For the final edition of my Dividend Investor’s Natural Gas Export Playbook, I have taken a look at two companies that didn’t quite make the cut. In this edition, I have selected Comstock Resources (NYSE:CRK) as a viable Haynesville natural gas producer and USA Compression Partners (NYSE:USAC) as a compressor supplier to the midstream sector.

Since I have already provided my high-level views on the roles upstream and midstream companies will play in natural gas exports, I will get right into the analysis. If you are jumping into this series late, I recommend starting at Part 1.

1. Comstock Resources

I’ll start this by acknowledging right away that CRK is a boom or bust play on natural gas.

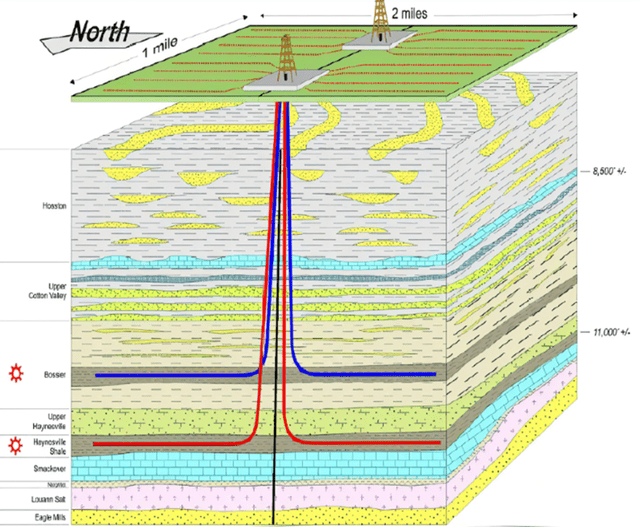

CRK is a natural gas producer that produces 1.4 BCF/d from the Haynesville and Bossier shales in Louisiana and Eastern Texas. While the location of this shale is ideally located to send molecules down a short run of pipe to an export terminal, it is one of the more expensive shales to drill for natural gas. To set expectations correctly, investors need to understand the role Haynesville plays in US natural gas production.

Bossier and Haynesville Shale plays (University of Texas)

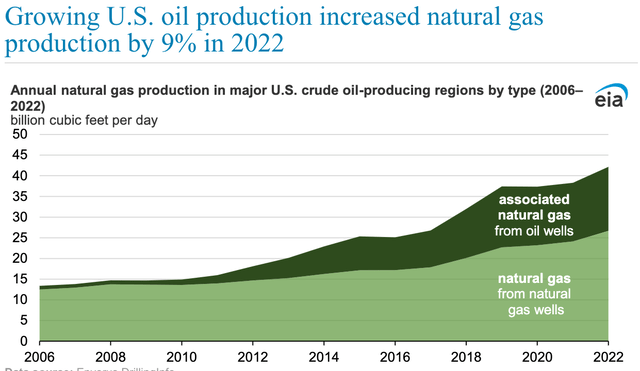

From a simplistic view, the current demand for natural gas is met by a combination of the Marcellus Shale and the Permian Basin. The Marcellus is one of the lowest-cost producers of pure natural gas while the Permian produces natural gas as a byproduct of oil production. Typically, 25% of the volumes extracted from the Permian is natural gas and is not the primary reason for companies to invest in new wells. The net effect is that oil production growth out of the Permian drives natural gas production, not natural gas economics as shown below.

Natural Gas Production Growth (EIA)

Growth in the Marcellus is hampered by regulation and takeaway capacity. In the Permian, producers are there for the oil. Natural gas prices will not meaningfully influence business plans or entice these producers to drill more. Therefore, Haynesville will only see significant investment when natural gas markets are under-supplied. This means Haynesville is the peaker basin.

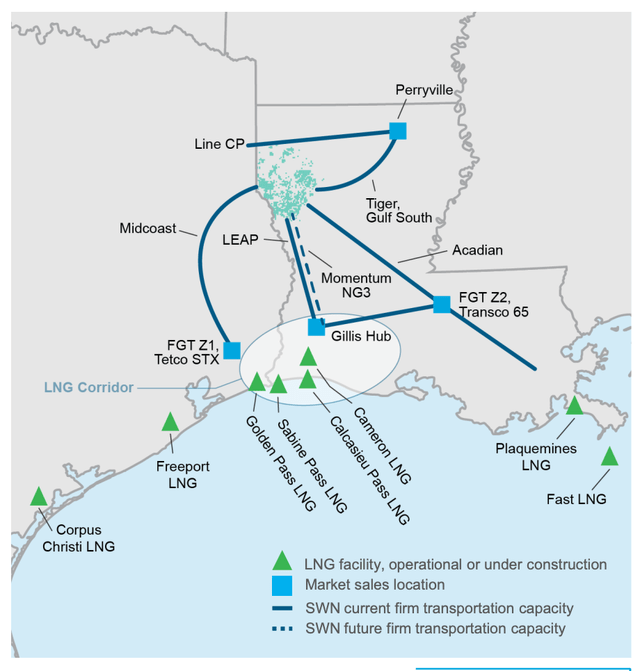

When demand lowers, producers will throttle back as the Marcellus and the Permian have sufficient capacity to meet demand. When demand outpaces supply, Haynesville is the main basin to make up that gap. The proximity of CRK’s acreage to LNG facilities makes this a compelling play. Not only is Haynesville the basin with additional capacity but is also the closest geographically.

Southwestern Energy

With most headlines highlighting that natural gas storage is at 5-year highs, it’s easy for investors to miss the forest amongst the trees. The size magnitude of the proposed LNG export terminals is simply remarkable. For example, Comstock CEO Jay Allison had an interesting perspective on the impact of the Freeport LNG facility fire.

We got a surplus of 13% above the normal five-year average (natural gas inventories). But if Freeport, if that 2 Bs hadn’t been injected into storage, would’ve been exported.

If you look at the number where we would be today on the five-year average, we’d have a deficit of about 8.8%. So, I still think the gas marks a little bit misunderstood because I think we’re doing the right thing, but all of a sudden you take 2 Bs a day, that exportable and it’s now being injected into storage, it changes things.

This statement really helps drive home just how much demand is created by a single LNG facility. Therefore, with the projected 8.5 BCF/day of demand coming online by 2025, it is clear that the Haynesville shale will very much be in play.

Free Cash Flow Analysis

Before we get into what COULD be, let’s analyze where CRK is at financially today. 2023 has been a tough year for CRK due to natural gas prices bottoming out around $2.00/MCF earlier this year. The table below summarizes the operating results thus far in 2023.

| Realized Nat. Gas Price | Net Income | Capital Expenses | |

| Q1 2023 | $3.06/MCF | $134.5 million | $372.6 million |

| Q2 2023 | $2.25/MCF | -$45.7 million | $379.9 million |

| Q3 2023 | $2.41/MCF | $14.7 million | $351 million |

Note: All data sourced from quarterly 10-Q reports.

There are two big takeaways from this data.

1. Operating breakeven prices are roughly $2.40/MCF but do not account for capital expenses to continue drilling wells.

2. Net Income accounts for asset depreciation, which has averaged $140 million per quarter. CRK projects that starting in Q4 it will begin to realize decreased rig rates associated with lower natural gas drilling activity. This will bring Q4 capex spending down to $240-$280 million. These two facts produce a self-funded business model above $3.50/MCF. This value should be sufficient to also fund the dividend, which currently is a healthy 4.6%.

Right now, CRK carries a fair amount of risk after running nearly all of 2023 below breakeven prices. With a breakeven price at greater than $3.50/MCF, this will always be a possibility. However, CRK understands the role of their basin and plans to meet the LNG demand drivers head-on with plans to increase production by 500 MMCF/day (35%) by 2025. My assumption for normalized natural gas prices for 2025 is $4.00/MCF once multiple LNG export terminals have reached commercial operation.

