Elevator Pitch

My investment rating for PT Telekomunikasi Indonesia Tbk (NYSE:TLK) [TLKM:IJ] stock remains as a Buy. Previously, I wrote about the favorable prospects for TLK’s mobile and broadband businesses in the long run with my earlier article published on June 21, 2023.

The focus of my latest write-up is the potential for Telekomunikasi Indonesia to engage in specific corporate actions that might unlock value for the company. Based on a review of media reports and management commentary, I take the view that the “hidden value” of TLK’s data center and fintech businesses might be unlocked with potential stake sales or public listings in the future. I have identified significant catalysts for Telekomunikasi Indonesia, which gives me the confidence to stick with a Buy rating for TLK.

TLK Could Possibly Sell Part Of Its Interest In Fintech Business Finnet

Bloomberg reported in July that Telekomunikasi Indonesia “is considering selling a stake in PT Finnet Indonesia”, its “fintech unit” at an implied valuation in the $100-$150 million range.

In its fiscal 2022 20-F filing, TLK disclosed that it has a 60% equity interest in Finnet Indonesia, a company that was first established in 2006. On Finnet Indonesia’s website, it is highlighted that Finpay, Finnet’s flagship brand, is a leading payments solutions business in Indonesia boasting a network of “122 billers, 90 banks, 100 thousand outlets, 800 online merchants.”

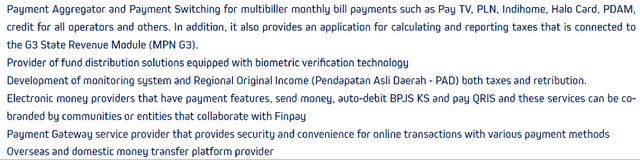

An Overview Of Finnet Indonesia’s And Finpay’s Digital Payment Services

Finpay’s Website

Finnet Indonesia has a long runway ahead, as the company is operating in an underpenetrated market with strong growth potential. A October 13 2022 research report published by McKinsey highlighted that cash still represented more than half of “POS (Point-Of-Sales) transaction value” in Indonesia last year. Separately, HSBC (HSBC) issued a report on May 13, 2022 mentioning that “ASEAN (Association of Southeast Asian Nations) is the world’s fastest-growing region for mobile wallets” with Indonesia being one nation with huge potential thanks to the its “large, highly dispersed and often remote population.”

Given that Telekomunikasi Indonesia is primarily a telecommunications company, investors are mostly focusing on TLK’s core mobile and broadband businesses and they don’t pay much attention to the company’s other non-core or financial investments. As such, it is reasonable to assume that the market currently assigns little or no value to Telekomunikasi Indonesia’s 60% interest in Finnet Indonesia.

Assuming that TLK does divest a portion of its stake in Finnet Indonesia in time to come, this will help to assign a valuation to Telekomunikasi Indonesia’s equity interest in this fintech and payment services company based on the actual stake sale transaction. More importantly, this might pave the way for an eventual public listing of Finnet Indonesia with new shareholders coming on board, who are likely to be keen on monetizing the value of their investments in the future.

Potential Data Center Business IPO Might Happen Soon

At the company’s Q2 2023 earnings briefing last month, Telekomunikasi Indonesia revealed that it is in “the process of restructuring our data center business by consolidating the business and assets under one entity called PT Telkom Data Ekosistem with NeutraDC as the brand.”

Although TLK noted at its most recent quarterly results call that the recent move to reorganize its data center business was to “enhance competitive advantages”, it isn’t a stretch to think that Telekomunikasi Indonesia is also preparing for a potential IPO of the company’s data center operations.

It is worthy of note that Telekomunikasi Indonesia’s CEO Ririek Adriansyah had mentioned in an October 2021 media interview that the company was thinking of listing its data center business in 2023. In November last year, a Bloomberg news article also noted that a public listing was one of the proposed fund raising options for TLK’s data center assets.

There are two factors supporting the case for TLK executing on an IPO of its data center business in the near term.

One key factor is that Telekomunikasi Indonesia’s data center operations have already scaled up significantly with the necessary size for a public listing. TLK generated IDR837 billion in sales from data centers & cloud services for 1H 2023 as indicated in its interim earnings presentation slides. This means that the annualized revenue for company’s data center business is roughly above $100 million. As of end-1H 2023, TLK operated 30 data centers, which includes those located in foreign markets (outside Indonesia) like Hong Kong, Singapore and Timor-Leste.

Another factor is that the performance of TLK’s prior spin-off, PT Dayamitra Telekomunikasi [MTEL:IJ], has been pretty decent. Dayamitra Telekomunikasi, TLK’s telecommunications towers and infrastructure business, was previously spun off from TLK and listed on the Indonesia Stock Exchange in November 2021. Adjusted for dividends received, Dayamitra Telekomunikasi’s last done share price of IDR745.00 as of September 4, 2023 is just roughly on par with its closing stock price of IDR746.59 (source: S&P Capital IQ) on its first day of trading (November 22, 2021), despite substantial equity market volatility in the past two years. This proves that there is meaningful demand for telecommunication and digital technology assets in public equity markets, and Telekomunikasi Indonesia’s potential data center IPO is likely to be well received.

Closing Thoughts

There is a mismatch between Telekomunikasi Indonesia’s valuations and growth outlook. The market sees TLK’s EBITDA expanding at a +9.9% CAGR for the FY 2022-2026 period, but Telekomunikasi Indonesia trades at a consensus forward next twelve months’ EV/EBITDA multiple of just 5.0 times as per S&P Capital IQ’s valuation data. In my view, TLK deserves a Buy rating, as potential value unlocking corporate actions could bring about a positive re-rating of the stock’s valuations in due course.

Read the full article here

Leave a Reply