Special Situations Report

Revealing the beauty of e.l.f.: a hidden gem for investors.

Company Description

e.l.f. Beauty, Inc. (NYSE:ELF), formerly known as J.A. Cosmetics Holdings, Inc., operates under the brand name e.l.f. cosmetics. This multi-brand beauty company is dedicated to reshaping the beauty industry by making it more inclusive and accessible. e.l.f. Beauty offers a range of beauty products catering to eyes, lips, face, and skincare.

The Company reaches its diverse customer base through direct-to-consumer channels, which include e-commerce platforms, e.l.f. stores, and other retail outlets across the United States. Additionally, e.l.f. Beauty’s presence extends internationally through a network of distributors. Notably, the Company has established strong partnerships with major retail giants, including Target, Walmart, and Ulta Beauty, reinforcing its market presence and enabling them to expand both nationally and globally.

e.l.f. Beauty, Inc. stands out in the industry for its commitment to cruelty-free, clean, and vegan beauty products that are accessible to a wide audience, making it an appealing prospect for investors seeking ethical and innovative opportunities in the beauty market.

Investment Thesis

We recommend a BUY position on e.l.f. Beauty with potential upside of close to 40% and a manageable downside risk of 10%. Despite experiencing robust growth, especially in recent years, e.l.f. Beauty remains underappreciated by the investment community. We attribute this lack of recognition to the fact that the investment world is predominantly male-oriented, leading to an insufficient appreciation of the company’s unique investment thesis.

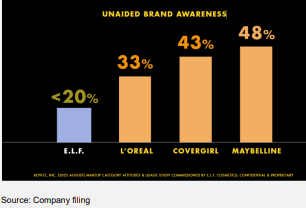

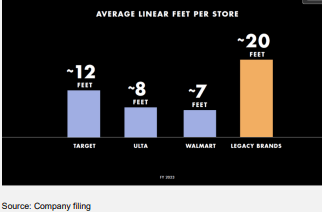

Despite the remarkable growth e.l.f. Beauty has achieved, the company is still in its early stages. Brand awareness, especially compared to mass cosmetics giants like Maybelline, Covergirl, and Revlon, remains modest. The company’s shelf space at key retailers such as Target, Walmart, and Ulta is relatively small. Nevertheless, the growing popularity of their products suggests that they may soon secure more substantial shelf space, offering potential leverage.

The skincare market is a rapidly growing white space category and e.l.f. Beauty has seized the opportunity by acquiring Naturium. Naturium is a brand with a proven track record in the competitive and fast-growing skincare market, emerging and thriving through social media channels. If e.l.f. Beauty successfully integrates this acquisition, it will open up another avenue for rapid growth.

Our assessment underscores the significant growth potential in international markets. In FY:23, international sales accounted for 12% of e.l.f. Beauty’s revenue, with impressive year-over-year growth of over 60%. Disciplined expansion in Canada and the U.K. has propelled the Company to the #7 brand in both markets, with a #3 position in the U.S. As the fastest-growing top ten brand in these countries, we anticipate further expansion opportunities.

Following in the Footsteps of Success

e.l.f. Beauty’s investment story mirrors those of beauty category success stories like Ulta, which experienced several years of substantial growth before gaining recognition in with the wider investment community. We anticipate that ELF will continue to deliver impressive results until it becomes a compelling and hard-to-ignore investment story. This opportunity allows for investors to capitalize on the investment community’s lack of insight into the beauty category and the enduring appeal and passion of the e.l.f. Beauty’s user base.

In conclusion, e.l.f. Beauty represents an investment opportunity with significant upside potential and controlled downside risk. Its innovative strategy, agility in market execution, early-stage growth, and entry into the skincare market all contribute to a compelling investment thesis that has yet to be fully appreciated by the broader investment community.

