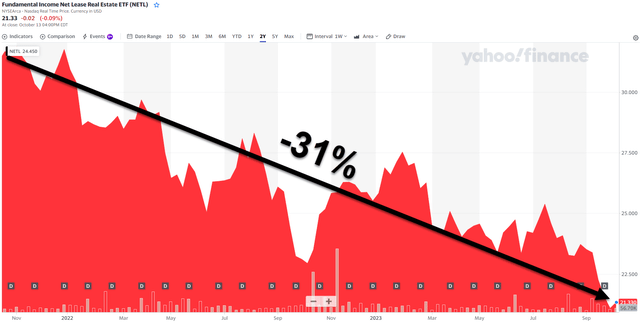

As I explained recently in a Reuters interview, the net lease sector has been pummeled as evidenced by the chart below (that represents the NETL ETF that invests in net lease REITs):

Yahoo Finance

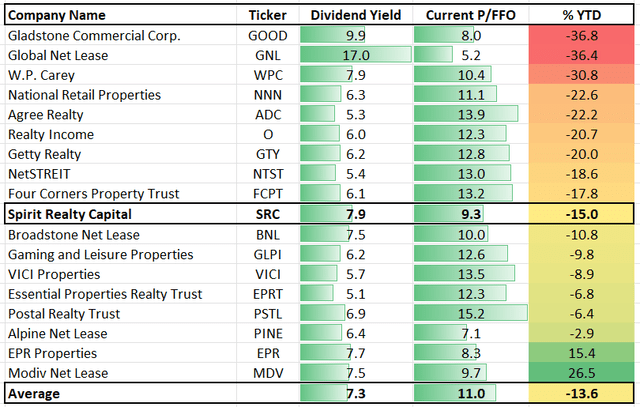

So far in 2023, the net lease REIT sector is down an average of -13.6% and the sector dividend yield average is 7.3%.

iREIT®

We’ve been avoiding two of the ugliest ducklings (shown above) – Gladstone Commercial (GOOD) and Global Net Lease (GNL) – recognizing the dividends weren’t sustainable.

Unfortunately, we were hoodwinked by W. P. Carey (WPC), like many others, after the company surprised investors with a dividend reset announcement. We covered that in great detail.

Seeking Alpha

We also have covered these net lease REITs recently:

- NNN REIT (NNN) – latest here

- Agree Realty (ADC) – latest here

- Realty Income (O) – latest here

- VICI Properties (VICI) – latest here

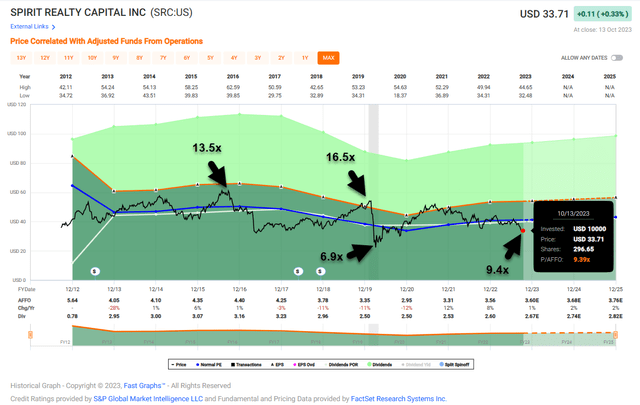

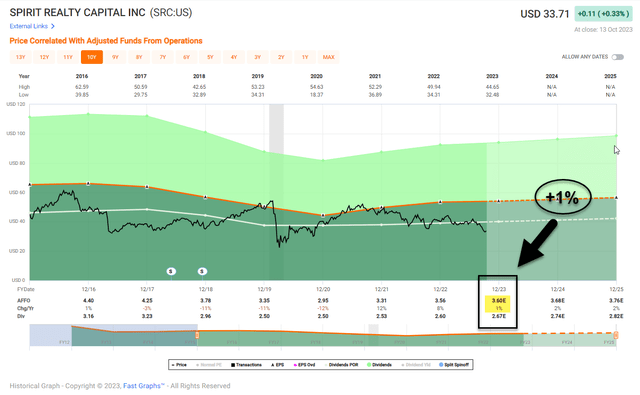

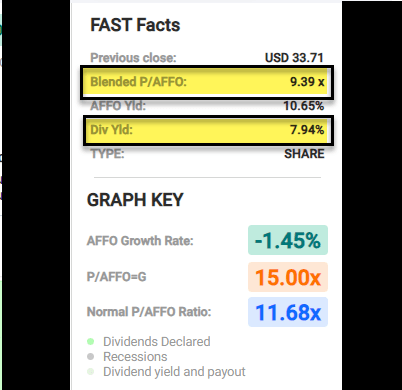

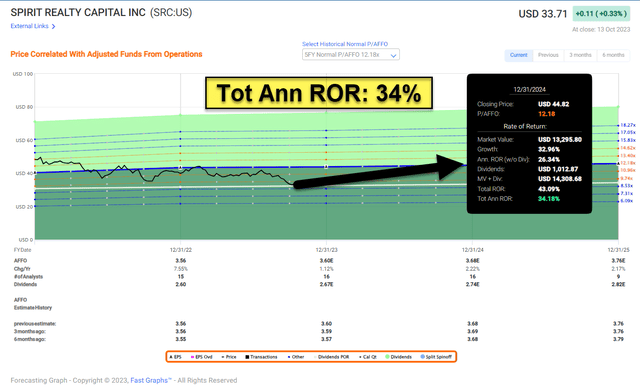

Now it’s time to shift gears over to Spirit Realty (NYSE:SRC), down around -15% year-to-date and now trading at a dirt cheap valuation of 9.4x.

FAST Graphs

The Basics

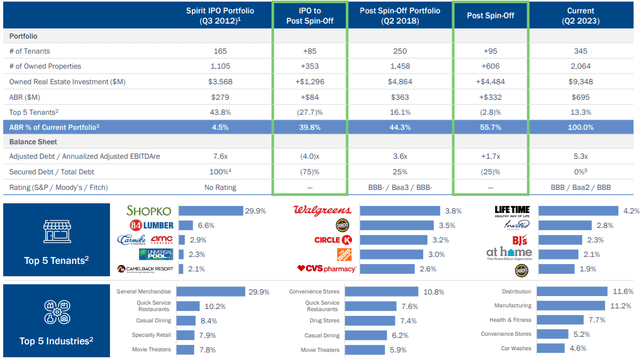

Spirit is a net lease REIT that owns more than 2,050 properties (in 49 states) and generates more than $694 million in annualized rent with a WALT (weighted average lease term) of 10.3 years.

SRC Investor Presentation

Spirit was listed in 2012 with 1,105 properties and several higher-risk tenants such as ShopKo, 84 Lumber, and Carmike.

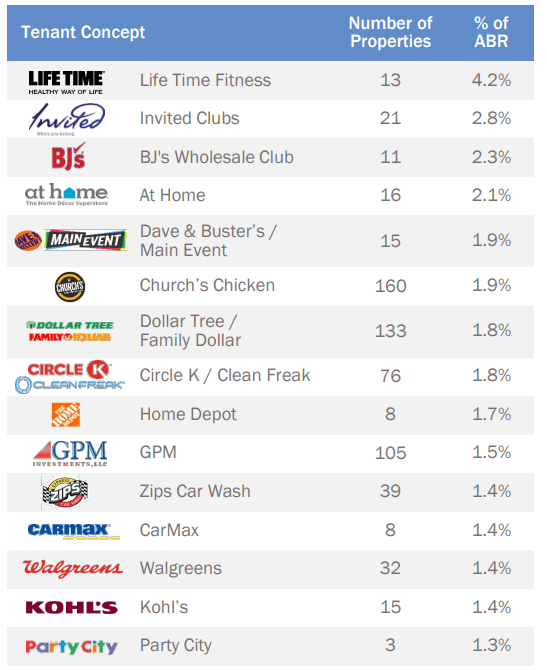

In 2018 the company spun its “ugly ducklings” (weaker tenants) to become a higher-quality net lease REIT. Here’s a snapshot of Spirit’s top tenants:

SRC Investor Presentation

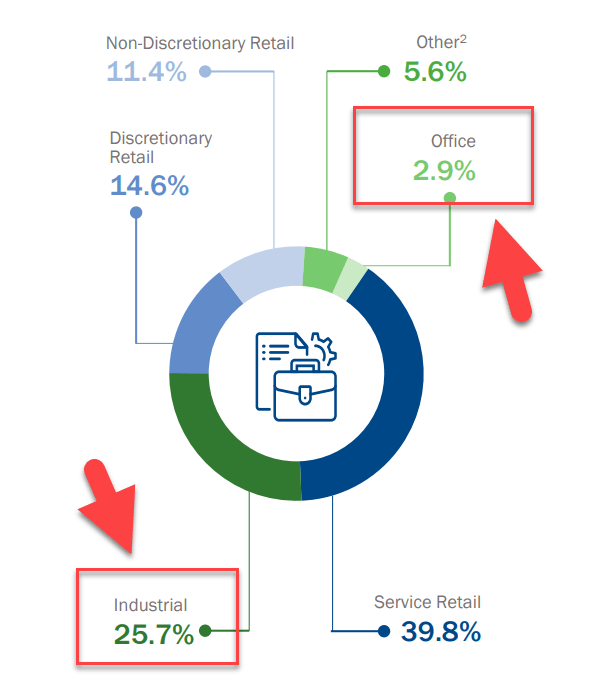

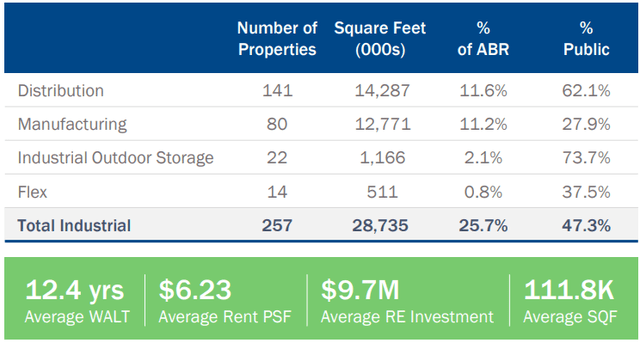

As illustrated below, SRC does not have significant office exposure (2.9%) and the company has purposely expanded its industrial exposure (now at 25.7%).

SRC Investor Presentation

SRC’s industrial assets are mission-critical properties leased at low rents to sophisticated operators, with 88.6% generating over $100 million in revenue.

SRC Investor Presentation

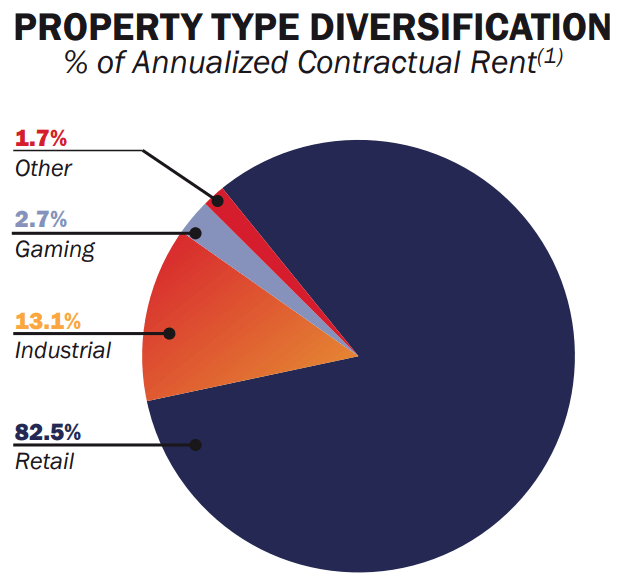

By comparison, Realty Income has 13.1% exposure to Industrial Real Estate.

Realty Income Investor Presentation

On the latest earnings call, Spirit’s CEO Jackson Hsieh said,

“I feel like our industry mix right now are idea and we’ve got a really good balance of retail, mission-critical industrial, industrial outdoor storage. The industrial is very well-diversified.”

For context, here’s how the Industrial REITs are trading:

P/AFFO

- (TRNO) 33.5x

- (EGP) 28.2x

- (REXR) 28.1

- (FR) 24.8x

- (PLD) 23.4x

- (STAG) 17.8x

- (PLYM) 12.5

- (SRC) 9.4x

Now, keep in mind, Spirit has just 25% exposure to industrial real estate, whereas these peers have 100%. However, you can see the disconnect that Mr. Market has with this beaten-down net lease REIT.

The Balance Sheet

At the end of Q2-23 Spirit had liquidity of $1.6 billion, comprised of cash and availability under its credit facility and delayed draw term loans. The adjusted debt to annualized adjusted EBITDAre remained flat at 5.3x compared to Q1-23. As shown below, Spirit is IG-rated across all three major agencies:

SRC Investor Presentation

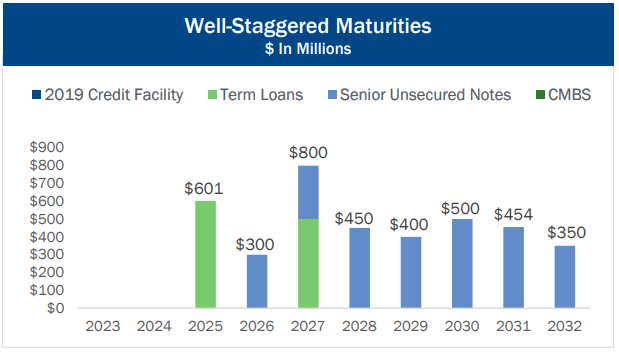

As seen below Spirit has limited debt maturities and all debt is fixed at low rates, so the balance sheet is locked in with yields and spreads that can produce better growth going into 2024. In other words, Spirit can simply print money without buying anything.

SRC Investor Presentation

During Q2-23 Spirit acquired $138 million in assets, comprised of 11 properties across five transactions at a cap rate of 7.63% and an economic yield of 8.88%. As the CEO pointed out, “this is the highest cash cap rate and the second highest economic yield achieved in the last eight quarters.”

Spirit also made $30 million of investments in revenue-producing expenditures related to the development and TI (tenant improvements) at a 9.87% cap rate. All combined, Spirit deployed $169 million in Q2-23 at a cash cap rate of 8.03% (+166 bps from Q2-22).

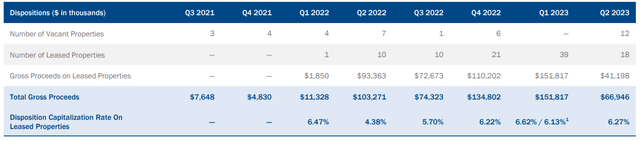

Spirit also sold 18 occupied properties in Q2-23 for $41 million at a cap rate of 6.27% (average deal size was $2.3 million).

SRC Investor Presentation

Consistent with its 2023 plan Spirit didn’t raise any equity in Q2-23 and funded its capital deployment with disposition proceeds, in-place debt, and free cash flow with no change in leverage. As the CEO pointed out,

“The strength and diversification of our tenants, the industries they operate in, and the quality of our real estate portfolio, combined with better-than-anticipated investment spreads are allowing us to surpass our previous forecast and revised our AFFO per share guidance upward for the second time this year.”

In Q2 Spirit’s AFFO per share was $0.91, $0.02 higher than Q1-23. It raised the year-end AFFO per share range to $3.56 to $3.62 and the disposition range to approximately $400 million, while maintaining the capital deployment range of $700 million to $900 million.

FAST Graphs

M&A Target?

Spirit’s is now yielding 7.9% with a P/AFFO multiple of 9.4x.

FAST Graphs

I usually don’t speculate on M&A, but I just can’t help myself.

This net lease REIT is trading at an insane discount, especially when you consider the 25% industrial property composition.

Spirit’s operating history has been choppy, and that’s mostly due to the previous management team.

Now that so-called “ugly duckling” properties have been removed from the portfolio, Spirit is screaming “buy me.”

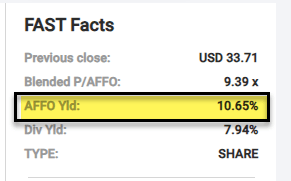

Of course, given the equity cost today (AFFO yield of 10.7%) it’s virtually impossible for Spirit to issue equity and grow.

FAST Graphs

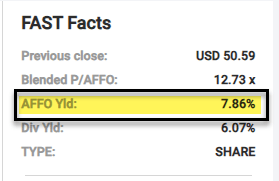

Conversely, peers like Realty Income are also challenged to issue equity. As viewed below, O has an AFFO Yield of 7.9%.

FAST Graphs

Yet, I believe there’s a window of opportunity for Realty Income to pounce on Spirit’s $8.5 billion portfolio.

As noted earlier, Realty Income has around 13% of rent being generated from industrial properties. The synergies are obvious!

FAST Graphs

I’m not betting on M&A though.

I know value when I see it…

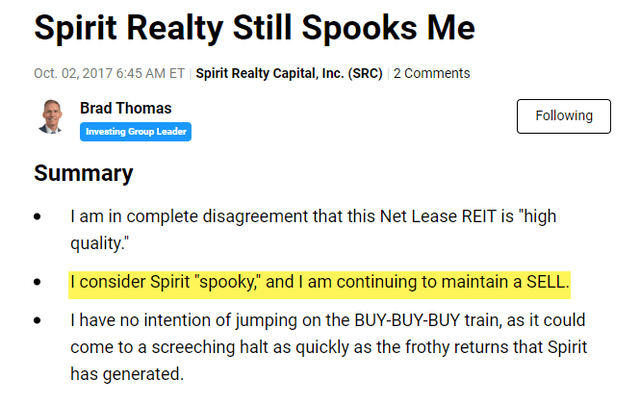

Spirit’s no longer spooky (they were a few years ago).

Seeking Alpha

Stay tuned for my Trick or Treat a REIT article….

Read the full article here

Leave a Reply