Mark your calendar because the October CPI report on Tuesday, November 14 could very well be one of the most important days for Wall Street all year. Several dynamics are coming together, which we believe will show a massive drop in the key inflation indicator.

If we’re correct, the implications here extend to everything from the next steps in Fed policy to the outlook on interest rates and ultimately set the stage for stocks to continue rallying into 2024.

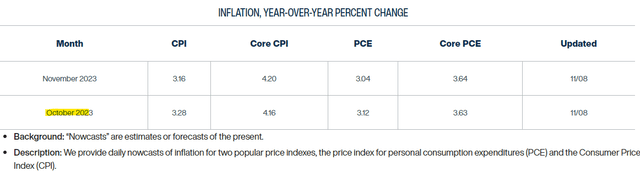

Compared to the 3.7% annual headline inflation indicator in September, the outlook here is for that figure to fall back towards “3.28%”, according to the current estimate from the Cleveland Fed. We wouldn’t be surprised by a tick even lower with downside, particularly to the 4.16% core-CPI estimate.

source: Cleveland Fed

The reason this is important is that it helps pour cold water on what has been some of the biggest market headwinds. Concerns that inflation was re-accelerating and that the Fed would need to keep hiking, fueled a rise in long-term bond yields and stock market volatility in recent months.

By this measure, a “good” inflation update next week has the potential to proverbially kill multiple birds with one stone. The Fed has claimed the group is “data-dependent” on assessing the need for further action, and the CPI report is the main event of hard data that matters.

Don’t just take our word for it, as the writing here is on the wall.

Maybe one of the biggest developments, and a welcomed surprise, has been the sharp selloff in energy prices. The spike during Q3 was likely the culprit for much of the uncertainty in the direction of the CPI, but the good news here is that Crude oil is currently down more than 20% from its September high, with the bulk of that move taking place in October.

source: finviz

Similarly, data shows that retail gasoline in the U.S. at a national average of $3.40 per gallon has dropped in recent weeks. Compared to fears last month that the Israel-Hamas war would result in trade disruptions or shortages and send oil surging. That scenario simply hasn’t played out. The data shows climbing supplies and inventories helping to bring the market back to a balance as the average price fell over the past year.

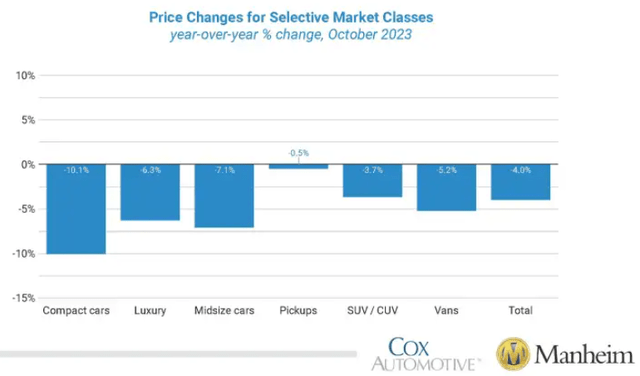

It’s not just energy. The closely watched “Manheim Used Vehicle Value Index” showed wholesale prices fell by -2.3% month-over-month in October and -4% y/y. The index is down -18% from its 2021 cycle peak. Vehicle prices within the core CPI, which excludes food and energy, had been stubbornly high but the trend now suggests pandemic-era dynamics passed.

source: Manheim

We also see favorable signs in housing, with evidence that near two-decade-high mortgage rates are working to at least limit price increases. The latest Case-Shiller Home price index with data from August shows prices up 2.6% y/y, a level that is already near the Fed’s broader 2% inflation target.

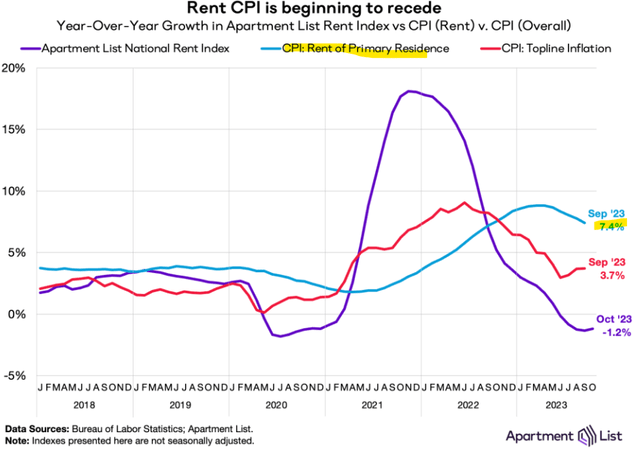

The sense is that there is more downside in housing prices, particularly as they are reflected in the official CPI data going forward. That dynamic is evident when we look at rent prices. According to the industry group Apartment List, the national average for October rents was down -1.2% y/y even as the figure reflected in the September CPI report still showed a 7.4% annual increase.

We expect to see some convergence lower in CPI shelter prices over the next several months, working to push the headline inflation indicator even lower. Overall, signs are that inflationary pressures have cooled, with disinflation accelerating into 2024.

source: Apartment List

A Door For The Fed To Cut In 2024

Ultimately, some conviction that inflation has been controlled could open the door for the Fed to cut interest rates down the line. This is possible, not because the economy is in trouble, but simply because forward expectations become anchored to the 2% target. While the Fed hasn’t discussed that possibility just yet, the upcoming October CPI report could go a long way to make that a reality.

This is exactly what the “soft landing” scenario has looked like defined by resilient economic indicators even as inflation trends lower. A setup many did not believe was possible back in 2022 but is playing out now. Indeed, the market is now starting to buy into that building consensus, and we agree.

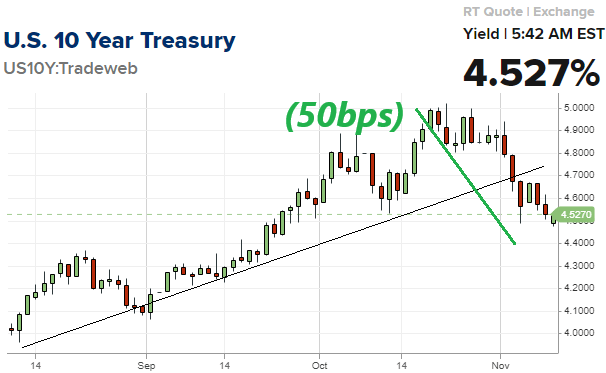

We’re watching bond yields make a sharp pullback from recent highs, which in part reflects the declining inflation expectations and even some underlying enthusiasm already looking ahead to the next few months of CPI data.

The 10-year Treasury Rate is currently down about 50 basis points to 4.5% from an October high when it breached the 5% handle. Again, the explanation here considers that if inflation is set to make a bigger move lower, the argument for further hikes by the Fed loses steam, and interest rates have a downside.

source: CNBC

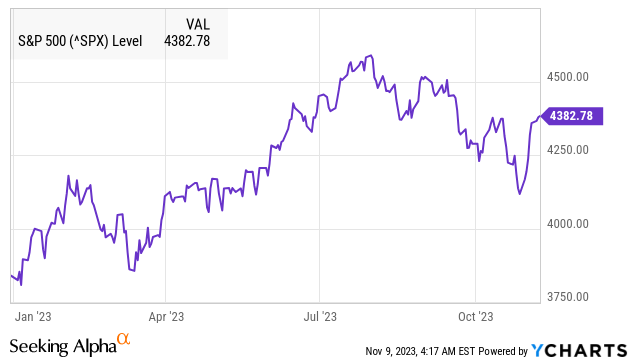

Similarly, stocks are trading on this same dynamic. The S&P (SP500) has rallied higher in each of the last eight trading sessions, back to a level from early October. The argument we make is that with less macro uncertainty today, stocks should be well-positioned to reclaim their summer highs when the S&P 500 reached $4,600.

The tailwinds here are threefold. First, companies benefit from lower inflation on the cost side in support of profitability margins. Second, Lower interest rates offer some room for expanding valuation multiples alongside strong sentiment. Finally, easing financial conditions can help boost top-line growth.

What’s The Opportunity?

The upcoming inflation data may be shocking to some, but we’re prepared. The opportunity here is that all these points still face intense skepticism by a large part of the market.

It amazes us that some still believe inflation is “out of control” and the Fed will need to keep hiking. By this measure, a good CPI update could force inflation hawks and market bears back to the drawing board, translating into a market-wide short-squeeze.

Of course, that also covers what remains the key risk here which is the possibility that the next CPI somehow surprises significantly higher. We can’t overlook the volatile situation in the Middle East or even Eastern Europe, which has been thus far relatively contained but introduces some tail risk scenarios. We’d be concerned if oil made its way to +$100bbl.

Overall, we’re bullish on stocks and bonds here and expect the favorable headlines surrounding the October CPI event to help build up a narrative that the market can trade into for a stronger year-end rally.

Read the full article here

Leave a Reply