Developing markets-focused bank Standard Chartered (OTCPK:SCBFF) should be well-positioned for a return to growth in emerging markets. Then again, that can make it vulnerable to a global financial downturn. For now, it is performing well and its first half results were strong.

I last covered the name in November 2020 in my sell piece Standard Chartered: Ignore The Dividend Headlines, since when the shares have increased 99% (and during that period I took advantage of the price rise to close my own longstanding position in the bank). There has only been one other SA article in the interim period, JP Research’s July “buy” piece “Standard Chartered: High-Quality Global Bank Priced At a Deep Discount”.

The Story and the Experience

For as long as I can remember, part of the appeal to the Standard Chartered investment case has been its exposure to emerging markets and their potential growth. Like rival HSBC it has China exposure, but it has so much more, from Africa to the Indian subcontinent. That brings risk but also potentially great growth.

In reality, though, this story seems to have been around for ages and to my mind, Standard Chartered has done a poor job capitalising on it. Consider last year’s results, compared to those of a decade before.

|

2012 |

2022 |

variance |

|

|

Operating income |

19.1 |

16.3 |

-14% |

|

Profit |

5.0 |

2.9 |

-42% |

|

Profit attributable to ordinary shareholders |

4.9 |

2.5 |

-48% |

|

Total assets |

637.0 |

819.9 |

29% |

|

Earnings per share (C) |

199.7 |

85.9 |

-57% |

|

Dividends per share (C) |

84.0 |

18 |

-78% |

|

Dec 31 share price (P) |

1,497.7 |

622.4 |

-58% |

Calculated and compiled by author using data from company accounts and historical share price information. All figures are $bn unless otherwise stated.

One year is only ever a snapshot, and arguably the bank gets something of a pass for the dividend, which like other U.K. banks it was forced to suspend early in the pandemic (though can now do with it as it chooses). Nonetheless, performance has moved substantially backwards over the decade on almost every key metric.

Meanwhile, the share price now is within pennies of where it began the millennium! Google Finance’s pricing data on this stretches back further than SA and shows the long-term trend.

Google Finance

I sold my shares when I could because at best I felt they were dead money and over the long term risked losing value.

Yet, now as then, on paper Standard Chartered looks to have the right set of assets and local experience to exploit emerging market growth in decades to come. Was I wrong to sell?

Business Prospects

JP Research acknowledges in his piece, “After years of post-GFC underperformance, Standard Chartered doesn’t have the best record when it comes to shareholder value creation. But I wonder if shares are priced too cheaply here.”

He reckons the business strength, combined with dividend and share buybacks, means that the shares are undervalued.

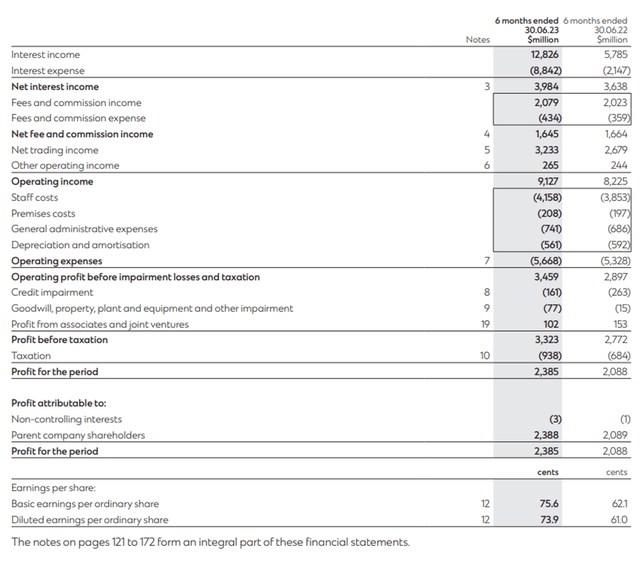

Certainly the bank has been performing strongly lately. In its interim results released in July, income rose 18% year-on-year and underlying pre-tax profit rose 29%. The business remains highly cash generative (operating net cash inflows in the six months were $29bn) and cash and cash equivalents at the end of the period stood at $125bn versus $91bn a year previously.

Company interim results announcement

However, in itself I am not sure the recent strong performance justifies a new view of Standard Chartered. It is doing what it has always done: making hay while the sun shines. But I remain unconvinced that the bank is especially well positioned for a downturn in the banking sector. We have seen again and again that Standard Chartered’s wide spread of businesses can work against it when the chips are down in the global economy: there is always something going wrong somewhere, it seems.

To make a bull case for the name at the moment I think it is necessary to have a broadly benign view of the global macroeconomic outlook. I’ve been in Hong Kong lately and things fire on as they always do there. I’ve been in China and the on the ground experience seems much more economically than the headlines, though if the property sector there continues to struggle as it is doing it is hard to see that will not negatively affect the financial services sector. But I’ve also been in the U.S. and here in the U.K. and I find it hard to imagine that we aren’t going to see a pretty big economic downturn over the next couple of years: consumer spending here is falling left right and centre and the socialist policies of the pandemic years are now showing their cost economically, in my view.

If there is a global economic downturn, I don’t think Asia can avoid it (in markets like Indonesia and Thailand I’ve observed that many people are still struggling with daily living expenses due to the significant economic dislocation of the pandemic years). On that basis, while Standard Chartered may continue to do well for now, I think there is a storm coming and it will be hard for the bank to avoid it.

Dividend Has Been Increased But Remains Small

At the moment the yield here is a paltry 2.0% at a time when some rival London-listed banks are offering two to three times that much.

Standard Chartered has been unreasonably slow in restoring its dividend to pre-pandemic levels, with this year’s interim payout matching what it paid in 2018 (and still below the 2019 interim) despite a 50% increase . With its substantial cash generation (see the buybacks) I see no excuse for the bank’s slovenliness in bringing back the dividend to what it used to be (and beyond).

Taking that as an indication of the board’s approach towards dividends, I do not see this as an attractive share from a dividend perspective in the current market.

In the first half alone, net income came in at approximately 8.3% of the bank’s total market capitalisation. The current capital return focus is on share buybacks rather than dividends. Arguably (as is always arguable with buybacks), that will also create value for shareholders over the long term. I have my doubts – the bank is buying its shares at twice what they cost when I lost wrote about it – and would also like to see a firmer, sustained commitment to predictable, steady dividend growth.

Valuation

What, then, is Standard Chartered worth?

Currently it trades on a P/E ratio of 10. The price to book value ratio is just above 0.5, which on paper looks like a bargain.

But I think earnings are pretty much as good as they will get in coming years. The second half should be solid unless the bottom falls out of the market, but my downbeat macroeconomic view means I think it unlikely that 2024 will be as good as this year, let alone 2025.

As for book value, as always that could change sharply if we do indeed go into full-on recession and property values decline substantially. I see that as a risk (property is already falling in multiple markets) but not a certainty.

If I am wrong and the global economy powers on, the current valuation could be cheap. However, given my concerns about where the wider economy is headed and Standard Chartered’s habitual struggle to do well during such times, I see the shares as overvalued and maintain my “sell” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply