Thesis

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is the largest worldwide electronic chip manufacturer, supplying to many of the world’s technological giants such as Apple, Google, and Amazon. Currently, TSM is up 23.56% year to date, sitting at a valuation of $89.25. Despite past struggles, including a recent semiconductor chip shortage across the globe, Taiwan Semiconductors remains a stock to look out for due to promising customers in a growing industry.

High Value Customers

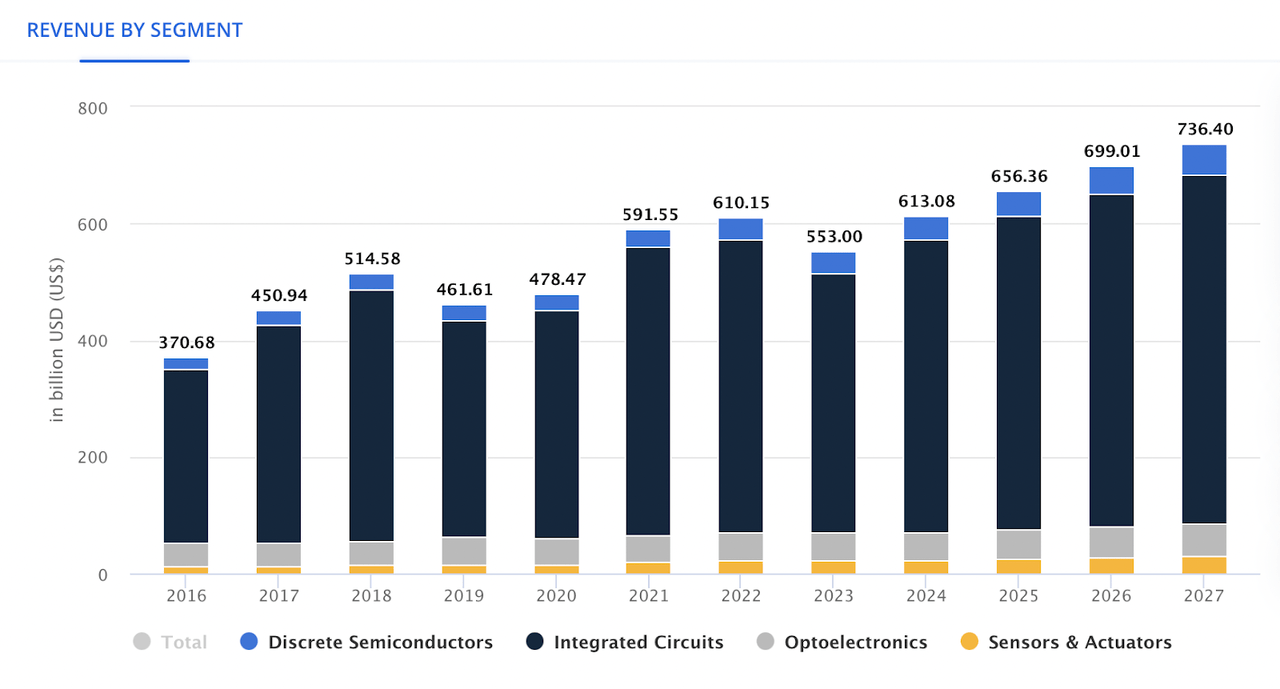

Compared to competitors in the semiconductor industry, Taiwan Semiconductors holds a sizeable lead due to the huge catalog of brands they produce products for. Among this list are high caliber and Fortune 500 brands such as Apple, Qualcomm, NVIDIA, Broadcom, Google, Amazon, Intel, and more. With the partnerships of these brand comes high market share in the semiconductor industry, placing TSM at a 60% global market share in an industry worth over $550 billion. Despite other competitors which high name recognition, TSM remains the dominant supplier and manufacturer for many recognizable technological brands, ensuring guaranteed sales and business for the global superconductor company throughout the entirety of 2023 and 2024.

Historical Semiconductor Industry Revenue (Statistica)

Main Supplier for Apple Inc.

Ultimately, the largest catalyst in Taiwan Semiconductor’s arsenal is being the main chip producer for Apple Incorporated, arguably the most recognizable technology brands in the world. With Apple accounting for 26% of TSM’s business, Taiwan Semiconductor’s financials are a sure bet to increase in the upcoming quarters with the release of a new line of flagship items for Apple, including a new line of iPhones, Apple Watches, and updates to the AirPods brand. As demand and sales for these new products begin, Taiwan Semiconductor’s revenue is set to increase, as they supply the new chips which constitute Apple’s technology. Compared to previous years, 2023’s line of iPhones are set to be introduced to a larger audience, especially with the implementation of USB-C as the charging port. In a brand comparison, Apple and TSM have revenues which reflect each other due to their close involvements. In 2018, when Apple began to have a surge in revenue, the steep incline in revenue until 2021 was also mirrored by TSM, whose revenue is strongly based off of the success of their collaborator, Apple technologies.

Another key player in TSM’s arsenal is their collaboration with NVIDIA, who is currently receiving major successes in the technology industry. With the recent resurgence of artificial intelligence in consumer technology products, such as Bing and ChatGPT, NVIDIA was not late to hop on the trend, with the creation of generative software, as well as GeForce AI software. Both of these new products have contributed to massive successes for Nvidia, which does indeed rely on Taiwan Semiconductor chips for their products and machinery, such as the GeForce RTX 40 series, or the highest end of graphic cards on the consumer market. With these and other products Nvidia use requiring further computational power, their reliance on TSM has only increased, leading to more revenue sourced for the semiconductor manufacturer.