Analysis

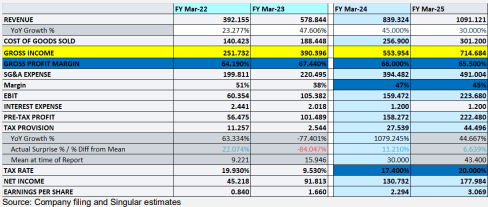

Singular Research Estimates

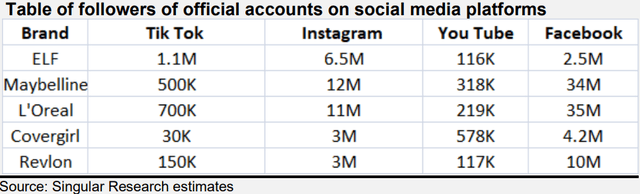

In 2022, a report by Traackr revealed key insights into the popularity of social media platforms among cosmetic consumers, shedding light on the rising prominence of ELF Cosmetics. The data illustrates the evolving landscape of marketing and consumer engagement. At the forefront is YouTube, which boasts a substantial 73% usage rate among consumers, followed closely by Instagram (66%), Facebook (65%), and TikTok (56%). This trend underscores the significant influence of video content and influencer collaborations as potent marketing tools. Of particular significance is the fact that over 70% of consumers have expressed a strong inclination to purchase products from brands that engage in partnerships with trusted influencers, which reflects the growing power of influencer marketing in the beauty industry. Furthermore, over 80% of brands have reported tangible benefits, including increased sales and heightened brand awareness, from incorporating influencer marketing into their strategies. While YouTube stands as the most frequently used platform, Facebook and Instagram, both under Meta ownership, have emerged as the favored platforms where consumers are most inclined to make cosmetic purchases. This insight aligns with the shifting consumer landscape in which cosmetic brands increasingly rely on influencer marketing and social media to drive sales and engagement.

Moreover, a notable generational disparity is observed in the choice of platforms. Gen Z consumers exhibit a preference for Instagram and YouTube, followed by TikTok, relegating Facebook to a lower position. This result aligns with the demographic focus of ELF Cosmetics, which caters to a predominantly younger audience. The data also indicates potential for the brand’s expansion into slightly older customer bases, as evidenced by the lower follower counts on platforms frequented by older demographics.

In summary, the table displaying social media followers signifies the growing popularity of the ELF brand, particularly among platforms popular with Gen Z consumers. This opportunity provides ELF Cosmetics an ability to expand its market reach, capitalize on the popularity among the key mass market base, and continue its trajectory of robust growth.

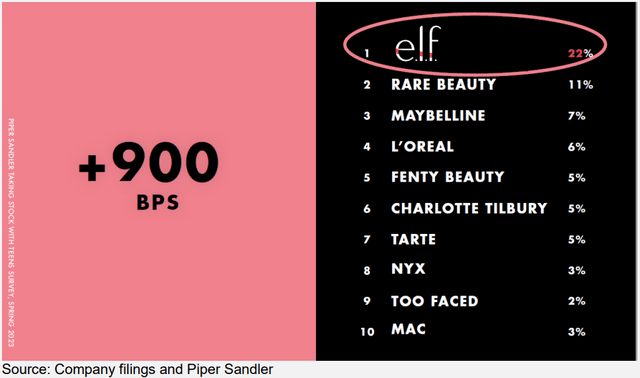

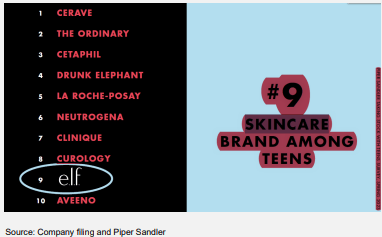

Recent surveys among teens also reinforce the brand’s popularity and provide a compelling case for future success. e.l.f. Beauty’s stronghold with the Gen Z demographic endures. According to Piper Sandler’s most recent semiannual teen survey, e.l.f. Beauty has once again secured its position as the top cosmetics brand of choice among teenagers, marking the third consecutive time it has achieved this feat. Impressively, the brand has expanded its market share by an impressive 900 basis points in comparison to the previous year, maintaining its #1 ranking across all income groups.

Company Filings and Piper Sandler

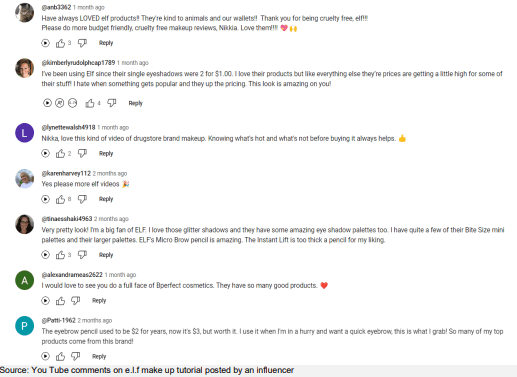

Excerpts from customary customer reviews of e.l.f. cosmetics underscore the brand’s widespread appeal and the resilience of its customer base in the face of higher pricing, indicating a strong perceived value proposition.

YouTube comments on e.l.f. makeup tutorial by an influencer

The growing prominence of e.l.f. Beauty, Inc. is exemplified by the substantial expansion of its Beauty Squad loyalty program. This program currently comprises nearly 3.7 million members, representing a substantial year-over-year increase of over 25% in 2023, 20% in 2022, and 40% in 2021. These dedicated members, contributing to nearly 80% of the company’s sales, exhibit elevated average order values, heightened purchase frequency, enhanced retention rates, and furnish the organization with a valuable source of first-party data.

e.l.f.’s High-Reward, Low-Risk Innovation Strategy

e.l.f. Beauty, Inc. has carved a niche in the cosmetics industry by implementing a fast-cycle innovation and validation model. The Company’s innovative approach is central to its success, enabling it to lead the industry in the speed and frequency of new product introductions. e.l.f. has established an agile innovation capability that can take a new beauty product from concept to online launch in an astonishingly short period, with some products being developed in as few as 20 weeks from conception and an average of 27 weeks. This swift development process has allowed e.l.f. to stay ahead of their competition.

Their innovation strategy is based on three core pillars, with the first being “First-to-mass.” This pillar involves identifying and bringing prestige beauty trends to the mass market. Customers are increasingly knowledgeable about prestige beauty trends and are seeking ways to achieve similar looks without the high price tag. Over the past eight years, e.l.f. has introduced more than 50 new items that directly compete with higher-end products. For instance, they launched their e.l.f. Mineral Infused Face Primer at just $6, offering an alternative to a prestige primer priced at $36. This “dupes” strategy has found immense success, with products like the e.l.f. Baked Eyeshadow Trio, Contouring Brush, and Lip Exfoliator following suit in providing affordable alternatives to premium cosmetics.

e.l.f.’s impressive track record shows how a high-reward, low-risk strategy can pay off. The Company’s emphasis on speed, innovation, and embracing emerging trends has enabled them to gain market share, even against well-established competitors. The Company has been particularly successful in engaging with Gen Z consumers, as demonstrated by their status as Gen Z’s favorite makeup brand and a top-10 shopping destination. e.l.f.’s curiosity-driven approach, dedication to listening to their community, and willingness to experiment have set them apart. Although they faced challenges in the past, the Company’s commitment to innovating when on top, expanding into the rapidly growing wellness sector, and catering to the value-conscious mass market has established a solid foundation for their future growth.

Overall, e.l.f.’s strategic agility, quick product development, and ability to bring prestige like products to the mass market at an affordable price position the Company for continued success in the ever-evolving cosmetics industry. Their commitment to staying in touch with consumer preferences and trends, embracing new platforms like TikTok, and exploring opportunities in gaming, AI, and data analytics further reinforces their low-risk, high-reward innovation strategy.

Skincare Opportunity

Euromonitor, McKinsey analysis, McKinsey Global analysis

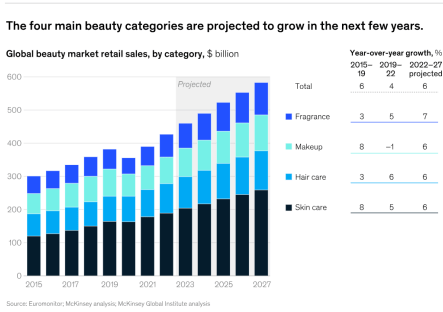

According to a report by McKinsey, the beauty market in 2023 is expected to reach approximately $580 billion, growing by a projected six percent a year. The demand for skincare products is driven by factors such as rising disposable income, technological advancement, product innovation, and consumer awareness of natural and organic ingredients.

Moreover, the Company has identified significant opportunities in the mass skincare sector. Although it is currently a $5 billion category in the United States, according to Nielsen (March 23), the Company currently holds the 19th position in this segment, with a modest market share of slightly over 1%. Impressively, the Company has already achieved top 10 brand status among teenagers, demonstrating its resonance with this important demographic. Skincare currently constitutes 8% of the consumption within Nielsen-monitored channels and contributes significantly, making up almost 20% of the business on company’s site. This popularity underscores the robust product range and the favorable response from consumers when they explore the full spectrum of the Company’s skincare offerings.

Company Filing and Piper Sandler

One of the trends on the horizon is the demand for customized skincare solutions, reflecting the growing awareness that one-size-fits-all no longer suffices. Consumers are increasingly seeking tailored products that address their specific skin needs. At the same time, there is an emphasis on the convenience of mass-market skincare that is easily accessible.

ELF’s Recent Acquisition to Bolster its Skincare Portfolio

Company Filing

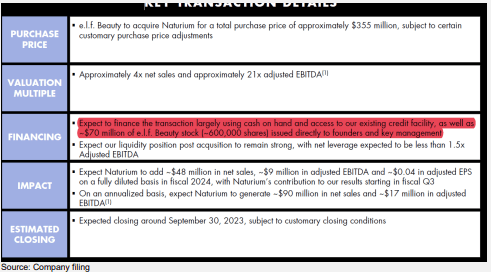

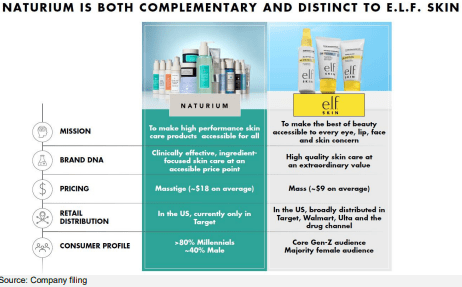

In late 2022, Naturium created quite a sensation on TikTok as people eagerly flocked to their nearest Target stores or online platforms to lay their hands on the viral products, including The Glow Getter Multi-Oil Hydrating Body Wash and The Smoother Glycolic Acid Exfoliating Body Wash. Naturium, known for its skincare and body care products, has also gained popularity with its best-sellers, such as the Vitamin C Complex Serum and Dew-Glow Moisturizer SPF 50. The rapid and substantial impact made by Naturium in such a short time has prompted the brand to join the E.L.F. Beauty family. On August 29, E.L.F. Beauty announced its acquisition of Naturium for $355 million. Naturium will join Well People and Keys Soulcare under the E.L.F. Beauty umbrella, expanding the parent Company’s skincare portfolio. The acquisition is set to close at the end of September, and it is expected to make a significant impact on e.l.f.’s sales in fiscal 2024, with a projected contribution of $48 million.

Additionally, this move will double e.l.f.’s skincare revenues, currently at 9%, to a combined 18%. Naturium’s impressive growth of an 80% compound annual growth rate over the past two years, along with e.l.f.’s expanded retail distribution and robust marketing efforts, is poised to enhance Naturium’s brand awareness. The acquisition represents a strategic move that aligns with E.L.F.’s mission and vision. E.L.F. Beauty continues to strengthen its position in the skincare industry, with Naturium as the latest addition to its growing skincare brand family.

Company Filing

e.l.f. is Still in the Early Stages

e.l.f. Beauty’s investment potential is notably promising, especially when considering its early stage compared to legacy brands. The Company’s unaided awareness is currently less than 20%, which falls significantly short of established legacy brands. However, the Company has made substantial progress in driving productivity in collaboration with major retail partners. In fiscal ’23, e.l.f. improved its productivity per sales per linear foot with key partners like Target, Walmart, and Ulta Beauty. While the Company’s average store footprint in these retailers is growing, it still lags behind legacy cosmetics brands, which can command up to 20 feet of space on average. This productivity-driven approach, accompanied by continuous expansion with retail partners, positions e.l.f. Beauty for significant future growth and a remarkable journey to increased awareness in the beauty industry.

Company Filings

Company Filing

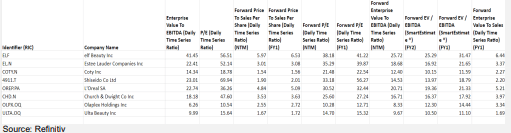

Valuation

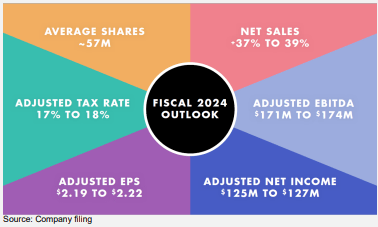

Incorporating management’s FY:24 forecast, as detailed below, and employing a more conservative growth rate of 30% for FY:25, along with a peer group P/E multiple of 40 times that mirrors respected brands in the industry, yields a valuation of $120. It is worth noting that a more optimistic scenario comes into play with a 50 times multiple, which represents the upper limit of P/E multiples seen among competitors in the beauty and skincare segment, resulting in a valuation of $150.

Company Filings

Company Filings and Singular Estimates

Refinitiv

Employing a multi-stage discounted cash flow (“DCF”) model with a cost of equity set at 15%, we consider a top-line CAGR of 25% until 2028, followed by stable high single-digit growth across the entire Company. This analysis leads to a Target Price of $150.

Given these findings, we opt for a Target Price of $140, factoring in a weighted average of both valuation methods. Our approach assigns a greater weight to the more optimistic forecast, recognizing its heightened significance in our assessment.

Conversely, on the downside, we apply a conservative estimate using a DCF model with a more restrained growth rate of 20% until 2028, followed by high single-digit stability, yielding a valuation of $90. Alternatively, applying a 30 times P/E multiple based on the group average also arrives at $90. Therefore, we are confident in asserting that the downside risk is approximately 10%.

Risks

- The loss of TikTok as an application to use in the U.S. The potential TikTok ban in the U.S. is a crucial marketing tool for customer engagement.

- China-based manufacturing. Speed is a critical element of their strategy, and altering key manufacturers could pose challenges.

- The declining perception of quality and value of e.l.f. products among the target demographics in the growth strategy.

- Macroeconomic risks may impact consumer preferences.

Read the full article here

Leave a Reply