It is looking increasingly likely that there will be some sort of Bitcoin (BTC-USD) Spot ETF in the near future.

Brief account of events

In late August, Grayscale (OTC:GBTC) won a court ruling over the SEC’s block of its launch of a BTC spot ETF. On Friday, October 13th it was revealed that the SEC is not appealing which allowed Grayscale Bitcoin Trust to move forward with its application for an ETF.

It also potentially paves the way for other companies to make Bitcoin ETFs. Bitcoin’s price has risen materially as the news came out. The spike on the 16th is likely related to the late Friday news release.

SA

Crypto enthusiasts are excited about the prospect because they think it will increase the price of Bitcoin. There is a clear mechanism by which it could increase the price:

- The ease of trading an ETF could bring in demand from those who find owning Bitcoin directly to be too cumbersome.

Note, however, that this does not actually improve the value of Bitcoin, it merely has the potential to increase the price in the near term.

While it is possible there are some flip trading profits to be had here, I think it will overwhelmingly be a bad investment and people will lose more money on it overall than they will make.

In my opinion, Bitcoin is a clear negative sum game and the introduction of ETFs further increases the negative.

Negative sum game

Those familiar with economics or its sub discipline game theory will be familiar with the term “zero sum game.” It refers to any sort of closed system in which the winnings to some equal the losses to others.

Think of your standard kitchen table game of poker. The winner of a given hand gains chips equal to the chips lost by other players in that hand.

Bitcoin is more like poker played in a casino with a rake. The money won by the winner equals the money lost by other players but then the croupier takes their rake. It is still zero sum, but with outflows which makes it negative sum.

The rake for Bitcoin comes in the form of trading commissions, margin interest expense for accounts that hold it on margin, payment for order flow, and any other frictions involved in trading and or owning BTC in whatever form it is owned.

What is paying for LeBron James crypto ads at the Super Bowl or 30 Grayscale Bitcoin Trust commercials a day on CNBC? That is the rake.

It is possible for some professional gamblers to individually make a profit playing in casinos with a rake so long as the differential in their skills to the rest of the table is greater than the magnitude of the rake. The best player will on average make X while the others at the table will lose X. If X is greater than the rake, the pro makes money on average.

Perhaps Bitcoin is similar. Extremely good traders may be able to make a profit by timing it vastly better than the other traders. If they are better traders by enough margin, perhaps they can overcome the Bitcoin rake.

That is not a sustainable source of profit. It works great during popularity surges in which tons of less experienced traders are pouring in, but it does not work once those guys lose their money and exit the game. Eventually it will only be sharks left at the table and no matter how good they are at cards or trading Bitcoin it will not be enough to overcome the rake because the others they are trading against are now equally as good.

I believe that BTC is a money losing negative sum game and the rake is only made bigger by the introduction of an ETF.

ETFs adding to Rake

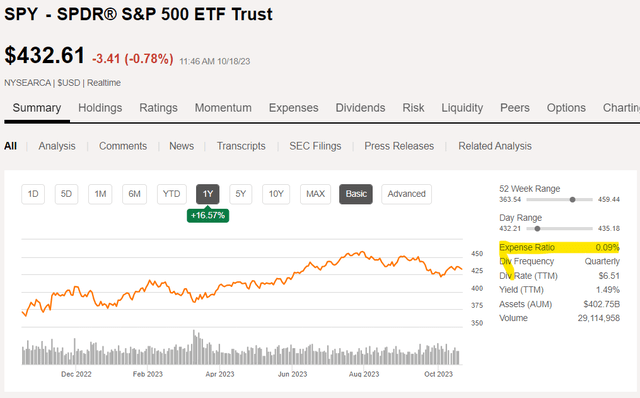

Functionally, what an index or commodity tracking ETF does is it layers on a fee in exchange for removing some of the difficulty of buying the assets by other means. If we look at a broader market ETF like the S&P 500 ETF (SPY) you can see an expense ratio highlighted in yellow below.

SA

Investors are paying 0.09% annually to own the ETF.

As compensation for this fee, the investors are getting to trade hundreds of stocks with a single click rather than having to track each constituent of the index down individually and manually enter the proportional amount they want to buy.

It is functionally a convenience fee.

To see how this relates to Bitcoin, it behooves us to dig a bit deeper. Specifically, what determines how large the fee is and where the money is coming from.

Size of fee

There are significant expenses involved in running an ETF. Compliance alone is quite costly so there is a minimum revenue for the ETF to be viable. Most of the costs are fixed in nature with almost no variable expenses – meaning that increasing AUM does not incur much additional cost. Thus, the larger an ETF, the lower the percentage fee it can charge.

SPY is among the biggest and also among the cheapest at a 9 basis point expense ratio.

Source of fee

The fee is of course paid by the investor. In the case of SPY, the fee can be covered by the dividends the investor receives. SPY pays a 1.49% dividend so the 9 basis point fee is well covered for the investor and they can still net cashflow. The dividend itself is covered by the cashflows of the underlying securities. These stocks have positive earnings and pay a portion of those earnings out as dividends.

Bitcoin ETF fee and source of fee

If we look at these same concepts with regard to the potential Bitcoin ETF, some problems appear.

The Bitcoin ETF will almost certainly be smaller than SPY. SPY has AUM of $402B which is a tiny fraction of the market caps of the underlying securities. Bitcoin as a whole has a market cap of $552B. Even a wildly successful Bitcoin ETF would have just a fraction of the market cap. Thus, it will be much smaller than SPY and therefore will have to charge significantly more than 9 basis points.

Smaller ETFs tend to charge between 40 and 100 basis points.

So it will be more expensive and where is that money coming from? Once again, the fee will be paid by the investor. However, in this case, there is no dividend stream to cover it. Bitcoin pays zero dividend and it can’t pay more than 0 dividend because it has no cashflows. Thus, in holding a Bitcoin ETF an investor will suffer a constant cash drain.

How long can one endure a cash drain when they are not getting any sort of cashflows? I’m sure it will vary by the individual, but it certainly doesn’t seem like something one would want to buy and hold forever.

Why Bitcoin Investors are so excited by the prospect of an ETF

Open ended ETFs are terrible traders. They buy securities when AUM inflows and sell securities when AUM outflows. That is just their mechanical nature.

AUM inflows tend to happen after the underlying stocks rise. The market gets excited about a particular sector because it has performed well so it pours money into the related ETFs. Similarly, when a sector crashes, ETFs experience significant outflows.

Since the ETF’s job is to buy the targeted securities on behalf of its investors, it doesn’t really have a choice in the timing. It has to buy or sell according to flows. The result is buy-high and sell-low.

Bitcoin traders are salivating at the concept of this being introduced because it dilutes the skill of the other players at the table. It will make it more possible to have a large enough skill gap to overcome the rake.

So a Bitcoin ETF is great for Bitcoin traders but any profits they make will come straight from the pockets of Bitcoin ETF investors.

Don’t be the patsy that feeds the professional trader’s profits.

The decentralized finance angle and the ETF absurdity

One of the key founding principles of Bitcoin is that it is decentralized. Fiat currency like the U.S. dollar implies some sort of trust in the U.S. government as it is the backing of the U.S. that gives dollars their value.

Bitcoin is intended to be “trustless” in the sense that it being stored on a decentralized blockchain means no single entity has the power to control it.

The decentralized angle is probably the closest thing Bitcoin has to a fundamental thesis. It is an angle that at least potentially makes it something other than speculation. I don’t think this actually provides intrinsic value to Bitcoin, but many people do.

An ETF is antithetical to the decentralized concept. The ETF itself is going to be run by a specific centralized entity. So while Bitcoin might be decentralized, if one owns Bitcoin through an ETF their ownership is dependent on a specific entity. Whatever freedom or security supposedly comes from decentralization is lost.

I find it far more likely that some financial entity running the ETF will break trust than the U.S. government failing to protect the dollar. Already in the brief history of cryptocurrency there are quite a few scandals, such as FTX (FTT-USD).

Recall that before the scandal Sam Bankman-Fried was regarded as one of the most trusted and knowledgeable in the crypto space. When it comes to alleged fraud or other forms of abuse it is really hard to detect the bad actors until it is too late.

Bitcoin ETF compared to other investments or ETFs

Many of these problems are also true of other ETFs. Non-crypto ETFs also require placing some trust in a specific entity. Other ETFs also come with a rake.

The key difference here is the underlying securities. Ownership of most other investments comes with cashflows or at least the prospect of future cashflows in the case of early stage growth. It is these cashflows that make most forms of investment such as SPY positive sum games. The cashflows coming from the underlying companies are much larger than the rake such that there are gains to be had for all.

When trading an individual stock or ETF comprised of companies’ stocks you can still make the trading profits from potentially timing it better or otherwise outsmarting fellow traders, it just has a base return on top of that which makes it better for all investors involved.

I just don’t see a practical reason to play the negative sum game when positive sum investments are so widely available. Earnings and cashflow are simply better than no earnings and no cashflow.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply