Historically speaking, I have not been a big fan of the automotive industry. I love certain markets that play to the industry like the automotive retail space, but when it comes to the actual production and sale of automobiles, I see a highly undesirable market. What you have is a relatively slow growing market that is highly mature. Products are often commoditized, and margins are slim. And even small changes in the state of the economy can have a sizable impact on financial performance in the near term. The good news about the market is that some of the companies are cheap because of these issues. And one good example that I could point to in this regard involves one of the largest players in the world, General Motors (NYSE:GM).

Recently, the financial performance achieved by General Motors has been solid. This comes after a rather strong 2022 fiscal year. Shares are cheap, both on an absolute basis and relative to some similar firms. And management has demonstrated decent margin improvements over the past few years. All of these are positive developments for shareholders of the company. But even with these positive aspects, the company is far from being a home run prospect. Based on my own assessment of the company, I would argue that a ‘hold’ rating makes the most sense, even though recent developments revealed by management have been positive.

An interesting ride

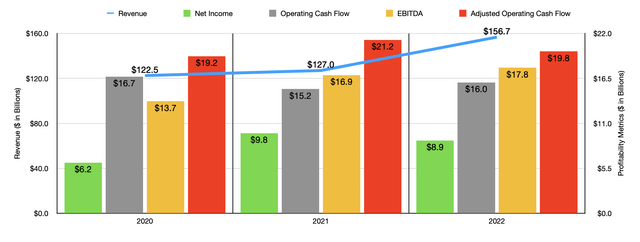

From a purely fundamental perspective, the past few years have been an interesting ride for General Motors and its investors. Take revenue as an example. Between 2020 and 2022, sales generated by the enterprise jumped from $122.5 billion to $156.7 billion. The vast majority of that increase came from 2021 to 2022. During this window of time, revenue increased by 23.4%, or $29.7 million. The largest chunk of this increase came from the company’s GM North America segment, also known as GMNA. Sales under this segment jumped 26.7% from $101.3 billion to $128.4 billion. Management attributed this increase in revenue to a combination of factors, including higher wholesale volumes, favorable pricing driven by low dealer inventory levels, higher revenue associated with parts and accessories, and more.

Author – SEC EDGAR Data

The much smaller GM International segment of the company saw an identical 26.7% rise in revenue, with sales expanding from $12.2 billion to $15.4 billion. The same aforementioned factors, combined with a favorable product mix in the Middle East and the Asia Pacific region, helped to push revenue quite a bit higher. The only real weakness from the company came from its GM Financial segment, with revenue dropping from $13.4 billion to $12.8 billion. This, management stated, was mostly driven by a decrease in the average balance of the company’s leased vehicles portfolio.

Author – SEC EDGAR Data

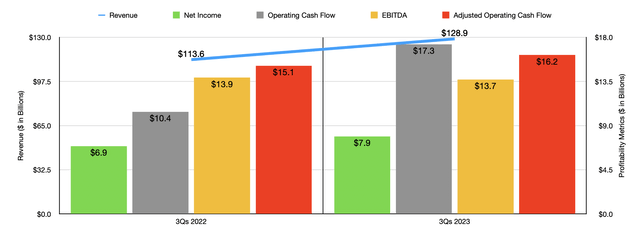

On the bottom line, the picture has been rather mixed. Yes, net profits did manage to rise from $6.2 billion in 2020 to $8.9 billion last year. But operating cash flow dropped from $16.7 billion to $16 billion. Even if we adjust for changes in working capital, we get a modest increase from $19.2 billion to $19.8 billion. The only profitability metric to show a meaningful increase that rose consistently year after year was EBITDA. It managed to grow from $13.7 billion to $17.8 billion. As you can see in the chart above, financial performance this year has been largely positive for shareholders. With the exception of EBITDA, all profitability metrics, as well as revenue, increased from one year to the next. A good portion of this sales increase came from a rise in the number of vehicles sold. In North America, for instance, the company sold 2.31 million vehicles in the first nine months of 2023. That’s up from the 1.95 million reported one year earlier. Total worldwide sales, meanwhile, came in at 4.59 million units compared to the 4.39 million reported the same time of 2022. Strong demand also kept prices elevated. Add on top of this certain profitability improvements such as the more modest 6.4% rise in automotive and other costs of sales, and you get impressive bottom line results.

Author – SEC EDGAR Data

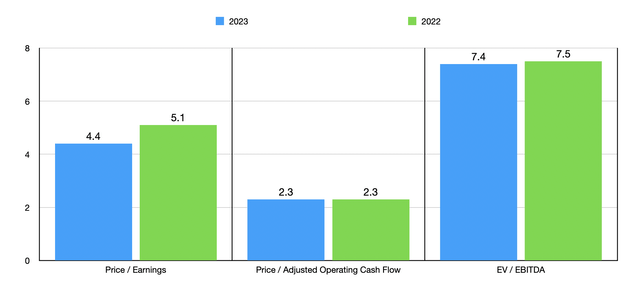

When it comes to 2023 in its entirety, the picture is largely looking up. Management did decrease guidance when it comes to net income. But even so, at the midpoint, it should come in at around $9.4 billion. Operating cash flow guidance has actually been increased from a midpoint reading of $18.9 billion to $20.3 billion. No guidance was given when it came to EBITDA. But my estimate implies a reading for this year of $18.2 billion. Using these figures, I then valued the company as shown in the chart above. As you can see, the stock is trading at the low to mid single-digit rate. I then compared the firm to five similar companies as shown in the table below. When it comes to both the price to earnings approach and the price to operating cash flow approach, only one of the companies was cheaper than it. But when it comes to the EV to EBITDA approach, four of the five ended up being cheaper. This is because of the nearly $84 billion in net debt on the company’s books, which far eclipses its $45.8 billion market cap.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| General Motors Company | 4.4 | 2.3 | 7.4 |

| Ford Company (F) | 7.3 | 3.3 | 6.7 |

| Stellantis (STLA) | 3.4 | N/A | 1.2 |

| The Toyota Motor Corporation (TM) | 9.0 | 9.8 | 7.6 |

| Honda Motor Co (HMC) | 8.2 | 4.1 | 5.8 |

| Nissan Motor Co (OTCPK:NSANY) | 4.8 | 2.2 | 5.9 |

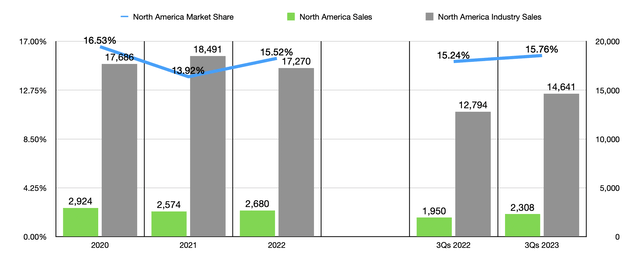

Even though the company has a debt issue, you might think that the continued growth and low trading multiples would make me bullish on the business, but I need more than that to be persuaded. And unfortunately, when you dig into some other data you see some rather concerning signs. The most important is that the firm continues to see a drop in market share. To be clear, in North America, its market share has dropped from 16.5% back in 2020 to 15.5% in 2022. For the first nine months of this year, we did see a bit of a rebound, with a market share of 15.8% compared to the 15.2% seen one year earlier.

Author – SEC EDGAR Data

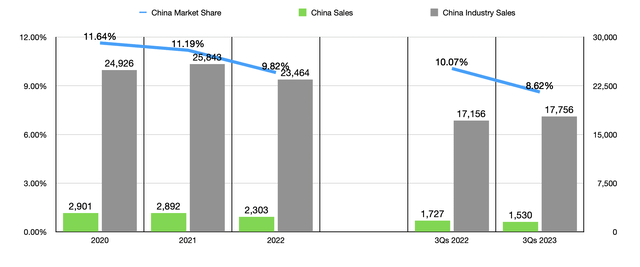

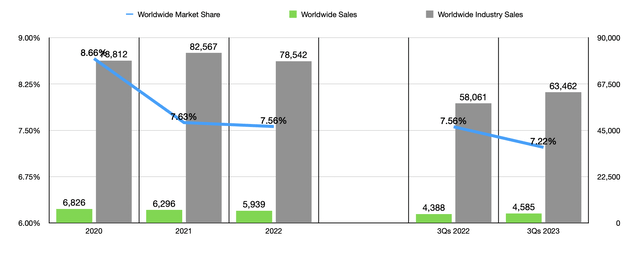

Unfortunately, we haven’t seen such an improvement in other markets. Most notably, General Motors continues to struggle in China. Back in 2020, the company sold 2.90 million vehicles in China. That number declined to 2.30 million in 2022. In the first nine months of this year, it sold 1.53 million units in China. That’s down from the 1.73 million reported one year ago. In fact, over this window of time, its overall market share in that country has plummeted. It was 11.6% back in 2020. By the end of 2022, it had fallen to 9.8%. And in the first nine months of this year, it totaled 8.6% compared to the 10.1% reported the same time last year. Thanks to the weakness in China, overall market share for the business has also been on the decline. Back in 2020, General Motors controlled 8.7% of the global market. As of the first nine months of this year, that number has come out to 7.2%.

Author – SEC EDGAR Data

Author – SEC EDGAR Data

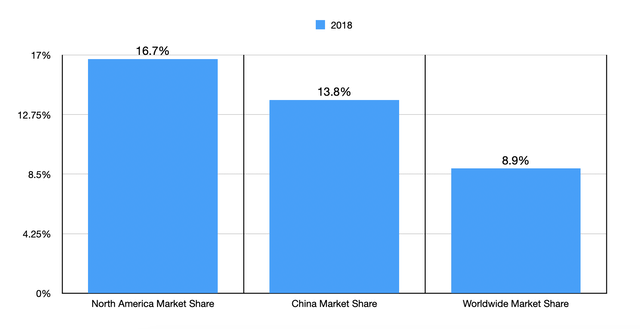

Back in 2018, I wrote a rather neutral article about General Motors. I made the claim that the company was making certain mistakes and that investors could probably find better prospects elsewhere. Since then, shares have pulled back by 1.4%. By comparison, the S&P 500 has generated a return of 73.1%. Back then, the company had a larger market share. In North America, it was 16.7%. In China, it was a hefty 13.8%, and globally, it was 8.9%. So this is not a short term trend that has just started.

Author – SEC EDGAR Data

It would be one thing if management was making some major investments aimed at recapturing market share. But I just don’t see that. In fact, at the end of November of this year, after finally reaching an agreement with the UAW regarding wages and benefits for union workers, the company announced a $10 billion accelerated share repurchase program that will see all $10 billion worth of stock repurchased before the year is out. And the company also increased its dividend by 33%, effective early next year. This is not to say that the company is not making any investments. It is. The most recent announcement was released on December 12 when the company announced that it was collaborating with Komatsu on producing a hydrogen fuel cell powered mining truck. But for a firm with the kind of leverage that General Motors has, the market share loss that it has, and the low margins that it has, I could think of many different ways to use $10 billion, plus the distributions, that would create more value for the long run.

Takeaway

All things considered, I really want to like General Motors. Shares are certainly cheap enough. Recent financial performance, while mixed, has been mostly positive. But when you add in the market share decline, and financial moves that I believe are a sign of poor management at a time when the company is dealing with these issues, I cannot get behind the business in any serious way. Because of that, I have decided to rate the enterprise a ‘hold’ for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply