price estimates range from $68 to $156, with the most likely scenario pointing to a share price slightly below $100.

P/E Valuation of PayPal (Author Calculations)

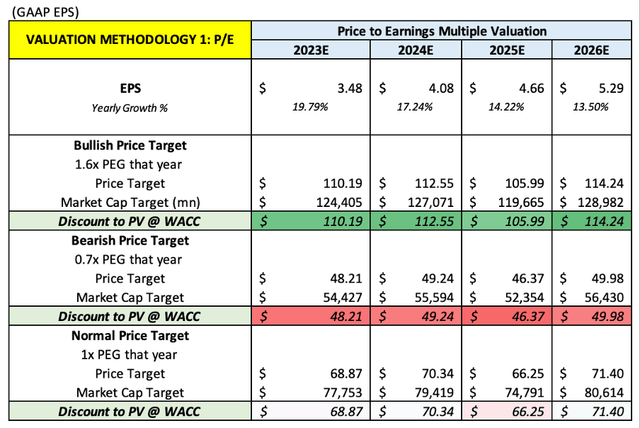

Using GAAP EPS suggests that PayPal’s valuation aligns with the market. However, this may not be the most accurate measure, as PayPal’s latest financial statement reveals restructuring costs of $410 million, or roughly $0.36 per outstanding share.

P/E of PayPal based on GAAP (Author Calculations)

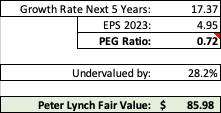

The Price/Earnings to Growth (PEG) ratio indicates that PayPal is undervalued by approximately 30%, assuming a projected growth rate of 17% over the next five years.

Peter Lynch’s Fair Value Analysis indicates the stock’s current fair value should be around $86 per share.

Peter Lynch Fair Value Analysis (Author Calculations)

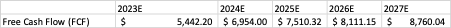

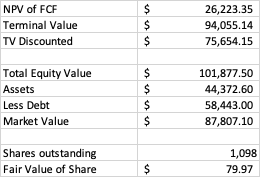

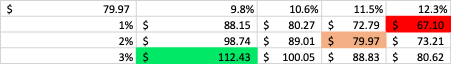

The DCF analysis uses a Weighted Average Cost of Capital (WACC) of 11.5% and assumes an 8% Free Cash Flow growth rate and a 2% perpetual growth rate. The DCF model yields an average current share price of $80, aligning closely with the Peter Lynch Fair value analysis.

Estimate FCF of PayPal (Author Calculations)

DCF Valuation of PayPal (Author Calculations)

A sensitivity analysis that varies the WACC and perpetual growth rate produces a range of valuations. The bearish estimate stands at $67 per share, the base-case valuation is $80 per share, and the bullish scenario suggests a valuation of up to $112 per share and all these using a low growth rate of only 8%.

DCF Sensitivity Analysis of PayPal (Green: Bullish, Orange: Base, Red: Bearish) (Author Calculations)

Risks

PayPal, as the dominant player in the online payment sector, is grappling with challenges stemming from volatile macroeconomic conditions and the current interest rate landscape. The company’s position is further tested by the surge of competition from fintech giants like Google Pay, Square, and Apple Pay. The recent change in leadership at PayPal introduces an element of unpredictability. This, coupled with potential concerns about the company’s ability to maintain a strong brand presence and retain its consumer and merchant base, adds layers of complexity to its outlook. Moreover, the evolving regulatory environment, especially regulations surrounding transaction fees and Buy Now, Pay Later services, presents potential operational challenges. While PayPal’s influence in the market is undeniable, these multifaceted challenges warrant careful observation for investors gauging its future prospects.

Conclusion

We expect that PayPal’s performance will stabilize under the new CEO and after the completion of its restructuring plan. Additionally, we believe that the investment community will eventually recognize that the current share price overreacts to the decline in active accounts. We anticipate these developments to unfold within a year, although we will continue to monitor the situation closely.

Read the full article here

Leave a Reply