Intro

The Cooper Companies (NYSE:COO) is a US-based healthcare company that offers a vast array of products in the contact lens market (CooperVision) plus an array of women’s healthcare products (CooperSurgical) ranging from fertility offerings to contraception. The company recently announced its third-quarter earnings numbers where although the non-GAAP number of $3.35 per share slightly beat consensus, Cooper’s GAAP earnings of $1.71 per share missed the mark by quite some distance. In fact, the GAAP number came in 14% behind the same quarter of 12 months prior.

Despite the non-GAAP earnings beat in Q3, investors made their feelings known by selling off the stock since the earnings announcement on the 30th of August. Shares are now down over 15% since the announcement as growth concerns look to be mounting. The CEO spent a lot of time focusing on the company’s record revenue tallies on the Q3 earnings call, with CooperVision & CooperSurgery blasting past $600 million & $300 million in quarterly sales for the first time in their histories. The company’s daily silicone hydrogel portfolios helped drive CooperVision’s organic sales by 13% whereas CooperSurgery’s 9% organic growth was principally driven by the fertility segment.

However, rising sales in an inflationary environment many times is taken for granted. The market though focuses more on earnings growth and here is where Cooper’s growth metrics come in below what we are accustomed to in this company. In fact, if we look at non-cash growth numbers and specifically cash flow, we see that Cooper’s operating cash flow as well as free cash-flow generation have been declining pretty steeply since fiscal 2021. Operating cash flow has declined from $738+ million at the end of fiscal 2021 to $564+ million over the past four quarters. Consequently, free cash flow has fallen from $10.65 per share to $4.48 per share over the same period. Since free cash flow is the main precursor to sustained growth in companies, investors obviously believe that Cooper’s steep valuation needs to fall somewhat to account for the company’s changed financials.

Therefore, let’s go through a technical analysis piece to see if we can decipher where Cooper will eventually bottom in this latest down move.

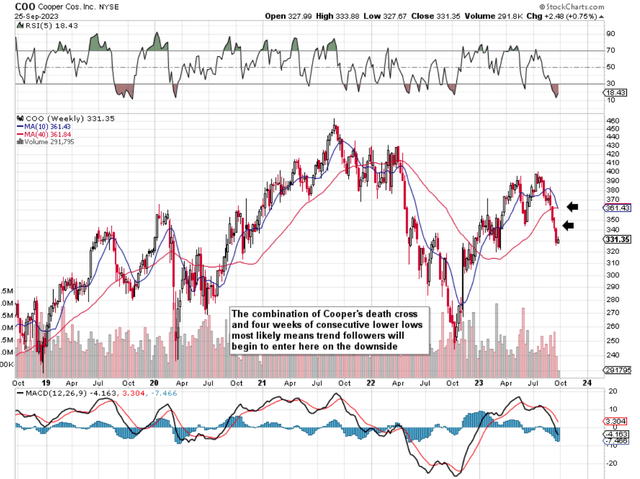

Intermediate 5-Year Chart

First, if we go to Cooper’s intermediate 5-year chart, we see that shares (with the recent crossing over of the stock’s 10-week moving average beneath its corresponding 40-week average) have now delivered an intermediate ‘sell’ signal. Furthermore, shares of Cooper up to the end of last week have printed four consecutive weeks or lower lows. Suffice it to say, four weeks of consecutive lower lows coupled with the bearish death cross mentioned above will most likely bring trend followers into the fray here on the downside.

Cooper Intermediate 5-Year Chart (Stockcharts.com)

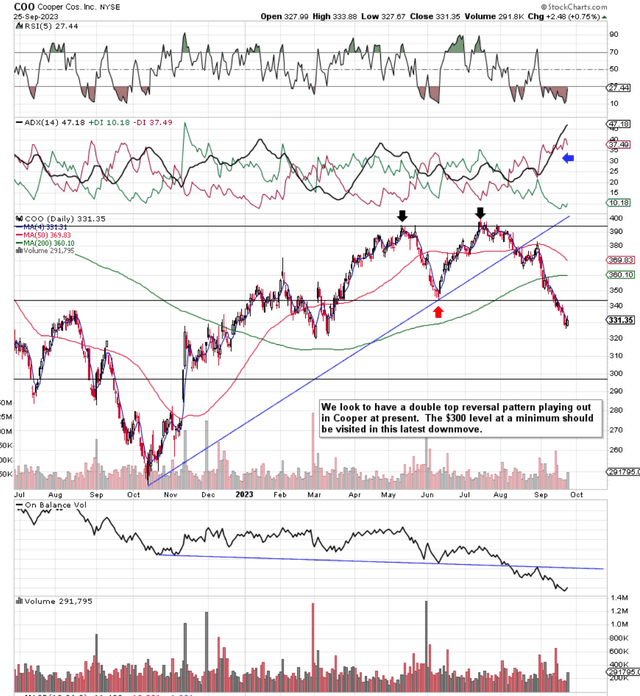

12-Month Daily Chart

If we go to Cooper’s daily chart, we see that the ADX indicator (Trend-following indicator) has almost reached 50 which demonstrates an ultra-strong bearish trend in motion. In fact, a double-top reversal pattern looks like it is playing itself out here where underside support (June lows) has now been broken. Therefore, when one sizes up the height of the reversal pattern, there is every possibility that shares will drop to somewhere close near the $300 a share mark in due course. A drop to this level would almost be a further 10% drop from where shares are currently trading.

Although shares topped out in mid-July this year, the OBV indicator (On balance volume) did a fine job of spotting the impending reversal as we see below (Early August). In fact, the technician would have most likely doubted the validity of Cooper’s rally which lasted from October of last year to July of this year. The reason being is that strong buying volume did not accompany the rally for the most part and since volume trends tend to precede share-price action, it is not surprising now to see shares of Cooper fall to the downside.

Cooper Daily 12-Month Chart (Stockcharts.com)

Conclusion

To sum up, although Cooper has been posting record revenue numbers in both of its segments, profitability in the company’s most recent third quarter came in well down compared to the same period of 12 months prior. Although an excellent-run company, investors believe at present that Cooper’s growth curve does not justify the stock’s present valuation. Probably more downside to come here. We look forward to continuing coverage.

Read the full article here

Leave a Reply