Tesla, Inc. (NASDAQ:TSLA) reported Q3 2023 results and stumbled in a major way, missing analyst consensus on both the top line and earnings. In the September quarter, the EV company reported revenue of only 9% YoY and an EBITDA compression of 24% YoY.

Needless to say, these numbers sharply contrast with investors’ implied expectations about Tesla’s growth story, likely causing a massive rerating of Tesla stock over the next 6-12 months. In line with this expectation, following the earnings announcement, Tesla shares lost about 7% in extended market trading (pre-market), after already losing almost 5% on the day leading up to the earnings release.

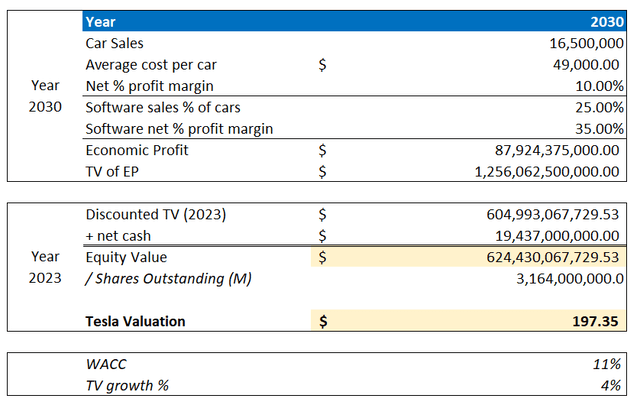

Post Q3 reporting, I update my growth and margins expectations for Tesla: I now see 15-18 million cars by 2030, compared to 20 million estimated previously. Moreover, I reduce my net-profit margin assumption by 50 basis points, to 10.5%. Adjusting my valuation model for Tesla accordingly, I now see a fair implied share price of $197.35. As a function of both valuation and economic uncertainty relating to Tesla’s growth and profit margins, I downgrade Tesla to “Underweight/Sell.”

Tesla Disappoints In Q3

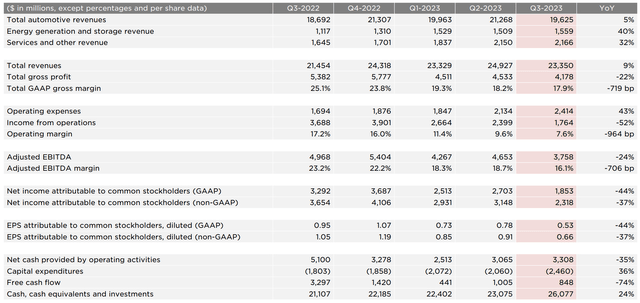

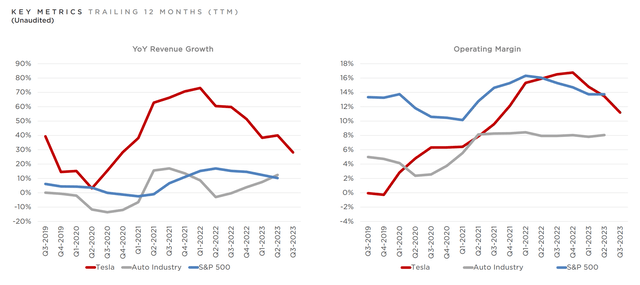

Tesla’s performance in the third quarter of 2023 broadly disappointed against expectations, and will likely catalyze many investors to reconsider Tesla’s growth story. During the September quarter, the U.S EV maker generated only 23.4 billion in total revenues. Now, while revenues are up 9% year over year, investors will likely note that a 5% year over year growth is not enough to justify a 69x TTM P/E valuation. Moreover, Tesla’s Q3 top line indicates stagnation versus Q1, and a 6% drop vs. Q2. Tesla’s revenue number is also materially below analyst consensus expectations, missing almost $800 million. The slowdown in growth can be attributed exclusively to automotive revenues, which expanded on 5% year over year, versus a growth of 40% and 32% for energy generation and services, respectively.

Disappointment also extends to profitability. In Q3 2023, Tesla failed to keep up with the company’s proud margins of 2022. Gross profit, which is certainly also a function of volume, dropped by 22% year over year, on a 720 basis point contraction in margin. Meanwhile, operating expenses climbed 43% year over year, pressuring operating income margin (-700 basis points) even more aggressively than the gross margin, with operating income dropping to $1.76 billion, down 52% year over year. Similarity, GAAP net income attributable to shareholders reached fell to $1.85 billion (-44% YoY); and GAAP EPS fell to $0.53.

Tesla Q3 results

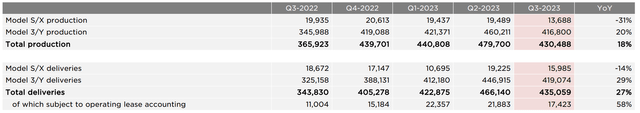

I understand that there are quite a few macro headwinds pressuring automotive sales growth. And margins are certainly not supported by the impact of materials and labor inflation trend. However, what concerns me about Tesla’s fundamentals is also a shift in product volume mix, with premium vehicles (S/X) losing production and deliveries share to mass-market cars (3/Y). For context, Tesla’s production of S/X vehicles dropped 31% YoY, to 13.7k for the September quarter, while 3/Y expanded by 20%, to 416.8k.

I understand that Tesla is testing a new strategy in favor of volume. And investors have been extensively warned about this. However, I don’t think the message has been understood quite as loudly as presented in Q3, with Tesla’s revenues only being up 9% YoY on a 27% YoY deliveries jump.

Tesla Q3 results

That said, I don’t believe that Tesla’s volume strategy necessarily reduces the potential for value accumulation, especially when considering the lifetime value generated by features such as autonomy, supercharging, connectivity, and service. Previously, CEO Elon Musk emphasized this in the Q1 conference call with analysts, stating that their cars could potentially be sold at zero profits now but yield substantial profits in the future through autonomy. Moreover, a cost reduction on vehicles production could also be a lever to offset the pricing headwinds of the volume strategy, with Elon Musk teasing a 40% cost reduction upside.

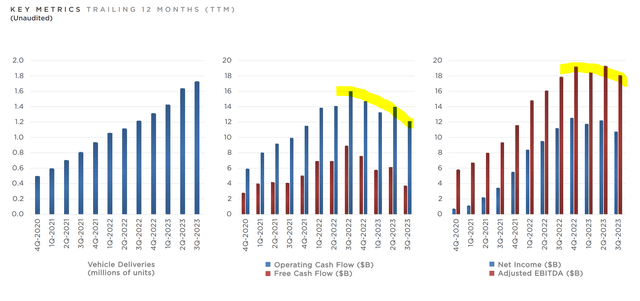

However, as long as material revenue contribution from autonomous driving, supercharging, and connectivity remains absent, and non-existent cost reduction of 40% meets an operating expenses increase of 43%, investors are likely to doubt the margin upside. In that context, Tesla’s key metrics certainly trend in the wrong direction, no matter the perspective.

Tesla Q3 results

Tesla Q3 results

In the conference call with analysts, Elon Musk also delivered a blow to Cybertruck-bulls, who have seen this product as a growth engine for Tesla’s fundamentals in the future. The outlook appears very bearish, as Elon Musk said:

I mean, we dug our own grave with Cybertruck … the Cybertruck is one of those special products that comes along only once in a long while. And special products that come along once in a long while are just incredibly difficult to bring to market, to reach volume, to be prosperous.”

I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck, and then in making a Cybertruck cash flow positive

In that context, Musk said that it will likely take a year or two until the Cybertruck will contribute positively to Tesla’s cash flow. And reflecting on the many Cybertruck’ s delays already, and Elon Musk’s often ambitious timeline targets, markets likely will see Cybertruck profitability in closer to 4 years. Moreover, Musk also gave insights that the Cybertruck will likely not be a blow-out success in terms of vehicle volumes, saying that his best guess would be an annual production of approximately 250,000 Cybertrucks by 2025.

Lower TP To $197 Per Share

Following Tesla’s Q3 results, I reduce my car volume sales expectations for 2030 to 16.5 million cars per year (range: 15-18 million). Moreover, seeing Tesla struggling to safely maintain once-proud, industry-leading margins at 10%, I also lower my base case net-profit margin assumption to 10.0%, down 50 basis points from my previous assumption.

On Tesla’s technology and service portfolio, I continue to assume that for every dollar of hardware sales, Tesla will be able to sell 25 cents of post-purchase revenue, including energy services, software solutions and insurance (for reference, Apple (AAPL) generates about 30 cents worth of services for every dollar of hardware sales). Moreover, for Tesla’s software business, I continue to view a 35% net-profit margin as reasonable.

Given this analysis, I compute an annual economic profit for Tesla of $87.9 billion, which translates to a present value of $1,256 billion by 2030. Discounting this value back to early 2023, considering an 11% weighted average cost of capital (WACC), and incorporating a net cash reserve of $19.4 billion results in an equity valuation of $624.4 billion, equivalent to $197.35 per share.

Company Financials; Author’s EPS Estimates; Author’s Calculation

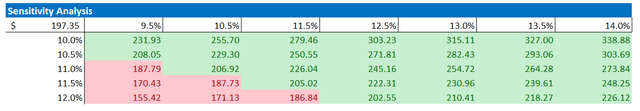

Below the updated sensitivity table — varying discount rate (row) and net % profit margin (column).

Company Financials; Author’s EPS Estimates; Author’s Calculation

Conclusion

Tesla’s Q3 2023 results fell short of expectations, with both revenue growth and margins disappointing. There were quite a few headwinds: First, macro pressures have contributed to a slowdown in automotive sales growth, despite the often promoted price cuts. Second, the growth that was materialized was adversely affected by shift in product volume mix, where premium vehicles like the Model S and Model X lost market share to mass-market cars like the Model 3 and Model Y. Third, materials and labor inflation ate into Tesla’s proud, industry-leading margins. Fourth, Elon Musk gave bearish commentary on the outlook of the Cybertruck, relating to both sales volume and profitability.

In response to these developments, I have adjusted my expectations for Tesla’s car sales volume in 2030 to 16.5 million cars per year, along with a slightly reduced net-profit margin of 10%. I continue to assume that Tesla can generate service revenue, including energy services, software solutions, and insurance, equivalent to 25 cents for every dollar of hardware sales. Additionally, a 35% net-profit margin for Tesla’s software business seems reasonable. Based on this analysis, I estimate Tesla’s intrinsic worth per share at $197.35.

As I believe that other market participants will likely need to materially adjust growth and margin assessments for Tesla, as I did too, I downgrade Tesla stock to “Underweight/Sell.”

Read the full article here

Leave a Reply