Being an asset manager is a great business, if you’re lucky enough to find yourself in the position of being one. It’s (paradoxically) asset light, high margin, and incredibly predictable. Fees churn in quarter after quarter, no matter what is going on in the world.

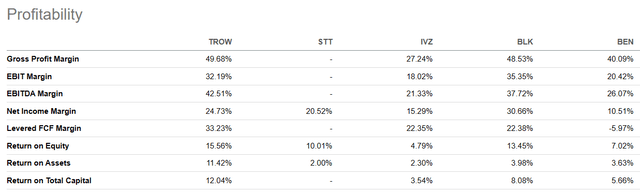

For proof of this fact, look no further than a few of the top public equity fund companies that are currently listed on U.S. stock exchanges:

Seeking Alpha

Each of these competitors – including BlackRock (BLK), Franklin Resources (BEN), Invesco (IVZ), T. Rowe Price (NASDAQ:TROW), and State Street (STT) – regularly rakes in net income margins of 10% or more; and closer to 25%+ if you’re at the top of the heap.

T. Rowe Price is one of these premium managers.

The firm has been in business for longer than almost anyone else, and it’s earned a status and reputation for being a big dog in the industry. The company earns thick margins and industry-leading returns on assets, equity, and total capital.

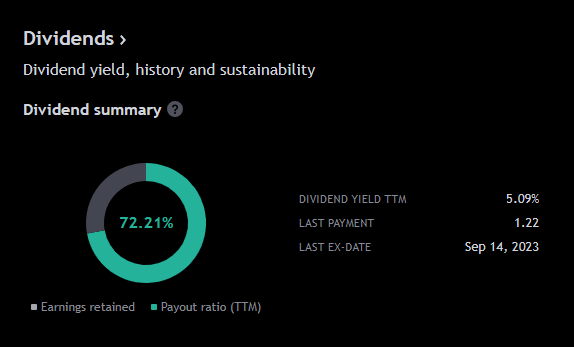

The company also pays a generous 5.1% dividend to investors, a sign of the company’s maturity and end market saturation.

Despite this, the company’s stock has had a rough few years, dropping more than 57% since the market highs in late 2021:

TradingView

Behind the slump are fears of fee compression stemming from competition with Blackrock, a general market malaise that has hurt almost all public equities, and an increase in indexing as the ‘go-to’ investment strategy for the masses.

For context, TROW’s products are mostly high-end, expensive, actively managed funds that earn fat fees from a majority-boomer investor base that has no real reason to switch.

However, once the wealth gets passed on as the boomer generation begins to die off, many current investors fear that those who inherit wealth from their parents will see TROW’s investment vehicles as too high-cost.

This has sparked fears about a potential future dividend cut should TROW’s business begin to deteriorate, which would be a massive blow for the company which presently maintains its Dividend Champion status, having paid growing dividends to investors over the last 34 years.

Today, we’ll examine TROW, its prospects, and its dividend situation to get a better idea about whether or not the storied investment manager is in trouble.

Let’s dive in.

Financials

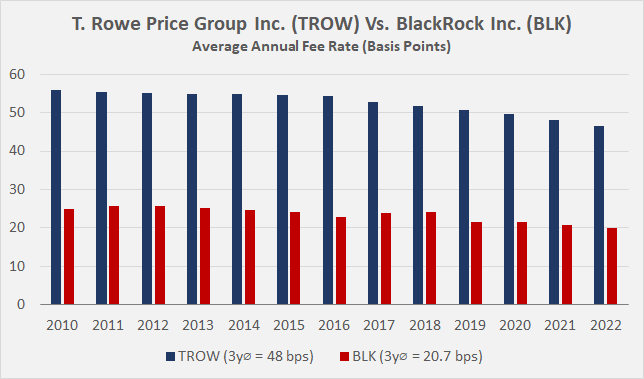

If you could sum up the bear case in a single chart, it would be this:

Deep Value Ideas

Put together by Deep Value Ideas, this chart shows fee trends (in basis points) across TROW and BLK over the last decade plus.

The trends are not pretty.

As time has passed, TROW has had to reduce fees on its investment products significantly as lower-cost competitors have entered the space – folks like Blackrock and Vanguard.

Average fees have declined from ~55 basis points in 2010 to ~48 now, a drop of 12%.

While certainly not a death knell, in combination with net cash withdrawals picking up recently, the only bullish trend is the growth in the underlying equity markets themselves:

Assets under management ended the second quarter of 2023 at $1,399.4 billion, an increase of $57.7 billion from March 31, 2023 and $124.7 million from the end of 2022. The increase in assets under management during the second quarter of 2023 was driven by market appreciation, net of distributions not reinvested, of $77.7 billion, offset by net cash outflows of $20.0 billion.

For the six months ended June 30, 2023, the increase in assets under management was driven by market appreciation, net of distributions not reinvested, of $160.8 billion, offset by net cash outflows of $36.1 billion.

These trends are worrying, especially as competitors like Blackrock continue to hoover up assets:

On the most recent earnings call, CFO Martin Small had the following to say:

“Clients entrusted BlackRock with an industry-leading $190 billion of net inflows in the first half of 2023. Our $9.4 trillion in assets, 9.4 trillion units of trust are up over $830 billion since year end.

This increase reflects continued strong organic growth and ongoing client confidence in the work that BlackRock is doing on their behalf as markets evolve. Clients choose BlackRock for performance.“

CEO Larry fink continued:

“BlackRock’s industry-leading results reflect our client’s continued confidence in our long-term performance. We are delivering sustained organic growth and base fee growth even as the traditional asset management industry logs persistent outflows. BlackRock generated $190 billion of total net inflows in the first half of 2023, including $80 billion in the second quarter, reflecting positive flows from wealth and institutional clients across regions.“

These trends have impacted financial results.

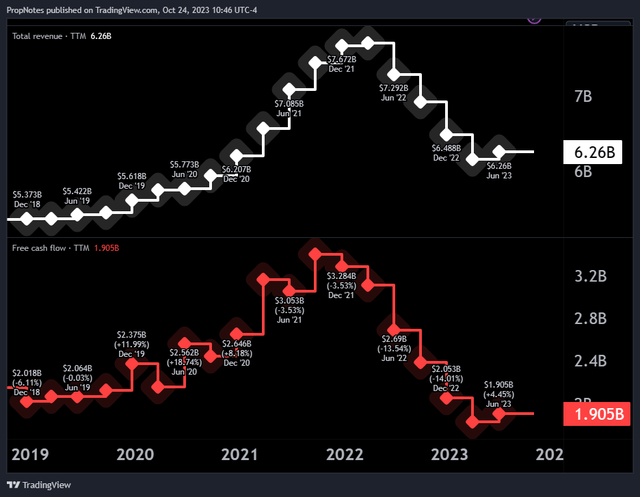

When looking at TTM financials, TROW saw a decrease of top line sales from ~$7.7 billion in late 2021 to ~$6.2 billion at present:

TradingView

While this trend has recently reversed somewhat and a decent percentage of this revenue is dependent on underlying appreciation, one might ask why bother holding a stock that’s simply a leveraged business model on the size of the U.S. equity market?

This trend is mirrored in TROW’s free cash flow statement, which saw nominal pickups and declines of about the same amount, but on a lower base – contributing to relatively volatile bottom line results.

It is impressive that TROW’s cost structure is stable to this degree, but it also means that the business could be structurally disadvantaged should equity markets shrink further.

Given the economic backdrop, that’s not an impossibility.

The Dividend

But what about the dividend?

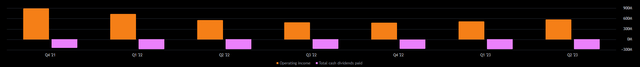

Right now, the TROW stock pays out roughly $280 million per quarter in dividends, which is thankfully well within the company’s ability to pay, with operating income more than double that in most financial periods:

TradingView

However, it shouldn’t take too much margin or asset compression for this number to recede to the point of becoming an issue.

TROW’s payout ratio, when you look on a retained earnings basis, is closer to 72%, which is somewhat concerning:

TradingView

It’s not ‘stressed’, up at 90%+, but anything more than 60% makes it tough for a company to maneuver in the markets.

The company may not need that maneuverability given the static business model, but it’s something to note.

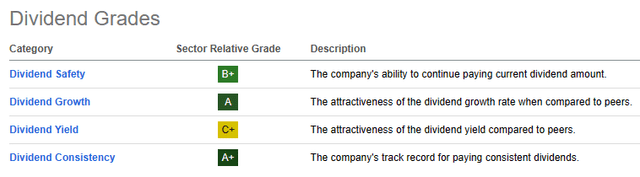

Finally, it’s worth noting that Seeking Alpha’s dividend rating system has assigned a safety rating of “B+”, which is quite good:

Seeking Alpha

However, that rating looks to describe whether or not the company can keep paying the current rate, not continued growth into the future.

When combined, our opinion lands somewhere in the middle of the bullish and bearish trends we’re observing.

While it seems likely that TROW will be able to keep its dividend at this level for a long time to come, the combination of net outflows and declining fee structures over time means that the core business is in secular decline, only buttressed by capital markets appreciation.

It’s tough to know which of these trends will win out over the next decade.

In our view, holding the stock is likely the best course of action for the time being, but looking for early signs of trouble as an exit strategy may also be prudent.

Risks

It’s worth pointing out that earnings are this Friday, the 27th. We’re not expecting any earth shattering news, due to the aforementioned stability and predictability of the business.

However, it’s always difficult to tell how the market will react to earnings numbers, even if the company ‘beats’ expectations.

Other risks continue to be the obvious ones, like net outflows and fees being snatched up by competitors. However, at this point, the fears seem well understood by the market given their long-term nature.

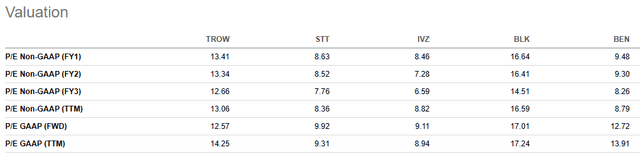

Finally, the valuation presents a potential concern. While not nominally expensive vs. the average S&P 500 stock, the company does trade at a premium to its peer group:

Seeking Alpha

If the market begins to smell weakness on the part of TROW, then it’s premium status could be cut and the multiple may come in closer to smaller competitors that are facing the same headwinds, like IVZ and BEN.

That represents a potential ~30% downside, depending on financial results and how the market reacts to them.

Summary

All in all, we see TROW as a hold. The company has a long track record of paying dividends, which is something we don’t see stopping anytime soon.

However, secular declines in TROW’s core asset management business should lead to pressure over the long run, and for those reasons we don’t see the stock as a “forever hold” company. Blackrock seems like a company much more suited to that moniker.

If you’re long, then probably stay long. But if you’re looking for a high paying dividend champion to add to your portfolio for the first time, TROW might not be the right fit for you.

If you enjoyed this article, be sure to give us a follow and turn on notifications to hear about when we publish again.

Cheers!

Read the full article here

Leave a Reply