High-yield exchange-traded products, or ETPs, have become all the rage among the income investor community. After all, who doesn’t want to buy an ETP, do nothing, and collect a double-digit yield? The problem is that some of them aren’t constructed all that well, and as is all too often the case, the advertised yield is a bit of a mirage.

In my view, that is the case with the subject of this piece, the Neos S&P 500(R) High Income ETF (BATS:SPYI). SPYI is a relatively new entrant into this space, but the exchanges are littered with funds that do roughly the same thing, so it’s not all that different from the sea of competitors. And in my estimation, it has a flaw that is a no-go for me, so I don’t see how it should have a place in your portfolio.

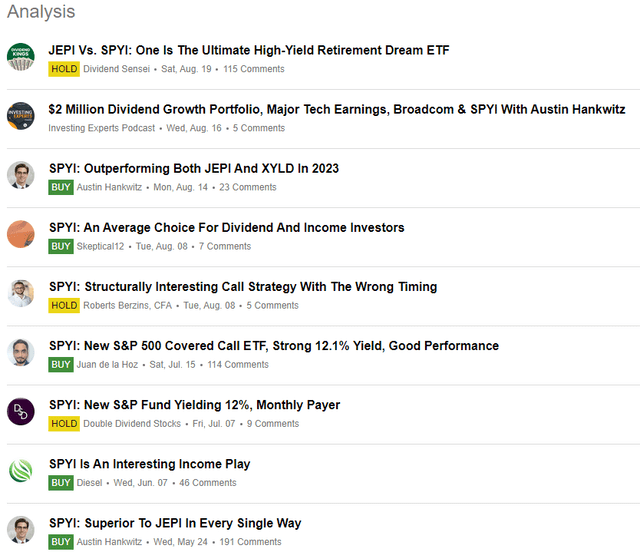

Interestingly, the analysis for SPYI has been extremely bullish here on Seeking Alpha.

Seeking Alpha

However, I’m taking a stance against the hype, and putting out a contrarian opinion on this fund. That is, I think you should pass on this one.

What is SPYI?

In short, SPYI attempts to generate high monthly income using covered calls. If you think that sounds familiar, it’s because it is. As I mentioned, there are many of these funds, and SPYI uses the S&P 500 (SP500) as a base from which to buy and sell calls.

Now, one thing that makes SPYI slightly different is that it uses index options on SPX – as opposed to common stocks or an ETF like SPY – which is more tax efficient. That’s not necessarily a huge difference, but it’s something. SPYI sells calls to generate income, but also buys calls to take advantage of potential upside. It seeks to sell more premium than it buys, such that the net of its options transactions is a credit (or income) to the fund.

That sounds great, but the problem is that it’s hard enough to generate meaningful income by selling calls, but when you use the premium to buy calls, it becomes extremely difficult.

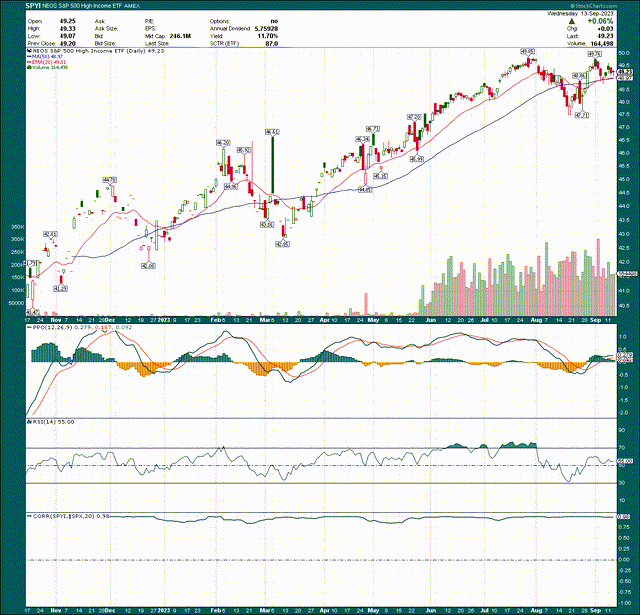

Before we get into whether this strategy actually works or not, let’s make sure the fund at least does a good job of tracking the S&P 500.

StockCharts

We can see here the price chart of SPYI looks pretty similar to that of the S&P 500. In fact, I’ve plotted correlation to the SPX in the bottom panel, and it’s 0.98. That means the two instruments essentially move in lockstep most of the time, so we can check that box.

Does it work?

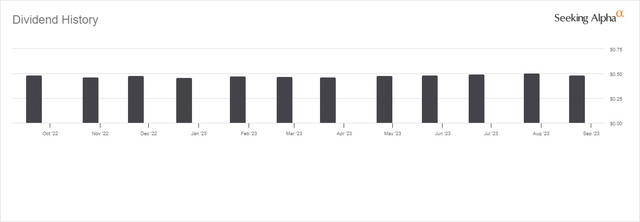

In short, I believe the answer is “not really.” Now, before we get into that, SPYI does pay pretty impressive dividends.

Seeking Alpha

It’s right at 1% per month, and has been since launch. You can pretty much expect 45 to 50 cents per share in distributions each month. That gives us a yield of almost 12%, but is obviously slightly variable given the distribution changes each month. Still, 1% a month is a lot for distributions.

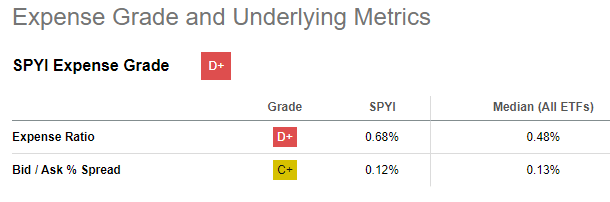

Here’s the problem, or, more accurately, two problems. First, SPYI is expensive.

Seeking Alpha

Sixty-eight basis points annually is a lot these days for any exchange-traded products, as they’ve become ubiquitous and therefore, much cheaper for customers. Keep in mind that eats into your yield, as you’re paying for the constant churn of buying and selling calls (and underlying holdings) that SPYI does in order to meet its stated goals.

The bigger issue for me on top of the expense is that SPYI is generating almost no net investment income. In other words, the distributions are almost entirely return of capital, because it simply isn’t making anywhere near enough with its strategy to pay anything like current monthly distribution of 45 or 50 cents.

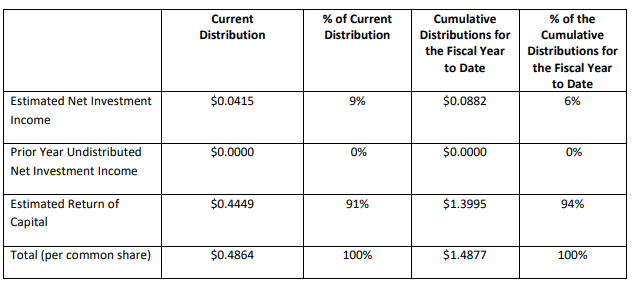

Fund website

This is the August 19a-1 disclosure, and the other months look a lot like this one. You can see that NII was 4.15 cents for the month, while return of capital was 44.49 cents. That means 9% of the distribution was from the fund’s stated strategy of generating income in August, while the other 91% was returning capital. For the year so far, it’s been 6% and 94%, respectively. That yield doesn’t look so good anymore.

In fact, if we just use the actual NII the fund has generated, which was 8.82 cents per share YTD in August, the yield for the fund would be well under 1%, not 11.5% or 12%.

You can make of this information whatever you want, but for me, a fund that generates less than 1% a year in net option income isn’t all that useful.

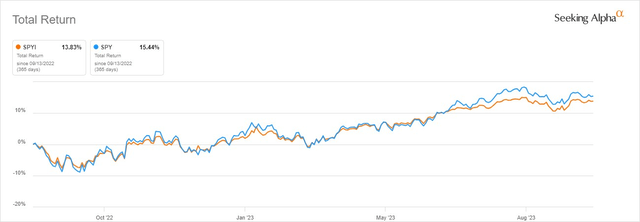

If we now compare SPYI’s total return with that of the SPY, we can see the SPY has outperformed it this year, and keep in mind that SPY costs about 15% what SPYI does, so it’s also a lot cheaper.

Seeking Alpha

If we wrap this up, I really don’t understand the appeal of SPYI. I get the theoretical appeal of a fund that pays you 12% per year, but in my opinion, SPYI isn’t doing that. It’s paying less than 1% in actual NII, and the rest in return of capital. It’s not for me, and I think you’re better off just owning SPY or something similar.

Read the full article here

Leave a Reply