A few days ago, Tesla, Inc. (NASDAQ:TSLA) released its Q3 2023 earnings with investors who were not satisfied with results and operational figures to the point that the stock lost 9% in trading hours. Increasing revenues were indeed accompanied by increasing costs and decreasing margins, raising some questions about Tesla’s financial sustainability.

In this article, I will provide a review of the Q3 2032 results and I will explain my BUY thesis.

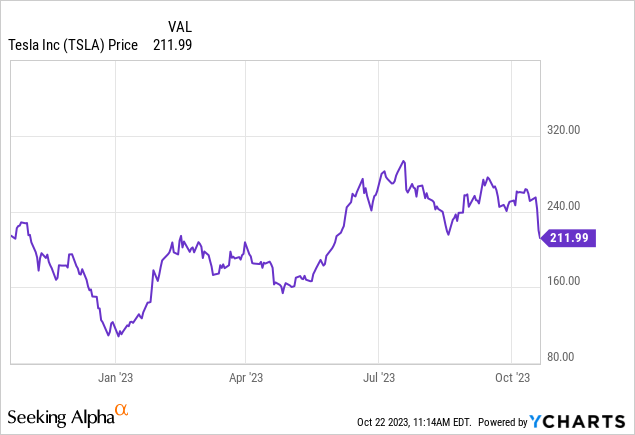

Stock Performance

Tesla is currently trading at $212/share, equivalent to a market cap of $673 bn. Since the beginning of the year, the stock is up 72%, while in the last 52 weeks it lost 27%. When I wrote my last article about Tesla, issuing a BUY recommendation, the stock was trading at $164/share and has therefore gained about 30%. The 52-week minimum is $108/share, recorded at the beginning of January 2023, while the 52-week maximum is $293/share, recorded on July 18th, 2023.

Tesla Q3 Financial and Operating Results

Total revenues increased by 9% year-on-year to $23.3 bn (+$1.8 bn) with almost equal growth across the automotive business unit and the two other smaller units, energy generation-storage and service. However, the story is a bit different if we compare Q3 sales with those of the previous quarter, Q2 2023: indeed, total revenues are down 6% (or -$1.5 bn) versus the almost $25 bn recorded in Q2-2022.

Going more in detail across the three business units, here are the revenue trends:

- Automotive: sales increased by 5% YOY from $18.6 bn to $19.6 bn accounting now for 85% of the total revenues. Quarter-on-quarter, automotive sales are down 8% from the previously recorded $21.2 bn.

- Energy generation and storage: sales of this division increased by an incredible 40% YOY, from $1.1 bn to $1.6 bn, and by 3% QOQ. It is worth mentioning that this quarter was the record one for revenues generated by this business unit

- Service and other: even this business unit recorded a strong performance with sales increasing by 32% YOY from $1.6 bn to $2.1 bn, and 1% QOQ.

Revenues were mostly impacted by two opposite trends, namely the increase in delivered vehicles and the decrease in the average selling price. In particular, the total number of delivered vehicles (Model S/X plus Model 3/Y) increased YOY by about 66k units even though deliveries of Model S/X were down by almost 4k units (deliveries of Model 3/Y were up by about 70k units). On the contrary, looking at the quarter-on-quarter figures, one can notice that the number of delivered vehicles in Q3-2023 is down 7% vs. Q2-2023 which, however, was the quarter with the highest deliveries ever. The benefit of the 18% yearly increase in delivered vehicles was partially reduced by the decrease in the average selling price ($37,500) which is constantly falling in an attempt to capture more buyers.

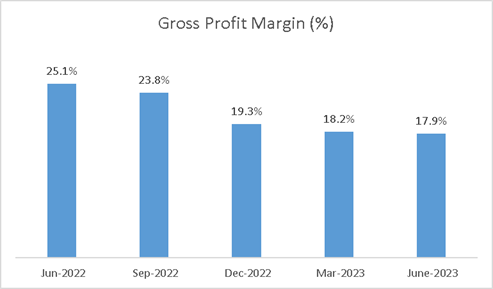

Moving to the cost side, operating expenses increased by 43% year-on-year, more than proportionally than the revenue growth. As a result, operating margin decreased by 9.6% year-on-year to 7.6%. Gross margin also decreased by 7.1% to 17.9%.

Author’s analysis of Tesla data

EBITDA was $3.7 bn, down 24% from the $4.9 bn of Q3-2022, with the EBITDA margin was 16.1%. Free cash flow was robust at $848 M. The decrease in EBITDA was mostly due to increasing operating costs for R&D activities and idle costs related to new factories ramping up.

At the end of the quarter, cash and cash equivalents amounted to $26.1 bn.

Outlook

Despite this quarter being weaker than expected with declining margins, I still believe that there is a lot of potential in Tesla that could support further stock growth. Indeed, the planned plant shutdowns are now behind, and Q4 should see higher production volumes. In addition, Cybertruck could become a new source of strong revenues with over 1 million orders already placed.

Another interesting aspect to consider in the long run is the FSD (Full Self-Driving, Tesla’s beta testing program for autonomous vehicles). During Q2 2023, Elon Musk mentioned that Tesla was in talks with a major OEM to license its FSD. In my opinion, the licensing of FSD to other OEMs could represent a new business line with a very high profitability.

Analysts’ Ratings

Tesla is currently covered by 40 equity research analysts, with 16 of them having issued a buy or strong-buy recommendation in the last 90 days. The average target price is $240/share, which would represent a 13% upside versus the current price.

Conclusion

Overall, despite the Q3 2023 results not coming in as analysts expected, I believe that Tesla’s growth is far from over. The recent decline in stock price could represent an interesting entry point for investors who are in for the long run. Cybertruck and FSD licensing will be some of the key catalysts that should impact the stock price.

Read the full article here

Leave a Reply