In recent news, SunOpta Inc. (NASDAQ:STKL) has made a significant announcement regarding the sale of its frozen fruit business, marking a pivotal moment in the company’s ongoing transformation efforts. This strategic move aims to strengthen the balance sheet and enhance gross profit margins. While this development appears to be a positive stride, the question on investors’ minds is, what lies ahead for SunOpta? The stock price has seen a 24.13% rise in the last day, yet it’s important to note that the stock has experienced a 63.81% loss in value over the past year.

One year stock trend (SeekingAlpha.com)

While there are potential growth opportunities in plant-based sales and opportunities within the protein nutrition and better-for-you snacking business, according to bullish analysts, investors should be aware that revenue and EBITDA have declined over the last five quarters. Preliminary Q3 2023 results indicate that this trend will continue. There has also been a new CFO appointed after four years. I recommend a wait-and-see hold position as we get a better idea of the impact of the recent developments.

Company Overview:

SunOpta is a company that has expanded primarily by acquiring businesses that make and sell sustainable, plant-based, and fruit-based food and drinks. They supply these products to retailers, foodservice providers, well-known food brands, and food manufacturers in the United States, Canada, and around the world.

Customers, partners and brands (Investor presentation 2023)

The recent sale of its frozen fruit business for $141 million is part of SunOpta’s ongoing strategy to streamline its portfolio and concentrate on its core business. SunOpta’s goal is to become a prominent manufacturer of value-added products in the plant-based and healthy snack industries. This divestiture has led to enhancements in the company’s balance sheet and gross profit margins.

Company overview (SeekingAlpha.com)

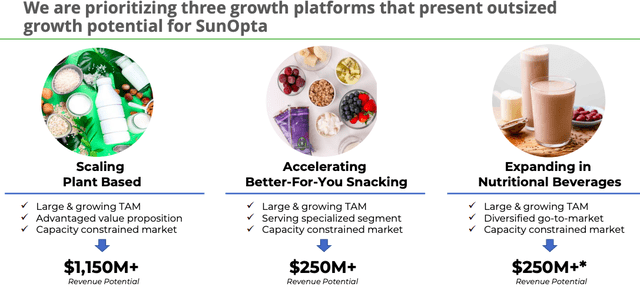

The company’s growth strategy centres on three primary platforms as outlined below. It sees potential in the protein nutrition and healthier snack sectors. The nutrition drinks market alone is valued at around $5 billion.

Growth drivers (Investor presentation 2023)

Financial Overview

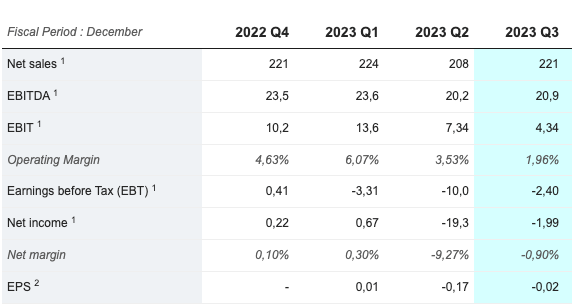

Despite being in a promising growth industry, the company has faced challenges. Its annual revenue has remained fairly stagnant over the last five financial years, and costly acquisition decisions have negatively impacted its financial performance. While the company began divesting non-core businesses in 2017, substantial improvements in both revenue and profitability have yet to materialize. In the past five quarters, SunOpta has experienced a downward trend in revenue and EBITDA.

Quarterly overview (SeekingAlpha.com)

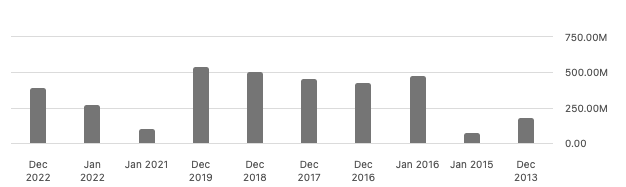

Over the past three financial years, the company’s net debt has been on the rise. However, with the recent sale, where it received cash proceeds, the company has a chance to strengthen its balance sheet by using the funds to pay down debt and other financial obligations.

Annual net debt (SeekingAlpha.com)

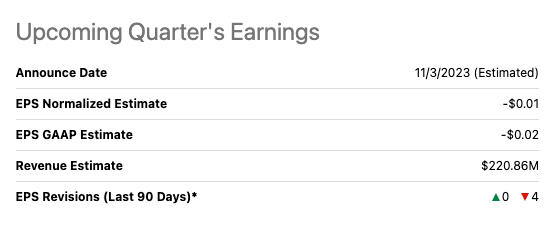

This move will help reduce our net leverage from the previous quarter’s 3.7 times to 3.2 times when we consider the seller notes being collected. SunOpta has also released its initial projections for the third quarter. The estimated total revenue from ongoing operations is expected to reach around $152 million, with anticipated adjusted EBITDA ranging from $18.5 million to $19 million. While this divestiture brings in cash, it might result in short-term sales reduction. Notably, the revenue estimates for Q3 2023 are higher than what the company anticipates, and there’s an expectation of negative earnings.

EPS and revenue estimates (SeekingAlpha.com)

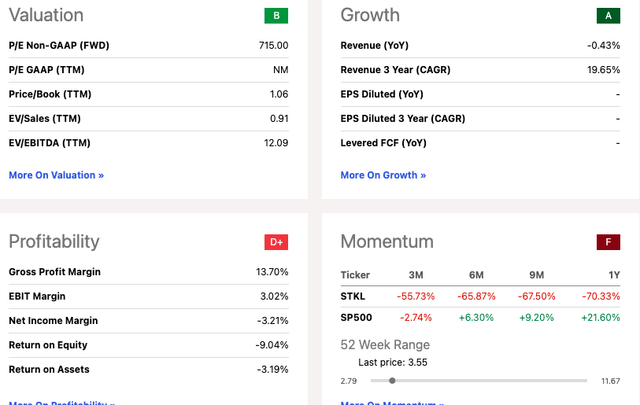

Valuation

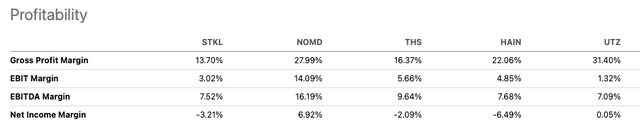

SunOpta’s recent stock price surge, triggered by its divestiture, still leaves it trading well below the average price target of $9.17. The company’s strategic move to shed non-core assets and focus on high-growth areas is a positive sign for its long-term value, but it’s important to note that SunOpta has experienced declining revenue, negative earnings, and a significant 70.33% stock value loss over the past year, reflecting unfavorable market sentiment. Furthermore, the company’s notably low gross profit margin poses a risk in a competitive retail market.

Quant rating (SeekingAlpha.con)

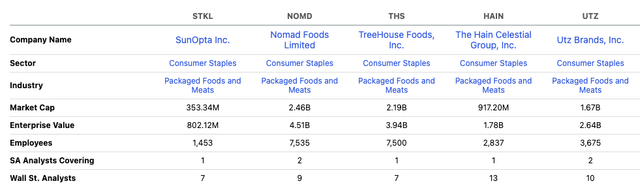

When compared to its market peers, it becomes evident that SunOpta’s gross profit margin lags behind its competitors.

Industry peers (SeekingAlpha.com) Margin compared to peers (SeekingAlpha.com)

Risk

Investing in SunOpta comes with its set of risks. Although the company is concentrating on promising sectors, it still operates within a competitive landscape. Potential market competition could pose challenges for SunOpta’s growth trajectory. Additionally, divestitures like the one in question can have unintended consequences. While this sale is seen as a positive move, it’s vital to monitor how it affects the company’s future financial health and market positioning.

Final Thoughts:

SunOpta recently sold its frozen fruit business, which is a significant move towards its strategic realignment to high-growth industries, better profitability, and a stronger financial position. This change is promising, but it’s crucial to proceed with caution to see how SunOpta will use the proceeds from the transaction and navigate the competitive market. It’s important to note that the company’s revenue and EBITDA have been declining over the past five quarters, and they expect a weaker FY 2023 than the previous year. Because of this, I recommend a “wait and see” approach, closely monitoring how these changes affect the company’s performance before making any buying decisions, and therefore suggesting a “hold” stance.

Read the full article here

Leave a Reply