Investment Update

Following my second buy rating on Sylvamo (NYSE:SLVM), the stock is +6% and provided ~400bps of alpha vs. the S&P 500 on a time-weighted basis. The overarching thesis on SLVM supporting its buy rating includes the following:

- Reasonable valuations where the risk/reward opportunity is asymmetrically skewed to the upside. At ~10x earnings / 1.9x EV/IC, market multiples 1) have a high propensity for expansion but 2) have less scope for contraction beyond current levels [unless a complete change in the business performance occurs].

- Management’s attitude towards allocating capital, with ~$200mm set for allocation towards “high return projects” at the end of Q1 FY’24. It is rolling off capital as well (via debt service + NWC work through) and has shed gross debt by >40% since the spin-off.

- The business repurchases high amounts of stock, therefore increasing our stake in a high-quality enterprise without any additional outlay of capital to do so. All cash that isn’t serviceable internally, where $1 of earnings retained will fail to create >$1 intrinsic value, is returned to shareholders. Management is shareholder-oriented, in other words.

- Valuations supportive up to $95 per share in base case assumptions, stretching above $200/share in the upside scenario with (i) less embedded risk [i.e. discount rate] and (ii) more aggressive growth targets.

Net-net, I reiterate SLVM as a buy with a price target range of $95-$97/share. This brief report will discuss all updates to modelling and assumptions, plus a breakdown of the company’s latest quarter.

Figure 1.

Seeking Alpha

Q2 FY’24 Earnings Breakdown

SLVM put up Q2 revenues of $933mm (+150 bps YoY) and pulled this to adj. EBITDA of $164mm. Geographically, the business saw growth in Europe (+14%), and North America (+300bps) but saw a 100bps declining business in its Latin America domain. Management said that operating rates saw a short-term tailwind from 1) a large supplier converting ~400 bps of its uncoated free sheet capacity over to pulp during the quarter, and 2) A major European competitor mothballing a machine in Germany, thus reducing supply in Europe by c.500bps. There’s no saying what long-term structural tailwinds these will provide, but in the near term, they are favourable for pricing in my view.

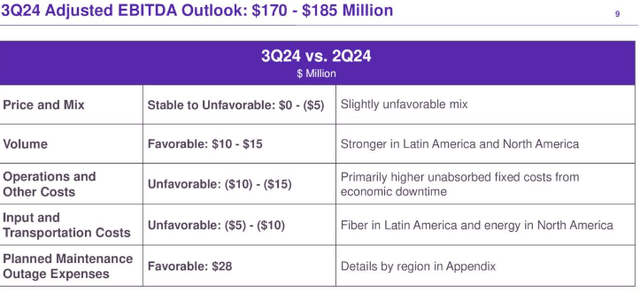

Moving down the P&L, it saw ~$26mm of price + mix improvement combined, and this was supported by a $8mm increase in volume for the quarter. This isn’t out of the norm, as this business is quite cyclical and seasonality is highest in this part of the year. Management now expects $185mm adj. EBITDA for Q3, driven by a $15mm increase in volume at the upper end of the range. Critically, it won’t see the same pricing tailwinds as Q2, but volumes should do enough to drive growth in my opinion. Moreover, operating costs are expected to lift by$10-$15mm, particularly as it works through downtimes in its main sites.

Figure 2.

SLVM investor presentation

A central point of attractiveness for this name is the amount of capital that is returning to investors. SLVM raised its dividend by 50% to $0.45 per share in ’24, and has re-purchased $30mm worth of its own stock this YTD. These are shareholder-friendly moves that add to the buy thesis in my opinion.

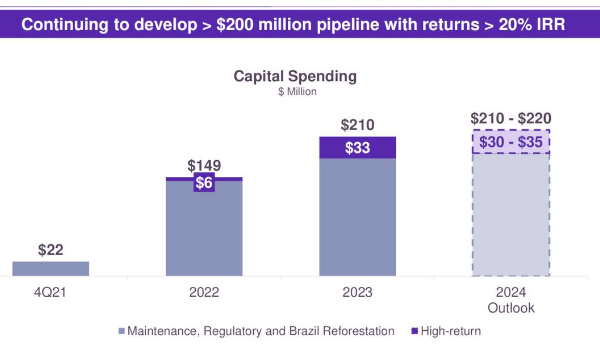

Finally, one of the most compelling factors from management is that it continues to eye off high-return projects to reinvest capital internally. When the business first spun off, it had ~$100mm of ‘high-return’ projects in its grasp. It has funded about $70mm of these so far and has another $200mm worth of “high return capital projects to invest in the coming years”. Per management’s language on the call:

These projects are of varying sizes,, and are largely focused on our flagship mills providing us with opportunities to grow our earnings and cash flow.

We expect such investments to generate well above cost of capital return.

Such language is exactly the kind of attitude I am looking for to fund our equity portfolios here at Bernard. I am specifically after management that can identify high-return investment opportunities to plough back funds into the business and grow the capital base (call this growth vs. sales growth, for instance). The capacity to produce high returns – that is, high incremental earnings – on these incremental investments is the secret source in my opinion. But the ability to retain and reinvest high sums of cash back into an existing operation is the key to compounding a company’s market value at high rates of return at a given multiple. SLVM exhibits just that.

Therefore, my view of the company’s quarter is that it was tremendously attractive and fits with a reiterated buy thesis.

Figure 3.

