Salad chain Sweetgreen (NYSE:SG) has a long runway for store expansion, as well as margin expansion driven by automation and cost savings. Prospects however appear baked into stock.

Company Overview

Sweetgreen is an American fast casual restaurant chain that specializes in healthy salads and warm bowls. As of June 2023, the company operated 205 restaurants in 18 states and Washington D.C.

1H 2023 performance

-

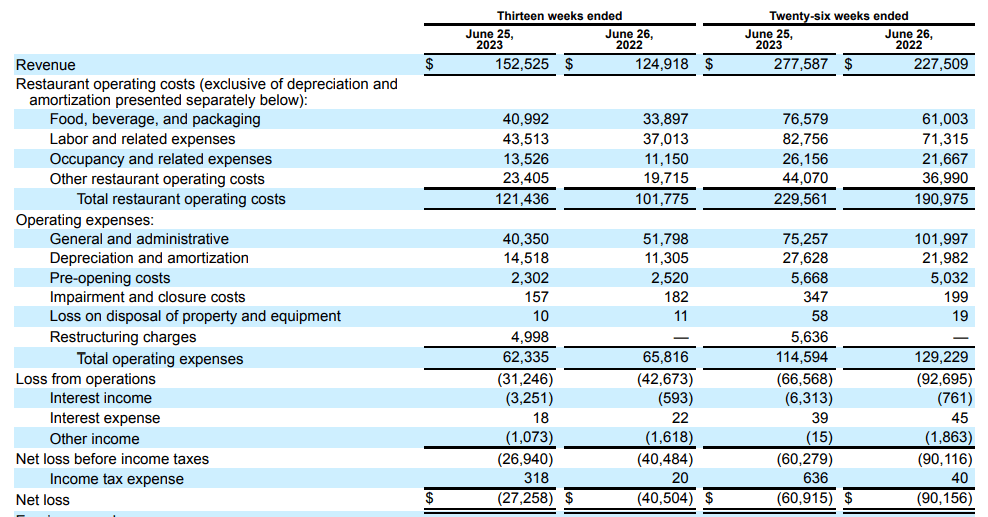

1H 2023 revenues rose 22% YoY to $277 million supported by 19 net new restaurant openings. Average unit volumes (AUV) increased to $2.92 million compared with $$2.881 million the prior year period.

-

Restaurant level margins increased to 20.4% during the period from 18.5% the prior year period driven by a decrease in labor costs (labor accounted for 28% of total revenues in 1H 2023 compared with 29.6% in 1H 2022).

-

Operating losses improved to $66.5 million from $92.6 million the same period last year largely driven by a 26% YoY drop in General & Administrative expenses. G&A expenses accounted for 27% of revenues in 1H 2023 compared with 44% the same period last year.

Sweetgreen 10-Q, Q2 2023

For FY2023, management is guiding for revenues in the range of $575 million to $595 million (a 22% – 26% YoY growth rate), net new restaurant openings of 30 to 35, and restaurant level margins of 15%-17%.

Prospects

Looking further ahead, the company’s growth strategy rests on store expansion domestically and internationally with management aiming for 1,000 stores over the coming years. There is ample runway for store expansion considering Sweetgreen’s store count of 205 (all in the U.S.) at the end of June 2023 is below fast casual rivals like Cava (CAVA) (279 stores as of June 2023), and is a far cry from Chipotle (CMG) (over 3,200 locations in North America and a handful of countries outside the U.S.). Growth momentum however appears to be slowing with 30-35 net new restaurant openings planned in 2023, after 15, 31, and 36 net new restaurant openings in 2020, 2021 and 2022 respectively. It is also slower than rival Cava which plans on opening 65-70 locations in 2023.

The company’s ongoing cost saving initiatives could support margin expansion and there is room for profitability improvement going forward; at 27% of revenues in 1H 2023, the company’s G&A expenses are still considerably higher than rivals like Chipotle (6% of revenues for 1H 2023), and Cava (13.9% of 1H 2023 revenues).

Occupancy costs (around 9.4% of revenues compared with 5% for Chipotle, and 8% for Cava) could reduce as the company expands its store network in less costly suburban areas (Sweetgreen’s stores are typically located in high-traffic, high employment, urban areas close to their corporate lunch crowd target market who can better afford Sweetgreen’s menu which has historically been pricier than rivals like Chipotle).

Meanwhile automation could drive down labor costs which at around 30% in 1H 2023 is higher than Chipotle (24.5% 1H 2023), and Cava (25% in 1H 2023). Management said in their Q2 2023 earnings call that their automation-powered Infinite Kitchen hired one-third fewer team members than a restaurant with similar volume. The company plans to open a second Infinite Kitchen later this year and plans to have more over the coming years.

