In March of last year, during the banking crisis, I challenged myself to dig deeper into the financial institutions that are publicly traded. Most of my emphasis has been on fairly small regional banks. One of the companies I ended up coming across that tilts toward the higher end of the spectrum in terms of size compared to what else I have looked at is Community Bank System (NYSE:CBU). For those not familiar with the company, it operates around 200 full-service branches, not to mention some drive through only locations, in places like upstate New York, northern Pennsylvania, Vermont, and Massachusetts.

At the time that I wrote my September article, I found the bank to be interesting. At the time, shares were still down 28.7% compared to where they traded prior to the beginning of the banking crisis. But despite that discount, I could not bring myself to become bullish on the firm. I was discouraged by a decline in deposits. In addition to this, shares do not look to be as cheap as I would have liked. This combination of factors led me to rate the company a ‘hold’, which is the rating I assign a bank that I believe should more or less match the broader market moving forward. However, the company has not even performed that well. Shares are up only 3.6% since then. That pales in comparison to the 14.1% rise seen by the S&P 500 over the same window of time. In some respects, the institution is showing signs of recovery. However, the stock remains expensive, and I have a difficult time believing that further significant upside is on the table.

Still not the right time to jump in

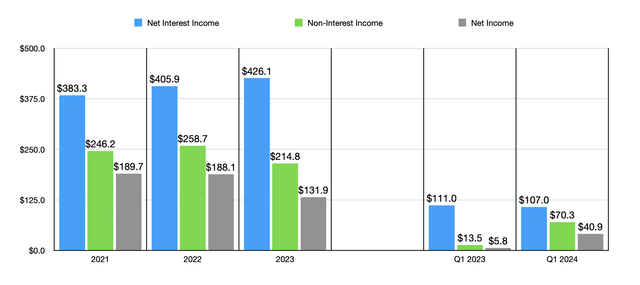

Since I last wrote about Community Bank System in September of 2023, a lot has happened. We have seen additional data come out covering the final quarter of the 2023 fiscal year. And just recently, we saw data come out covering the first quarter of 2024. In the chart below, you can see net interest income, non-interest income, and net profits, covering the most recent quarter compared to the same time one year earlier. You can also see the same data covering 2023 relative to 2022.

Author – SEC EDGAR Data

What we see here are some results that are somewhat mixed. From 2022 to 2023, net interest income rose modestly from $405.9 million to $426.1 million. Part of this increase has undoubtedly been due to a rise in net interest margin from 2.89% to 3.11%. While this may not seem like much, when applied to the total interest earning assets of the bank during 2023, you’re looking at an extra $31 million on the top line. Even though net interest income rose nicely, non-interest income actually shrank from $258.7 million to $214.8 million. This metric would have been higher had it not been for a $52.3 million loss on the sale of investment securities that the company booked during 2023. Unfortunately, this pain resulted in net profits also taking a hit, dropping from $188.1 million in 2022 to $131.9 million last year.

The good news is that the 2024 fiscal year is looking up to some extent. In the first quarter of 2024, net interest income of $107 million is lower than the $111 million reported the same time one year ago. However, the absence of the loss on sale of investment securities has allowed non-interest income to spike from $13.5 million to $70.3 million. Meanwhile, net profits skyrocketed from $5.8 million to $40.9 million. So it does seem as though the worst for the bank is behind it, at least from a revenue and profit perspective.

Author – SEC EDGAR Data

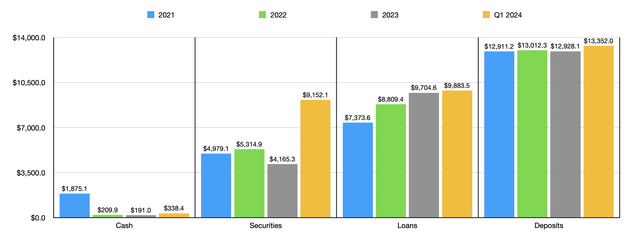

When it comes to the balance sheet, there have been some other changes. And finally, we are getting some positive movement. First and foremost, deposits during most of 2023 ended up disappointing. They went from $13.01 billion in 2022 to $12.93 billion in 2023. But then, in the first quarter of 2024, they grew, hitting $13.35 billion. On top of this, it’s important to note that less than 20% of all deposits are classified as uninsured. That adds an extra layer of safety to the company since it was overexposure to uninsured deposits that caused the banking crisis to begin with.

Author – SEC EDGAR Data

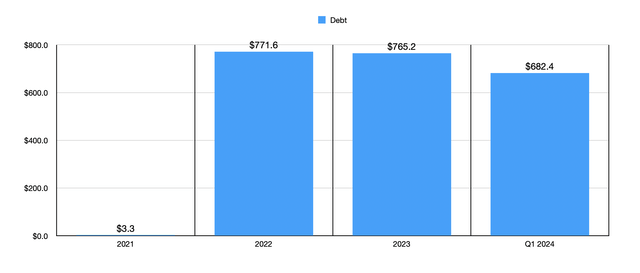

As of late, we have also seen growth elsewhere. The value of loans hit $9.88 billion in the most recent quarter. That compares favorably to the $9.70 billion reported at the end of 2023 and the $8.81 billion reported at the end of 2022. This is not to say that everything went up. However, most things did. As an example, the value of securities as of the end of the first quarter of 2024 totaled $9.15 billion. That dwarfed the $4.17 billion generated at the end of last year, and it was up from the $5.31 billion that the bank had at the end of 2022. The value of cash on its books, meanwhile, hit $338.4 million in the most recent quarter. That’s well above the $191 million that the bank had at the end of 2023. And lastly, debt is finally coming down. At the end of last year, it totaled $765.2 million. But as of today, it’s around $682.4 million.

Author – SEC EDGAR Data

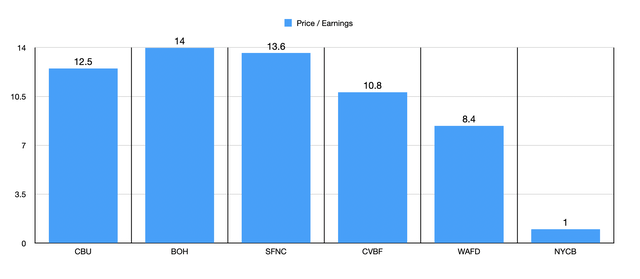

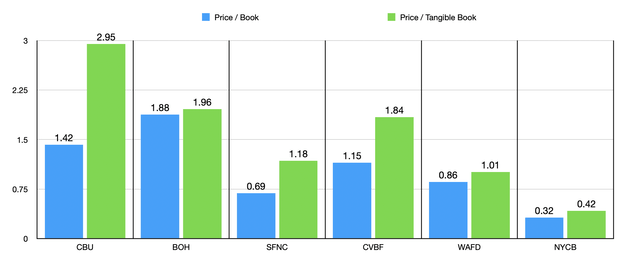

The general trend here is positive. But this alone doesn’t make the company an attractive prospect. There are some other issues that need to be taken into consideration. Shares, for instance, are rather pricey. Even if we use the 2022 results instead of 2023 because of the aforementioned loss on investment securities, the stock is trading at a price to earnings multiple of 12.5. In the chart above, you can see this metric stacked up against five similar firms. While only two of the five companies ended up being cheaper than Community Bank System on this basis, that multiple is rather lofty for a bank. Most of the banks that I have been looking at as of late have multiples of 10 or lower. However, those are becoming increasingly rare. In the table below, meanwhile, I compared the institution to the same five firms using both the price to book approach and the price to tangible book approach. When it comes to the price to book approach, four of the five companies ended up being cheaper than it. And when it comes to the price to tangible book approach, it ended up being the most expensive of the group.

Author – SEC EDGAR Data

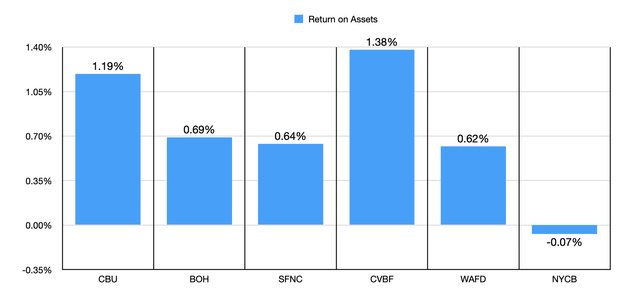

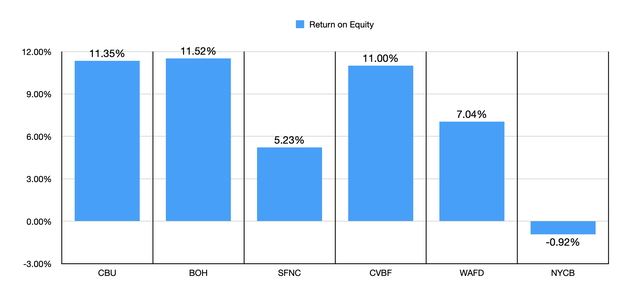

We should also be paying attention to asset quality. This is one category in which Community Bank System excels. In the first chart below, you can see how the firm stacks up against the same companies I compared it to already when it comes to the return on assets. Only one of the five ended up being higher than it. In the chart below that, I did the same thing using the return on equity for each company. And once again, our candidate ended up being the second best on the list. This does show high asset quality. However, it’s not quite enough to offset how shares are priced in my book.

Author – SEC EDGAR Data

Author – SEC EDGAR Data

Takeaway

Fundamentally speaking, Community Bank System is looking better than it did when I last wrote about it. I’d like to see deposits, as well as other balance sheet metrics, increase. The company also has high quality assets. Having said that, the stock does look pricey for what I, as a value investor, look for. Because of this, I would still argue that a ‘hold’ makes the most sense for now. But if shares get cheaper or if fundamentals start to improve even faster, my mindset on the matter could change.

Read the full article here

Leave a Reply