The “bull market” support level

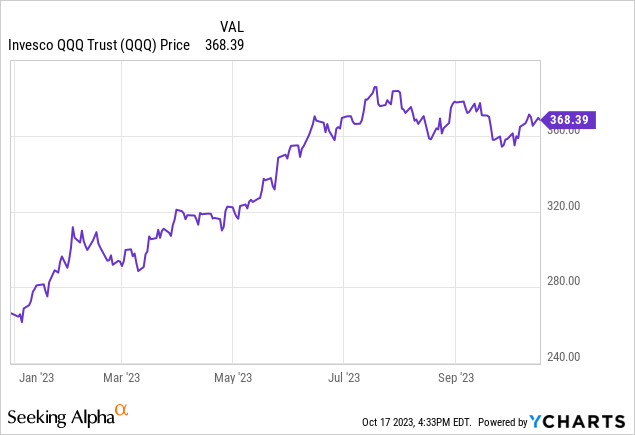

Invesco QQQ Trust ETF (NASDAQ:QQQ) which tracks the NASDAQ 100 (NDX) is up by almost 40% YTD in 2023.

When the market opened for trading on January 3rd, 2023, NASDAQ 100 was near the November lows. Market commentators and analysts have defined this extraordinary performance YTD as the “new bull market”, following the 2022 “bear market”.

Well, this “new bull market” is currently facing a major test as QQQ is “sitting” at the key support level. This is not a technical analysis article, and I don’t believe that technical analysis alone can produce consistent trading profits over the longer term. It’s the fundamentals that affect the prices over the long term.

However, most market participants are glued to the charts, trying to decrypt the message and predict the next move. They will, as a group, sell when the price goes below a certain line, and buy when the price goes above a certain line. Thus, these market participants do move the markets, and thus, it is important to monitor “the lines” and the price action around these lines.

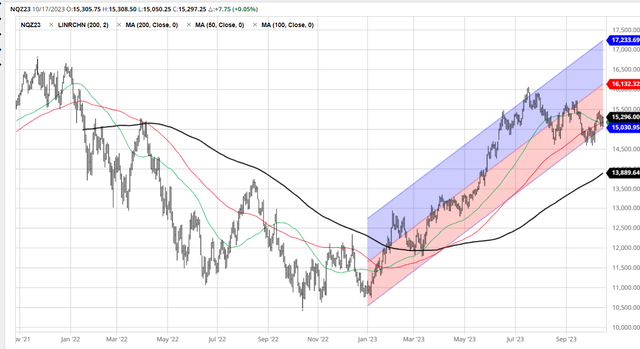

Currently, the NASDAQ 100 is sitting just above the 100dma (red line) at the uptrend support level, which also coincides with the regression line range bottom of the uptrend channel. Also, the 50dma line (green line) is in a downtrend and crossing the 100dma, which could be defined as a “junior death cross” and signals further downside.

Thus, technically, once the support at the bottom of the range level and the 100dma line is breached, NASDAQ 100 is likely to drop significantly, with the first stop at the 200dma (black line). If the 200dma level support holds, the drop could be just a correction, but if the 200dma fails to hold, the NASDAQ 100 is likely going to the January lows – erasing the 40% gain YTD.

Why do breakdowns happen as the major technical support levels are breached? It’s because the trend followers usually close their long positions in these situations, and possibly go short. Further, many fundamental traders usually have their stop-loss orders right below these levels, which adds to the selling pressure.

Here is the chart with the levels:

Barchart

The fundamentals

Somebody could look at the chart above and see a completely different situation. In fact, as long as the support levels hold, NASDAQ 100 appears to be at the bottom of the uptrend channel, and thus, this could be an excellent opportunity to buy more – as the uptrend continues.

What happens next, uptrend or downtrend, will be decided by the unfolding fundamental situation.

Let’s evaluate the long case first. The QQQ rally YTD has been led by the GenAI theme and the several megacap tech stocks that directly benefit from the AI theme. In fact, the QQQ rally in January has been triggered by Microsoft (MSFT) investment in ChatGPT. Thus, the continuation of the “bull market” depends on the validity of the AI theme.

The GenAI hype is over now, and we need to see the actual results related to GenAI. We need to see the earnings boost from the GenAI. We need to see the wide adoption of GenAI. Most importantly, we need to see the productivity boost from the GenAI. None of the results will likely be directly observable in the near term. Thus, it is unlikely that QQQ can continue to climb solely based on GenAI hope.

What are the fundamental triggers to the downside?

First of all, the NASDAQ 100 is overvalued with a P/E ratio at 30. The recent selloff (to the support levels in the chart above) since late July is due to the rising 10Y yields. As the long-term interest rates increase, the PE multiple contracts. Thus, given that NASDAQ 100 is overvalued, and that interest rates are still rising, the PE multiple contraction alone can cause a significant drawdown in QQQ.

The Wall Street Journal

The second trigger is the expected downgrade in earnings expectations for 2024, due to the likely recession sometime in 2024. The fact is that the yield curve has been inverted since October 2022, and eventually the lagged effect of the monetary policy tightening will start affecting the economy and likely cause a recession. But this is likely not an imminent trigger.

The Fed’s November meeting could be an imminent trigger for the QQQ selloff. The market still expects the Fed to pause in November and for the rest of 2023. However, the Fed “penciled in” another hike in 2023, and given the recent hot CPI report, and strong labor market, the Fed is likely to surprise the market consensus, and either hike in November or indicate an intention to hike in December. This is negative for the overvalued NASDAQ 100.

Another imminent trigger for the selloff is the escalating geopolitical situation in the Middle East, and the possibility of a sharp spike in the oil price as Israel starts the new phase of the war against Hamas.

Key QQQ holdings analysis

The most important NASDAQ 100 holdings actually face serious threats.

Apple (AAPL) has significant exposure to China, and the Chinese government just recently reportedly banned iPhones for government workers. I’m not sure how significant this specific event is, but the direction is important. The fact is that the US and China are decoupling, which will cause less trade between them, especially in the tech industry. Apple is over 11% of QQQ by weight.

NVIDIA (NVDA) is also facing the export ban to China, which is also likely to eventually significantly affect the revenues, as the ban broadens to other countries and products. Amazon (AMZN) is facing a major FTC lawsuit for alleged monopoly, which could even break the company.

Thus, I don’t see the reason why somebody would aggressively bet on these QQQ tech megacaps, as they have significant firm-specific and systematic risks.

Implications

The 2023 “bull market” in QQQ with the near 40% YTD gains is isolated only to the technology sector. During the same period, the Russell 2000 (IWM) index of small stocks has been essentially flat with 0% gain YTD, the Dow Jones Industrials (DIA) index of large caps is up by only 2% YTD, while the equal-weighted S&P 500 (RSP) is also flat at 0% YTD gains.

The true “bull market” would require broader participation, and thus the underperforming sectors, stocks, and factors, should be catching up to QQQ. Unfortunately, we are likely in a major bear market rally in QQQ, and thus QQQ will likely catch down to the rest of the market. It appears we are on the verge of such a selloff in QQQ – once the technical support levels are broken.

Read the full article here

Leave a Reply