CAPEX needs may increase as the construction of Infinite Kitchens likely costs more (management has not provided figures). This potentially may be offset by introducing less capital intensive store formats; an example is the company’s planned “pick up kitchens” which have a lower build-out cost due to absence of dining areas.

May need to raise capital

Sweetgreen has long been free cash flow negative. Recent cost savings helped narrow the shortfall however they are likely to remain free cash flow negative for the foreseeable future barring an unforeseen material improvement in profitability. 1H 2023 free cash flow amounted to a negative $50.9 million, improving from negative $65.6 million the prior year period (before factoring stock based compensation). G&A expenses appear to offer the biggest opportunities for cost cuts near term (cost savings from automation, occupancy would take time) but even if management were to halve this expense (which would have amounted to savings of roughly $37 million in 1H 2023), cash flows would still be negative ceteris paribus. With around $280 million in their bank as at June 2023, at their current burn rate they are likely to require further capital to fund their store expansion efforts.

Risks

Execution risks

Strategic missteps, mismanagement and other execution errors could result in market share erosion, cost overruns and hinder growth prospects.

Food safety risks

Sweetgreen’s focus on fresh foods increases risks associated with foodborne illnesses which could result in a material loss of customers, sales, and brand equity.

Competitive risks

Stiff competition may hinder the company from realizing its 1,000-store target which may affect its valuation multiple and therefore investor returns.

Conclusion

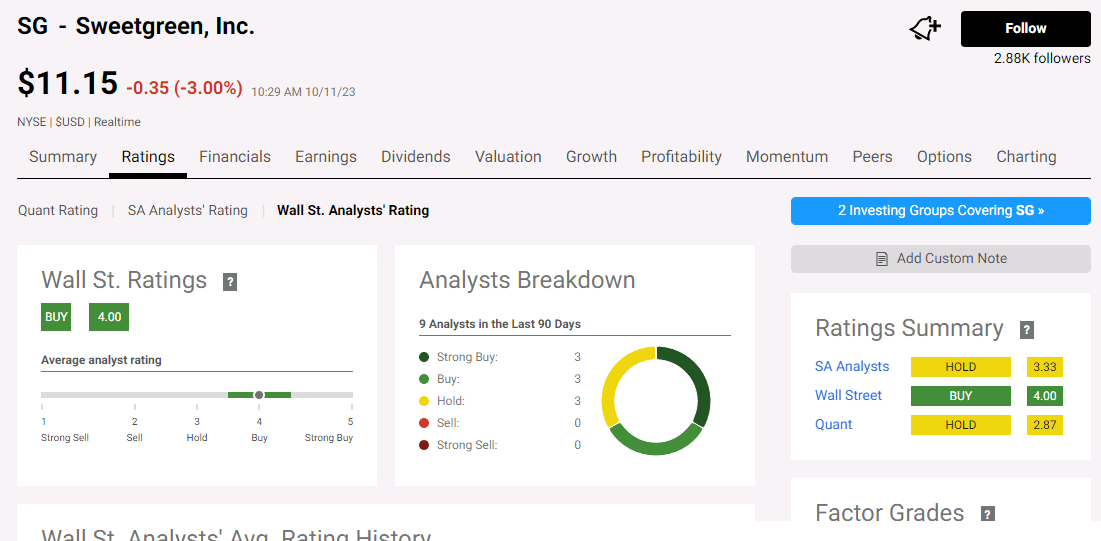

Sweetgreen has a moderate buy analyst consensus rating.

Seeking Alpha

Conservatively assuming marginal AUV growth and the company maintaining their growth momentum of 35 net new restaurant openings per year, along with the assumptions below suggests the company may turn profitable at around the 360-store mark (around 4 years away).

By then, the company, newly profitable, still has room to double its business assuming industry prospects and competitive pressures remain favorable. Taking this into consideration, assigning a valuation multiple of 40 (sector median forward P/E = 14.5, fast-growing rivals like Chipotle forward P/E = 42) suggests the company is worth under $1 billion, lower than its $1.3 billion market valuation currently.

|

Net new restaurant openings |

35 annually over the next four years |

|

Revenue growth rate YoY % |

Gradually decelerating to around 11% over the next four years |

|

Labor / revenues % |

Gradually dropping to 21.8% of revenues |

|

G&A / revenues % |

Gradually dropping to 8% of revenues |

|

Net margin % |

Gradually improving to 3% (for context, Chipotle whose store network is more than 15 times bigger than Sweetgreen has a net margin of around 12%) |

|

Discount rate |

10% |

Read the full article here

Leave a Reply