With the addition of these mega-corporations and their business comes the addition of new demand; however, rather than getting held up by the new production requirements, TSM is already planning to expand operational business. Projected for 2025, Taiwan Semiconductors will be opening a semiconductor plant in Arizona to further satisfy customer orders and expedite the production and shipping process to North American consumers. With $40 billion projected to be invested in developmental projects in this facility, TSM will be increasing partnership details and producing more inventory for their customers, all yielding higher return on investments and further increasing company revenue. Although one semiconductor fabrication plant is currently under construction, six in total are projected to be placed in the campus, gradually opening operations, with the second fabrication being slated for 2026. Ultimately, this will only mitigate risks of business and further escalate operations.

Financials

Despite a 4.9% year-over-year revenue decline reported in Q2 of 2023, with $15.68 billion being brought in, financials are relatively stable for the semiconductor manufacturer. In July, net income increased 13.6% month over month, with additional revenue estimates being beating consensus estimates by 0.43%. Further, EPS resulted in higher than expected values, beating expectations by 5.11% to an ultimate valuation of $7.01.

Ultimately, the decline in revenue production is largely contributed to the decline in semiconductor production, largely back behind the recent semiconductor shortage. The scarcity of chips led to TSM’s operations slowing down, with less parts being sold and reeling in less revenue.

Analyst expect for this metric to increase during Q3 2023 for two main contributing reasons. First, with the shortage of semiconductors coming to an end, production and shipping is expected to resume to normal rates, and consumers returning to purchasing high amounts of semiconductor chips. Additionally, the fall months of the year are typically those which hold the highest amount of technological product releases, as seen by the recent Apple lineup mentioned above. The increases in purchases will return TSM’s operations to its former status.

Valuation

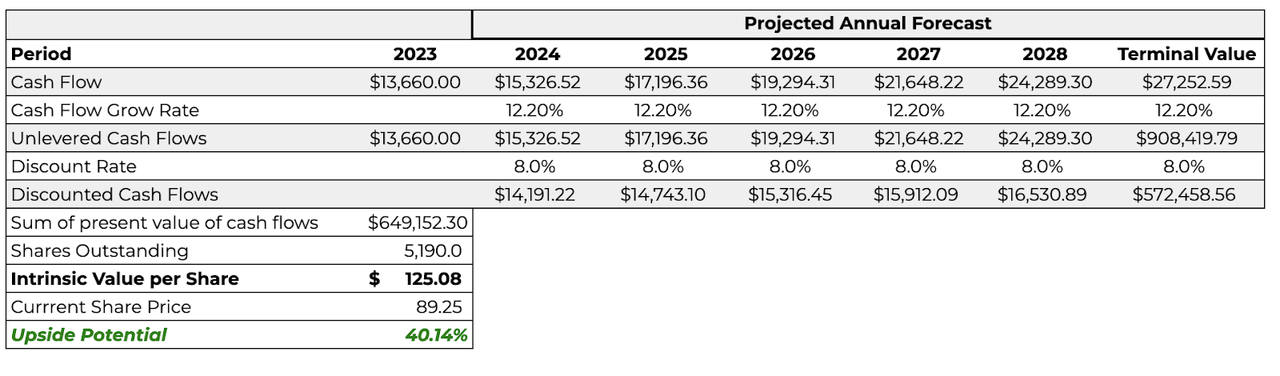

My discounted cash flow analysis of Taiwan Semiconductor marks a 40.14% upside potential, with an intrinsic value of $125.08 compared to the current price of $89.25. In this discounted cash flow model, I used a compound annual growth rate of 12.2%, as per Fortune Business Insights. Additionally, I used a terminal growth rate of 5% and discount rate of 8%, or other industry standard rates. The intrinsic value poses as a high measure of future profitability of TSM, thus the buy rating for the stock.

Discounted Valuation Analysis (Fortune Business Insights)

Risk

Although Taiwan Semiconductors is largely a stock which has minimal downsides, the current state of the sector presents a potential risk to profitability. In 2022, after pandemic complications led to a global semiconductor chip shortage, the overall industry took a tumble for the worst. Companies like TSM were detriment due to supply shortages, creating downturns in business. Some repercussions were still impacting recent financial returns, viewed by the 4.9% decline in revenue year over year in this past quarter. However, potential risks are mitigated through the 6% growth projected for the sector in the upcoming fiscal year, as well as great projections for the overall profitability and revenue of TSM in upcoming quarters, highlighted under financials.

In further addition, the location of Taiwan Semiconductor’s base operations is not the most optimal, with the largest percent of development occurring in Taiwan. Although the current political climate between China and Taiwan seems volatile, especially considering the ramifications of conflict between the powers on the global economy, TSM is already planning for alternatives pending the potential altercation. As mentioned, TSM plans to open a fully operational development factory in Phoenix, Arizona in 2025, where additional chips will be produced in addition to further products for new customers. This mega-operation building seems to be a safety net in case of posed threats, as well as an excellent way to further expand current business and mitigate risks.

Other potential concerns may include the termination of certain partnerships of TSM, such as Apple technologies. However, the possibility of Apple and Taiwan Semiconductors parting ways is fairly unlikely, considering the nearly 10 year partnership the brands have together. Finally, with research and development costs accumulating rapidly, it would be an extremely unwise investment for the technology giant to leave their main supplier of semiconductor chips without notice.

All of these beneficial projections project for TSM to reduce potential risks, and be a relatively safe investment.

Conclusion

Ultimately, Taiwan Semiconductor Manufacturing Company Limited looks to be a strong, valuable stock for growth. The combination of a great prosperous sector and the mega-corporation brand partnerships with Apple and Nvidia, among others, sets up TSM to be a company almost certainly guaranteed for commercial success. Additionally, potential downsides are mitigated in company plans, ensuring TSM a likely successful future, as well as a buy grade.

Read the full article here

Leave a Reply