SLVM investor presentation

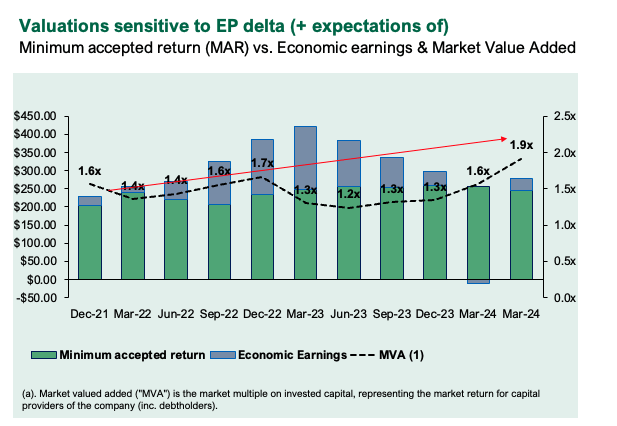

Valuation Upsides Intact

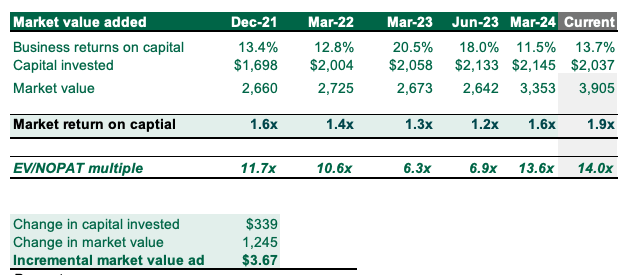

The market pays attention to the economic value SLVM is producing and has awarded the company with higher valuation multiples over the last two years. The business now trades at. 1.9x EV/IC, up from a low of 1.2x in FY’23.

Critically, the market values SLVM management’s capital allocation decisions highly, indicating they are of an intelligent nature and that management is a good steward of investor funds. Each dollar that has been reinvested back into the business since 2021 has been valued at $3.67 in the market, such that $340mm of capital reinvestment has produced $1.25Bn of additional enterprise value (Figure 4).

Figure 4.

Company filings, author

Figure 5.

Company filings, author

Valuation insights

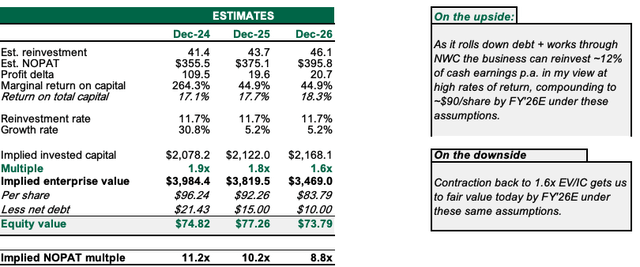

- My view is these trends in ROIC, reinvestment and capital growth can continue. My updated forward estimates (see: Appendix 1) illustrate the forward progression under steady-state assumptions. Here I am assuming the future (next 2-3yrs) is similar to the present for SLVM. As it rolls down debt + works through NWC, the business can reinvest ~12% of cash earnings p.a. in my view at the high rates of return management seeks, compounding to ~$90/share by FY’26E under these assumptions. The embedded expectations are still low in my opinion (~10x NOPAT, and I get to ~8x by FY’26E) meaning the propensity to surpass these expectations is high.

- On the downside, contraction back to 1.6x EV/IC gets us to fair value today by FY’26E under these same assumptions. This is a ~15% margin of safety on the multiples side.

Figure 6.

Author

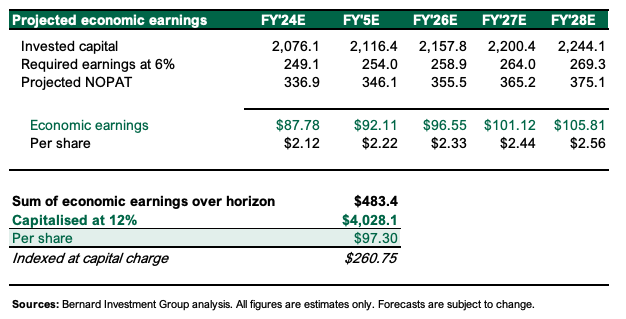

- The discounted value of cash in present value terms under my base case assumptions shown in Appendix 1 sums to $97 per share – in line with my previous estimates of intrinsic value of this business. Here I am applying tremendously high-risk factors to these estimates – a capital charge of 12% on all cash producing assets – and discounting these at the opportunity cost of 12% as well. These are high parameters, and the business looks as if it can still grow its intrinsic at a statistically meaningful rate of return over the next 3 to 5 years. This supports a reiterated by rating.

Figure 7.

Author

Risks To Thesis

Key downside risks to the thesis include 1) negative revenue growth as this trumps the valuation, 2) management failing to redeploy funds at a rate of ~8% NOPAT at the min. for the same reasons, and 3) the space of macroeconomic factors that must be built into all investment reasoning right now, principally the risk of unforeseen rate changes or inflation prints, geopolitical risks and the spillover of commodity supply shocks on equity markets.

Investors must recognize these risks in full before proceeding any further.

In Short

SLVM remains a buy in my opinion due to 1) management’s shareholder oriented attitude in returning capital to shareholders and seeking out high return investment opportunities by retaining and re-deploying freely available cash flows, and 2) valuations that support $95-$97 per share with high embedded risk factors and hurdle rates built into the economic modelling. I am after businesses that can retain and reinvest loads of cash at high rates of return, and do this on a persistent basis. This “persistence” is highly desirable, yet it is equally as rare. SLVM is in possession of these economic characteristics in my opinion. Reiterate buy.

Read the full article here

Leave a Reply