Under these conditions, my financial model shows CRK generating $160 million of discretionary cash flow annually after paying the dividend and capital expenses in 2025. This also assumes capital expenses return to Q3 levels of $350 million per quarter.

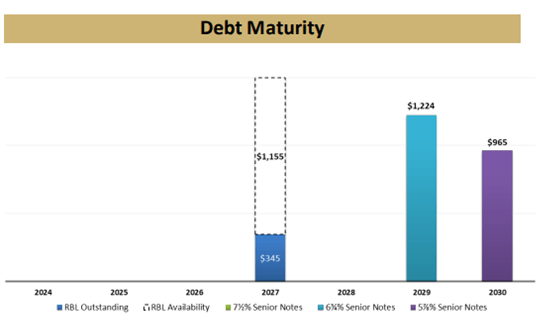

With no debt maturities until 2027, CRK will have ample opportunities to reward shareholders via dividends, buyback shares, or improve the balance sheet. Having a multi-year runway of zero debt maturities is another positive for CRK.

CRK Earnings Presentation

Risks

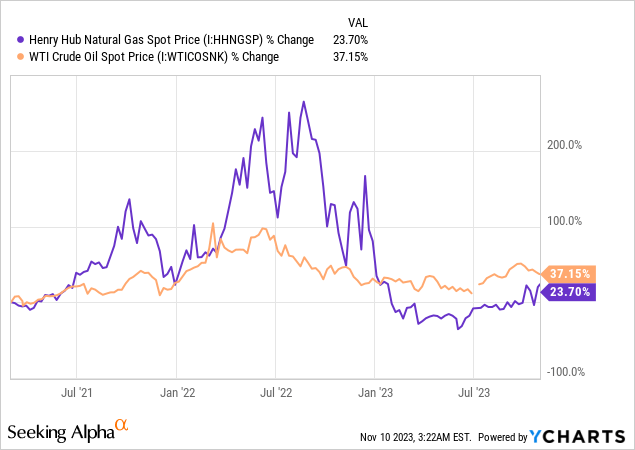

Clearly, CRK’s future prospects hinge on LNG growth. Haynesville’s operating costs are too high to support long-term operations in the current price environment. As shown below, natural gas is extremely volatile, even when compared to WTI crude prices. The possibility of operating below operating costs is a legitimate reality.

Wrap Up

Despite this risk, I believe there is strong evidence to suggest that future natural gas prices will be meaningfully higher than 2023 market conditions. However, investors must acknowledge that another warm winter can keep market conditions subdued for longer. The higher capital costs for CRK make it a riskier investment than a comparable company in the Marcellus.

The tradeoff here is that CRK has ample opportunity for growth with the ability to increase production quickly. CRK projects that it has 25 years of production in its current acreage in both the Haynesville and Bossier shales.

CRK remains a compelling opportunity given the LNG demand drivers. However, the price needs to be risks adjusted to be commensurate with its high breakeven price. Buying under $10.25 per share presents a compelling risk/reward opportunity paired with a yield of nearly 5%. At the current price, I rate CRK a hold. CRK would also be on my radar as a trade candidate to fluctuate with natural gas prices rather than a long-term holding position.

2. USA Compression Partners

USAC is one of those under-the-radar companies that all midstream companies depend on. While midstream companies own the pipe that these molecules travel on, the compressors supplied by USAC are what provide the motive force. Without compressors, the midstream business is just empty pipe.

USAC operates its business under long-term take or pay contracts and has never cut its distribution since its IPO in 2013. USAC deploys a fleet of 3.36 million horsepower with a utilization rate of 93.6%. The compressors supplied to large midstream operators are vary in size from 1,000 to 5,000 HP and are signed to lease contracts that are typically 2-5 years in duration.

