Target Overview

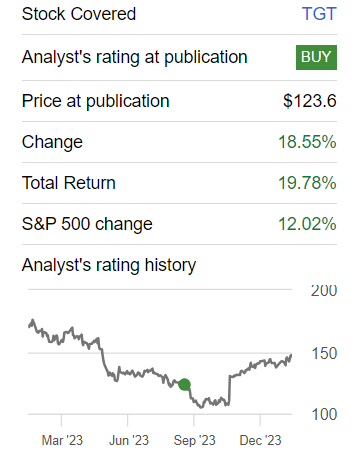

I previously covered Target (NYSE:TGT) back in September 2023 and rated the stock as a Buy. The target stock price back then was about $123/share. We’ve since seen the price appreciate by about 20% in comparison to the S&P 500’s (SPY) 12% upside over the same period. The TGT dividend growth is likely to continue being strong based on the future outlook and cash flow. The dividend streak has now reached 55 years of consecutive increases, making Target a certified dividend king. I like Target as a dividend growth holding in my portfolio because it gives me exposure to one of the highest quality companies in the consumer sector.

Seeking Alpha

As a quick summary of the business, Target is a leading general merchandise retailer in the United States. They offer a diverse array of products to cater to various consumer needs such as trendy apparel and accessories, beauty products, household supplies, pet care, and more. Target ensures a one-stop shopping experience. In addition to groceries, electronics, furniture, and home décor, Target collaborates with designers and offers unique in-store experiences to enhance customer satisfaction.

Target’s financials have remained consistently healthy and the revenue outlook is strong despite short term consumer headwinds. TGT stock valuation metrics indicate that the price also trades below fair value so I plan to add more to my small position size. TGT will announce earnings on March 5, 2024, so we first look into what we can expect from the next report.

Target Q4 Earnings Preview

A year ago Target reported their Q4 2023 earnings and crushed it by beating EPS expectations by $0.49/share. The FY EPS estimate for 2024 is 8.37x. This means I’m expecting Target’s Q4 earnings preview to align within the range of 2.4 – 2.45 to meet expectations. Ideally, TGT will report higher than this and surpass expectations as they have done in the past. The upcoming earnings will be reported on March 5, 2024. For reference, actual reported earnings surpassed expectations for 4 quarters in a row now.

Over the last five year span, Target’s EPS diluted growth has achieved a 12.77% CAGR while operating cash flow has grown at an average of 10.26% per year over the same time span. Revenue growth has slow since the pandemic but now that consumer spend is increasing, I think it’s likely Target will achieve between a 6%-8% revenue growth YoY. For context, the revenue growth average over the last five-year span was 8.25% per year. I believe strong Target will experience strong growth from here based on a few outlook items.

TGT Stock Outlook and Valuation

I think that the outlook for Target’s stock is looking great over the course of 2024. The reasons I believe this to be true are due to outside influences not related to Target’s business itself. Nowadays, people are becoming increasingly comfortable with the higher costs of goods and market analytics show us that the consumer spending numbers have increased. Just as a point of reference, here are some figures to reinforce this:

- Fitch estimated consumer spending to increase 1.3% over 2024.

- Household income increased 6.9% in 2023.

- Average disposable household income increased 4.2% YoY.

- The percentage of loan balances 90+ days delinquent remain at a multi-decade low across auto, home, and credit.

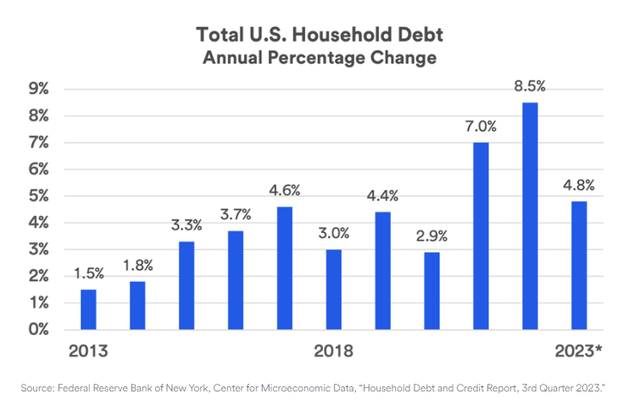

Federal Reserve Bank Of NY

Looking at the chart above, you can see that the average household debt has increased by 4.8% as of Q3 of 2023. Naturally, you might think that this means families are more conscious with their spending. However, data tells us that the opposite is true.

