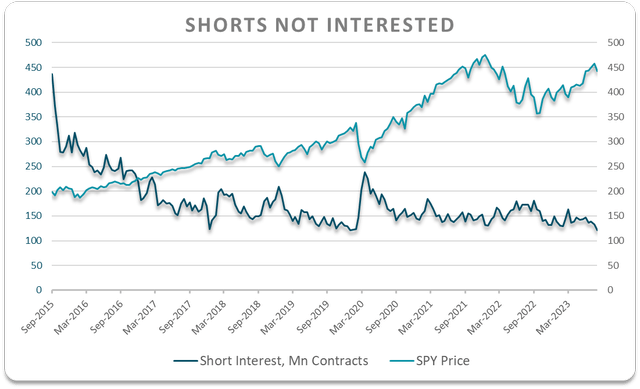

There is an eerie sense of calm in US equity markets, with the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) remaining near all-time highs despite mounting valuation and interest rate headwinds. Short interest has fallen to its lowest level in decades, which paints a picture of widespread complacency even as high rates make shorting profitable from a cash flow perspective. The longer the market remains elevated, the greater the likelihood that the Fed will be forced to maintain high rates.

The SPY is the largest and most liquid S&P 500 ETF, with $415bn in assets, slightly ahead of the Vanguard S&P 500 ETF (VOO) while its expense fee is slightly higher at 0.09% vs the VOO’s 0.03%. I last wrote about the SPY in July, arguing that the concentration risk had risen beyond the levels seen at the dot com bubble peak. This remains the case, while real yields have risen further, compressing the equity risk premium to new lows.

Widespread Complacency Contrasts With Deteriorating Fundamentals

SPY short interest has fallen back below the lows seen in December 2017 and February 2020, which preceded significant market declines. Despite the fact that high interest rates make shorting highly attractive from a cash flow perspective as the income received far exceeds dividend payments, shorts appear to have thrown in the towel amid the continued strength in the market.

Bloomberg

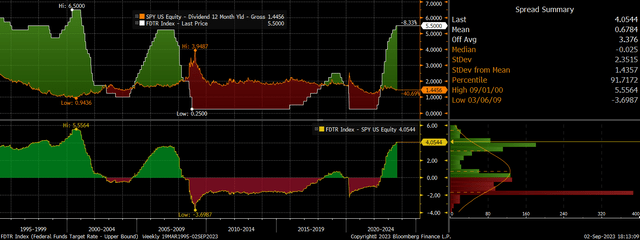

The recent sharp move lower in implied volatility also smacks of complacency. To be sure, a declining VIX has tended to be positive for the SPY from a short-term perspective and suggests an imminent decline is unlikely. However, low implied volatility and short interest are not the conditions under which large rallies tend to occur. This is good news for SPY shorts like myself who do not actually require the market to decline to generate positive returns at these interest rates, which even after fees are higher than the 1.4% dividend yield on the SPY.

While a rising stock market has averted concerns of rising real interest rates and the risk of a recession, real short-term borrowing costs have continued to rise, while leading economic indicators continue to point to a deep recession. Short term interest rates are now the highest they have been relative to inflation expectations since the peak of the dot com bubble and the Conference Board’s Leading Indicator Index remains deeply negative despite rising stock prices which are a component of the index.

Bloomberg, Author’s calculations

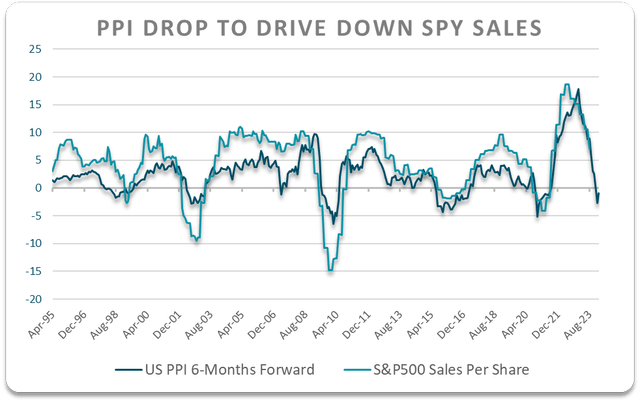

Despite strong sales over the past few years, the market is still valued at a price-to-sales ratio of 2.5x, which puts it in the 94th percentile of valuations going back to 1990. Falling inflation expectations and the decline already seen in producer prices suggest sales growth will continue to slow over the coming months, potentially turning negative. With profit margins and dividends as a share of sales continuing to decline from their record highs, the meagre dividend yield on the SPY is unlikely to rise unless the SPY itself falls.

Fed Funds Vs SPY Dividend Yield (Bloomberg)

As investors slowly realize that they can earn significantly more in cash and short-term bonds than they can on the large cap US stocks in the absence of further increases in valuations, valuations themselves will begin to decline. While the trigger of any major market decline is only likely to be known after the event, the negative equity risk premium means that even a minor shift in expectations could cause huge losses. Long duration bonds have lost more than half of their value in many cases from the 2021 highs as investors who were willing to accept deeply negative real returns suddenly decided that was a bad idea. The duration of the SPY is equivalent to a very long-term bond, and even a 1 percentage point rise in the required rate of return would result in a decline of around 40%.

A Fed Reversal Unlikely Until After Stocks Decline

A case could be made that if the sharp rise in real borrowing costs over the past two years has not brought down the SPY, then any subsequent decline may provide the catalyst for another leg higher. While this is indeed a significant risk to my position, interest rate markets are already pricing in significant cuts, with over 100bps of cuts expected in 2024. While stocks are trading near all-time highs and inflation still above target, the Fed is unlikely to cut rates significantly, if at all. Furthermore, it is worth reminding readers that the SPY suffered huge losses in the early-2000s and 2008/09 despite aggressive rate cuts.

Read the full article here

Leave a Reply