Momentum investing is mostly rewarded with solid long-term returns. However, investors often fail to consider obstacles such as crash risk and the lack of economic rationale behind the anomaly.

In today’s analysis, we discuss the Invesco S&P 500® Momentum ETF (SPMO), a momentum factor tilt exchange-traded fund, or ETF, emphasizing the S&P 500 (SP500).

Let’s delve into a deeper analysis of the ETF.

Momentum Investing & Crash Risk

Originally discovered by Titman and later developed by Carhart, Momentum investing is known as a rewarded factor approach. In simpler terms, a rewarded factor means that investors are likely to derive long-term alpha by investing in a quantitative anomaly, which, in this case, is momentum.

The Invesco S&P 500® Momentum ETF’s concept is based on momentum investing in its purest form, which includes going long on an upper quantile of stocks that outperformed the stock market in the past 12 months while avoiding the lower quantile. Subsequently, alpha returns are expected to last between two and twelve months.

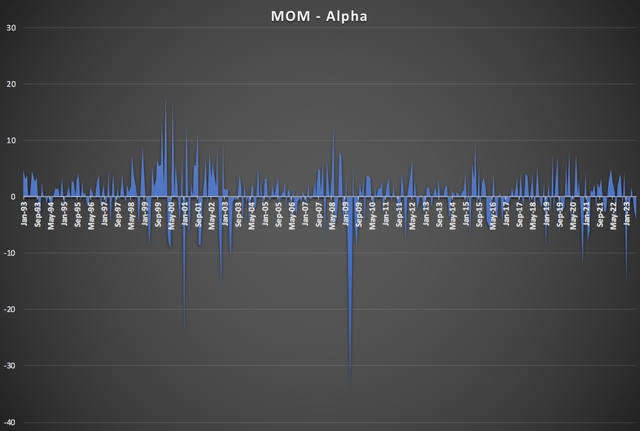

Although the original momentum strategy does work in a stable market, it has been shown to default in abrupt market shifts. To illustrate my claim, I plotted momentum alphas in the diagram below, and it is rather striking to see how abrupt and large drawdowns are in volatile economic environments (note the sequences: tech bubble, 08 housing, and COVID).

Author’s Work; Data from Duke University

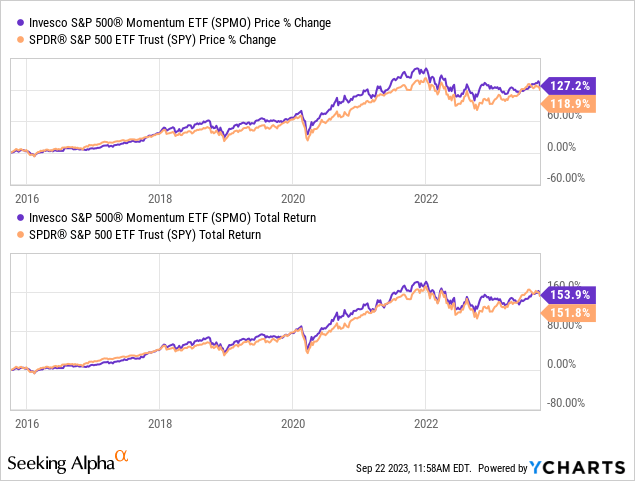

Idiosyncratically, the Invesco S&P 500® Momentum ETF hasn’t experienced significant drawdowns (relative to the S&P 500) since its inception. However, the prolonged stable performance presents a few worries; let’s traverse into the next section to find out why.

Why We Don’t Like The ETF’s Structure

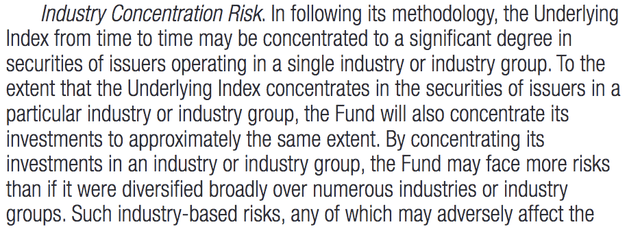

Like the S&P 500, the Invesco S&P 500® Momentum ETF is market-cap weighted; however, the vehicle assumes excess concentration risk by holding less than 100 of the index’s constituents. To illustrate the risk, I pulled the fund’s concentration risk statement from its fund literature below.

It might be wise to read through the statement before we traverse into a more detailed discussion beneath the diagram.

Fund Literature (Invesco)

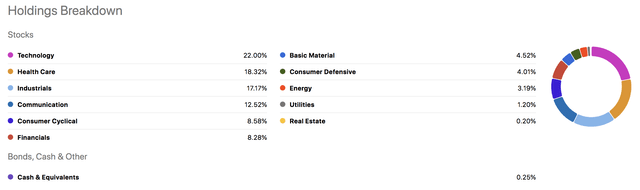

If we look at the fund’s breakdown, it is evident that it is highly invested in cyclical sectors such as industrials, consumer cyclical, and technology. Although it has risk-off exposure to health care and communications, I think it is safe to say that the ETF’s market-cap weighted methodology ignores intra-sector risks. Therefore, I believe the vehicle might find itself in a tizzy at times as it overlooked real economic variables.

Seeking Alpha

In my experience, modern momentum investors phase out crash risk by implementing strategies such as “sector neutral exposure,” which uses a more evenly weighted methodology. Unfortunately, I think the Invesco S&P 500® Momentum ETF’s strategy is overly susceptible to crash risk and might underperform expectations in the coming years, given our volatile macroeconomic environment.

Quantitative Proof

I drafted the Invesco S&P 500® Momentum ETF’s risk attribution metrics to enhance the argument (available at the end of this subsection), and the first data point that stood out was the vehicle’s negative skewness, which confirms the ETF’s sensitivity to crash rise as negative skewness means the Invesco S&P 500® Momentum ETF’s large downside movements are larger than its upside deviations.

Furthermore, the Invesco S&P 500® Momentum ETF has positive kurtosis, meaning it is frequently exposed to tail risk, which is not done any justice by observing the vehicle’s sizable value-at-risk metric.

Click on Image to Enlarge (Portfolio Visualizer)

Collectively, I have to conclude that the ETF’s key variables indicate that it is sensitive to tail risk, leading me to believe that its momentum strategy is probably best implemented when economic rationale can be phased in by the investor.

Income-Based Prospects

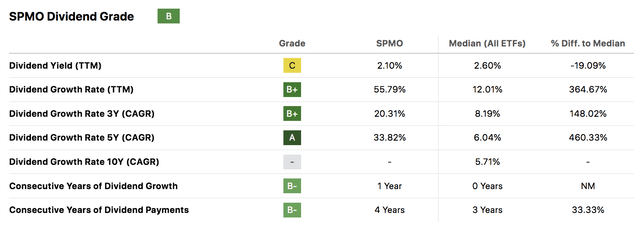

The Invesco S&P 500® Momentum ETF’s dividend prospects are actually much brighter than I initially anticipated. Keep in mind that the fund is constrained to S&P 500 securities, meaning its scope for dividend-seeking is limited, especially if you consider the SPY’s (SPY) dividend yield is merely 1.51%.

I believe this is a high-quality dividend play; however, be careful not to ignore the Invesco S&P 500® Momentum ETF’s price risk while chasing those dividends.

Seeking Alpha

Closing The Argument

Our analysis shows that the Invesco S&P 500® Momentum ETF has provided its investors with lucrative returns since its inception.

However, our analysis also discovered that the vehicle possesses significant price risk, which is likely undesirable in today’s volatile economic environment. Therefore, we place the Invesco S&P 500® Momentum ETF asset on hold.

Read the full article here

Leave a Reply