Surprisingly, the economy surged ahead with a robust 3.3% annual growth rate in the last quarter of the previous year. This unexpected expansion was largely fueled by strong consumer spending, marking a significant turnaround from initial concerns. American consumers demonstrated confidence by increasing their spending at retailers throughout the December holiday season.

In terms of valuation, TGT’s P/E (price to earnings) currently sits at 18.6x which sits below the five-year average P/E of 19.16x. In addition, the current price to book ratio is 5.18, which sits below the average five-year price to book ratio of 5.97. If we compare these metrics to close competitors, we can reinforce that TGT remains undervalued. For reference, Walmart’s (WMT) P/E ratio sits at 28x and the sector median P/E is 20.82x.

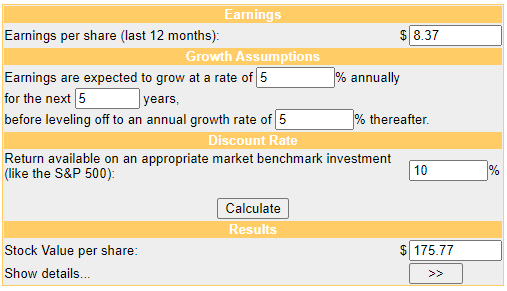

The current target stock forecast is quite optimistic with upside expected. The average price target stated by Wall Street is $154.76/share which represents a small upside of about 3%. However, the highest price target in the range falls at $180/share which would represent a potential upside of 20%. Running our own DCF (discounted cash flow) calculation, we determine Target’s fair stock value to be around $175/share which represents an upside potential of about 17% from the current Target stock price.

Money Chimp

Since consumer spend continues to be strong, I think a 5% growth is certainly achievable here. Target’s average year-over-year EPS growth currently averages 6.35% but taking a conservative outlook here gives us a realistic perspective that considers any unexpected headwinds. When you take this into consideration and combine it with the dividend yield of 3%, you are looking at double-digit growth through 2025. This is not considering the strong dividend growth history that Target has been able to achieve as well.

Target Stock Dividend

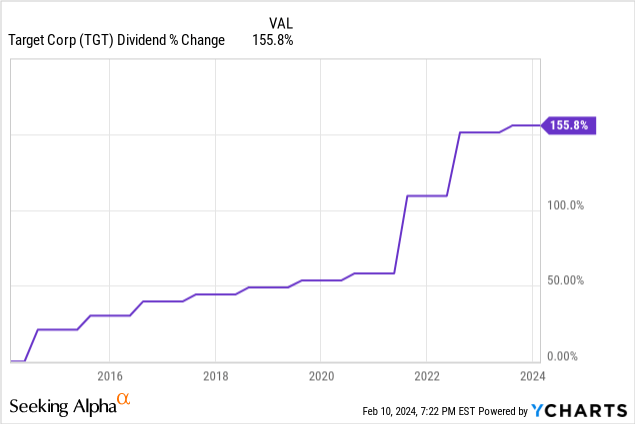

As of the latest declared quarterly dividend of $1.10/share, the current dividend yield sits at 3%. The dividend has been increased for 55 consecutive years in a row. Not only is this an amazing feat in itself, but the dividend growth has been pretty solid as well. Over the last decade, the dividend has grown at a CAGR of 10.68% per year. This means that in total, the dividend has grown over 155%. On a smaller time frame, the growth is even more impressive. Over the last three-year period, the dividend has grown at an impressive CAGR of 17.61%. When you consider that the pandemic was still actively in progress and consumer spend was suppressed for the last three year period, this is especially impressive.

The safety metrics here are also pretty solid and I have no doubt or concerns about the sustainability of the dividend. The current cash dividend payout ratio sits at 55% which aligns with the sector median payout ratio of 54%. This is a big improvement over the pandemic-era dividend payout ratio. If we look back over the last five-year period, the average dividend payout ratio during this time frame was 80%. The company has a cash from operations balance over $8B which will certainly cover any potential revenue headwinds.

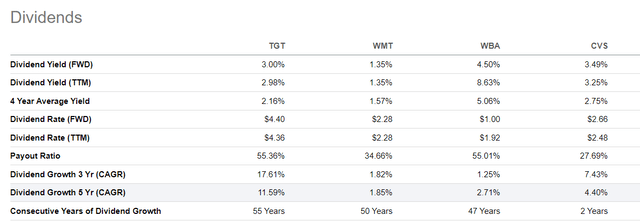

In comparison to their peers, the dividend growth is in unmatched in my opinion. For this, we will compare Target against Walmart (WMT), CVS (CVS), and Walgreens (WBA). As we can see, the dividend growth of Target completely outperforms these group of peers by a mile. Though Walmart is a great company, its dividend growth has lacked in comparison which makes TGT a better fit in a dividend growth portfolio.

Seeking Alpha

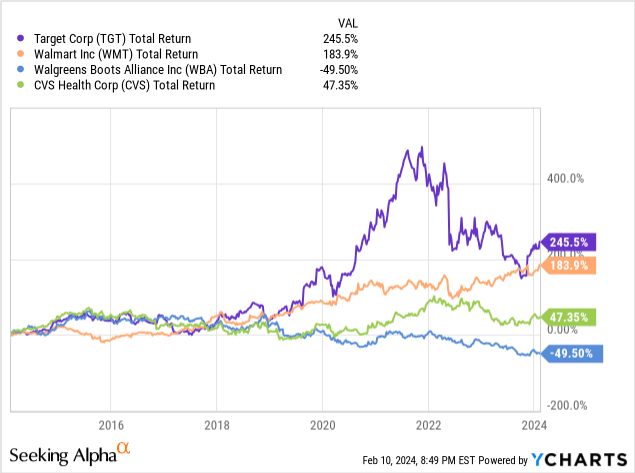

However, WMT does admittedly have a much better payout ratio than Target which means they have more cash to reinvest back into the business. Not only does TGT’s dividend growth outpace the group of peers but it also outperforms in total return over the last 10-year period.

All of this reinforces that Target continues to deserve a spot in my dividend growth portfolio. I love that it can provide exposure to an industry with continued projected growth and simultaneously provide a growing stream of income to help fund my retirement. As a bonus, Target’s price appreciation also helps match or outperform the S&P 500 (SPY).

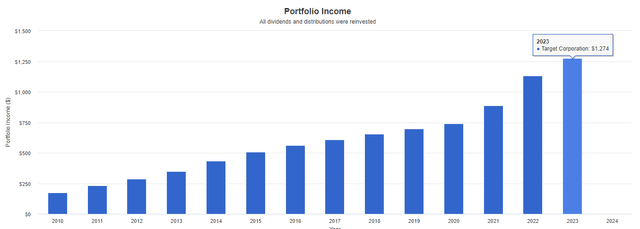

Using portfolio visualizer, we can see that an initial $10,000 investment in Target starting 2010 has yielded strong results in total return and income growth. If you invested $10,000 and only reinvested dividends without adding additional capital, your income would have grown from $175 in dividend income up to $1,274 in present day. Your original $10,000 investment would also be worth over $40,000. I plan to add to my position and replicate these results over the next 10 years.

Portfolio Visualizer

Risks

Like other companies in this consumer sector, Target remains vulnerable to shifts in consumer spending and other macro elements such as interest rates or high inflation. High interest rates and high inflation can impact Target in several ways. Firstly, high interest rates increase the cost of borrowing for both consumers and businesses. This could lead to reduced consumer spending that doesn’t align with the previous mentioned projections.

We’ve also had the doom of a recession happening soon which can impact revenue and profitability. According to economists, the chance of a recession within the next 12 months is about 50%. As a result, consumers may opt for cheaper alternatives or reduce their overall spending.

Though there’s always a possibility of these things happening, I believe the risks are well managed. Target has close to $9B in cash from operations that will help them to navigate any potential headwinds. Also, I believe that Target’s product mix is diverse enough to maintain revenue levels as people shop at target for different things. There are people who are customers exclusively for their groceries, clothing, home furniture and appliances, or a combinations of all.

Takeaway

In conclusion, Target (TGT) continues to present a great entry opportunity for investors seeking both growth and income in their portfolios. With a track record of solid financial performance and a commitment to shareholder value, Target stands out as a top choice in the consumer sector. Despite potential macroeconomic headwinds such as high interest rates and inflation, Target’s robust business model, diverse product offerings, and excellent financial management mitigate these risks to a considerable extent.

The company’s impressive dividend growth history, coupled with its consistent revenue and earnings growth, reaffirms its status as a reliable income generator. Not only are the dividend metrics great but the valuation looks attractive here when you consider the projections of consumer spend. Looking ahead, the optimistic outlook for consumer spending and Target’s strategic positioning within the market aligns them for continued success. As an investor, I remain confident in Target’s ability to deliver long-term value therefore the stock is rated as a Buy.

Read the full article here

Leave a Reply