Dear readers,

I’ve been writing articles on the site for a better part of this year and the single most frequent comment I get, especially on REIT stocks which I cover, has been:

Why not invest in 5% money markets (MUTF:SPAXX) instead and get a higher yield (than most REITs) and safety of capital?

And it is a fair question to ask.

After-all, 5% isn’t too far from most conservative investors’ 8% goal and a risk-free return seems very attractive when you see markets crashing left and right.

Today, I want to discuss why I believe waiting in market money funds is NOT the answer. I also want to discuss two alternatives – the all-mighty S&P 500 (NYSEARCA:SPY) and REITs (VNQ).

The S&P 500

Let’s start with my expectations for the S&P 500, which hold even more true for the Nasdaq 100 (NDX). Both indexes are heavily weighted towards technology stocks, many of which trade at very high multiples today, despite high interest rates. I find this somewhat odd, because technology stocks should be very sensitive to changes in interest rates, given their long duration (most cash flows far in the future).

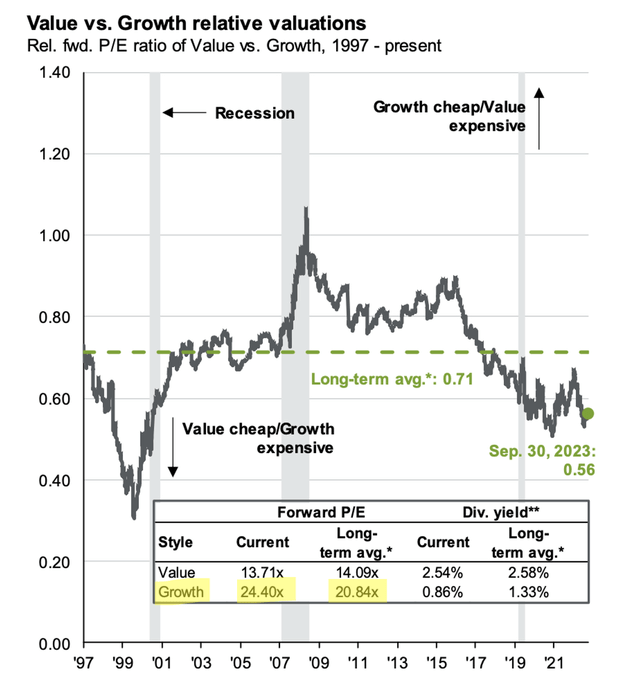

Of course, we’ve seen the AI trend play-out, but I fear that technology stocks are currently overpriced. Growth is historically expensive relative to value and technology stocks trade at forward P/E 20% higher than the average between 1997 and today. It seems as though valuations have not adjusted to a higher rate environment at all.

J.P.Morgan

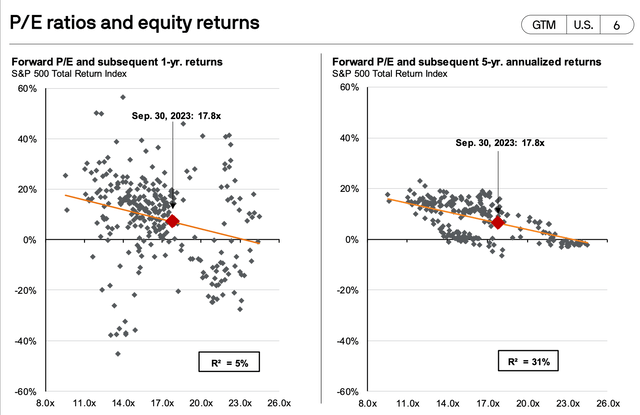

Expensive growth stocks have led to the index being relatively over priced as well at a forward P/E of 17.8x. Historically speaking, a forward P/E of 17.8x tends to result in average total returns of around 5% over the next 5 years. This 5% should come from a 1.6% dividend yield and about 3.4% of price appreciation.

To make things worse, JPMorgan’s (JPM) study only looks at the period from 1997 forward. During a large part of this period, interest rates have been near zero, which could have (and frankly did) inflated the average P/E multiple. So now that rates are above 5% and unlike to come back to zero any-time soon, actual future performance of the index could be even worse than the 5% suggested by this model.

J.P. Morgan Asset Management

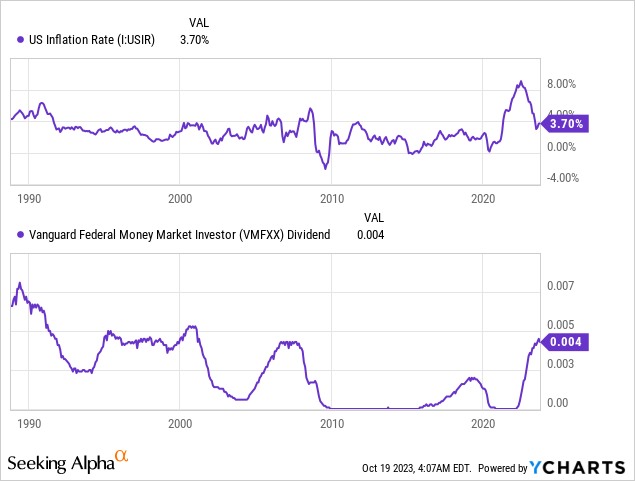

A sub-5% total return over the next 5 years isn’t very exciting, especially in a high 3%+ inflation environment and begs the question.

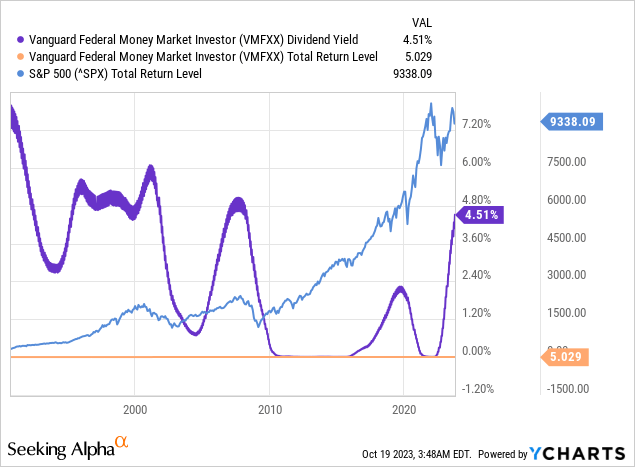

Isn’t it better to get 5% risk-free from money markets?

Over the short-term, sure. For money that will be needed over the next couple of years and will be spent and not reinvested, there is absolutely nothing wrong with buying money market funds and other fixed income instruments to generate at least some yield. In fact, this is something that should be done.

But over the long-term, which is what we focus on when investing, the answer is (in theory) no, because yield from money markets tends to be short-lived and eventually the money will have to be reinvested. By then, interest rates will have likely dropped and prices of stocks will have risen substantially, leading to massive opportunity cost.

In reality, however, it doesn’t always play-out like this. Let’s look at some examples from history.

In some cases, such as 2000 and 2008, the strategy of waiting in money market funds at peak rates paid off and investors were actually able to invest their money into the market at lower valuations once rates dropped.

But in 1990s, 1995 and most recently 2020 the strategy failed terribly as the index soared by 50-100% before rates bottomed out. Those waiting in money markets would have missed the entire rally.

The truth is that none of us know what’s going to happen this time around, we simply can’t time the market and we shouldn’t try to. But that doesn’t mean that we should settle for money market funds, which have historically failed to beat inflation, especially post-2000.

A Possible Solution

The bottom line is that the S&P 500 isn’t positioned to deliver the 10%+ annual returns we’ve seen over the past decade, but waiting in treasuries isn’t a sure fire strategy either, as inflation is likely to take most of our nominal returns while we wait and we risk missing substantial upside in stocks over the long-term horizon.

My strategy at the moment is to avoid expensive stocks that haven’t repriced for the high interest rate environment and invest into those that have. I look for beat-up companies where sentiment is low despite strong balance sheets, growing cash flows (with pricing power) and high dividends.

Some might argue that it’s better to buy recent winners and sell recent losers. I’m doing the opposite. But isn’t that the name of the game? Buying when others are fearful…

Depending on your risk appetite, there are many such stock and sectors that could produce very significant gains from current levels and I try to cover many of those here on Seeking Alpha.

Here are a few examples:

I like alternative asset managers for their exposure to private credit which is set for a boom in the current high rate and tight credit environment.

- Brookfield Asset Management (BAM)

- Blue Owl Capital (OWL)

- Apollo Global Management (APO)

- Blackstone (BX)

I like selected consumer discretionary stocks, because they tend to do well early in the cycle and I believe the Fed will cut interest rates at some point over the next 12 months.

- Starbucks (SBUX)

- LVMH (OTCPK:LVMHF)

- EssilorLuxottica (OTCPK:ESLOF)

I like Equity REITs, which despite their bad reputation have a very good track-record of outperforming in a high interest rate environment.

- Agree Realty Corporation (ADC)

- VICI Properties (VICI)

- Alexandria Real Estate (ARE)

- Crown Castle International (CCI)

I like a handful of preferred shares on REITs, utilities and financials that pay solid dividend yields of 7-9% while providing upside and safety at the same time.

- EPR Properties (EPR.PR.C)

- Athene (ATH.PR.A)

The point is that there are a lot of good deals in the market today and there is no reason to invest in the overpriced S&P 500 or in money market funds. Don’t just take my word for it, do your own research and I’m sure you’ll find some bargains out there today.

Read the full article here

Leave a Reply