So far in this series, we have focused on companies with high exposure to LNG volumes. This certainly will create additional compression demand as these facilities build out pipeline infrastructure and the liquefaction process begins. However, USAC also has the added benefit of being involved in all domestic natural gas business and thus will grow with the general electrification movement.

1. As the US population grows, natural gas consumption for heating, petrochemicals, and refining will grow accordingly.

2. Electricity production continues to complete the transition from coal-based power plants to natural gas power plants.

3. As electric vehicles continue to grow in market share, demand for electricity will grow. Which in turn will require more natural gas to be consumed for electricity generation.

All three items above require more compression and give me optimism that demand for USAC’s services will continue to be robust. This sentiment is shared by CEO Eric Long.

Our assets are must run assets. People can’t drill, can’t produce natural gas, oil production, et cetera, without compression.

You’re starting to see some LNG facilities that’ll be coming on screen [ph] in the next 18, 24, 36 months. Exactly at a point in time where there’s not a lot of available equipment and cost of the equipment are going up. So that’s why we look at it. We’ve always been a story of stability and growth. Right now it’s a time for us to focus on stability.

Equipment shortages will be the key driver of margin expansion over the near term. USAC should be in the driver seat when it comes to setting market price for its equipment. After investing millions or perhaps billions of dollars on pipelines and related infrastructure, pipeline owners will be forced to take USAC’s terms if they want their system to enter operation. USAC can leverage this to not only raise rates but also to attract the best customers. Eric Long also discussed this during the Q3 conference call.

We believe continued equipment shortages will provide us the ability to both high grade our customer base to larger customers who understand and value the exemplary levels of compression services provided by USA Compression, as well as the opportunity to capture expanded economic margins and maintain our high fleet utilization rates. We envision continued improvements to our balance sheet and financial condition consistent with what was shown by our most recent results.

Free Cash Flow Analysis

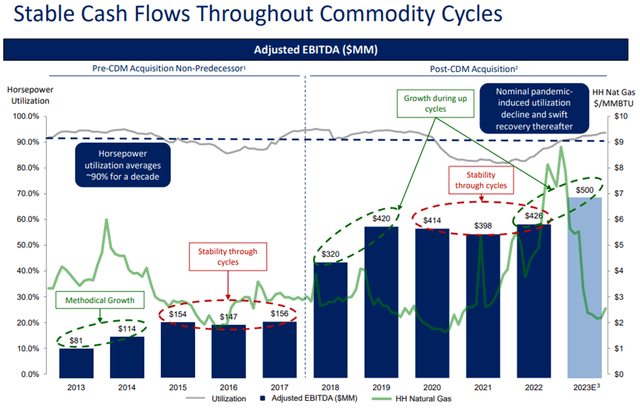

Over the last decade, USAC has managed a very consistent utilization rate of approximately 90% which has in turn resulted in very consistent earnings. More importantly, there is almost zero correlation between USAC’s profitability and changes in commodity prices. This is another testament to the take-or-pay contracts of the midstream business.

USAC Earnings Presentation

This has allowed USAC to maintain a continuous annual distribution of $2.10/share since 2016. This distribution has a coverage ratio of 1.30x which provides adequate margin to maintain the current pace but minimal room for distribution growth.

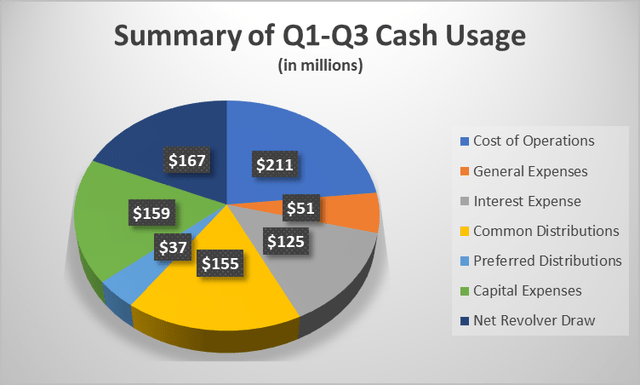

When comparing USAC to some of the best midstream companies out there, the most obvious difference is the lack of a self-funded business model. Below I have plotted the cash usage for USAC through the first nine months of 2023.

While revenue has grown from $492 million for the same period in 2022 to $590 million in 2023, capital expenses have nearly doubled from $88 million to $159 million. Inflation has also caused operating costs to increase $43 million during the same period. The net effect is requiring to draw down $167 million on the companies’ revolver to support this level of spending and the distribution.

USAC Quarterly 10-Q

While this is a manageable problem, it is in contrast to a midstream company such as Enterprise Products (EPD) that does not have to rely on external markets to fund operations. USAC has not yet achieved the scale necessary for this transition but may in time as it reduces its debt balances.

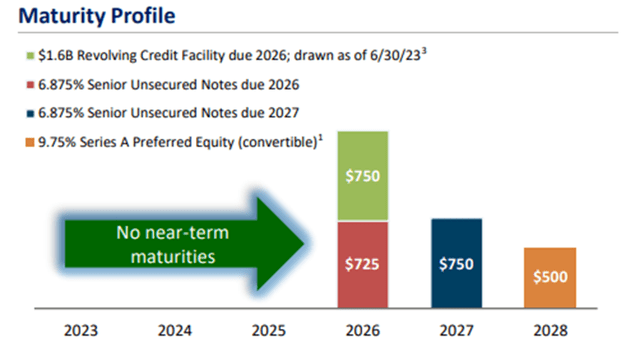

The current debt profile is structured with zero maturities due until April 2026. With nearly 30 months until its next maturity, USAC has plenty of time to make incremental progress on its debt to reduce costs, increase distribution coverage, and help fund the purchase of new compressor units.

USAC Earnings Presentation

Risks

The biggest risk to USAC is debt management while funding purchases of additional compressors. New compressors will obviously be needed to fuel the growth of the partnership, but these expenses must be navigated intelligently to ensure debt levels do not become excessive.

Fortunately, USAC has nearly 6% of the unutilized capacity that is available for deployment to help reduce near-term capital requirements.

We currently expect to take delivery of an additional 62,500 horsepower of new large horsepower units during the fourth quarter, plus additional and ongoing conversion of current fleet idle units to active status. During the first half of 2024, we expect to take delivery of 37,500 horsepower, which is the remainder of our late 2022 order.

Additionally, throughout 2024, we anticipate the conversion from idle to active status of about a 100,000 horsepower of existing fleet assets at capital costs substantially below those of new organic growth equipment bills.

We believe the best way to maximize stakeholder value in the current market is to direct capital in 2024, primarily to the conversion of vital units to active status and limiting the acquisition of new organic growth compression units.

The ability of management to efficiently upgrade existing equipment into serviceable condition will greatly affect the financial health of the partnership over the next three to four years.

Wrap Up

USAC supports vital infrastructure that is projected to continue to grow. This growth is driven by both domestic and international demand for natural gas. While USAC supports a solid distribution of 8.1%, the ramp in share price over the last two months has reduced the yield from what was once greater than 10% back in line with the general midstream pack. Thus, I find the valuation for USAC to be less compelling, as this level of yield can be found elsewhere with more opportunities for distribution growth. I rate USAC as a hold at the current price of $25.93/share. I would upgrade USAC to a buy if prices regress to prices seen in August and September of this year.

Summary

Both CRK and USAC are small-cap investments that will be directly involved in the LNG markets as they develop. However, both need to see the share price decline to improve their risk-adjusted returns. Both companies have weaknesses that keep them at a hold rating.

Part 5 is the final episode of this series. I have enjoyed this in-depth dive into multiple aspects of the natural gas markets. I have learned a great deal along the way and hope you have as well. Thank you for all of the comments and follows. Happy investing.

Read the full article here

Leave a Reply