Thesis

The SPDR Portfolio Aggregate Bond ETF (NYSEARCA:SPAB) is a fixed income exchange traded fund. The vehicle seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg U.S. Aggregate Bond Index.

The Bloomberg Aggregate Bond Index is a broad-based fixed-income index used by bond traders and managers of exchange-traded funds as a benchmark to measure their relative performance:

The Index is designed to measure the performance of the U.S. dollar denominated investment grade bond market, which includes investment grade government bonds, investment grade corporate bonds, mortgage pass through securities, commercial mortgage backed securities and other asset backed securities that are publicly for sale in the United States. In addition, the securities must be U.S. dollar denominated, fixed rate, non-convertible, and taxable. The Index is market capitalization weighted.

The index is market cap weighted and reconstituted on the last business day of the month. SPAB is a passive fund that will yield results corresponding to a fixed income market benchmark. The fund is mostly composed of Treasuries and Agency MBS bonds, thus a rates play:

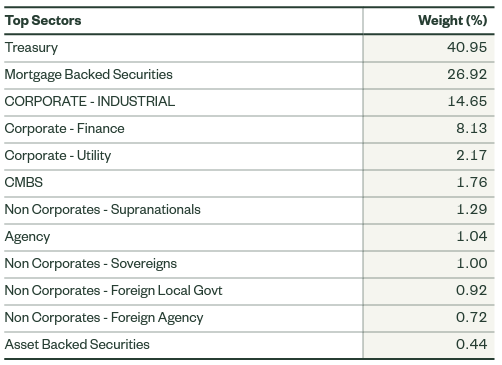

Sectors (Fund Fact Sheet)

We can see from the above table that treasuries and MBSs account for over 66% of the fund. Investment grade corporate bonds account for roughly 25% of the fund composition, with the rest made up of CMBS and supranationals:

Supranational bonds are debt instruments issued by supranational organizations, which are institutions created by the governments of several countries to promote economic, political, and social cooperation. These bonds play a crucial role in the global economy by providing financing for development projects, addressing social and environmental issues, and fostering economic stability.

The European Investment Bank is an example of a supranational agency.

The main driver for portfolio returns in SPAB is constituted by rates. The fund has a negligible credit risk given its ratings composition, which is further discussed in the ‘Holdings’ section. The fund falls in the intermediate portion of the duration spectrum, with a 6.06 year duration:

Duration (Fund Fact Sheet)

Risk factors and performance

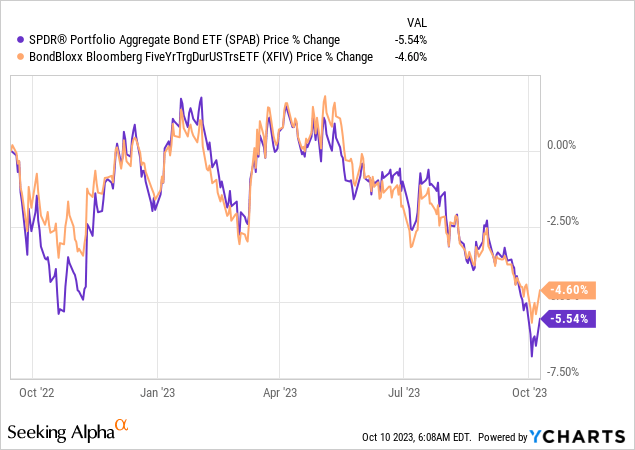

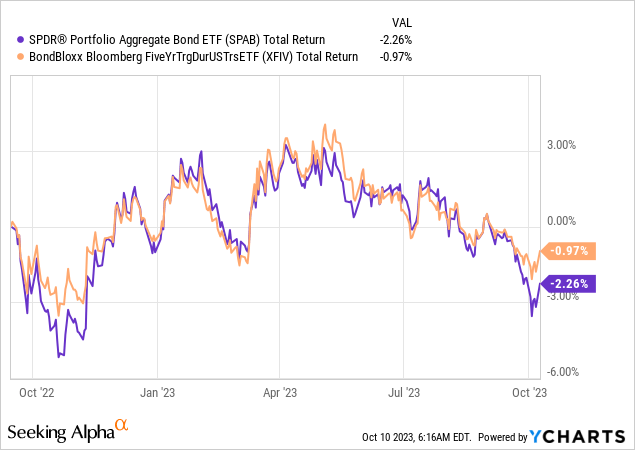

SPAB is a rates-driven product, and given its duration profile, the closest proxy is the 5-year point in the yield curve:

We are plotting SPAB against the Bondbloxx Bloomberg Five Year Target Duration US Treasury ETF (XFIV). We can observe an extremely close correlation between the two products. As rates have moved higher, both funds have lost value in the past year. Five-year rates have moved up by 80 bps in the past year:

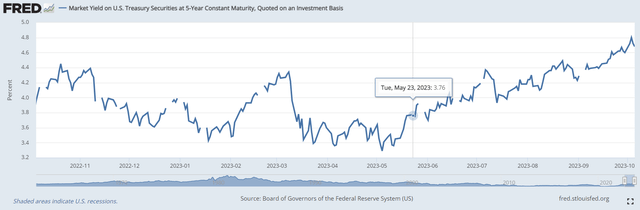

5-Year Rates (The Fed)

There has been quite a bit of volatility in the past year, but rates started off at slightly below 4%, and are now at 4.7%. The move in the fund from a price perspective tallies up nicely with its duration. A 6-year duration translates into a -6% price performance when rates move up by 100 bps in the respective duration bucket. SPAB is down -5.5% in the past year from a price perspective. When we factor in the dividend yield, the loss is much smaller:

The fund now has a high dividend yield of 4.9%, which is going to help its total return performance going forward.

If rates go up by another 100 bps in the 5-year point, the fund is set to lose -6%, mitigated by a dividend yield of 4.9%, thus accounting for a pro-forma total return of -1.1%.

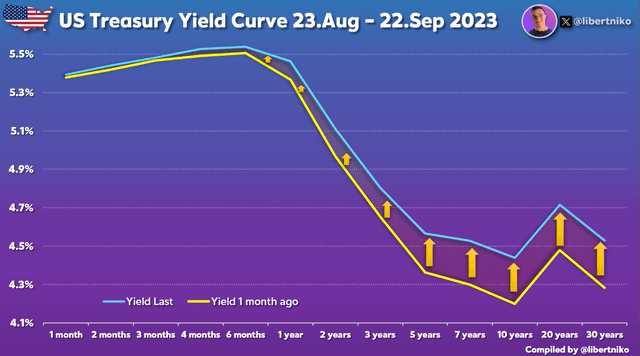

We do not think rates are going to go up much more. In fact, all we have witnessed in the past months is the embedding of term premium in the yield curve. That means that the intermediate and long end of the curve has shifted up to account for a higher for longer rates regime:

Curve Shift (Twitter – libertniko)

In our opinion, the Fed is done raising rates, but what we are going to witness is a move up in term premium. We feel the 5-year tenor point can go up much closer to Fed Funds, so in a negative scenario we can see another 50 bps in rates widening, which per its duration profile should result in a -3% performance for SPAB from a pure price perspective.

An extreme rates shock, where the Fed is forced to raise higher, and the entire curve shifts, could see another 70-80 bps in widening for the 5-year tenor point. That would translate into a flat performance for SPAB, with the price loss offset by dividends during the next 12 months.

Holdings – only investment grade bonds here

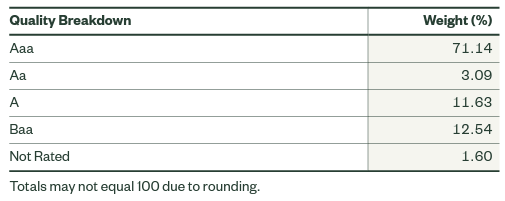

As described above, the fund contains a mix of treasuries, MBS bonds, and corporate bonds, all investment grade:

Ratings (Fund Fact Sheet)

The vast majority of assets are AAA, including the treasuries, MBS, and supranationals sleeve. Only 12% of the collateral pool falls in the BBB bucket, the lowest of the investment grade ratings.

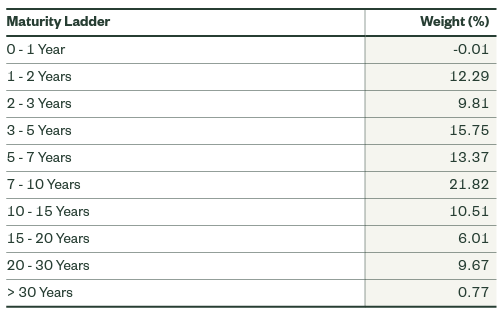

The fund is extremely granular, with over 6,000 holdings, with most names concentrated in the 7-10-year maturity bucket:

Maturity Ladder (Ladder)

We can see the bulk of the holdings falling in the 7-10 years bucket, which accounts for 21.82% of the fund. The other tenor profiles with a large representation are the 3-5 years and 5-7 years buckets.

Historic context and strategy for a retail investor

As retail investors, we can never time the market. The reality is that most people cannot call a top or bottom but can identify a trend. If we look at a historical chart, we can get a better sense of where we are heading:

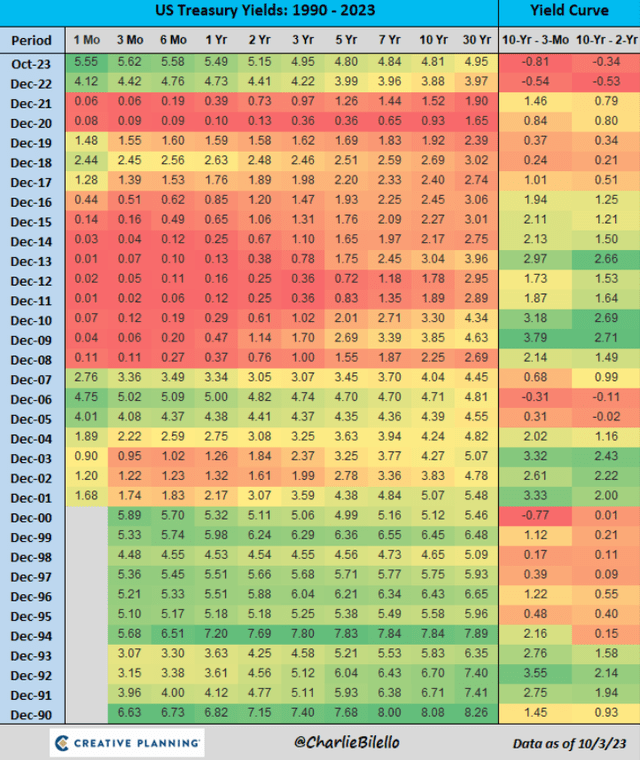

Historic Rates (Creative Planning)

5-year yields now sit squarely at the levels last seen in the 1990-2001 period. Even in the 2001-2007 period, the highest levels were at 4.7%, lower than today’s levels. The reset in yields has been violent, but we are not within the historic context of yields prior to the great financial crisis.

Can 5-year yields move closer to Fed Funds? Sure. Will 5-year yields be lower than today a year from now? We are firmly of that belief. History indicates that rates are topping, even if nobody knows exactly what the highest figure will be.

A retail investor is best served by employing a dollar cost-averaging strategy in such instances. If one wants to be long $100 notional of SPAB, then the best way to do it in today’s environment is to purchase equal weight notionals every week for the next few months. Utilizing this method ensures the trend is captured, irrespective of the exact level of peak yields.

Conclusion

SPAB is a fixed income exchange traded fund. The vehicle aims to replicate the return profile of the Bloomberg Aggregate Bond Index and has an exclusive investment grade bond composition. The fund is mostly composed of treasuries and Agency MBS bonds and comes with a 6.06-year duration. The fund’s current dividend yield is 4.9% and has been a mitigant for the ETF’s price loss from the duration impact as rates have risen.

The main risk factor for SPAB is composed of rates, with the vehicle having a negligible credit risk component. With rates peaking, SPAB is an attractive way to express a long view on treasuries and MBS bonds, with an expected 10% total return until December 2024. We expect an investor to clip the fund’s dividend plus a 5% return from the fund’s price appreciation following the Fed cutting rates mid-next year.

Read the full article here

Leave a Reply